Report Overview

Russia AI in Military Highlights

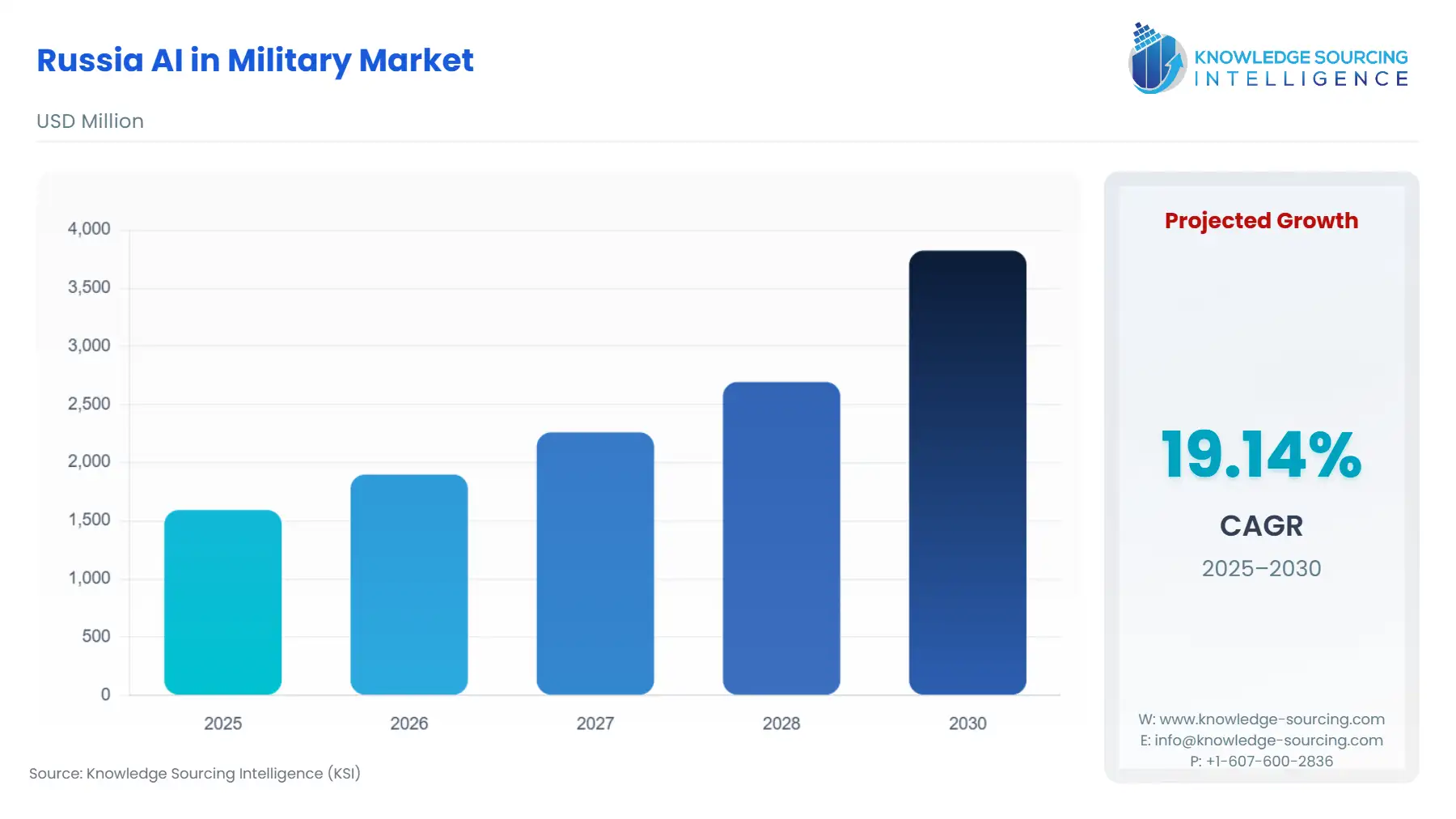

Russia AI in Military Market Size:

The Russia AI in Military Market is expected to grow at a CAGR of 19.14%, reaching USD 3.824 billion in 2030 from USD 1.593 billion in 2025.

The Russian AI in Military Market is undergoing a state-directed transformation, anchored by a political and strategic mandate to achieve technological parity in "intellectualized" warfare. President Vladimir Putin has publicly framed leadership in Artificial Intelligence as an existential geopolitical necessity, cementing AI as a central pillar of the nation's long-term military modernization strategy. This high-level political endorsement translates directly into dedicated federal budget allocations and programmatic directives aimed at integrating autonomous and AI-enabled systems into both legacy and next-generation weapons platforms.

The market landscape is characterized by the centralized dominance of state-affiliated defense enterprises and a renewed emphasis on civil-military fusion to rapidly deploy AI solutions, particularly in the face of ongoing geopolitical constraints that severely complicate the acquisition of crucial, cutting-edge Western microelectronics. The operational environment dictates that technological advancements focus immediately on improving the efficiency of existing forces and overcoming logistical hurdles through smart systems.

Russia AI in Military Market Analysis:

Growth Drivers

- The primary factor propelling market growth is the Concept of the Russian Armed Forces Activity (July 2022), which institutionalizes the integration of AI, directly creating long-term procurement demand. This imperative accelerates spending on Machine Learning (ML) and Computer Vision technologies, which are essential for processing the massive influx of data from battlefield sensors and UAV swarms. A second, immediate driver is the operational demand for AI to enable network-centric warfare by improving Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance (C4ISR) capabilities. This creates direct demand for AI-driven software that facilitates faster observation, orientation, and decision cycles for commanders, reducing the reliance on human-intensive analysis.

Challenges and Opportunities

- The foremost challenge is the comprehensive regime of international export controls, which starves the military-industrial complex of advanced sub-7nm microprocessors, vital for high-performance deep learning applications. This creates a supply side constraint, directly limiting the sophistication and capability ceiling of Russian-developed AI hardware, thus depressing demand for the most cutting-edge AI software that requires such hardware. Conversely, this constraint presents a unique opportunity for domestic software and services firms to capture market share by developing AI/ML solutions optimized for older, domestically available hardware platforms (e.g., 90nm/28nm chips) and focusing on the massive demand for Services related to data management, system integration, and predictive maintenance within the expansive existing military apparatus.

Supply Chain Analysis

The global supply chain for the Russian AI military market is characterized by a critical dependency-diversion-domestication triad. Cutting-edge hardware, essential for modern AI, cannot be domestically produced due to the lack of lithography technology (ASML monopoly). This forces a logistical pivot: the supply chain relies heavily on transshipment hubs, principally in China and Hong Kong, for dual-use microelectronic components. In 2024, approximately $13.6 billion of microelectronics were sourced from China, representing a considerable percentage of Russia’s total microelectronics imports. This dependency introduces logistical complexities related to sanctions evasion networks and creates significant quality control constraints, as the components are often commercial-grade rather than military-spec. Key production hubs for integration and final assembly remain centralized within the state-owned military-industrial complex (OPK), such as Rostec's subsidiaries, which are mandated to integrate these foreign-sourced components with domestically developed software.

Government Regulations

The regulatory framework is driven by a two-pronged strategy: aggressive technological development and centralized control over national security applications.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Russia | Concept of the Russian Armed Forces Activity in the Development and Use of Weapon Systems Using Artificial Intelligence Technologies (July 2022) | Demand Catalyst: Mandates the systemic integration of AI across all military branches, creating a stable, long-term procurement demand signal for AI-enabled weapons and C4ISR systems. |

| Russia | National Strategy for the Development of Artificial Intelligence Through 2030 (October 2019) | Market Structuring: Coordinates public/private R&D efforts, providing directed funding for core technologies (e.g., computer vision, robotics) and focusing on talent development, which lowers long-term labor constraints for AI-focused defense firms. |

| Russia | Main Directorate for Innovative Development (Ministry of Defense) and ERA Military Technopolis | Supply Side Governance: Centralizes R&D and innovation efforts, forcing civil-military cooperation to rapidly adapt commercial AI technologies for military use, thereby shortening the time-to-market for certain applications but potentially stifling independent innovation. |

________________________________________________________________

Russia AI in Military Market Segment Analysis:

By Application: Warfare Platforms

The Warfare Platforms segment, encompassing land, sea, and air combat systems, is the market’s dominant demand epicenter due to the ongoing modernization drive focused on unmanned and autonomous systems. This necessity is intrinsically linked to the imperative to reduce combat losses and increase system precision. Specifically, this segment’s growth is driven by the mandate to integrate AI-based Computer Vision for real-time target recognition and tracking into uncrewed aerial vehicles (UAVs) and guided munitions. Furthermore, AI is critical for automating the target designation and fire control loop in new and upgraded vehicles, such as the integration of intelligent algorithms into high-precision weapons like the Kitolov-2M guided artillery projectile, which uses guidance systems to enhance lethality. The core demand is for algorithms that provide sensor fusion and autonomous navigation for vehicles like the S-70 Okhotnik-B heavy combat UAV, enabling complex, coordinated operations without constant human override. This segment also fuels demand for Machine Learning to rapidly analyze aerial and ground data, informing platform deployment and tactical planning.

By Platform: Land-based Force

The Land-based Force platform represents a massive and immediate demand sink due to the sheer size of the existing ground apparatus and the need to rapidly upgrade legacy systems. The primary growth driver is the requirement for logistical resilience and operational efficiency in complex, distributed environments. This specifically translates into high demand for AI Services for predictive maintenance and supply chain optimization for armored vehicles and artillery, as evidenced by Rostec's focus on AI-driven economic and logistical services for its defense holdings. Furthermore, there is direct and verified demand for integrating AI-enabled robotics and autonomous systems for specialized ground roles, such as the development and deployment of counter-drone systems like Rostec’s Sfera and SERP systems, designed for the real-time detection and suppression of hostile low-flying UAVs. This technology uses machine learning to discriminate between targets and clutter, creating demand for robust, deployable software solutions tailored for hardened, mobile land platforms.

________________________________________________________________

Russia AI in Military Market Competitive Environment and Analysis:

The Russian AI in Military Market is a highly consolidated oligopoly dominated by a small group of state-owned defense conglomerates. Competition for major state contracts is primarily an internal, inter-holding contest governed by the Ministry of Defense's priorities. The competitive landscape is defined by vertical integration, where a few major entities control the entire value chain from R&D to final system assembly.

Rostec

Strategic Positioning: Rostec is the central pillar of the defense industrial base and is positioned as the primary integrator and digital service provider for the entire military-industrial complex. Its strategic focus has shifted to include non-traditional military AI applications, specifically those related to industrial efficiency and logistics. Rostec leverages its vast network of subsidiaries (including KRET, Ruselectronics, and High Precision Systems) to implement AI across its holdings.

Key Products/Services:

- Integrated Regional Counter-Drone Protection: Developed by its subsidiary Polyot Radio Plant, this system, based on the Sfera drone detection and suppression platform, uses AI for pattern recognition and neutralization of uncrewed aerial vehicles.

- AI Enterprise Solutions: The corporation has actively adopted commercial AI solutions (e.g., from T1 IT Holding) for internal use, including automated production schedules, equipment failure forecasts, and digital assistants for engineers, directly impacting the military supply chain's efficiency.

Kalashnikov Concern

Strategic Positioning: Kalashnikov is evolving from a small arms manufacturer to a broader robotic and guided weapons system developer. Its strategic focus is on integrating AI into high-precision, tactical-level platforms, moving from unguided to guided munitions. This transition creates direct demand for embeddable AI software for guidance, navigation, and control (GNC) systems.

Key Products/Services:

- Vihr-1 Antitank Missile: A high-precision weapon whose production Kalashnikov successfully increased output for in 2024. These systems rely on advanced guidance and targeting logic, increasingly incorporating computer vision for fire-and-forget capabilities.

- Kitolov-2M Guided Artillery Projectile: This guided munition requires a targeting solution that utilizes ML/AI for terminal guidance correction, representing a demand concentration in the Deep Learning/Computer Vision segments for fire support applications.

________________________________________________________________

Russia AI in Military Market Recent Developments:

- March 2025: Kalashnikov Concern announced the start of production process refinement for the RPL-20 Light Machine Gun. This new belt-fed 5.45mm weapon was showcased at the Army 2024 forum and refined based on combat feedback. While a physical weapon, its launch signals a demand shift toward new-generation standard armaments that are often designed to integrate seamlessly with digital, AI-enabled sighting and fire control systems.

- December 2024: Kalashnikov Concern completed all contracts for the supply of high-precision weapons, including Vihr-1 antitank missiles and Kitolov-2M guided artillery projectiles. The completion was achieved through the opening of additional production sites, signaling a significant, verified capacity addition in the high-precision guided munition sector, which are inherently reliant on AI-enabled guidance and control software.

________________________________________________________________

Russia AI in Military Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1.593 billion |

| Total Market Size in 2031 | USD 3.824 billion |

| Growth Rate | 19.14% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component Type, Technology, Application, Platform |

| Companies |

|

Russia AI in Military Market Segmentation:

- BY COMPONENT TYPE

- Hardware

- Software

- Services

- BY TECHNOLOGY

- Machine Learning

- Deep learning

- Computer Vision

- Natural Language Processing

- Robotics

- Others

- BY APPLICATION

- Warfare Platforms

- Cybersecurity

- Logistics & Transportation

- Surveillance & Reconnaissance

- Command & Control

- Battlefield Healthcare

- Simulation & Training

- Gathering Intelligence

- Others

- BY PLATFORM

- Land-based Force

- Naval Force

- Air Force

- Space Force