Report Overview

Quantum Computing Market - Highlights

Quantum Computing Market Size:

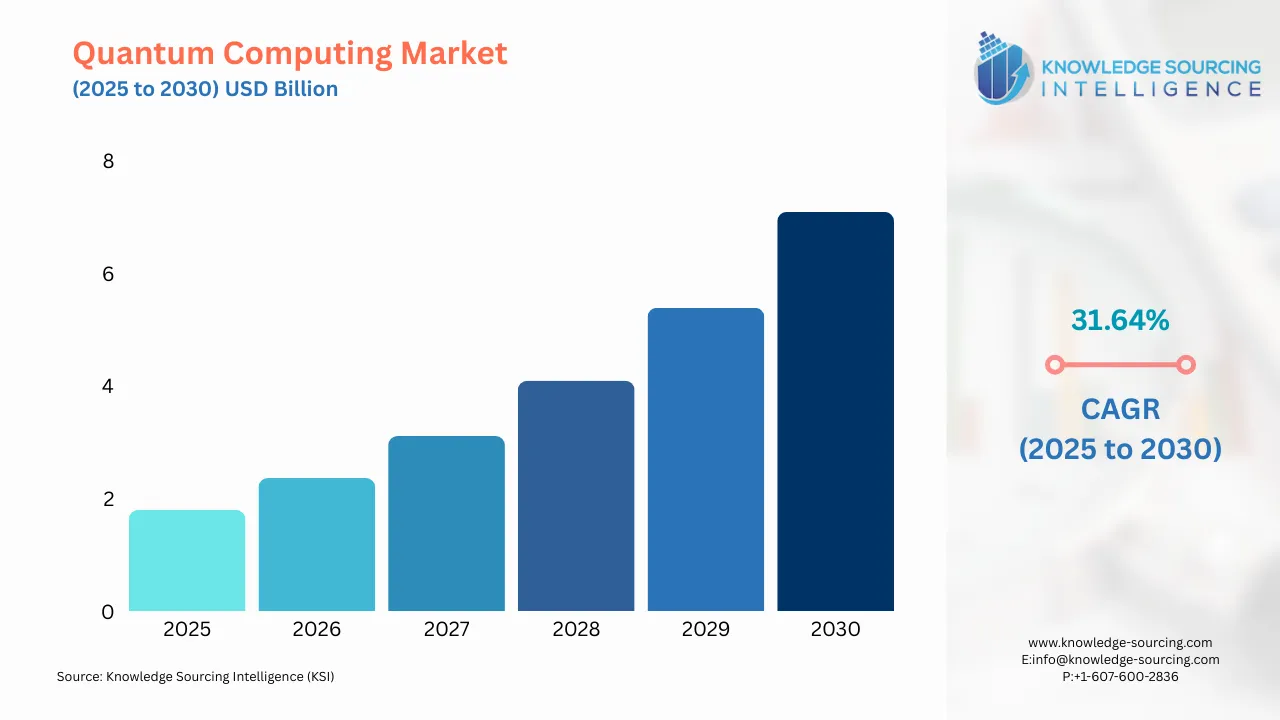

The quantum computing market is projected to grow from USD 1.793 billion in 2025 to USD 7.088 billion by 2030 at a CAGR of 31.64% during the forecasted period.

Quantum Computing Market Trends:

Quantum computing is an innovative method that applies the principles of quantum mechanics, such as superposition, entanglement, and quantum interference, for processing information. While classical computers use bits that exist in either of two states, quantum computers use quantum bits or qubits that can exist in multiple states simultaneously, thus offering faster solutions to applications such as cryptography, optimization, and molecular simulations. The quantum computing market is witnessing rapid growth owing to some key factors, such as growing investments from governments, tech giants, and venture capital are substantial drivers fuelling research and development in this market.

Moreover, the rise in enterprises utilizing cloud computing technology solutions leads to an increase in the adoption of quantum computing solutions. This will also lead to providing quantum resources which are more reliable, scalable, and accessible, with cost-efficient for diverse-sized enterprises. According to Eurostat, the enterprises purchasing cloud computing services accounted for 45.2 percent in 2023, which was a substantial increment from the 2022 data of 41 percent.

Quantum Computing Market Overview & Scope:

The quantum computing market is segmented by:

Component: By component, the quantum computing market is segmented into hardware, software, and services. The hardware segment is increasing with diverse industrial applications. The development of the quantum computing hardware market is driven by the need for more powerful and efficient processors. Breakthroughs in areas like cryptography, optimisation, and machine learning are accelerating the growth of the quantum computing market.

Deployment: By deployment, the quantum computing market is segmented into on-premises and cloud-based. The cloud-based is predicted to be the fastest-growing market share, due to increasing accessibility of this for startups and smaller-sized enterprises. It is cost-effective and provides scalability and flexibility to the users, which contributes to its increased adoption among diverse sectors in the coming years.

Application: By applications, the quantum computing market is segmented into artificial intelligence & machine learning, computational chemistry, drug design & development, cybersecurity & cryptography, financial modelling, logistics optimisation, and others. The artificial intelligence & machine learning segment is expected to have a significant market share in this segment.

Industry Vertical: By industry vertical, the quantum computing market is segmented into BFSI, automotive, manufacturing, healthcare, it & telecom, energy & power, and others. The automotive segment is rapidly expanding in the industry vertical segment.

Region: The Asia Pacific is poised to hold a significant position in the quantum computing market, particularly due to its increasing quantum computing demand in diverse industries inclusive of BFSI, IT & Telecom, and the energy sector and the presence of regional players and innovations. Rise in demand for high-performance computing, with an increase in government and private sector investments is expected to propel the market growth.

Top Trends Shaping the Quantum Computing Market:

1. Growing Advancement in Quantum Technologies

The market players and research institutes are working towards the development of Quantum solutions and algorithms, which are refined and improved versions for integration in quantum systems. These advancements are inclusive of machine learning, optimization, and cryptography, aiming to enhance the advantages of quantum computing over traditional computing, especially in fields like logistics and drug discovery.

2. Rising Investment in Quantum Technologies

There is a rise in the global tech companies such as Google, Microsoft, Intel, and IBM, and governments, along with venture capital, are investing in the research and development related to quantum technologies. These funding such as Google and Softbank, raised a funding of $230 million for QuEra in 2025, which is working to advance the quantum system. These trends will contribute to increasing the quantum computing potential in diverse applications in multiple industries such as healthcare, manufacturing, and financial sectors. Similarly, IBM has been investing in product advancements, for instance, in November 2024, it launched its advanced quantum computer that will leverage IBM’s “Qiskit” software to accurately run classes in quantum circuits.

Quantum Computing Market Growth Drivers vs. Challenges:

Drivers:

Increasing Demand for High-Performance Computing: The growing demand for high-performance computing is a major driving factor for market expansion. The traditional high-performance computing faces issues, such as minimal optimization and complex data analysis, which are due to its exponential computational complexity. Meanwhile, the latest quantum computing works with the superposition principle, which helps solve these issues faster, which is boosting its acceptance in diverse industries such as pharmaceuticals, financials, logistics, and aerospace, among others.

Additionally, with the increasing utilization of quantum computing in the propelling of research and development and the drug discovery process, with the application of stimulating the molecular interaction at an unprecedented speed, work is being done in the reduction of time and cost, which leads to the growth of the market. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), the research and development expenditure of Europe’s pharmaceutical sector accounted for € 47,010 million in 2022 and grew to a value for n € 50,000 million by 2023.

Similarly, it is utilized in the financial sector for risk analysis, problem optimization, and for the management of portfolios from quantum algorithms that offer wide data processing with efficiency and precision compared to previous computing systems, which increases the demand for quantum computing solutions.

Growing Computing Hardware Components Demand: The demand for advanced quantum computing hardware is expected to rise due to the increasing complexity of quantum processors and systems. As quantum computers evolve with more qubits and advanced quantum gates, there is a growing need for high-precision hardware to ensure reliable performance and accurate calculations. Other attribute driving the demand is the rising adoption of quantum technologies in areas like cryptography, optimisation, and AI, which require powerful quantum hardware to solve complex problems.

As a result of this factor, quantum hardware has gained attention for its potential to transform industries and achieve breakthroughs in computing capabilities, enabling researchers and companies to push the boundaries of quantum innovation. Moreover, the increased funding in quantum computing hardware shows an increase in the market. For example, according to Quantum Insider, the quantum computing market raised over 1,200 million in funding in the first quarter of 2025, which was an increase of 125% from the first quarter of the previous year.

Rising Technological Advancement: Technological advancements and ongoing investment in emerging technologies have picked up pace globally, fueled by the growing emphasis on promoting automation and industrial applications. Hence, quantum computing offers higher flexibility in solving complex problems via mechanical learning abilities, which is driving its usage in sectors such as BFIS, manufacturing, logistics, and healthcare.

The US government has formed strategic policies such as the “National Quantum Initiative Act,” which aims to bolster the US in advanced quantum technologies. As per the “National Quantum Initiative Supplement to the President’s FY-2024 Budget”, the US Federal Department and agencies reported estimated budget expenditure of US$968 million for Quantum Information Science (QIS) research & development, which marked a 3.86% growth in over 2023’s QIS expenditure.

Challenges:

High Initial Investment Cost: The high investment cost involved in the development and deployment of these quantum computing systems is a challenge for smaller and medium enterprises. Moreover, the cost increases with the requirement of maintenance, which is financially burdensome for smaller market players, limiting the growth of the expansion.

Quantum Computing Market Regional Analysis:

North America: The region is expected to hold the largest market share due to ongoing adoption of emerging technologies, inclusive of artificial intelligence and machine learning in major regional nations, namely the USA is gaining traction in major sectors which has providing a new scope for advanced computing technologies. Likewise, major US-based market players are investing in innovations and launches, which is also driving the overall market expansion. For instance, in November 2024, IBM announced quantum hardware & software advancements that will execute complex algorithms in its “IBM Quantum Platform” using “Qiskit” software. The development marks an achievement that meets the company’s “Quantum Development Roadmap”.

Quantum Computing Market Competitive Landscape:

The market is fragmented, with many notable players, including IBM, Microsoft, Quantum Computing Inc., Intel Corporation, D-Wave Quantum Inc., Quix Quantum BV, Alpine Quantum Technologies GmbH, ORCA Computing, Rigetti & Co., LLC., Google LLC, Nanofiber Quantum Technologies, IQM Quantum Computers, and IonQ, Inc., among others.

Partnership: In March 2025, IBM, in partnership with the Basque government, announced the plan for the installation of IBM Quantum System Two, together with the IBM-Euskadi Quantum Computational Center in Spain. It is the first of its kind in Europe with a system provided with a utility-scale 156-qubit IBM Quantum Heron processor, with predicted completion by the end of 2025. The central objective is to utilize IBM's most proficient quantum computing solution to enhance the solutions and discovery in physics, material science, and information science.

Quantum Computing Market Key Developments:

November 2025: The European HPCQS project inaugurated two Pasqal quantum processors, Jade and Ruby, integrated into HPC environments in Germany (FZJ) and France (CEA), each “capable of controlling more than 100 qubits.”

November 2025: IQM Quantum Computers launched its Halocene product line, a modular on-premises quantum computer focused on error correction, starting with a 150-qubit system.

October 2025: Google Quantum AI announced its Quantum Echoes algorithm, achieving verifiable quantum advantage on its Willow chip, running 13,000× faster than the most powerful classical supercomputer.

Quantum Computing Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 1.793 billion |

| Total Market Size in 2030 | USD 7.088 billion |

| Forecast Unit | Billion |

| Growth Rate | 31.64% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Component, Deployment, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Quantum Computing Market Segmentation:

By Component

Hardware

Software and Service

By Deployment

On-Premises

Cloud-Based

By Application

Artificial Intelligence & Machine Learning

Computational Chemistry

Drug Design & Development

Cybersecurity & Cryptography

Financial Modelling

Logistics Optimisation

Others

By Industry Vertical

BFSI

Automotive

Manufacturing

Healthcare

IT & Telecom

Energy & Power

Others

By Region

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East & Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Indonesia

Taiwan

Others