Report Overview

EV Charging Connectors Market Highlights

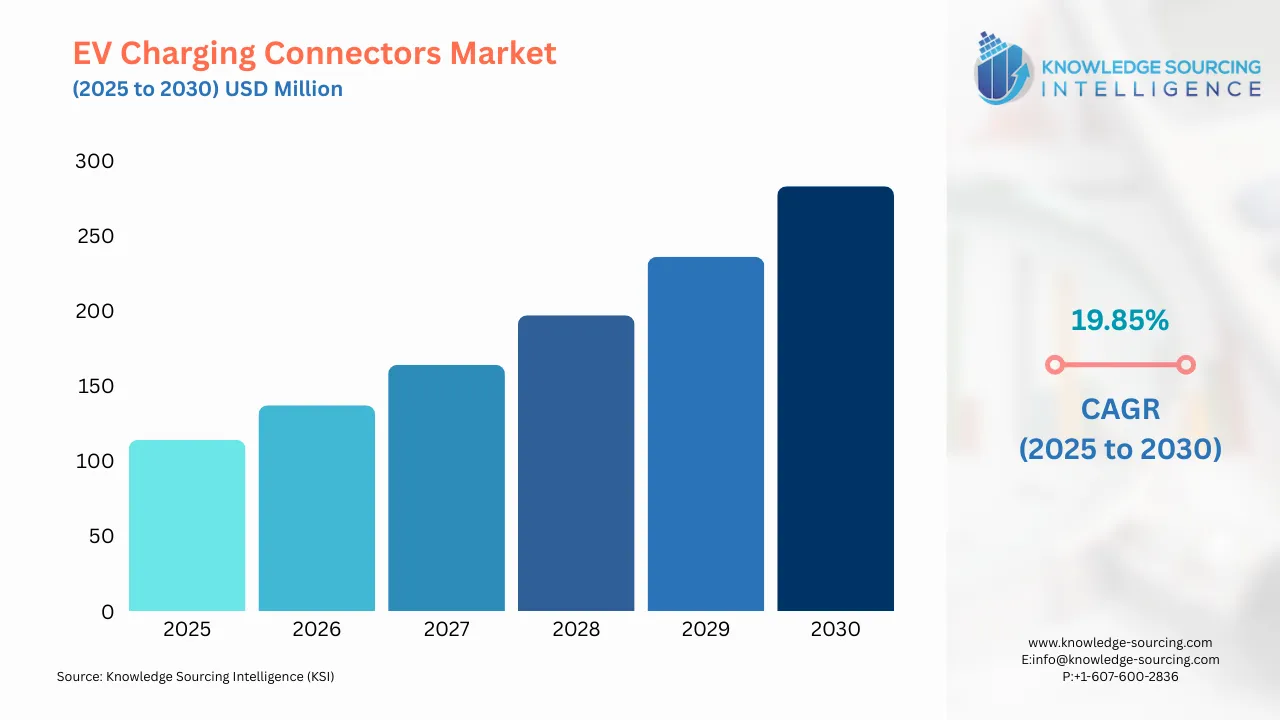

EV Charging Connectors Market Size:

The EV charging connectors market will grow from US$114.395 million in 2025 to US$282.920 million in 2030 at a CAGR of 19.85%.

The electric vehicle (EV) charging connector is among the most critical components in EV charging infrastructure, as the connector transmits electric energy from the charging boards to the automobiles. EV charging connectors are often used by EV charging stations or residential charging infrastructure. These connectors provide a wide range of charging power outputs and charging timeframes. The EV connector makes it easier for an electric car's battery to be connected to the charging source, ensuring power is timed with the battery.

The EV charging connectors offer multiple benefits to the users, like ensuring flexibility and convenience for the EV operators to charge from a wide range of EV chargers. These connectors also help to lower energy costs and promote sustainability for EV drivers. The market for EV charging connections is projected to grow significantly due to the increasing demand for electric vehicles. The global demand for electric vehicles has observed massive growth in the past few years, mainly due to the growing public perceptions towards an eco-friendly transport model and increasing governmental initiatives and investments for EV chargers.

EV Charging Connectors Market Growth Drivers:

- The rising demand for electric vehicles is expected to drive the market growth

One of the major driving factors forecasted to propel the global EV charging connector market growth is the rising demand for electric vehicles worldwide. This growth is expected to increase the number of publically available EV chargers and charging stations worldwide.

Furthermore, the increased awareness of carbon emissions and tight emission requirements is expected to drive EV sales forward, simultaneously driving the charging connection market forward.

The global sales of EVs have grown significantly over the years. The global BEV & PHEV sales report by EV Volumes stated that in 2021, 6,774 thousand EVs were sold, which grew to about 10,524 thousand units in 2022. The total BEV and PHEV sales in the global market grew to 14,182 thousand units in 2023, an increase of about 35% from previous years.

Furthermore, the total electric car stock worldwide has also grown significantly during the past few years. The International Energy Agency, a global organization, stated that Europe had a total battery electric vehicle (BEV) of about 2.9 million, and the USA had 1.5 million BEVs in stock in 2021. The BEV stock of Europe and the USA grew massively to 4.4 million and 2.1 million, respectively, in 2022. This figure rose to 6.7 million in Europe and 3.5 million in the USA in 2023.

EV Charging Connectors Market Geographical Outlook:

- Asia Pacific is forecasted to hold a major share of the EV Charging Connectors Market.

The Asian Pacific region is forecasted to attain a greater market share in the global EV charging connectors market. The major driving factors for this market’s growth are the increasing demand for EVs across the region and governmental investments in developing the EV charging infrastructure.

Some of the major countries in the Asian Pacific region, like China, Japan, and India, have introduced key initiatives that are expected to boost the EV charging connectors market in this region.

The Asian Pacific region is among the biggest markets for EVs, with China being the biggest producer and consumer of electric vehicles. The International Energy Agency (IEA), in its global report, stated that in 2021, the total EV stock in China was recorded at about 6.2 million, which significantly grew to 10.7 million units in 2022. The total BEV stock in the nation in 2023 was estimated at 16.1 million, almost half of the global BEV stock in the same year. Similarly, EV sales in the nation have also grown massively over the past few years. The total EV sales in China were recorded at about 3.3 million in 2021, which increased to 6 million in 2022, and finally reached 8.1 million in 2023.

EV Charging Connectors Market Players and Products:

- Sumitomo Electric is a Japanese multinational corporation that offers products and solutions for multiple markets like telecoms, defense & radar, environment & energy, and data centers. The products of the company include fusion splicers & tools, optical fiber cables, optical connectivity, electron devices, fiber management & closure, EV connectors, environment & energy, and water treatment filters. The company offers CHADEMO DC fast chargers in three variants in the global EV charging connector market. The EV connector features a user-friendly solution that can be used with Vehicle-To-Home (V2X) or high-power charging stations.

- Fujikura is a Japanese multinational corporation that offers products across multiple industries, including telecommunications, energy, transportation, industry, medical, and digital electronics. The product catalogs of the company include telecommunication business, automotive products, energy business, new business development area, and real estate business.

The company offers two different types of EV charger connectors: DC Charging Connector (CHAdeMO) and DC Charging Connector (CCS Type 2). These EV connectors offer improved security with a better locking mechanism, simple operations, and higher insulation performance. They are also highly durable, with the company claiming the charger can be used more than 10,000 times for insertion and extraction.

EV Charging Connectors Market Key Developments:

- In August 2024, Enphase Energy, Inc., a global energy technology corporation, announced that it had introduced its NACS Connectors for the IQ EV chargers for the US and Canadian markets. Its latest J1772 connector is set to increase the compatibility of the EVs with the charging stations while maintaining the same functionality. The company also offers a 5-year limited warranty on the connectors and chargers.

- In August 2024, ChargePoint Holdings Inc., one of the major innovators in the EV charging industry, launched a charging connector that fits almost all types of EVs. With the launch of its Omni Port Adaptable charging solution, the company aimed to eliminate the confusion in the EV charging sector. The company made the Omni Port solution publicly available in North America.

List of Top EV Charging Connector Companies:

- Degson

- Zhengzhou Saichuan Electronic Technology Co., Ltd.

- iConnector Technology Co., Ltd.

- Amphenol Corporation

- Fujikura Ltd.

EV Charging Connectors Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

EV Charging Connectors Market Size in 2025 |

US$114.395 million |

|

EV Charging Connectors Market Size in 2030 |

US$282.920 million |

| Growth Rate | CAGR of 19.85% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in EV Charging Connectors Market |

|

| Customization Scope | Free report customization with purchase |

EV Charging Connectors Market Segmentation:

- By Product Type

- Wall Connector

- Charge Plug Connector

- By Speed

- Slow Charging

- Rapid Charging

- By Socket Type

- Type 1

- Type 2

- By Vehicle Type

- Battery Electric Vehicle

- Plug-in Hybrid Electric Vehicle

- Hybrid Electric Vehicle

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- UK

- France

- Spain

- Others

- Middle East and Africa

- Suadi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Others

- North America