Report Overview

Waterborne Resins Market Size, Highlights

Waterborne resins market size

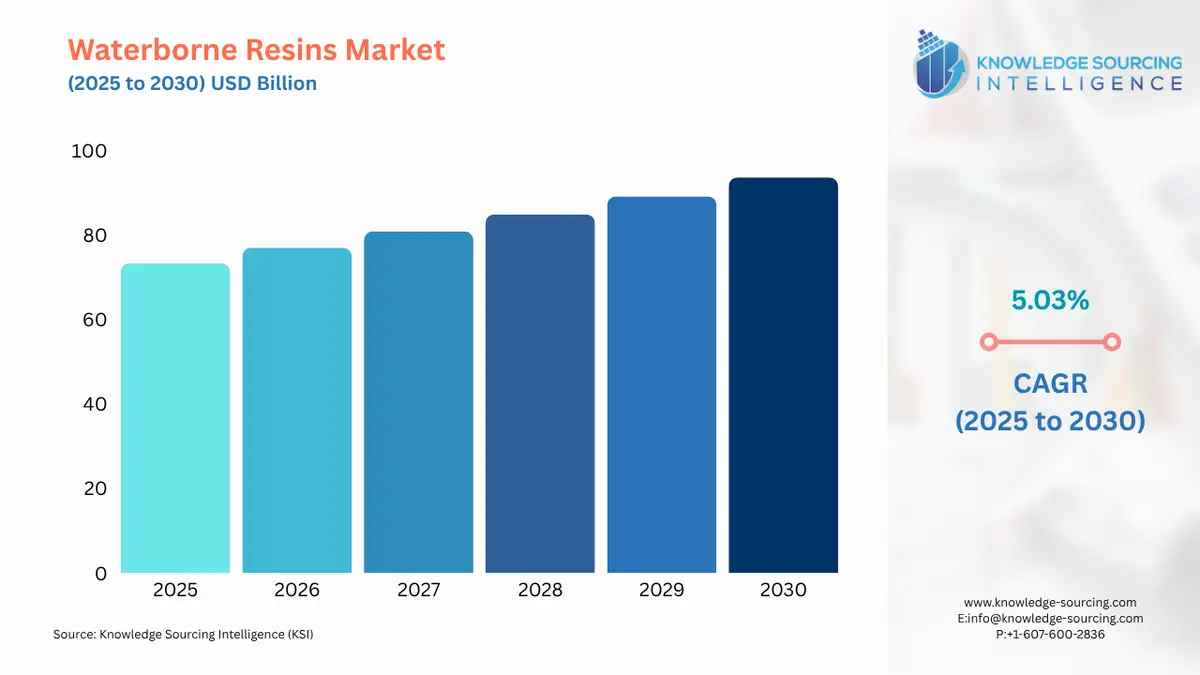

The waterborne resins market is valued at a CAGR of 5.03%, reaching a market size of US$93.65 billion in 2030 from US$73.28 billion in 2025.

Waterborne resins are used for multiple purposes. For example, epoxy resins can be used as coatings, floor primers, top coats, self-leveling coatings, grouts and sealants, adhesives, composites, etc. The driving factor of the waterborne resins is the increased volume in the construction and automotive markets.

Further, the growing awareness of a sustainable environment and increasing focus on pollution-free manufacturing practices drive this market’s growth during the forecast period. Waterborne resins use water as a solvent to disperse a resin, thus making these resins environment-friendly and low in toxicity and flammability. It significantly contributes to the reduction of volatile organic compound (VOC) emissions.

In 2023, according to the China Construction Co., Ltd, China Construction's signed contracts amounted to 4.32 trillion yuan, a year-on-year increase of 10.8%. They reached an operating income of 2.27 trillion yuan, a year-on-year increase of 10.2%. China Construction's business performance is spread across more than 100 countries, and its business layout covers investment and development in real estate development, construction financing, holding, and operation, and new businesses like green construction, energy conservation, environmental protection, e-commerce, etc.

India's leather products exports were continuously increasing from US$3,682 million in 2020-21, US$4,873 million in 2021-22, and US$5,380 million in 2022-23. Footwear, including leather footwear, footwear components, and non-leather footwear, holds a major share of 42.6% of the total exports of leather and leather products.

What are the drivers of the waterborne resins market?

- Rapid urbanization leading to growth in the paints & coatings industry

The construction and building industry worldwide is showing significant growth. One of the major reasons for this industry's expansion is the growing global urbanization. Urbanization causes the rapid industrialization of the country and region. The global urban population has increased from 56% in 2021 to 57% in 2022, according to the World Bank. The rate of urbanization in the developing part of the world, mainly APAC, Middle East, and African regions, is rising significantly.

The innovative development in the construction industry, such as adhesives and sealants, is a major factor in the waterborne resins market growth. Clear concrete sealers were based on solvent-based resin technologies earlier, but recently, water-based technologies have been gaining attention as an alternative to regulatory restrictions on VOCs and emissions. Water-based coatings are likely to be safer alternatives to handle and use compared to solvent-based technologies.

Lubrizol developed water-based resin technology and is continuously evolving and improving this technology. In July 2022, a new water-based resin for concrete sealers was launched. This resin further enabled floor coatings with lower VOC formulating capabilities, free of hazard-regulated substances.

Geographical outlooks of the waterborne resins:

- The waterborne resins market is segmented into five regions worldwide

By geography, the waterborne resins market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.

The Asia Pacific region is expected to see the fastest growth in the waterborne resin market due to its increasing applications in paints, coatings, leather, and sealants.

According to IBEF (India Brand Equity Foundation), India is the second-largest exporter of leather garments and the fourth-largest exporter of leather goods in the world. North America is expected to have a significant waterborne resin market share due to the major utilization of waterborne resins for architectural coatings, industrial coatings, and textiles.

Products in the waterborne resins:

Key developments in the waterborne resins:

The market leaders for the waterborne resins market are BASF SE, Lawter Inc., Allnex Group, The Lubrizol Corporation, Arkema, and DOW, among others. The key players in the market implement growth strategies such as product launches, mergers, acquisitions, etc., to gain a competitive advantage. For Instance,

- In April 2024, Arkema expanded its sustainable offer in the United States. Arkema showcased a wide range of solutions and technologies in support of decarbonization, more circularity, and sustainability goals at the 2024 American Coatings Show. The offerings included bio-based segregated solutions, UV-LED-EB-curable resins, waterborne resins, and additives featuring up to 97% bio-content. Arkema is also pursuing ISCC+ certification for its acrylic production in North America to expand its bio-attributed mass balance resins.

- In June 2023, DIC Corporation released the HYDRAN GP series of environment-friendly waterborne polyurethane resins. These resins have a higher solid content than conventional water-based polyurethane resins. The product contains no amines, helps to shorten process times, and lessens odors. This is a sustainable solution to reduce greenhouse gas emissions and volatile organic compounds (VOCs). These resins deliver solvent-based products, previously seen as difficult for waterborne polyurethane resins. The company planned to promote this series globally for applications such as artificial leather, coatings, and adhesives to achieve annual sales of ¥10 billion by fiscal year 2030.

- In May 2023, Polynt Group expanded resin production capacity to serve the North American Coatings Market. This would meet the growing needs of the paint and coatings industry. This expansion would be further enhanced with the opening of Polynt Coatings Canada Limited in Port Moody, BC, during the second half of 2023. This additional investment would allow Polynt to add further capacity and flexibility in conventional alkyds, oil-modified urethanes, and water-based technologies. The expansion showed Polynt’s continued commitment to support the dynamic resin marketplace.

- In February 2023, Covestro announced it is developing a Waterborne and Waterborne UV family of high-performing resins. This could be applied to wood furniture, cabinetry, and building products. Covestro’s waterborne resins are used in the transformation of the coatings industry. Coaters are seeking improvements in factory efficiency and need to expand production. This would help the development of technology with less rework and damage due to current coating systems with slow water-releasing properties. One of their water-based solutions offers up to a 50-60% improvement in line speed while maintaining other key performance properties of the end-use product.

Waterborne Resins Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

Waterborne Resins Market Size in 2025 |

US$73.28 billion |

|

Waterborne Resins Market Size in 2030 |

US$93.65 billion |

| Growth Rate | CAGR of 5.03% |

| Study Period | 2019 to 2029 |

| Historical Data | 2019 to 2022 |

| Base Year | 2024 |

| Forecast Period | 2024 – 2029 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in the Waterborne Resins Market |

|

| Customization Scope | Free report customization with purchase |

The waterborne resins market is analyzed into the following segments:

- By Type

- Acrylic Resin

- Epoxy Ester Resin

- Saturated Polyester Resin

- Epoxy Resin

- Polyurethane Resin

- Alkyd Resin

- Others

- By Application

- Paints & Coatings

- Adhesives & Sealants

- Inks

- Leather

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America