Report Overview

Saudi Arabia 5G Fuel Highlights

Saudi Arabia 5G Fuel Cell Market Size:

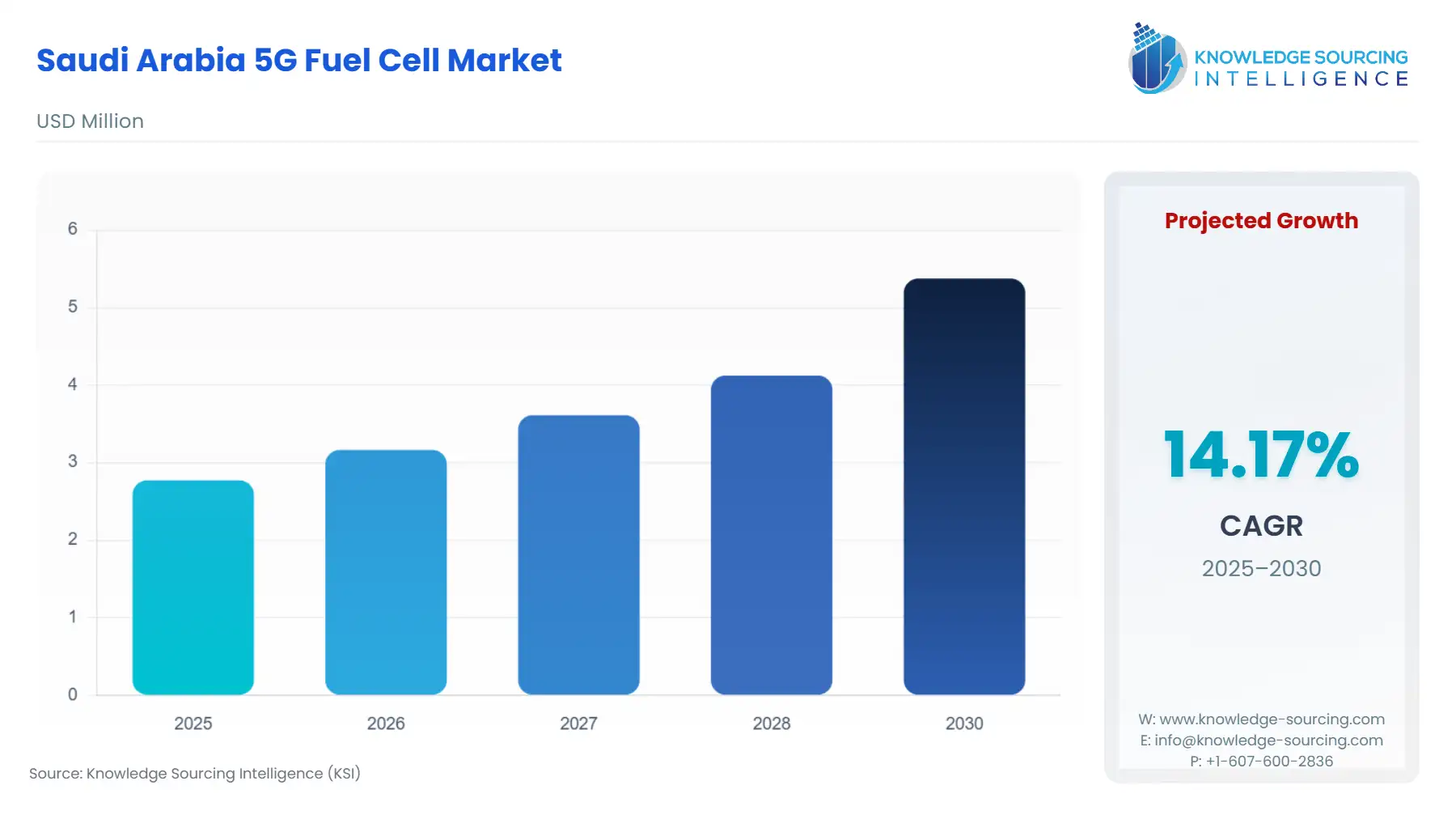

The Saudi Arabia 5G Fuel Cell Market is expected to grow at a CAGR of 14.17%, reaching USD 5.376 million in 2030 from USD 2.772 million in 2025.

The Saudi Arabian 5G Fuel Cell Market is transitioning from a nascent niche to an essential infrastructure component, driven by the aggressive national mandate to digitalize the economy while simultaneously decarbonizing its operational footprint. The convergence of one of the world's most rapid 5G network rollouts with the ambitious renewable energy targets of Vision 2030 positions fuel cell technology—particularly Proton Exchange Membrane (PEM) and Solid Oxide Fuel Cells (SOFC) for stationary power—as a critical enabler of energy-resilient communication infrastructure. This market's trajectory is fundamentally shaped by the high energy consumption needs of advanced 5G hardware and the imperative from key government-affiliated entities to localize clean energy production and technology, establishing a direct link between national economic diversification and technological demand.

Saudi Arabia 5G Fuel Cell Market Analysis:

Growth Drivers

The imperative for energy resilience in the 5G network drives direct demand for fuel cells. Unlike 4G, 5G architecture requires a denser network with far higher power consumption per site, making grid instability or remote location power supply a critical issue. Fuel cells, offering long-duration, high-reliability power, directly increase demand as a superior alternative to conventional battery-only or diesel-reliant backup. Furthermore, the National Hydrogen Strategy creates a verifiable feedstock supply chain. Projects from entities like NEOM Green Hydrogen Company and Saudi Aramco, which focus on large-scale blue and green hydrogen production, de-risk the operating costs and logistics of hydrogen-powered fuel cells, thereby fueling higher adoption rates among telecom operators.

Challenges and Opportunities

A primary challenge remains the initial capital expenditure (CAPEX) relative to established diesel or solar-lithium hybrid systems, which creates an adoption hurdle, decreasing demand elasticity in the short term. The opportunity lies in the substantial regulatory push towards sustainability and energy efficiency. Telecom providers facing the public scrutiny and government mandate to meet clean energy goals are incentivized to invest in fuel cells despite the CAPEX, driving demand for innovative, high-efficiency systems with low total cost of ownership (TCO) over a 5-10 year lifecycle, aligning with Vision 2030’s environmental objectives.

Raw Material and Pricing Analysis

The Saudi Arabia 5G Fuel Cell Market deals with a physical product (the fuel cell stack and system). Key raw material inputs for high-efficiency PEM fuel cells, the dominant technology for telecom backup, include Platinum Group Metals (PGMs) such as platinum and iridium for catalysts, alongside nickel and zirconium for certain electrolyzer and SOFC components. Pricing dynamics are governed globally by mining output and geopolitical stability, creating supply-side risk. The Kingdom’s large-scale hydrogen strategy, however, is leading to a localization effort. Establishing robust domestic hydrogen feedstock production at a competitive cost mitigates the pricing risk on the fuel side, ultimately increasing the value proposition of the fuel cell system itself and stimulating greater product demand.

Supply Chain Analysis

The global supply chain for PEM fuel cell systems is characterized by high-value component manufacturing centered predominantly in North America, Europe, and Asia-Pacific. Key production hubs for stacks are typically located in Canada (Ballard Power Systems) and the US (Plug Power), with balance-of-plant components being globally sourced. Logistical complexities for the Saudi market stem from the need to import specialized, high-tolerance components like gas regulators, reformers, and thermal management systems. The market is dependent on international logistics for stack delivery, and local systems integrators are essential for final assembly, deployment, and crucial fuel supply management. This dependency necessitates strategic partnerships between global OEMs and local entities to secure consistent supply and maintenance support, a critical factor for end-user purchasing decisions.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Saudi Arabia | Saudi Vision 2030 / National Renewable Energy Program (NREP) | Sets ambitious renewable energy generation targets (originally 9.5 GW by 2023). This top-down mandate forces state-affiliated entities and large telecom operators to aggressively reduce carbon footprint at all operational sites, creating non-negotiable demand for non-fossil fuel power solutions like fuel cells, particularly in remote and new smart city developments (NEOM, Red Sea Project). |

| Saudi Arabia | Communications, Space & Technology Commission (CST) | Responsible for regulating 5G network rollout and quality. The CST's push for widespread coverage (90%+ in major cities) requires highly reliable, small-footprint power solutions. This drives demand for high-density, low-maintenance fuel cell backup solutions that meet stringent uptime requirements, surpassing the capabilities of traditional batteries alone. |

| Saudi Arabia | Saudi Standards, Metrology and Quality Organization (SASO) | Defines safety and performance standards for electrical equipment. SASO certification requirements for fuel cell systems ensure product quality and safety, but can act as a non-tariff barrier if international OEMs lack proper documentation or local compliance partners. Compliance is an essential prerequisite for market entry and subsequent demand. |

Saudi Arabia 5G Fuel Cell Market Segment Analysis:

By Application: Backup Power Solutions

The Backup Power Solutions segment in the Saudi 5G Fuel Cell Market is uniquely driven by the intrinsic architectural shift from 4G to 5G and the Kingdom's geographical challenges. 5G infrastructure requires significantly higher power draw per cell site, placing immense strain on traditional battery backup systems, which offer limited run-time. Fuel cells, utilizing stored hydrogen or methanol, directly address this by providing long-duration, high-power-output backup, which is a non-negotiable requirement for ensuring 5G network uptime in an arduous environment. In remote or off-grid areas, where grid power is unstable or non-existent, fuel cells act as a robust alternative to noisy, high-emission diesel generators, thus fulfilling both the technical need for continuous power and the strategic goal of environmental stewardship mandated by government initiatives. The direct link is forged by the need for regulatory compliance on network resilience, combined with the move away from carbon-intensive fossil fuels.

By End-User: Telecom Operators

Telecom Operators, such as stc, Mobily, and Zain, represent the foundational and most aggressive market growth driver. The rollout of 5G is a core strategic pillar for their business continuity and competitive advantage. The sheer scale of the 5G deployment—which involves both new mast construction and the power upgrade of existing sites—translates directly into a massive, immediate demand for reliable, long-duration power sources. Fuel cells provide a distinct operational advantage: extended run-time without the logistical complexity of repeated, time-consuming diesel refills in remote locations, and a significant reduction in operational expenditure (OPEX) once the hydrogen supply infrastructure is secured. Operators are not merely seeking backup power; they are seeking a strategic energy asset that aligns with their corporate ESG reporting and the national Vision 2030, making the fuel cell a crucial tool for both network performance and public relations compliance.

Saudi Arabia 5G Fuel Cell Market Competitive Environment and Analysis:

The Saudi Arabian 5G Fuel Cell Market’s competitive landscape features a contest between global pure-play fuel cell OEMs and strategically positioned domestic entities with hydrogen production capabilities. Competitive advantage stems not just from product performance but from local integration partnerships and proven supply chain robustness within the Kingdom.

Ballard Power Systems

Ballard holds a strategic positioning as a long-established global leader in Proton Exchange Membrane (PEM) fuel cell technology. Their focus is heavily on high-power-density modules suitable for heavy-duty mobility and stationary power, including telecom. Their strategic positioning is to provide high-reliability stack technology, often through systems integrators or local partners, focusing on superior product efficiency and long-term durability. The company's key products include various iterations of the FCgen® and FCwave® power modules, adaptable for stationary power generation needs in 5G infrastructure.

Plug Power Inc.

Plug Power positions itself as an end-to-end hydrogen ecosystem provider, spanning production, storage, delivery, and power generation. This integrated model is highly attractive to the Saudi market, which prioritizes a de-risked hydrogen supply chain. Their strategic positioning involves creating hydrogen plants and supply logistics alongside their stationary power GenSure® fuel cell systems, which are designed for robust, continuous backup power in critical infrastructure applications like telecom. This comprehensive solution directly addresses the Saudi market's twin need for technology and a verifiable fuel source.

NEOM Green Hydrogen Company (NGHC)

NGHC, a joint venture between NEOM, ACWA Power, and Air Products, represents a unique competitive force. While not a fuel cell manufacturer, their strategic positioning as the developer of the world’s largest commercial-scale green hydrogen production facility in Oxagon (with an initial output of up to 600 tonnes per day) makes them a foundational enabler. Their operation, while slated for 2026, de-risks the long-term, low-cost green hydrogen supply, which is the singular most critical operational factor for fuel cell adoption in the Kingdom. They compete by making fuel cell TCO attractive, thereby driving indirect demand for all fuel cell hardware vendors.

Saudi Arabia 5G Fuel Cell Market Recent Developments:

- August 2025: Ballard Power Systems reported in its Q2 2025 financial results the completion of strategic restructuring actions initiated in 2024 aimed at reducing annualized operating costs by approximately 27% relative to the first half of 2025. This focus on operational efficiency and cost management directly impacts the long-term commercial viability of their stationary power modules for telecom applications in markets like Saudi Arabia, offering a path to more competitive pricing.

- September 2024: GenCell Energy announced a supply deal for additional units valued at US$4.4 million to CFE, the largest utility in North America, further expanding the deployment of their long-duration substation backup solution. Although outside Saudi Arabia, this development, sourced from their press releases, validates the company’s ability to secure large-scale, critical infrastructure contracts for long-duration backup power, a key requirement for the high-availability needs of 5G infrastructure.

Saudi Arabia 5G Fuel Cell Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 2.772 million |

| Total Market Size in 2031 | USD 5.376 million |

| Growth Rate | 14.17% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Deployment, Power Output Range, End-User |

| Companies |

|

Saudi Arabia 5G Fuel Cell Market Segmentation:

- BY PRODUCT TYPE

- Fuel Cell Systems

- Fuel Cell Stacks & Components

- Fuel Supply Solutions

- BY DEPLOYMENT

- Backup Power Solutions

- Off-grid / Remote Power Solutions

- Hybrid Energy Systems

- High-capacity Solutions

- BY POWER OUTPUT RANGE

- <5 kW

- 5–50 kW

- 50 kW

- BY END USER

- Telecom Operators

- Tower & Infrastructure Providers

- Government & Defense Communication Networks

- Enterprise 5G Networks