Report Overview

Electric Vehicle Tires Market Highlights

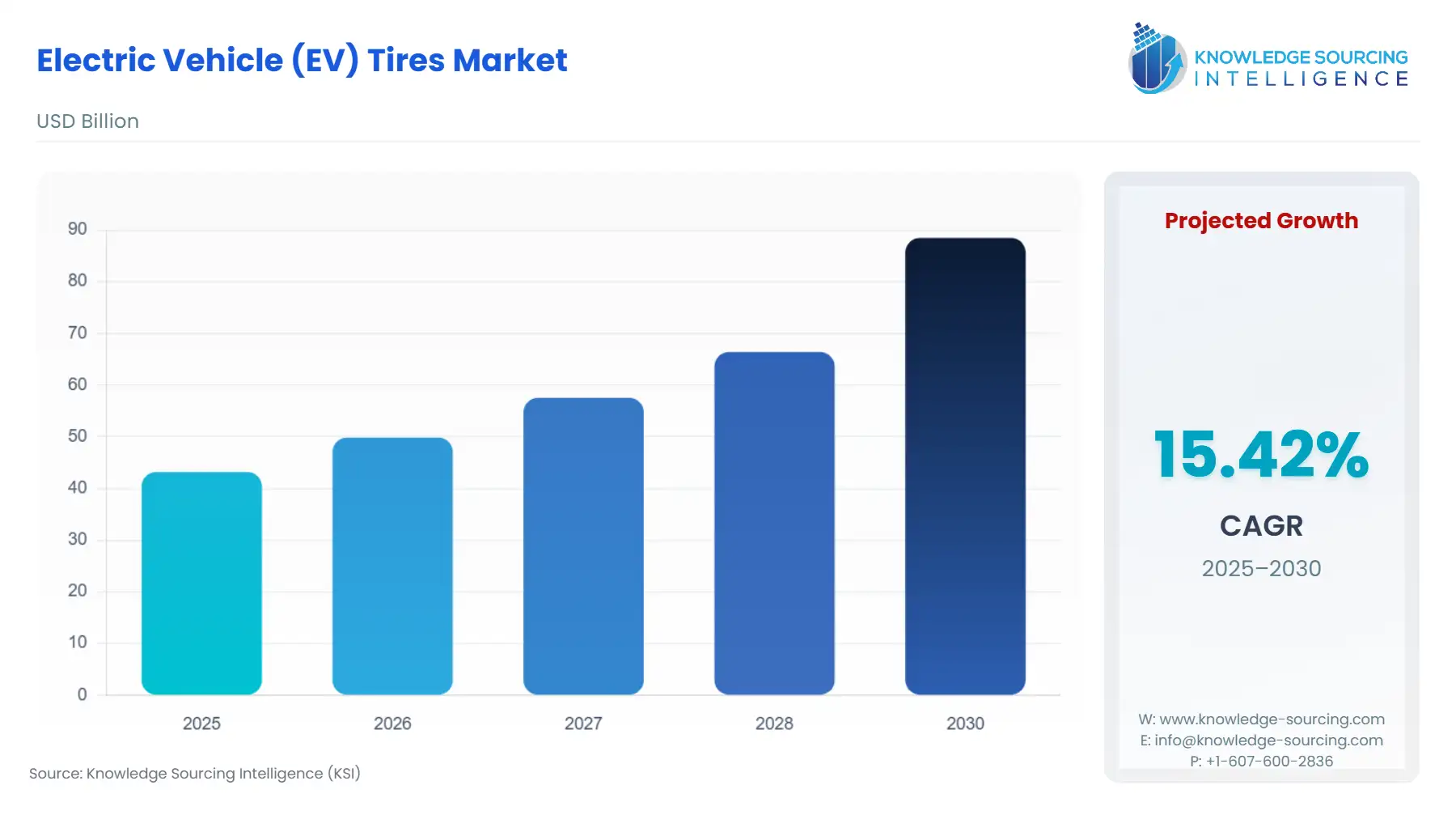

Electric Vehicle Tires Market Size:

The electric vehicle (EV) tires market will grow from US$43.196 billion in 2025 to US$88.498 billion in 2030 at a CAGR of 15.42%.

Electric vehicle (EV) tires are specially designed tires that are made to support electric vehicles because of their unique design and architecture. These tires are quieter than conventional tires and are preferred for EVs that are quieter than combustion engines. As the EV engines are quieter, they need to cancel out the noise produced by the tires and prevent it from reaching the passengers. Compared to combustion cars, EVs drive technology lowers maintenance, emissions, engine noise, and running costs.

However, one consequence of electric vehicles' many benefits is a major weight increase. Batteries are heavy, and their weight puts a strain on EV tires. Choosing the right tires for electric vehicles is essential to maintaining mileage, braking performance, and efficiency. Additionally, with high instant torque and increased weight, the demand for long-range and lower emissions comes with an even greater need for minimal rolling resistance, so tires for electric cars offer a smoother, more energy-efficient, and low-impact ride.

Electric Vehicle Tires Market Trends:

The electric vehicle tires market is driven primarily by the increasing demand for EVs and their adoption as commercial vehicles, such as electric buses, trucks, and vans. These tires are equipped with technology that is different from traditional combustion engine tires, making the vehicle quieter. Tires can impact the overall performance and efficiency of the vehicle, so it is an essential part of EVs, with an increase in demand, propelling the electric vehicle tires market growth.

The adoption of IoT (Internet of Things) enabled devices is driving market growth. These devices are a major part of the development process of the automotive industry and have been a significant part of this industry in recent times, accelerating the growth and development of electric vehicle smart tires. Major tire manufacturers are developing the functionality of smart tires that depend upon IoT connectivity to deliver more efficient and reliable tires.

Electric Vehicle Tires Market Growth Drivers:

The Adoption of EVs for commercial and personal use is predicted to propel the electric vehicle tire market

The demand for EVs has seen rapid market growth for better efficiency and more eco-friendly options for the general public. This, in turn, is increasing the demand for appropriate tires that go with these EVs, which have different requirements for a tire than a traditional car tire. These smart tires, or connected tires, are mainly used in new-generation electric vehicles. Therefore, the EV tire market growth is prominent in the forecast period. For instance, the American government is investing heavily in public and private sectors to provide affordable electric vehicles, which will turn up EV sales and, in turn, EV tire sales.

The adoption of the IoT-enabled smart devices market trend is projected to drive the electric vehicle tires market.

The acceptance of IoT in the global automotive industry and the rising demand for connectivity in IoT are helping in innovations and new developments in EV tires. Many major tire manufacturers are moving towards IoT connectivity to increase efficiency, driving market growth.

The enhanced features of EV tires are anticipated to propel market growth.

According to electric vehicle specifications, the specially developed tires produce less carbon emission than traditional combustion engine vehicle tires during manufacturing. These tires also produce less sound than traditional tires, which goes perfectly with EVs, as they are quieter than fuel-engine vehicles, and the sound does not reach the passenger sitting in the driving seat. The added weight of EV batteries provides improved road resistance and stiffness.

Electric Vehicle Tires Market Restraints:

The use of high-performance tires results in efficient and smooth EV rides. Electric vehicles produce more power and torque than traditional fuel-engine vehicles, increasing the strain on the tires because they have heavy batteries. This reduces their lifespan as they wear down 20% faster than fuel engine tires because of these vehicles' acceleration. These tires are more expensive than traditional car tires due to their enhanced features. However, their high cost and low lifespan might hinder the market growth of electric vehicle tires in the forecast period.

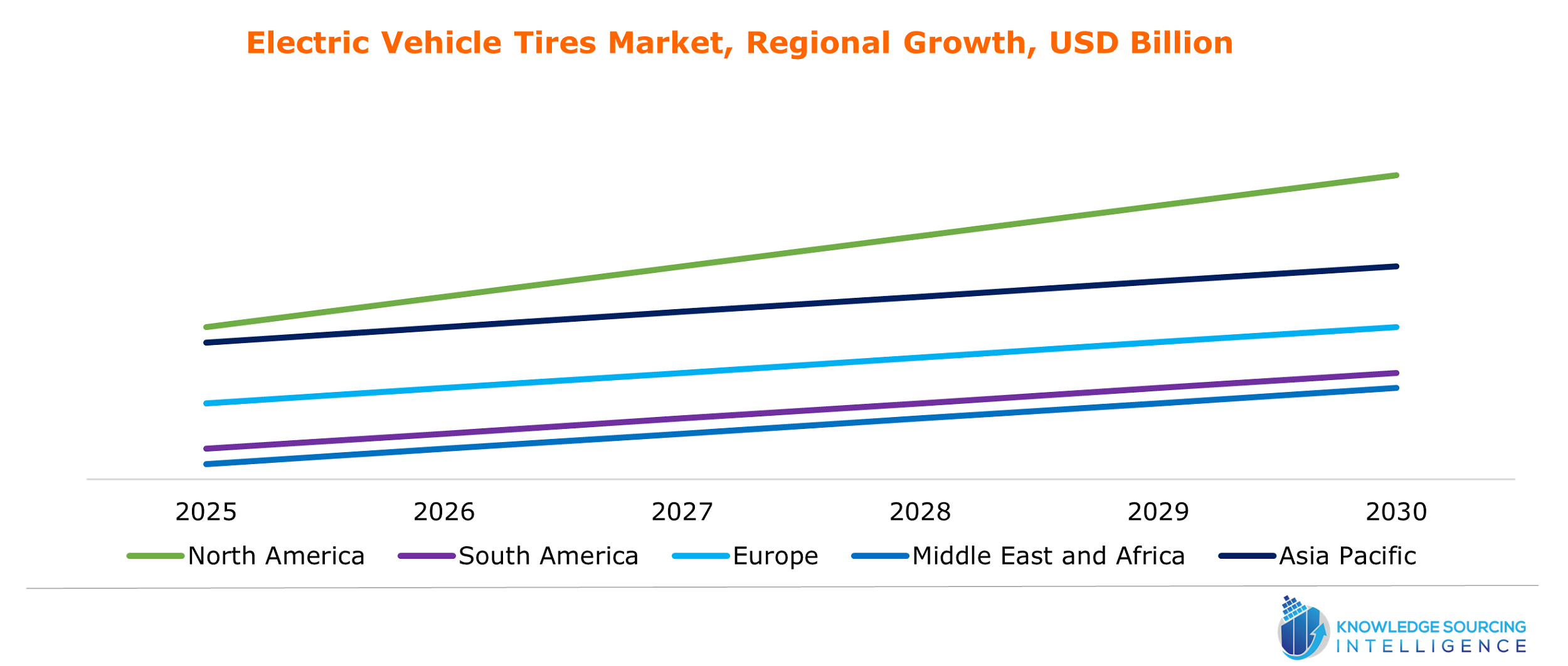

Electric Vehicle Tires Market Geographical Outlook:

The Asia Pacific region is expected to dominate the electric vehicle (EV) tires market.

The Asia Pacific region is expected to show major growth in the electric vehicle tires industry. This growth is attributed to the rapid increase in production and demand for the electric vehicle industry in countries like Japan, South Korea, and China. The rising demand for eco-friendly vehicles is driving growth in this region, with key players like Toyota, Honda, and others.

Furthermore, the development of infrastructure for electric vehicles, along with government initiatives promoting their use for both commercial and personal purposes, is driving significant technological advancements in these regions. This, in turn, is expected to boost the market growth of electric vehicle tires during the forecast period in the Asia Pacific region.

Electric Vehicle Tires Market Key Players and Products:

Yokohama: The ADVAN Apex® V601 is one of the tires produced specially for electric vehicles. It is used for ultra-high-performance cars that demand an ultra-high-performance tire. It is designed to redefine grip and dominate U.S. roads with a strong sidewall and tread, delivering a precise and immediate cornering response. It also has rigid construction and optimized groove angles to minimize road noise, providing a quieter road trip.

Michelin Tires: DEFENDER LTX PLATINUM is a product that is suitable for electric vehicles and provides the best performance and efficiency. It delivers exceptional tread life and cutting-edge aesthetics with a new class of tires developed specifically for luxury heavy-duty pickup trucks. It includes an ultra-premium design with a striking velour sidewall. It is designed to last twice as long as the previous generation, providing drivers with a smooth and classy ride the whole journey with these tires.

Electric Vehicle Tires Market Key Developments:

In January 2024, Yokohama Tires launched its product, the new ADVAN Sport® EV A/S, in the US market. These tires are an ultra-high-performance all-season tire specifically designed for electric vehicles. It’s the first tire to carry the new E+ badge, which is important for EV tires, and it signifies that the tire can fulfill the unique set of requirements brought by EVs and its compatibility with electric vehicles.

List of Top Electric Vehicle Tire Companies:

Yokohama

Smithers

Michelin Tires

Continental Tire

Hankook USA

Electric Vehicle Tires Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 43.196 billion |

| Total Market Size in 2028 | USD 88.498 billion |

| Forecast Unit | Billion |

| Growth Rate | 15.42% |

| Study Period | 2020 to 2028 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2028 |

| Segmentation | Propulsion Type, Vehicle Type, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Electric Vehicle (EV) Tires Market Segmentation:

By Propulsion Type

Battery Electric Vehicle (BEV)

Plug-in Hybrid Electric Vehicle (PHEV)

Hybrid Electric Vehicle (HEV)

Fuel Cell Electric Vehicle (FCEV)

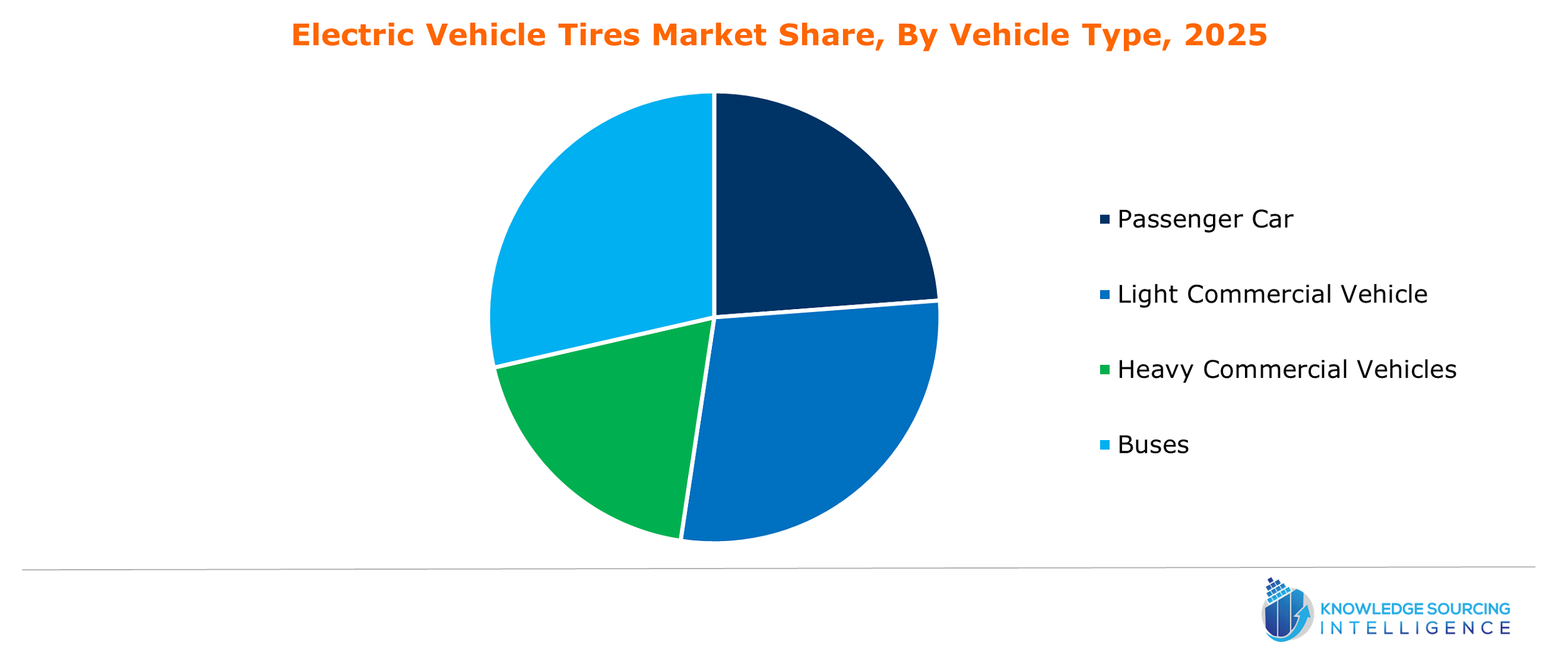

By Vehicle Type

Passenger Car

Light Commercial Vehicle

Heavy Commercial Vehicles

Buses

By Application

On-road

Off-road

By Sales Channel

OEM

Aftermarket

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Italy

Spain

Others

Middle East and Africa

Saudi Arabia

United Arab Emirates

Others

Asia Pacific

China

India

Japan

South Korea

Taiwan

Thailand

Indonesia

Others