Report Overview

Thailand Additive Manufacturing Market Highlights

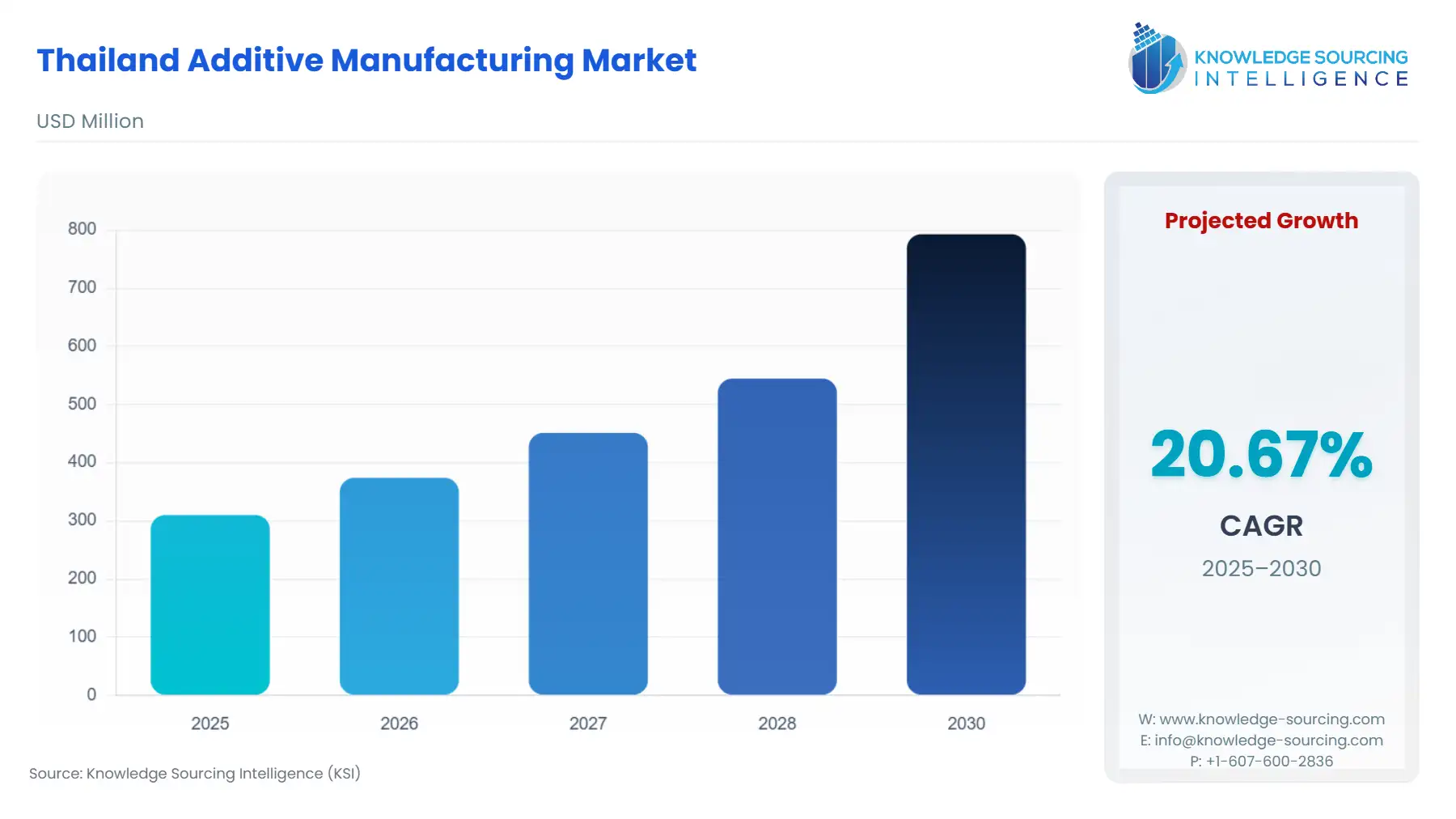

Thailand Additive Manufacturing Market Size:

The Thailand Additive Manufacturing Market is forecast to advance at a CAGR of 20.67%, attaining USD 0.793 billion in 2030 from USD 0.31 billion in 2025.

The Thai Additive Manufacturing (AM) market is evolving from a prototyping-centric segment into a strategic tool for high-value-added manufacturing, fundamentally aligning with the national "Thailand 4.0" economic model. This transition is marked by a concentrated push toward Industry 4.0 adoption within key economic zones, repositioning the country as a regional hub for advanced production. The government’s deliberate policy instruments and targeted incentives are functionally bridging the gap between nascent AM adoption and industrial-scale implementation, specifically targeting sectors where customization and material efficiency are paramount.

Thailand Additive Manufacturing Market Analysis:

- Growth Drivers

The Eastern Economic Corridor (EEC) initiative acts as the single largest growth catalyst. By designating the EEC as a special economic zone and focusing on advanced industries—specifically next-generation automotive, robotics, and aviation—the government generates direct demand for sophisticated AM solutions. This concentration of high-tech investment, coupled with attractive incentives such as up to 13 years of corporate tax exemptions offered by the Board of Investment (BOI), lowers the initial financial barrier for adopting industrial 3D printing. Consequently, large domestic and foreign manufacturers are compelled to invest in AM hardware and specialized AM service bureaus to optimize their supply chains for intricate, low-volume, high-value component production.

- Challenges and Opportunities

The substantial initial capital expenditure for industrial AM equipment presents a significant market constraint. The high cost of specialized hardware, along with the expense of importing industrial-grade polymer and metal powders, restricts broader adoption, particularly among Tier 2 and Tier 3 suppliers. However, this challenge simultaneously creates a massive opportunity for the Services segment, as it allows SMEs to access AM capabilities without incurring major capital costs. Furthermore, the rising integration of Artificial Intelligence (AI) and machine learning into AM workflows offers a critical opportunity: AI-driven generative design and process optimization can lead to reduced material wastage and enhanced part quality, directly increasing the perceived value and industrial viability of AM technology, thereby stimulating future demand.

- Raw Material and Pricing Analysis

Additive Manufacturing involves a physical product (hardware and materials). The raw material supply chain for AM in Thailand is heavily import-dependent, primarily for specialized metal alloys, engineering-grade polymers, and composite powders. This dependence subjects the local material supply and final part pricing to global commodity price fluctuations and currency exchange volatility. Since the supply of these technical-grade materials is concentrated among a few global chemical and material firms, pricing power resides with the international suppliers. This structure increases the base cost of AM production in Thailand compared to traditional manufacturing, thus making AM-produced functional parts primarily cost-effective for highly customized, low-volume, or geometrically complex applications only.

- Supply Chain Analysis

The global AM supply chain is functionally bifurcated: The design and material science hubs are largely situated in North America and Europe, while Asian manufacturing hubs, including Thailand, focus on application and adoption. Logistical complexity centers on the procurement and timely delivery of specialized materials and highly complex AM hardware maintenance parts. Thailand's excellent logistical infrastructure, particularly deep-sea ports and the planned high-speed rail within the EEC, mitigates some physical transport complexities. However, a dependency on foreign technical experts for complex machine calibration and maintenance introduces logistical and knowledge transfer dependencies that can affect production uptimes and total throughput.

Thailand Additive Manufacturing Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

Thailand |

Board of Investment (BOI) |

Offers tax exemptions (e.g., corporate income tax) and non-tax incentives for investments in target industries like Robotics and Aviation. This directly increases corporate investment and subsequent demand for AM hardware and training. |

|

Thailand |

Thailand Industrial Standards Institute (TISI) |

Develops mandatory and voluntary industrial standards. The development of TISI standards for AM-produced components is critical for building industry confidence, reducing regulatory uncertainty, and enabling the use of AM parts in safety-critical sectors like Automotive and Aerospace, thus expanding demand. |

|

Thailand |

Ministry of Digital Economy and Society (MDES) |

Focus on the "Thailand 4.0" policy and digital upskilling. This macro-policy imperative drives companies to digitalize manufacturing processes, increasing the adoption of AM-specific Software (e.g., topology optimization, generative design). |

Thailand Additive Manufacturing Market Segment Analysis:

- By Technology: Selective Laser Sintering (SLS)

Selective Laser Sintering (SLS) is a key growth driver in Thailand due to its inherent capability to produce complex, high-strength parts without support structures, making it suitable for functional, end-use components. The country's strong Automotive and emerging Aerospace sectors are driving demand for SLS. The shift towards Electric Vehicles (EVs), which require lightweighting to improve battery range and structural performance, directly increases the necessity for SLS technology utilizing high-performance thermoplastic powders like Nylon. Automotive manufacturers deploy SLS for end-use functional parts and for durable production tooling, fixtures, and jigs, which fastens production timelines and accelerates adoption.

- By End-User Industry: Automotive

The Thai automotive sector, already a major economic pillar, is undergoing a mandated transition toward next-generation vehicles, critically increasing the need for AM across the entire value chain. This structural change requires rapid iteration of new component designs, a process where AM-based Prototyping services are indispensable. Furthermore, the push for lower emissions and higher efficiency, particularly in the EV segment, generates acute demand for lightweighting. This necessitates the adoption of AM to produce complex, consolidated parts that were unachievable with traditional casting or machining, directly creating a sustained demand for AM machines, materials, and specialized engineering services.

Thailand Additive Manufacturing Market Competitive Analysis:

The competitive landscape in Thailand's AM market is characterized by global hardware manufacturers competing with local service bureaus, which hold a strategic advantage in localized application expertise and immediate service support. The market for industrial-grade hardware, particularly for metal and advanced polymer printing, remains concentrated among global entities with verifiable technological leadership.

- Airbus SE

Airbus is strategically positioned in the Thai AM ecosystem through its deep ties to the Aerospace & Defense sector. While not a local manufacturer of AM hardware, its official press releases confirm its long-term strategy to align with the Kingdom’s “Make in Thailand” policy through partnerships, such as the expanded Memorandum of Understanding (MoU) with Thai Aviation Industries (TAI). This commitment to in-country maintenance and capability transfer indirectly drives local demand for AM services and skills, as Airbus leverages AM to produce certified, flight-ready components, necessitating local capability development to support its supply chain.

Thailand Additive Manufacturing Market Developments:

- September 2025: Royal Thai Air Force orders next-generation Airbus A330 MRTT+

The Royal Thai Air Force (RTAF) placed an order for the Airbus A330 Multi Role Tanker Transport Plus (MRTT+). This procurement is paired with an expanded Memorandum of Understanding (MoU) between Airbus and Thai Aviation Industries (TAI) to include in-country maintenance support. This formalizes a commitment to local aerospace capability, acting as a demand pull for specialized AM services and qualified personnel to maintain and potentially produce complex replacement parts for a cutting-edge defense platform within Thailand.

Thailand Additive Manufacturing Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 0.31 billion |

| Total Market Size in 2031 | USD 0.793 billion |

| Growth Rate | 20.67% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Technology, End-User Industry |

| Companies |

|

Thailand Additive Manufacturing Market Segmentation:

- BY COMPONENT

- Hardware

- Software

- Services

- Material

- BY TECHNOLOGY

- Selective Laser Sintering (SLS)

- Laser Sintering (LS)

- Electron Beam Melting (EBM)

- Fused Disposition Modelling

- Stereolithography (SLA)

- BY END-USER INDUSTRY

- Aerospace & Defense

- Healthcare

- Automotive

- Construction

- Consumer

- Others