Report Overview

Thermal Management Solutions Market Highlights

Thermal Management Solutions Market Size:

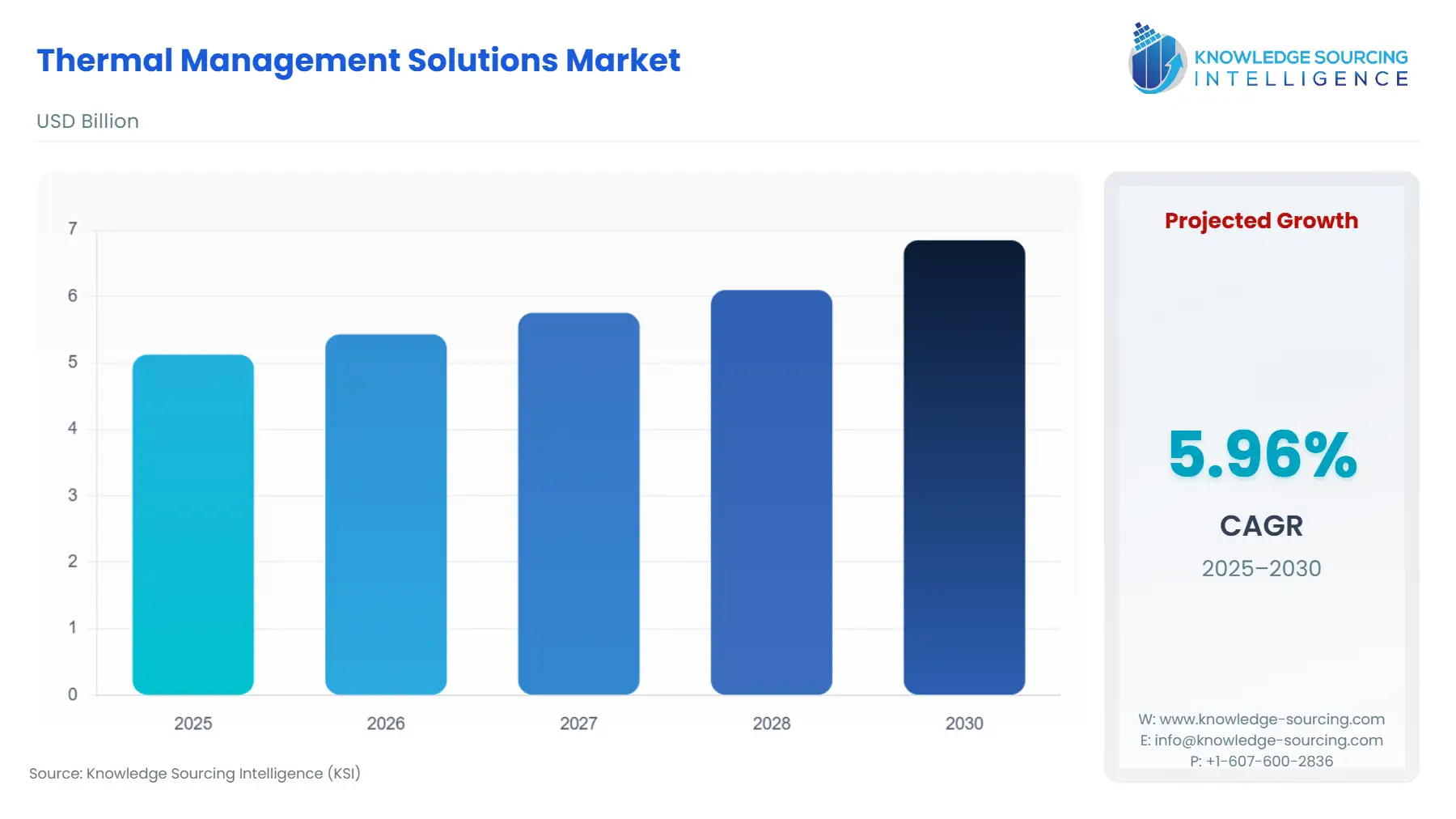

Thermal Management Solutions Market, sustaining a 5.79% CAGR, is anticipated to rise from USD 5.126 billion in 2025 to USD 7.186 billion in 2031.

Electronic packaging has resulted in improved performance and smaller product sizes. Due to the large rise in power consumption, thermal management is now necessary to maintain system reliability and performance by reducing the high heat flux produced by electronic devices. One of the main drivers of market growth is the electronics industry's notable global growth. As consumer electronics manufacturing technologies advance, there is a growing need for smaller devices with higher power densities. As a result, there is a greater need for thermal management technologies to reduce the high heat flux that these devices produce.

Thermal Management Solutions Market Growth Drivers:

Increasing need for advanced heat dissipation solutions

A development opportunity was predicted for the Thermal Management Solutions market in the upcoming years as thermal interface materials are to transfer heat while displaying a compression force characteristic that can accommodate both the heat-generating component and the heat-dissipating chassis or heat sink. When electronic components work, heat is produced. The functionality and dependability of these products are determined by how well they control their heat-generating and cooling systems. A means of wicking heat away from the components to a heat-dissipating mechanism, like a chassis, liquid cooling plate, or conventional heat sink, is required when temperatures rise too high.

Increasing Demand for Consumer Electronics

The electronics industry's advancements have led to a rise in the introduction of more intelligent and compact products. Because of these developments in the field, there is now a greater demand for novel thermal management technologies, which reduce heat generation from devices and enhance system performance and reliability. Over the last ten years, there has been a significant increase in the market for tablet and smartphone materials. In addition, the number of connected devices has been growing quickly in recent years due to the growing adoption of the Internet of Things (IoT), a technology that uses IP-enabled protocols and the Internet to allow communication between things or between things and people. For example, 29.3 billion devices will be connected to networks by 2023, according to Cisco.

Strict emission regulations and regulations

Due to environmental concerns and the fact that thermal management systems lower vehicle emissions, demand for them is rising. Ineffective cabin climate control can result in significantly higher fuel consumption and emissions, as well as potential safety risks from fogging and windshield damage. Furthermore, the California Air Resources Board (CARB) plans to tighten rules by 2024 to enhance NOx emission technologies that heat an after-treatment system quickly and maintain its temperature without degrading fuel efficiency. Vehicle fuel efficiency is improved by this system's assistance in regulating the internal combustion engine's temperature. Therefore, it is anticipated that growing attention to thermal management to reduce vehicle emissions will spur market expansion.

Increasing use of the conduction cooling devices

The physical transfer of thermal or heat energy is known as conduction. The purpose of connecting the two objects is to allow the object with a lower temperature to absorb thermal energy from the object with a higher temperature. Due to its low surface area requirement for energy transfer, conduction is regarded as one of the most successful methods of thermal management. Heat sinks, heat spreaders, and other similar items are typical instances of conduction-based thermal management products which is anticipated to create new opportunities for the Thermal Management Solutions market to grow.

Thermal Management Solutions Market Segment Analysis:

By end-user industry, the servers and data centers are expected to grow considerably

Regardless of complexity or size, thermal management is essential to ensuring the best possible operation and performance of all electronic applications. Thousands of data processing devices, including servers, switches, and routers, make up data centres, and these devices emit a lot of heat and energy. These data centres produce heat, which needs to be adequately dissipated to keep the temperature from rising and deteriorating the centres' performance and dependability, which would require more maintenance. For data center operations like data placement, data migration, data replication, data access task distribution, scheduling, and disk speed control to run smoothly, thermal management is required.

Hybrid Thermal Management and Electromagnetic Interference (EMI) Shielding to Promote Market Development

Several sectors are transitioning to higher-frequency navigation applications. Automotive radar for higher resolution detection and 5G telecommunications for faster data rates are two major examples of this. Electromagnetic interference (EMI) shielding using conventional techniques gets more challenging at higher frequencies. It becomes appealing to combine EMI shielding with efficient thermal management in one material. The rollout of 5G is well advanced, but the highest frequency wave (>24 GHz) infrastructure is still in its early stages of development.

Thermal Management Solutions Market Geographical Outlook:

North America is projected to have the highest share of the Thermal Management Solutions market

Due in large part to rising investments in technological innovation and the widespread adoption of thermal management technologies across various industries, the North American region is anticipated to hold the largest market share. One of the main drivers of the market's growth is the region's booming consumer electronics industry. As per a recent prediction by CTA, the retail sales revenue of the consumer technology industry in the United States is expected to surpass USD 505 billion for the first time. From the remarkable growth of 9.6% in 2021 over 2020, the projection shows a 2.8% increase in revenue in 2021. Strong demand for smartphones, car technology, health devices, and streaming services, according to the organization, will contribute significantly to the predicted revenue.

Thermal Management Solutions Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Thermal Management Solutions Market Size in 2025 | USD 5.126 billion |

Thermal Management Solutions Market Size in 2030 | USD 6.848 billion |

Growth Rate | CAGR of 5.97% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Thermal Management Solutions Market |

|

Customization Scope | Free report customization with purchase |

Thermal Management Solutions Market Segmentation

By Type

Active Solution

Passive Solution

By Interface Material

Thermal Pads

Gap Fillers

Grease

Thermal Tape

Others

By Application

Power Electronics

Charging Stations

Test & Measurement Devices

Motor Drives

Others

By End-User

Automotive

Aerospace

Electrical & Electronics

Medical & Healthcare

Military & Defense

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others