Report Overview

Rugged Server Market - Highlights

Rugged Server Market Size:

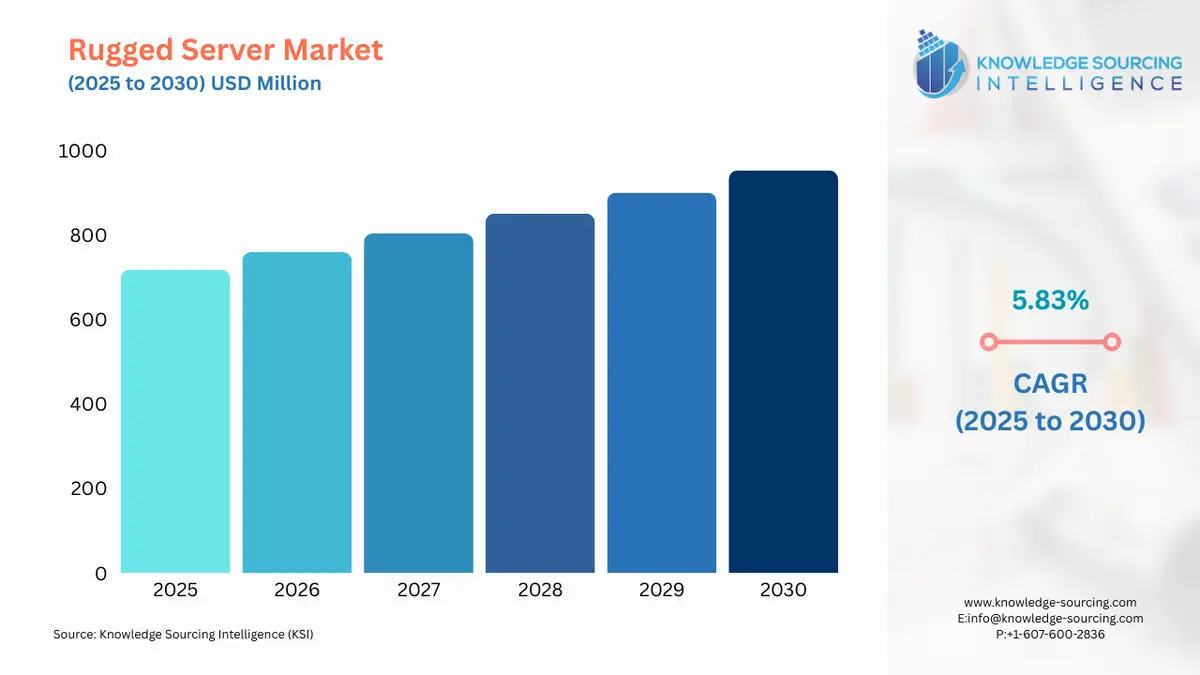

The rugged server market is projected to grow at a CAGR of 5.83% over the forecast period, increasing from US$717.547 million in 2025 to US$952.711 million by 2030.

A rugged server is best described as a server designed and manufactured to withstand multiple stress situations. These servers are designed and stress-tested to improve their performance capability and durability. They offer protection against extreme weather, like dust, heat, cold, water, and extreme vibrations. These servers also offer a higher level of security against cyber and phishing attacks.

Rugged Server Market Trends:

The growing investments in the data center landscape, especially in developing nations like India, Vietnam, Malaysia, and Bangladesh, are expected to further boost the global market for rugged servers. In India, various new policies and investment programs have been green-lit by the national and state governments. For instance, in May 2022, the Karnataka Government introduced its plan to create a technologically advanced data center landscape in the state. India is among the fastest-growing data center industries in the globe, with about 236 data centers available in the nation, as stated by the Data Center Map. The data further stated that the city of Mumbai in India has about 38 data centers, followed by Bangalore with 30, and Chennai with 27 data centers.

Rugged Server Market Growth Drivers:

- Increasing digitalization

The expansion of the internet among the global population is expected to significantly boost the market demand for rugged servers worldwide. The rugged servers offer a higher level of data and physical security to the data centers. These servers also increase the transferring speed of the data among multiple platforms of the operators.

One of the major factors increasing global Internet usage by the population is explained by the increasing technological advancements and the growing population. International Telecommunication Union (ITU), a global association that deals with the global telecommunication association, in its data stated that the global internet reach reached about 67% in 2023. In 2021, about 4.9 billion individuals had access to the internet, which was about 62% of the total population, which increased to 5.1 billion in 2022. In 2023, the total population using the internet reached about 5.4 billion.

- Rising investment in data server projects

A wide range of developing sectors, including manufacturing, shipping, oil and gas, energy, and power, are embracing digitalization and depending on data-driven digital services. Depending on the type of business, computer systems are becoming vital for either full or partial business operations.

Scalability, virtualization, and the use of several Rugged Enterprise Server (RES) form factors and Ethernet switches are made possible by these factors. Cloud computing services, which use data centers to operate over the Internet, are being adopted by many industrial sectors, including the marine industry. This is the outcome of higher investments made in local data centers. For example, Hyundai E&C invested USD 47.7 million and built a marine data center to support computer technologies, training centers, and data storage in South Korea.

Rugged Server Market Geographical Outlook:

By geography, the rugged server market is segmented into North America, South America, Europe, Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region such as ASEAN countries.

Country-wise, the North American rugged server market has been segmented into the United States, Canada, and Mexico. The United States and Canada are estimated to hold substantial market shares. A key driver for the rugged server market is the increasing demand for digitalization. The rugged server is expected to propel significantly in the projected period, owing to rising investment in data server projects in the coming years.

Major industries such as defense, aerospace, and various other industries are dependent on rugged servers for smooth functioning. Additionally, the increasing usage of cloud-based applications is rising in the country, which is one other reason boosting the market growth of rugged servers in the projected period.

The rising demand for modernization in sectors such as defense is further expected to propel the market in the coming years. For instance, the United States Department of Defense (DoD) approved the software modernization implementation plan in March 2023. Moreover, in February 2022, the Deputy Secretary of Defense approved the Software Modernization Strategy to deliver resilient software capabilities at a speed of relevance. Hence, such modernization projects in various end-use segments is expected to boost the market in the coming years.

The rising product launches in the rugged server market is expected to positively impact the market in the projected period. For instance, in February 2023, Dell, which is headquartered in Texas, United States, launched a new server for computing, which includes the PowerEdge XR5610 server, XR7620 server, and XR8000 server. The company has considered size and design constraints, and has added ruggedized components, and has added a short-depth server that fits into the cabinet. Additionally, the PowerEdge XR5610 monolithic server has short-deepen servers that are specifically designed for defense, telecom, and enterprise use and ruggedized with hyper-tolerance to extreme temperatures, humidity, and dusty environments.

According to the Aerospace Industry Association, the exports of aerospace, and defense products is rising rapidly in the country, which are expected to positively impact the market for rugged servers in the projected period. In 2021, the aerospace and defense exports were US$100.4 billion, which increased to US$104.8 billion in 2022, a 4.4% increase compared to 2021.

Rugged Server Market Segment Analysis:

Rugged server market by type

- The key factors for the rugged server market are its data-intensive application utilized in various sectors, including IoT, transportation, aerospace, and defense, and increasing employment in remote areas monitoring critical infrastructures.

- Rugged servers are developed to tolerate harsh environmental conditions such as extreme temperature and moisture, making them ideal for industries such as military and defense, aerospace, IoT, oil and gas, and transportation. These industries require computing power with high durability and performance.

- The rugged server market is segmented by type into semi-rugged, fully-rugged, and ultra-rugged.

Rugged Server Market Key Developments:

The market leaders for the Rugged Server Market are Dell Inc., Mercury Systems Inc., Crystal Group Inc., ADLINK Technology Inc., ZMicro, Siemens AG, Trenton Systems Inc., Elma Electronics, Core Systems, CP Technologies, BCD, Amity Technologies, Galleon Embedded Computing. The key players in the market implement growth strategies such as product launches, mergers, acquisitions, etc. to gain a competitive advantage over their competitors. For Instance,

- In September 2024, Crystal Group, Inc. collaborated with BAE Systems on an advanced rugged Cross Domain Solution for the tactical edge. Cross Domain Solutions (CDS) enables secure connectivity between networks of different trust levels. The new solution, XTS-Hercules, combined Crystal Group’s ruggedization capabilities with BAE Systems’ XTS Guard 7 accredited CDS.

- In February 2023, New servers for computing at the Edge were introduced by Dell. The XR8000 and XR5610 PowerEdge models are designed to withstand the rigors of modern edge and O-RAN deployment environments. Both servers have cloud RAN and vRAN optimizations. Short-depth servers like the single-socket, 1U PowerEdge XR5610 monolithic server are intended for use in enterprise edge, defense, and telecommunications applications. It has been toughened to withstand high humidity, temperatures, and dusty conditions. It also has NEBS Level 3 and MIL-STD-810H certifications.

- In August 2022, Dell Inc. introduced Project Frontier which is an edge operation software program integrating Dell's edge portfolio including Dell PowerEdge XR4000 for global deployment.

Rugged Server Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Rugged Server Market Size in 2025 | US$717.547 million |

| Rugged Server Market Size in 2030 | US$952.711 million |

| Growth Rate | CAGR of 5.83% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Rugged Server Market |

|

| Customization Scope | Free report customization with purchase |

Rugged Server Market is analyzed into the following segments:

- By Type

- Semi-Rugged

- Fully-Rugged

- Ultra-Rugged

- By Enterprise Size

- Small

- Medium

- Large

- By End-Use

- Military & Defense

- Aerospace

- Telecommunications

- Healthcare

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America

Our Best-Performing Industry Reports:

Navigation:

- Rugged Server Market Size & Forecast:

- Rugged Server Market Trends:

- Rugged Server Market Key Highlights:

- Rugged Server Market Growth Drivers:

- Rugged Server Market Geographical Outlook:

- Rugged Server Market Segment Analysis:

- Rugged Server Market Key Developments :

- Rugged Server Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 16, 2025