Report Overview

Indonesia Additive Manufacturing Market Highlights

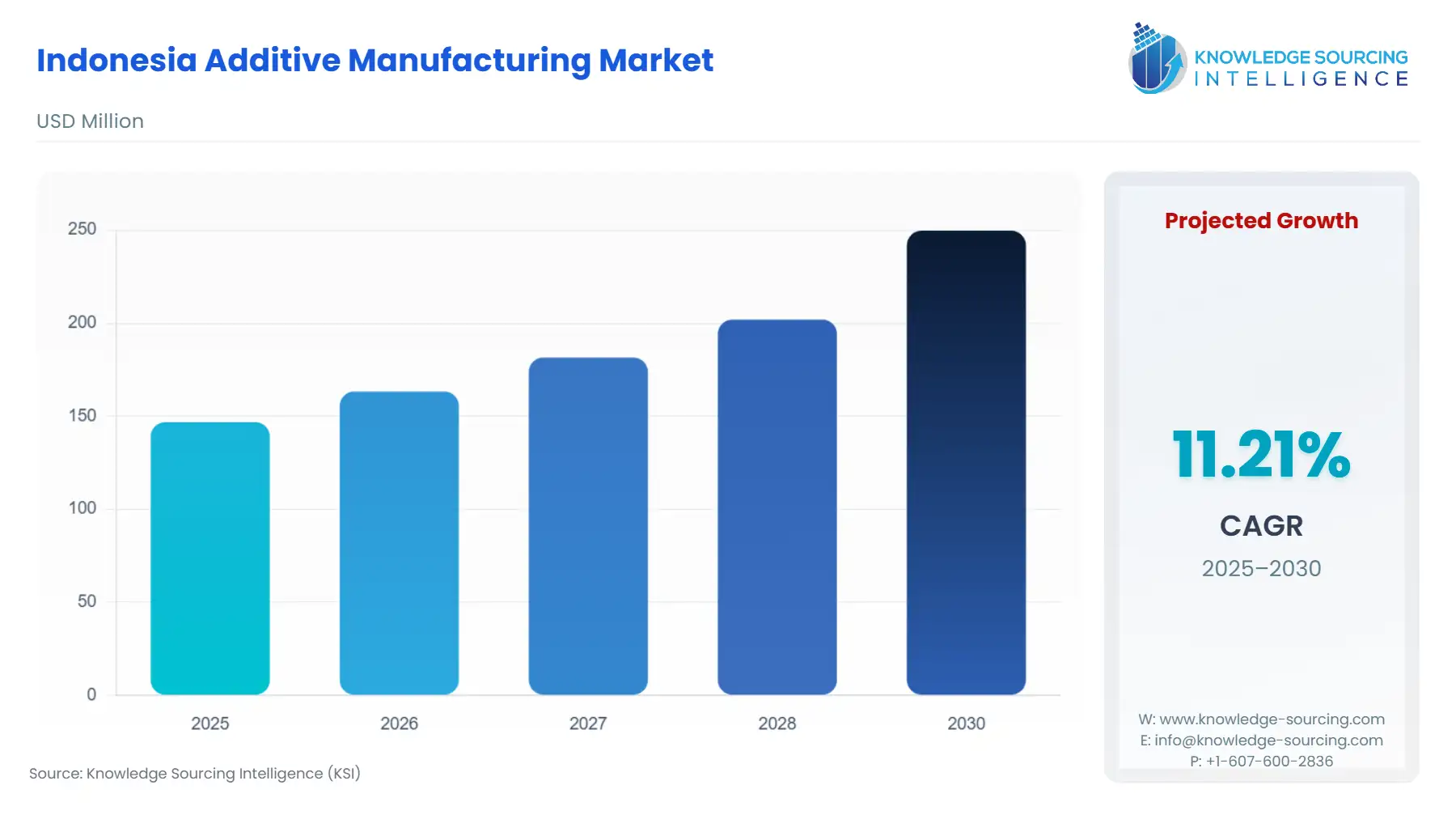

Indonesia Additive Manufacturing Market Size:

The Indonesia Additive Manufacturing Market is anticipated to advance at a CAGR of 11.21%, reaching USD 249.73 million in 2030 from USD 146.782 million in 2025.

The Indonesian Additive Manufacturing (AM) market is positioned at a crucial juncture, driven by the national push toward industrial digitalization. The government's strategic focus on the Fourth Industrial Revolution (4IR), articulated through the "Making Indonesia 4.0" roadmap, acts as the foundational catalyst. This top-down mandate forces the modernization of key manufacturing sectors, establishing a direct, fundamental demand for disruptive technologies like 3D printing. The market's evolution is shifting from rudimentary desktop printing to industrial-grade systems, a necessary prerequisite for producing high-performance parts that meet the stringent requirements of a globally competitive manufacturing base.

Indonesia Additive Manufacturing Market Growth Drivers:

The national imperative for manufacturing excellence, as codified in the "Making Indonesia 4.0" program, creates a structural demand for AM. This initiative specifically targets the automotive, electronics, and chemicals sectors, where the adoption of 4IR technologies, including 3D printing, is incentivized. This strategic mandate compels large-scale manufacturers to invest in AM hardware and services to enhance production volumes and efficiency in raw materials and key components. Furthermore, the rising need for complex, lightweight, and high-strength materials in the Aerospace and Defense sector directly increases demand for metal and composite-compatible AM systems. Additive manufacturing fulfills this requirement by enabling part consolidation and the fabrication of intricate internal lattices, improving mechanical performance while reducing overall weight, a crucial metric for aircraft and defense platforms.

- Challenges and Opportunities:

The most prominent headwind constraining the market is the prohibitively high initial cost of industrial AM equipment, materials, and specialized technical training. This capital barrier limits the rate of adoption, particularly among the nation's vast network of MSMEs, which are vital to the manufacturing supply chain. Conversely, a significant opportunity lies in the burgeoning trend of Distributed Manufacturing and the implementation of Digital Inventories. This model allows Indonesian enterprises to pilot secure, on-demand production of spare and low-volume parts closer to the point of use, thereby enhancing supply chain resilience and reducing costs associated with warehousing and obsolescence. This strategic pivot provides a clear value proposition that directly increases demand for AM hardware and specialized software solutions for digital file management.

- Raw Material and Pricing Analysis:

The AM raw material landscape is characterized by its reliance on globally sourced, specialized feedstocks, which creates supply chain dependencies and influences local pricing. Key materials like engineering-grade polymers (e.g., PEEK, ULTEM) and metal powders (e.g., Titanium, Nickel alloys) are typically imported, linking their cost and availability directly to global commodity prices and international logistics stability. The high price per kilogram of these qualified materials, compared to traditional manufacturing inputs, is a critical component of the total cost of ownership for AM systems. Consequently, higher feedstock costs dampen demand for high-volume AM applications, pushing adoption primarily toward high-value, low-volume components where the benefits of customization and geometric complexity outweigh the material premium.

- Supply Chain Analysis:

The Indonesian AM supply chain remains largely import-dependent for core components: advanced hardware (printers), specialized software, and performance materials. Key production hubs for industrial AM equipment are situated in North America and Europe (e.g., Stratasys, EOS), creating logistical complexities, longer lead times for machine delivery and maintenance, and reliance on foreign expertise for deep-level technical support. This dependency increases the total cost and time required for Indonesian manufacturers to integrate new AM capacity. The domestic supply chain is primarily composed of local service bureaus and distributors, which offer 3D Printing as a Service (3DPaaS) and initial technical support, acting as a crucial interface between global technology suppliers and local end-users.

Government Regulations:

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Indonesia | Making Indonesia 4.0 (Ministry of Industry) | Creates fundamental, top-down demand by mandating and incentivizing the adoption of 3D printing across five priority industrial sectors (e.g., Automotive, Electronics). |

| Indonesia | Absence of Indonesian National Standards (SNI) | Acts as a significant technical constraint; the lack of formalized certification and technical regulations for AM parts hinders their deployment in critical, high-stakes applications like flight-critical aerospace components or permanent medical implants. |

| Indonesia | Government Regulation No. 78/2019 on Tax Allowance | Provides fiscal incentives designed to lower the capital investment threshold, directly supporting manufacturers who invest in 4IR technologies, thereby stimulating demand for AM hardware. |

Indonesia Additive Manufacturing Market Segment Analysis:

- Fused Disposition Modelling (FDM) Technology Analysis: FDM, as a technology, drives robust requirements in Indonesia primarily due to its combination of low entry cost, material versatility with accessible thermoplastics (PLA, ABS), and relative simplicity of operation compared to powder bed fusion or stereolithography systems. This democratized access makes it the preferred AM technology for academic institutions and MSMEs engaging in rapid prototyping, tooling, and manufacturing aids like jigs and fixtures. The core growth driver is the automotive sector's continuous need for quick design iterations, where FDM enables engineers to validate form and fit rapidly, significantly shortening the product development cycle. Furthermore, academic research institutions, such as the ones at the Universitas Indonesia, are actively using FDM to explore complex applications, including the fabrication of personalized, controlled drug-release tablets using specialized polymers, further broadening demand beyond conventional industrial prototyping.

- Healthcare End-User Industry Analysis: The Healthcare sector's specific need for AM is driven by the intrinsic requirement for patient-specific customization and a growing need for localized supply of medical devices. AM's capability to produce custom surgical guides, anatomical models for pre-operative planning, and patient-matched prosthetics creates unique, non-negotiable demand. Unlike mass-produced items, these products must be tailored to an individual’s anatomy, a requirement that conventional manufacturing cannot meet economically or quickly. The rising focus on local content and reducing reliance on imported medical devices, especially in the wake of global supply disruptions, further acts as a powerful growth driver for Indonesian healthcare providers to integrate AM capabilities for on-demand production of low-volume, high-value specialized medical tools and training models.

Indonesia Additive Manufacturing Market Competitive Environment and Analysis:

The competitive landscape in Indonesia is a blend of global hardware giants and local service providers. International firms, such as Stratasys Ltd. and HP Inc., focus on deploying advanced industrial-grade hardware, while local entities concentrate on providing services, materials, and localized technical support.

- Stratasys Ltd.: Stratasys is a global leader in polymer AM, specifically in Fused Deposition Modeling (FDM) and PolyJet technologies. Their strategic positioning in Indonesia centers on offering industrial-grade solutions for high-reliability applications, targeting sectors like Aerospace and Automotive for both prototyping and certified end-use parts. Key products include the F900™ for production-grade FDM and the J-Series for multi-material, full-color PolyJet applications, emphasizing functional accuracy and engineering thermoplastics.

- HP Inc. (via PT HP Indonesia): HP leverages its proprietary Multi Jet Fusion (MJF) technology to target the production segment of the market. Its strategy focuses on rapid production of functional parts, contrasting with prototyping-centric systems. HP's product line, such as the Jet Fusion 5200 Series, is positioned to meet the demands of service bureaus and large manufacturers requiring high throughput, high part density, and improved cost-per-part economics, a direct response to the national call for efficient industrial production under the Making Indonesia 4.0 program.

Indonesia Additive Manufacturing Market Developments:

- November 2022: Partnership Establishment (Bakrie Group and COBOD International) Bakrie Group, an Indonesian conglomerate, partnered with COBOD International to establish PT Modula Tiga Dimensi. This initiative focuses on promoting 3D Construction Printing (3DCP) technology in Indonesia, aiming to introduce efficient and environmentally-friendly building methods to transform the construction industry.

Indonesia Additive Manufacturing Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 146.782 million |

| Total Market Size in 2031 | USD 249.73 million |

| Growth Rate | 11.21% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Technology, End-User Industry |

| Companies |

|

Indonesia Additive Manufacturing Market Segmentation:

- BY COMPONENT

- Hardware

- Software

- Services

- Material

- BY TECHNOLOGY

- Selective Laser Sintering (SLS)

- Laser Sintering (LS)

- Electron Beam Melting (EBM)

- Fused Disposition Modelling

- Stereolithography (SLA)

- BY END-USER INDUSTRY

- Aerospace & Defense

- Healthcare

- Automotive

- Construction

- Consumer

- Others