Report Overview

Non-Alcoholic Beverages Market - Highlights

Non-alcoholic Beverages Market Size:

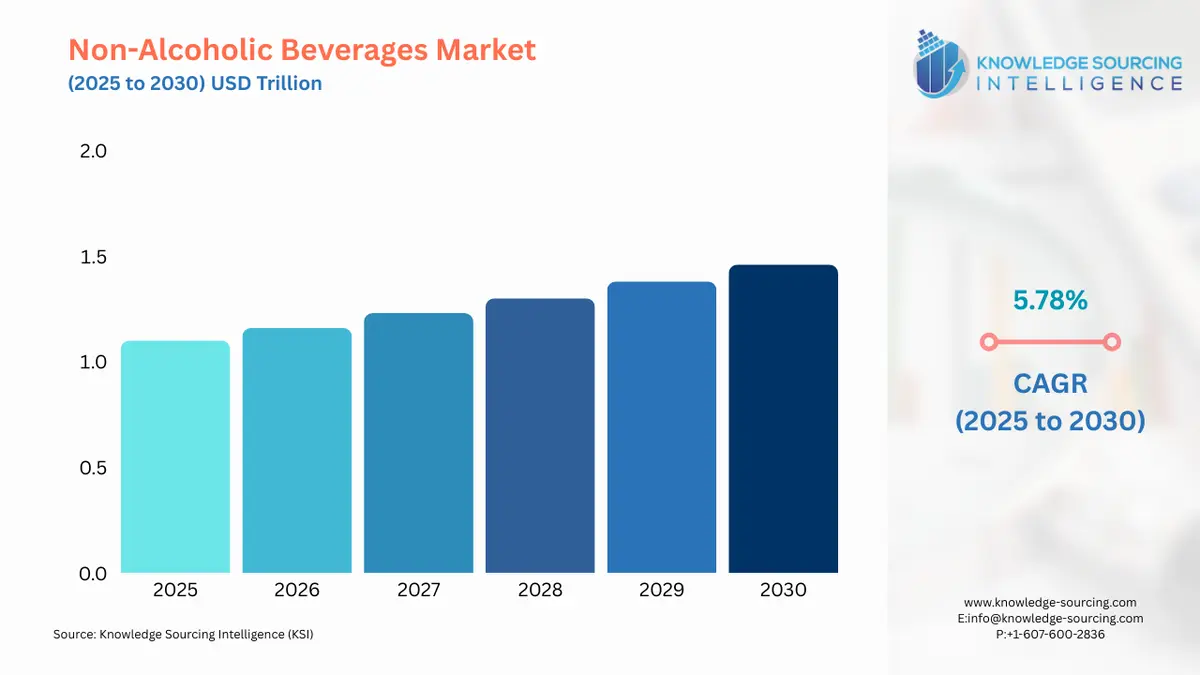

The Non-alcoholic Beverages Market is expected to grow at a CAGR of 5.78%, reaching USD 1.457 trillion in 2030 from USD 1.100 trillion in 2025.

The non-alcoholic beverages industry is on the cusp of a significant breakthrough triggered by a combination of changing consumer tastes and the positive reactions of the industry. Central to this is the change towards health and wellness, where people are looking for mind and lifestyle-related risks through the admission of alcohol and alcohol-free substitutes.

This "sober curious" trend, which is more prevalent in the younger generation of Millennials and Gen Z, is altering drinking habits, such as Dry January or informal get-togethers, without the intoxication of alcohol; instead, they are embracing clarity and vitality. Innovation is the key driver here, as companies are developing high-end, tasty products that are as good as the regular drinks. The range of products includes classic cocktails and fruity mocktails, botanical-infused beverages, and adaptogen-laced sodas, sparkling, among others, are appealing to consumers due to their functional benefits, like boosting immunity and stress relief.

Non-alcoholic Beverages Market Overview

The global market for nonalcoholic beverages is growing significantly, driven by changing consumer habits, technological breakthroughs in product development, and favorable macroeconomic factors. Among the various categories at the forefront of expansion, functional drinks, sparkling waters, and non-alcoholic (NA) substitutes for beer, wine, and spirits are the leaders. A growing working population is driving the demand for NA spirits/ready-to-drink (RTD) mocktails.

Health drinks are the new favorites among consumers due to low/no sugar, probiotics, adaptogens, vitamins, plant extracts, and beverages marketed for energy, digestion, immunity, or mental focus. The change in diet-related issues, such as obesity and diabetes, and the general interest in daily wellness and performance, combined with the discredit of soft drinks. This has provided an opportunity for the suppliers who can charge a premium for their functional products and set up new retail channels (health stores, clinics).

Additionally, the customers have come to expect more from their drinks than just being a thirst quencher. This has contributed to the growth of functional beverages, such as probiotic-containing drinks for gut health, stress-relief adaptogens like ashwagandha, and immunity-boosting vitamins/minerals, like vitamin-fortified waters.

The modern lifestyles, especially of the youth, are paving the way for new drinking patterns and hence changing the drinking habits publicly. The "sober-curious" movement, previously a minor trend, has become a lifestyle choice for a large part of Gen Z and Millennials, who prefer alcohol-free beverages for social events such as dinners, parties, and casual meet-ups. Moreover, the study by the National Institute for Health and Care Research (NIHR) of May 2020, on 800 weekly alcohol drinkers in the UK reported that participants were more likely to select non-alcoholic drinks, i.e., 49% if the greater proportion of non-alcoholic drink options are available, meanwhile, 26% participants were more likely to select non-alcoholic drinks if a greater proportion of alcoholic drinks is available.

Additionally, the data from Circana reports that the top reasons for not drinking alcohol among Americans 21 or above in 2024 were: 52% just don’t want to drink, 33% dislike the taste of alcohol, 29% aim to improve their physical health, 28% are afraid of becoming addicted, 21% want to save money, and 20% seek to enhance their mental health.

The combination of population characteristics and increasing wealth is acting as a demand multiplier, mainly in the fast-growing areas. The demand, driven by population dynamics and increasing wealth, is particularly strong in the fastest-growing regions. The increased birth rate worldwide, along with the aging and health-conscious population in the industrialized world, and the expanding middle class in developing countries, contribute to a large consumer market. Moreover, campaigns such as "Dry January" or "Sober October" have gone from being temporary tests to permanent decisions.

Another major trend is focusing on product innovation through the provision of alcoholic alternatives in taste, flavor, and texture, along with new companies entering the non-alcoholic segment of the beverage industry. For instance, on 10 December 2025, the announcement of Thrive Market's "dry" policy came along with the discontinuation of alcoholic beverages and the introduction of the new category of non-alcoholic drinks with over 100 SKUs, consisting of non-alcoholic beers, wines, and cocktails, which was done to meet the growing demand of members and take part in the shifting habits of American drinkers before Dry January. The decision aligns with the moderation trend among consumers and also comes at a time when non-alcoholic drinks are expected to grow to a ~$5 billion category by 2028, according to IWSR, and makes nationwide shipping easier due to fewer regulations compared to alcohol.

Non-alcoholic Beverages Market Analysis

- Growth Drivers

The primary factor propelling the non-alcoholic beverages market is the global surge in health and wellness consciousness. Consumers increasingly scrutinize product labels, seeking beverages with functional benefits such as improved gut health, enhanced immunity, or cognitive function. This imperative has catalyzed a direct increase in demand for products fortified with vitamins, minerals, probiotics, and adaptogens. For example, a consumer survey by Kerry Group Plc. found that nearly 86% of consumers would purchase functional beverages that offer additional health benefits. This shift drives brands to reformulate existing products and launch entirely new lines, such as probiotic smoothies and nootropic drinks.

Consumers are increasingly regarding beverages as a means to enhance their physical and mental welfare, rather than merely refreshments. This behavior has led to a decline in alcohol consumption as the latter is linked to liver disease, mental disorders, and poor quality sleep, along with obesity and diabetes. According to a study done in the Great Britain region in October 2020, there was 35% of the population that reduced their alcohol consumption. This was primarily through the consumption of non-alcoholic and low-alcohol drinks, which, according to the data from the National Library of Medicine (NIH) of September 2025, has risen to 43.9% in August 2024.

Furthermore, the document named “impact of alcohol consumption on cardiovascular health: Myths and Measures” by World Heart Federation points out that during the last decades, the number of people living with CVD has almost doubled globally and that alcohol is a major factor in not only the heart diseases—like hypertensive heart disease, stroke, cardiomyopathy, and atrial fibrillation—but also in many other non-communicable and infectious diseases, injuries, and cancers..

The World Heart Report 2025 on attention to obesity and cardiovascular diseases reported that one of the main attributes was that age-standardized CVD mortality attributable to high body mass index (BMI) globally was 22.8 deaths per 100,000 people in 2021.

Health and wellness trends are flooding the market with non-alcoholic drinks, such as functional ones that are not only designed to combat the negative health outcomes but also to provide benefits like better focus, immunity boosting, and stress reduction. Several global organizations' initiatives are also supporting this trend. For instance, the Global Alcohol Action Plan 2022-2030 of the World Health Organization is another initiative to reduce alcohol consumption in countries to 20% by 2030.

A second critical driver is the expansion of e-commerce platforms and modern retail channels. The increased accessibility of a wide range of beverages through online and in-store channels directly facilitates consumer purchasing decisions. This enhanced distribution network allows niche brands and innovative products to reach a broader audience, which in turn stimulates new demand by exposing consumers to alternatives beyond traditional soft drinks. The "grab-and-go" convenience offered by formats like canned beverages and RTD products directly addresses the demands of modern, fast-paced lifestyles, thereby increasing sales velocity.

- Challenges and Opportunities

The non-alcoholic beverages market faces several headwinds. A significant challenge is the increasing regulatory pressure on sugar content and labeling. Governments in various jurisdictions are implementing "sugar taxes" and mandating clearer nutritional information. These measures directly reduce demand for conventional sugary beverages and increase the operational and R&D costs for manufacturers who must reformulate products to comply. This regulatory environment acts as a constraint on the traditional carbonated soft drink segment.

Despite these challenges, the same factors create substantial opportunities. The shift away from sugary drinks presents a clear opening for the development and marketing of low-calorie, zero-sugar, and naturally sweetened beverages. The "sober curious" movement and the rising popularity of non-alcoholic spirits and beer, particularly among younger demographics, create an entirely new category of demand. This opportunity allows companies to diversify their portfolios and capture a segment of the market previously held by alcoholic beverages. Furthermore, the increasing consumer willingness to pay a premium for products with perceived health benefits creates a favorable environment for brands focusing on high-quality, natural, and functional ingredients, which can offset volume declines in other areas.

- Raw Material and Pricing Analysis

The non-alcoholic beverages market is a physical product sector, making raw material and pricing dynamics central to its economics. The supply chain is dependent on a diverse range of agricultural and chemical inputs, including sugar, high-fructose corn syrup, fruit concentrates, flavorings, and various additives. The price volatility of these raw materials, particularly sugar, directly influences the final cost of goods and, consequently, the retail price. Global sugar production is subject to weather patterns and agricultural policy, creating pricing uncertainty for manufacturers. This volatility can compress profit margins or necessitate price increases, which can temper consumer demand, especially for price-sensitive segments like CSDs.

The packaging component, primarily consisting of PET and glass bottles and aluminum cans, also impacts pricing. Fluctuations in the cost of petroleum-based plastics and aluminum can affect production costs. Manufacturers often manage these risks through long-term supply contracts and by investing in recycled or more sustainable packaging materials, which can also be a demand driver for environmentally conscious consumers. The supply chain for these materials is globally interconnected, with key production hubs for plastics and metals in different regions, making it susceptible to logistical disruptions.

- Supply Chain Analysis

The non-alcoholic beverage supply chain is a complex, multinational network. It begins with the sourcing of raw ingredients, which can be global in scope. For example, fruit concentrates may originate in Latin America or Asia, while sugar is sourced from key producing regions worldwide. These raw materials are transported to large-scale bottling and manufacturing facilities, which are strategically located to serve major consumer markets.

Logistical complexities include cold chain management for perishable products like juices and dairy-based beverages, and the efficient transportation of heavy, low-margin products like bottled water. The supply chain's efficiency is paramount to profitability, with companies relying on advanced logistics and distribution networks to deliver products to hypermarkets, convenience stores, and online retailers. A dependency on a robust and uninterrupted flow of goods from production to the point of sale is a defining characteristic of this market's supply chain.

Non-alcoholic Beverages Market Government Regulations

Government regulations are a critical external force shaping the non-alcoholic beverages market. These regulations directly influence product formulation, marketing strategies, and consumer purchasing behavior.

- United States: U.S. Food and Drug Administration (FDA) / Nutrition Labeling and Education Act (NLEA) - The NLEA mandates specific nutritional information on product labels, which has led to increased consumer awareness of sugar and calorie content. This transparency directly drives demand for low-sugar and "diet" alternatives as consumers make more informed health-based choices.

- United Kingdom: Soft Drinks Industry Levy (Sugar Tax) - The introduction of the sugar tax directly increased the cost of high-sugar beverages for consumers. This tax has compelled major manufacturers to reformulate their products to fall below the regulated sugar content threshold, which shifts the supply and demand curve toward low-sugar and zero-sugar options.

- Mexico: Tax on Sugar-Sweetened Beverages - A similar sugar tax in Mexico has led to a measurable reduction in the purchase of taxed beverages and a corresponding increase in the purchase of untaxed products like bottled water. The tax directly changes consumer behavior by making healthier alternatives more economically appealing.

- European Union: EU Food Information to Consumers Regulation (EU 1169/2011) - This regulation standardizes food and beverage labeling across the EU, including requirements for nutritional information. It creates a consistent environment for manufacturers and enhances consumer trust, while also encouraging a focus on products with favorable nutritional profiles to meet consumer demand.

- India: Food Safety and Standards Authority of India (FSSAI) / Sugar, Salt, and Fat Regulations - Regulations and advisories from the FSSAI aim to reduce the consumption of high-fat, sugar, and salt (HFSS) foods and beverages. This regulatory focus encourages product innovation towards healthier options and influences marketing practices to avoid claims that could be considered misleading.

Non-alcoholic Beverages Market Segment Analysis

- By Product: Carbonated Soft Drinks (CSD)

The Carbonated Soft Drinks segment, despite facing health-related headwinds, remains a foundational pillar of the non-alcoholic beverages market. Demand for CSDs is driven by a combination of factors, including their widespread availability, affordability, and the strong brand loyalty they command, particularly in emerging markets. In developed economies, demand is sustained through continuous product innovation, such as the introduction of new flavors, limited-edition releases, and the expansion of zero-sugar or artificially sweetened variants. For instance, the demand for Diet Coke and Pepsi Zero Sugar is a direct result of manufacturers' strategic response to consumer health concerns, which allows them to retain a core consumer base that desires the flavor profile without the sugar. Furthermore, the social and cultural role of CSDs in events, fast-food pairings, and daily routines ensures a consistent baseline of consumption. While per capita consumption in some Western markets has plateaued or declined, the vast populations of regions like Asia-Pacific and South America continue to drive significant volume growth for the CSD segment.

- By Distribution Channel: Supermarkets/Hypermarkets

Supermarkets and hypermarkets are the dominant distribution channels for non-alcoholic beverages, and their influence on demand is profound. This channel's demand-driving power is rooted in several key factors. First, the sheer volume and variety of products available in a single location allow consumers to compare different brands and categories, which stimulates impulse and planned purchases. Second, strategic product placement, promotional displays, and special pricing offers within these retail environments directly influence consumer buying decisions. This physical retail setting enables effective marketing and brand visibility. Third, the "one-stop-shop" convenience of supermarkets means consumers often purchase beverages as part of their larger grocery trip, ensuring a consistent and high-volume sales flow. The rise of private-label non-alcoholic beverages in this channel also creates competitive pressure on national brands and offers consumers more budget-friendly options, thereby expanding the overall market for beverages.

- By Distribution Channel: Online Retail

The growing technological development and transition towards modern concepts that offer cost and time utility to consumers have provided new growth prospects for digital and online retail platforms for purchasing consumer goods, including beverage items. Likewise, unlike physical stores, which operate within a given time limit, the online retail channel offers 24/7 services, making them an ideal choice for making purchases at uneven hours.

Furthermore, the booming internet penetration, followed by smartphone adoption, has further shifted consumer buying behaviour towards online platforms as they offer higher convenience, wider product varieties and access to specialty beverage items. According to data provided by the US Census Bureau, in Q2 2025, the estimated US retail e-commerce sales adjusted for seasonal variation reached USD 304.2 billion, showcasing 1.4% growth over Q1 2025, and a 5.3% increase over Q2 2024.

Major non-alcoholic beverage manufacturers, namely the Coca-Cola Company, have established their own online platform for selling their beverages. For instance, the “Coke-Buddy” platform by Coca-Cola enables consumers to place online orders for the company’s products. The platform further provides them updates regarding the latest product launches, offers & discounts.

Rapid urbanization has transformed the consumer landscape, with digital channels replacing traditional methods of buying goods. To bolster such transition, companies are investing to enhance their online presence through collaboration with major e-commerce players such as Amazon, Walmart, and Alibaba. Such favourable efforts further impact the prevalence of online retail channels for buying beverage products, thereby augmenting the overall segment growth.

Non-alcoholic Beverages Market Geographical Analysis

- US Market Analysis

The US market for non-alcoholic beverages is a mature yet innovative landscape. The wide consumer landscape in the United States holds high market potential, further fuelled by growing health consciousness, improvements in lifestyle, and generational shifts, especially among young consumers, including mainly Gen Z and millennials. Additionally, many product developments and launches of new energy drinks are materializing to address the dynamic market needs. For instance, in May 2025, Anheuser-Busch launched its energy drink “Phorm Energy,” which features natural caffeine from green tea, further boosting the natural taste.

Similarly, the rapidly growing urban population, followed by improvement in disposable income, has accelerated the demand for bottled water in the United States. According to the Beverage Marketing Association, in 2024, bottled water constituted 28.26% of the US beverage industry, followed by carbonated soft drinks with 20.31%, and tea & coffee with 16.8%. Another study by the same source revealed that in 2024, the per capita bottled water consumption in the USA was 47.3 gallons in 2024, marking a 2.1% growth over the preceding year.

Likewise, according to the International Bottled Water Association’s “2024 Progress Report, nearly 69% of Americans consider bottled water as their most-preferred non-alcoholic beverage. Moreover, the growing sports culture and frequency of outdoor activities have further impacted people’s beverage choices, with a transition being witnessed towards sports & energy drinks. Hence, major market players, such as RedBull, the Coca-Cola Company, and PepsiCo, are capitalizing on this growing sports culture through their extensive product offerings.

Furthermore, the busy lifestyle coupled with growing work culture has escalated the consumption of hot-beverages such as tea & coffee in the United States. For instance, according to the USDA’s “Coffee World Market and Trade Report” issued in June 2025, the domestic coffee consumption in the United States reached 25,350 thousand 60-kilograms bags during 2024/2025, representing a 7.6% growth over the preceding year’s consumption scale. Moreover, the same source stated that the consumption for 2025/2026 was recorded at 25,550 thousand 60-kilogram bags. Such improved domestic consumption is projected to escalate demand for hot beverages in the United States, thereby propelling overall non-alcoholic market expansion in the country.

- Brazilian Market Analysis

Brazil represents a significant growth engine in the non-alcoholic beverages market in South America. Its market expansion is primarily driven by a large, young population, increasing urbanization, and a growing middle class with rising disposable incomes. Traditional CSDs and juices are staples of the Brazilian market. However, a local factor influencing demand is the rising interest in regional superfruits and natural ingredients. Companies are leveraging this demand by introducing beverages that feature locally sourced flavors and healthy attributes. The growth of the e-commerce sector in Brazil also facilitates market expansion by making a wider variety of products accessible to consumers in diverse geographical areas.

- German Market Analysis

The German non-alcoholic beverages market is characterized by a strong consumer preference for mineral water, juices, and specialty coffees. The need for CSDs remains robust, but there is a clear and verifiable trend toward low-calorie and zero-sugar options, driven by a cultural emphasis on health and a heightened awareness of nutrition. A unique local factor is the "Pfand" deposit system for beverage containers, which encourages recycling and influences packaging choices for manufacturers. This environmental consciousness is a direct demand driver for products that use sustainable packaging materials. The market also sees high consumption of dairy-based beverages and a growing interest in plant-based milks and organic juices.

- South African Market Analysis

The non-alcoholic beverages market in South Africa is driven by a combination of factors, including a large and rapidly urbanizing population, a tropical climate that fuels demand for refreshing drinks, and a growing middle class. Growth is concentrated on CSDs, bottled water, and juices. However, local regulatory and economic factors significantly impact the market. The implementation of a Health Promotion Levy, or sugar tax, has directly impacted the affordability and demand for sugary drinks, compelling manufacturers to adapt their product formulations. The fluctuating exchange rate and high transportation costs can also influence the pricing and availability of imported raw materials, which in turn affects the final cost of goods for local consumers.

- Chinese Market Analysis

China is a dominant force in the Asia-Pacific non-alcoholic beverages market. Massive consumer base, rapid economic development, and evolving urban lifestyles fuel this growth. The market is highly segmented, with strong demand for traditional tea and herbal beverages alongside a growing appetite for Western-style products like CSDs and coffee. A critical local demand driver is the influence of a large millennial and Gen Z population that favors new and innovative products, such as bubble tea and energy drinks. The market is also heavily influenced by e-commerce, with online platforms and delivery services playing a crucial role in product discovery and purchase, which directly increases the reach and demand for new beverage offerings.

Non-alcoholic Beverages Market Competitive Analysis

The non-alcoholic beverages market is dominated by a few major multinational corporations, while also featuring a dynamic ecosystem of smaller, innovative brands. The competitive landscape is characterized by intense brand rivalry, continuous product innovation, and strategic acquisitions to secure market share.

- PepsiCo, Inc.: PepsiCo is a global food and beverage corporation with a broad portfolio of non-alcoholic brands, including Pepsi, Mountain Dew, Gatorade, and Tropicana. The company's strategic positioning is rooted in its extensive and highly efficient global distribution network, which ensures its products are widely available in diverse retail channels. PepsiCo's demand-centric strategy focuses on brand extensions and product innovation to adapt to changing consumer preferences. For instance, the launch of Gatorade Water demonstrates a direct response to the rising consumer demand for functional and flavored hydration options. The company leverages its strong marketing and celebrity endorsements to maintain brand relevance and drive consumer demand across its CSD and functional beverage segments.

- The Coca-Cola Company: As a global leader, The Coca-Cola Company's competitive advantage lies in its iconic brand recognition and a vast portfolio that extends far beyond its namesake product. The company's strategic positioning is to be a "total beverage company" by offering a wide range of products that meet various consumer needs throughout the day. This is evident in its ownership of brands like Minute Maid, Dasani, and Honest Tea. The company's strategy focuses on reformulating products to reduce sugar, launching new health-conscious options, and acquiring smaller brands to integrate innovative product lines. This approach allows the company to counter declining demand for traditional CSDs in mature markets by stimulating demand for new categories.

- Nestlé S.A.: Nestlé is a diversified food and beverage giant with a significant presence in the non-alcoholic segment, particularly with its water brands like Perrier, S. Pellegrino, and its ready-to-drink coffee and tea lines. The company's competitive strategy centers on its commitment to sustainability and health. Nestlé positions its products as a healthy choice, often highlighting natural ingredients and responsible sourcing. The launch of a water bottle made from 100% recycled plastics in Egypt demonstrates its effort to appeal to environmentally conscious consumers and create demand through sustainable product attributes. This focus on wellness and environmental stewardship is a direct response to evolving consumer values and serves as a key differentiator.

Non-alcoholic Beverages Market Developments

- February 2025: Constellation Brands' venture capital arm made a minority investment in Hiyo, a non-alcoholic functional beverage brand. Hiyo's products are social tonics crafted with a proprietary blend of adaptogens, nootropics, and botanicals. This investment shows that even companies traditionally focused on alcoholic beverages are actively seeking to enter and innovate within the non-alcoholic sector, specifically targeting the "sober curious" and wellness-focused consumer.

- 2025: Nestlé expanded its Nescafé Ready-to-Drink cold coffee range to India, the Middle East and North Africa (MENA) region and Brazil to meet the needs of young consumers who prioritize convenience, variety and on-the-go options that align with their fast-paced and dynamic lifestyles.

- 2025: Nestlé expanded its NESCAFÉ Ready-to-Drink Cold Coffee range in India, to meet the needs of young consumers who prioritize convenience, variety and on-the-go cold coffees that align with their fast-paced and dynamic lifestyles.

- March 2024: PepsiCo, Inc. announced the launch of Bubly Burst, a new sparkling water beverage line. The product launch, a direct extension of the successful Bubly brand, is designed to tap into the growing demand for flavored, zero-calorie, and unsweetened sparkling water alternatives. The introduction of this product demonstrates PepsiCo's strategy to diversify its portfolio away from traditional CSDs and capture a segment of the health-conscious consumer market.

Non-alcoholic Beverages Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Non-alcoholic Beverages Market Size in 2025 | USD 1.100 trillion |

| Non-alcoholic Beverages Market Size in 2030 | USD 1.457 trillion |

| Growth Rate | CAGR of 5.78% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Tillion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Non-alcoholic Beverages Market |

|

| Customization Scope | Free report customization with purchase |

Non-alcoholic Beverages Market Segmentation

- By Product Type

- Carbonated Soft Drinks (CSD)

- Bottled Water

- Ready-to-Drink (RTD) Tea & Coffee

- Fruit Juices & Vegetable Juices

- Functional Beverages

- Energy Drinks

- Sports Drinks

- Dairy-based Beverages

- By Packaging

- PET Bottles

- Glass Bottles

- Aluminum Cans

- Cartons

- Others

- By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Food Service Sector

- By Flavor

- Cola

- Citrus

- Fruit

- Others

- By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa