Report Overview

Saudi Arabia Electronic Health Highlights

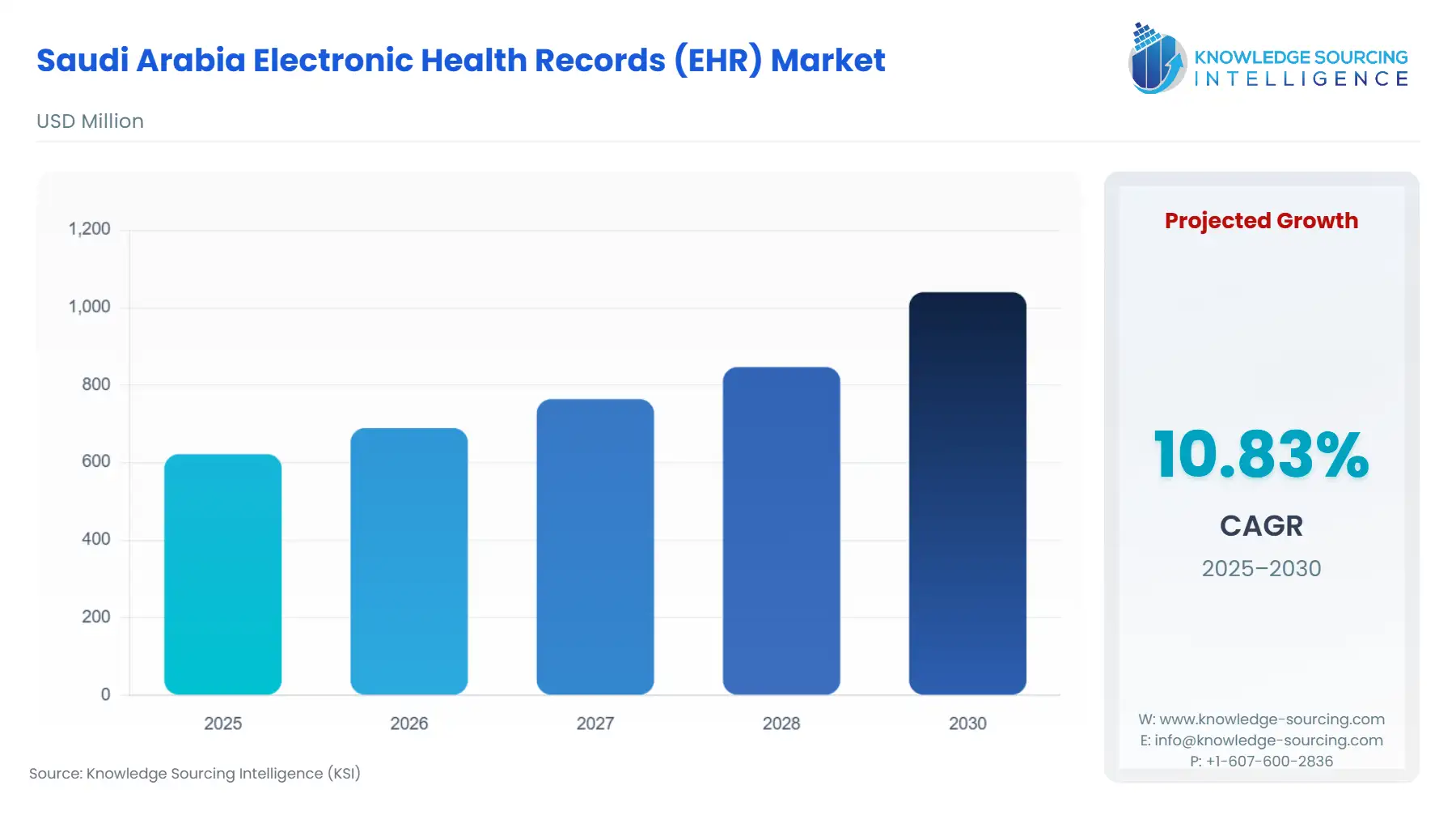

Saudi Arabia Electronic Health Records (EHR) Market Size:

The Saudi Arabia Electronic Health Records (EHR) market is estimated to grow at a CAGR of 10.82% to reach a market size worth USD 1.040 billion by 2030 from an initial value of USD 0.622 billion in 2025.

A host of opportunities and challenges influence EHR adoption in Saudi Arabia. On one hand, the government initiatives relayed via Vision 2030 mean that there are growing investments in digital health, along with recognition of the benefits of EHRs - e.g., improved efficiency, cost savings, and reduced errors are promising enablers. However, barriers remain, including high implementation costs, issues with system reliability, limited IT skills, resistance to change by healthcare personnel, weak interoperability policies, and ongoing concerns related to patient data privacy continue to slow EHR implementations.

Saudi Arabia Electronic Health Records (EHR) Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope

The Saudi Arabia Electronic Health Record (EHR) Market is segmented by:

- Product: By product, the market is segmented into cloud-based EHR and on-premise EHR. Cloud-based EHR is being adopted by vendors and customers due to its advantages, including the ability to access the EHR from anywhere in the cloud and lower costs. The cloud segment is anticipated to witness the fastest growth in the market, due to the benefits of cloud-based systems in decreasing the upfront cost for the healthcare system. In addition to this, the growing demand from the healthcare sector of the country for web-based EHR systems will also be an opportunity for segment expansions in the coming years. On-premise products have value as well, especially for those organisations that want to maintain absolute full control of the EHR.

- Type: By type, acute, ambulatory, and post-acute are the major segments. Acute EHRs are emergency department EHRs for electronic documentation of a patient's medical information in acute care settings. These EHRs are desired because of their real-time updating, integration with other systems, and ability to maintain a workflow. Ambulatory EHRs are effectively outpatient healthcare EHRs. The ambulatory market represents a significant share of the EHR market, in part due to the ambulatory EHR for managing user access to patient interactions through valuable portals and features that track patient billing and coding. The utilisation of post-care EHR is increasing. There is a demand for post-care electronic health records by hospitals, clinics, pharmacies, laboratories, and others. Hospitals are the leading segment of the demand for electronic health records systems because of their volume of demand.

- End User: The market is segmented into hospitals, clinics, pharmacies, laboratories, and others. The EHR systems used in hospitals are the most sophisticated because hospitals typically address the most complex and data-centric patient care. EHRs for hospitals incorporate admission, emergency, surgical intervention, lab results, imaging, and discharge information all on one platform. This method provides better continuity of care, minimises redundant tests, and ultimately increases patient safety.

Top Trends Shaping the Saudi Arabia Electronic Health Records (EHR) Market

- Government-Driven Digital Transformation & Virtual Hospitals

Saudi Arabia’s Vision 2030 and its digital health push accelerate the expansion of EHR systems and comprehensive, country-wide virtual health. Seha Virtual Hospital not only connects hundreds of hospitals but, more importantly, has made it commonplace to break distance by remote diagnosing and ongoing monitoring. - Government Push towards Reimbursements

AI, and big data and more are increasing EHR systems’ effectiveness. Meanwhile, the government is establishing data-sharing standards (interoperability) and moving towards a digital health reimbursement model, easing the adoption and subsequent universality of widely used digital health. - Increasing Integration of AI-powered EHR tools

There is an increasing trend of utilization of AI-powered tools in clinical solutions of the region, which is rising in clinicians and IT firms showing significant interest in the development of AI-enabled EHR technologies for boosting clinical decision-making and predictive analysis.

Saudi Arabia Electronic Health Records (EHR) Market Growth Drivers vs. Challenges

Drivers:

- Aging Population and Growing Government Initiatives: In Saudi Arabia, the increase in the ageing population and improvement in healthcare infrastructure are helping to drive the growth of this market. For instance, by the end of 2050, it is estimated that 25 per cent of the population of 40 million in Saudi Arabia will be composed of individuals aged 60 or older. The population of Saudis aged 80 or older is also projected to exceed 1.6 million, or 4 per cent of the total population. Older adults typically require more frequent healthcare services, long-term monitoring, and coordinated care across multiple providers. This drives demand for efficient record-keeping, seamless data sharing, and comprehensive patient histories, all of which EHRs enable. According to ITA, although the Kingdom of Saudi Arabia is attempting to accomplish privatisation, in 2024, government spending accounts for over 60 per cent of the country's healthcare spending. NUPCO is responsible for the centralised procurement of pharmaceuticals and medical supplies, along with supply chain and logistics management for all public healthcare providers. These initiatives will improve the electronic health records market as well.

- Increasing Digitalization: The digital health landscape of Saudi Arabia has vastly improved. For example, the National Platform for Health Information Exchange (NPHIES), an electronic health record management system, has been put in place, and the proportion of hospitals with Hospital Information Systems (HIS) has increased significantly. Electronic referrals are now standard in all Ministry of Health facilities.

Challenges:

- High Costs & Infrastructure Constraints: The implementation cost of EHR, along with the recurring cost for ongoing maintenance, can constrain the market due to substantial financial barriers for smaller clinics and hospitals, which could hinder the market expansion.

- Data Security & Privacy Concerns: With the significant number of hospitals/clinics migrating to EHR and through the cloud, it means there is unlimited potential for cyber-attacks and data compromises, as well as certainly ensuring compliance with Saudi Arabia's strict laws around data protection, having to develop trustworthiness of the infrastructure, and of utmost importance, trust of the patient.

Saudi Arabia Electronic Health Records (EHR) Market Competitive Landscape

The market is fragmented, with many notable players such as Philips, Oracle, Epic Systems Corporation, CloudPital, Ezovion, iPatientCare, Waseel, MedIQ Solutions, and GE Healthcare are some of the key players in the market.

- Ecosystem Enabler: In October 2024, Philips unveiled a suite of advanced health technology solutions at the Global Health Exhibition in Riyadh, including AI-enabled, patient-centric platforms including an advanced clinical command eICU Center developed with the Health Holding Company, as well as data-driven cardiology and imaging solutions. This development highlights the reinforcement of the EHR expansion in Saudi Arabia.

Saudi Arabia Electronic Health Records (EHR) Market Segmentation:

- By Product

- On-Premise

- Cloud-Based

- By Type

- Acute

- Ambulatory

- Post-Acute

- By End-User

- Hospitals

- Clinics

- Pharmacies

- Laboratories

- Others