Report Overview

PCB Connector Market - Highlights

PCB Connector Market Size:

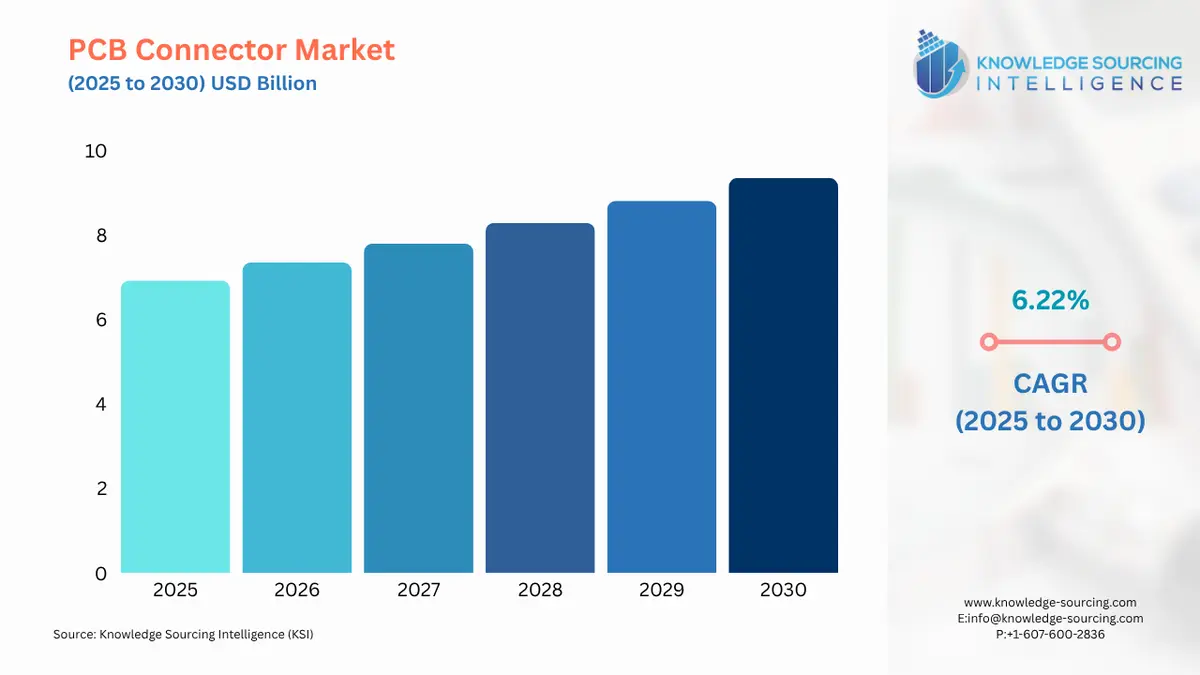

The PCB connector market is projected to expand at a 6.03% CAGR, attaining USD 9.83 billion in 2031 from USD 6.917 billion in 2025.

PCB Connector Market Trends:

PCB connectors, mounted on the printed circuit board, facilitate the transfer of signals or power between PCBs or between the PCB and external sources within a device. These connectors are crucial for facilitating smooth and uninterrupted connectivity. PCB connectors serve a wide range of end users including aerospace and defense, industrial, power and energy, automotive, and electrical and electronics. The growing adoption of automation and robotics, coupled with the booming automotive production serves as prominent drivers for the PCB connector market.

PCB Connector Market Segmentation Analysis:

Growing automation and robotics adoption bolsters the PCB connector market growth.

PCB connectors enable the seamless transmission of signals and power between various components, modules, and subsystems, ensuring smooth communication and coordination in automation and robots. The increasing need for enhanced productivity, improved precision, reduced labour costs, and the ability to handle complex tasks efficiently has propelled robotics installation which is booming the demand for PCB connectors proportionally. According to the International Federation of Robotics, global robot installations reached a record high of 517,385 units in 2021, growing by 31% compared to 2020. Also, as per the source anticipated installation for 2022 stood at 570,000.

Emerging automotive drives the PCB connector market expansion.

PCB connectors are essential in the automotive industry as they play a crucial role in connecting and interconnecting various electronic components and systems within vehicles. With the growing trend of automotive electrification, advanced driver-assistance systems (ADAS), and electric vehicles, the demand for PCB connectors has significantly increased. According to the International Energy Agency, in the first quarter of 2023, the global electric car market witnessed remarkable growth, with over 2.3 million electric cars sold, representing a significant increase of approximately 25% compared to the same period in the previous year.

Shift toward renewable energy drives PCB connector market growth.

PCB connectors are utilized for interconnecting various components and systems within solar panels, wind turbines, and other renewable energy installations. The growing shift towards renewable energy coupled with favourable government initiatives to tackle environmental concerns is expanding the power & energy sector which is expected to stimulate PCB connector’s market demand correspondingly, as they facilitate efficient power transmission and monitoring within renewable energy systems. According to the International Renewable Energy Agency, the global renewable generation capacity reached a total of 3,372 gigawatts (GW) in 2022 which signified a 9.6% increase in the stock of renewable power.

PCB Connector Market Geographical Outlook:

Asia-Pacific is expected to account for a major market share.

Asia-Pacific is projected to dominate the PCB connector industry owing to the significant investments made by leading economies namely China, Japan, and India in electric vehicle and robotics applications. These investments have propelled the demand for PCB connectors in the region. In 2023, Chinese electric vehicle (EV) leader BYD announced its investment of 17.9 billion baht to establish a new manufacturing facility in Thailand. The facility will focus on producing 150,000 passenger cars annually in 2024. Also, in March 2022, the Indian government, launched the Artificial Intelligence and Robotics Technology Park in Bengaluru, with an initial investment of Rs 230 crore. This initiative aims to drive research, innovation, and development in AI and robotics.

PCB Connector Market Growth Drivers:

The increasing adoption of wireless communication restrains the PCB connector market.

Wireless connectivity options are being widely adopted owing to which there is a possibility of a gradual shift away from traditional wired connectors, including PCB connectors. This changing landscape emphasizes the need for PCB connector manufacturers to adapt and innovate to remain relevant and address the evolving connectivity requirements of the market. For instance, in September 2022, Silicon Labs introduced the BGM240P and MGM240P PCB modules, featuring 2.4 GHz wireless capabilities, to provide IoT device manufacturers with accelerated and streamlined development processes. These modules bring about faster and simplified development, empowering IoT device makers to create their products more efficiently.

PCB Connector Market Company Products:

FFC Connectors: TE Connectivity offers FFC connectors that provide several advantages, including the elimination of cable stripping and plating processes. These connectors facilitate high-speed sequential application of multiple-crimp contacts, ensuring efficient and reliable connections. Additionally, the capability of intermixing FFC cable and round wire contacts adds flexibility to design and assembly options. With TE Connectivity's FFC connectors, customers can enjoy streamlined manufacturing processes, enhanced performance, and increased design versatility for their applications.

MSTBVA 2,5/ 4-G-5,08: Phoenix Contact offers the MSTBVA 2,5/4-G-5,08 connector, featuring a wave soldering mounting type. With a total of four connections, this connector provides a linear pinning layout. The MSTBVA 2,5/4-G-5,08 is designed to simplify the assembly process, allowing for efficient and reliable connections. This connector from Phoenix Contact is suitable for various applications where wave soldering is the preferred method of mounting, providing convenience and ease of use in electronic assemblies.

Micro HDAS: Amphenol Corporation presents the Micro HDAS, a rugged PCB connector that offers a smaller and lighter form factor. It provides a wide range of contact and fittings options, allowing for versatile customization. The Micro HDAS connector enables a compact mezzanine connection, with a mere 7.4 mm spacing between boards. With its robust design, diverse configuration choices, and space-saving capabilities, the Micro HDAS connector from Amphenol Corporation delivers reliable connectivity solutions for various applications.

PCB Connector Companies:

TE Connectivity

Phoenix Contact

Amphenol Corporation

HARTING Stiftung & Co KG.

Smiths Interconnect (Smiths Group)

PCB Connector Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

PCB Connector Market Size in 2025 | USD 6.917 billion |

PCB Connector Market Size in 2030 | USD 9.353 billion |

Growth Rate | CAGR of 6.22% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the PCB Connector Market |

|

Customization Scope | Free report customization with purchase |

PCB Connector Market Segmentation

By Type

Pin Header Connector

Board-To-Board Connector

Wire-To-Board

USB Connector

Others

By Material

Metal

Copper

Aluminum

Iron

Polytetrafluoroethylene (PTFE)

Others

By End-User

Aerospace & Defense

Industrial

Power & Energy

Automotive

Electrical & Electronics

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others