Report Overview

UAE Electronic Health Records Highlights

UAE Electronic Health Records (EHR) Market Size:

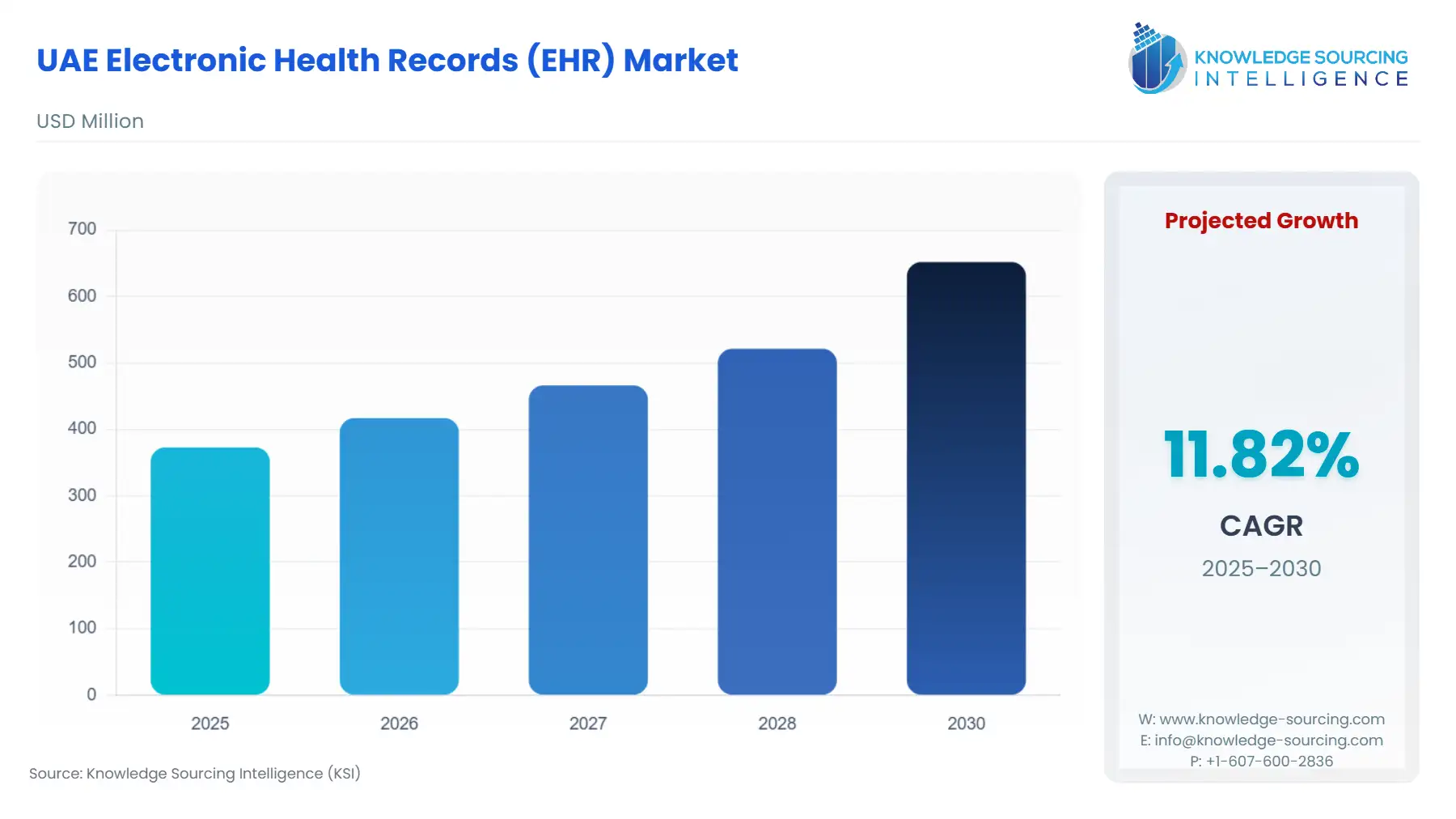

The UAE electronic health records (EHR) market is estimated to grow at a CAGR of 11.83% and reach a market size worth USD 0.652 billion by 2030 from an initial value of USD 0.373 billion in 2025.

Through initiatives such as Riayati, Malaffi, and NABIDH (part of the UAE Health Authority's National Health Service), the UAE is increasing its emphasis on using a unified system of digitised health information within the healthcare environment of the country. A significant component of these initiatives is making all hospitals, healthcare facilities, and EMR vendors fully interoperable, providing them with access to real-time data in a manner that meets or exceeds Quality Standards.

As compliance with government regulations becomes increasingly necessary for healthcare providers, the number of compliant providers continues to grow. Investments in cloud infrastructure, clinical tools enabled by artificial intelligence, and systems providing patients with access to their medical records are driving these growth trends. By combining these factors, the development of a unified system of digitised health information will continue to grow among all healthcare providers throughout the entire United Arab Emirates (UAE).

UAE Electronic Health Record Market Overview & Scope

The market for electronic health records in the UAE is guided by a national strategy for digital health, overseen by the Ministry of Health and Prevention (MoHAP) and emirate-level authorities. Core to this plan is the Riayati platform, as well as the National Unified Medical Record platform. Riayati is intended to connect thousands of providers (public and private) across the UAE, enabling the secure and consistent exchange of clinical data. By creating an information exchange across the country, Riayati connects the Nabidh platform in Dubai and the Malaffi platform in Abu Dhabi, allowing users access to each other's patient records regardless of their location.

Regulatory compliance is reinforced by Government policies as demonstrated by the MoHAP requirement that all connected platforms utilise internationally recognised clinical coding systems, such as SNOMED CT, to ensure the consistent recording of diagnosis, procedures, medication information and laboratory results across the healthcare sector. The onboarding process for vendors who wish to connect to the national exchange is defined by MoHAP and the Emirate Authorities based on both technical requirements and operational expectations for vendor participation.

The rise in beneficiary satisfaction to 85.76 per cent and health risk readiness reaching 90 per cent under Vision 2030’s Health Sector Transformation Program reflects how strongly Saudi Arabia is shifting toward digitised, patient-centered care. Higher satisfaction levels come from faster access to services, fewer administrative delays, and smoother information flow, outcomes directly supported by electronic health records. Strong readiness scores also show that hospitals and clinics are improving their ability to manage risks using real-time data. Together, these indicators signal increased investment in integrated digital systems, encouraging wider adoption of EHR platforms across public and private healthcare facilities in the Kingdom.

The UAE electronic health record market is segmented by:

- Product: By product, the market is segmented into cloud-based EHR and on-premise EHR. Cloud-based EHR is being adopted by vendors and customers due to its advantages, including the ability to access the EHR from anywhere in the cloud and lower costs. The increase in cloud-based EHR also has players focusing on providing more security capabilities, which helps to further foster cloud-based EHR for those end-user customers who have security fears and concerns. On-premise products have value as well, especially for those organisations that want to maintain absolute full control of the EHR.

- Type: By type, acute, ambulatory, and post-acute are the major segments. Acute EHRs are emergency department EHRs for electronic documentation of a patient's medical information in acute care settings. These EHRs are desired because of their real-time updating, integration with other systems, and ability to maintain a workflow. Ambulatory EHRs are effectively outpatient healthcare EHRs. The ambulatory market represents a significant share of the EHR market, in part due to the ambulatory EHR for managing user access to patient interactions through valuable portals and features that track patient billing and coding. The utilisation of post-care EHR is increasing. There is a demand for post-care electronic health records by hospitals, clinics, pharmacies, laboratories, and others. Hospitals are the leading segment of the demand for electronic health records systems because of their volume of demand.

- Application: The market segment of the application for EHR includes the Clinical, Administrative, Reporting and Analytics, and Other Applications. Clinical applications are at the centre of the applications segment, as they provide and maintain complete patients' history, medications and diagnostics, and treatment records. The standardisation of clinical data will continue to support the continuum of care and meet the requirements for interoperability as set forth by the UAE Health Authorities.

- End-Use Industry: The market is segmented into hospitals, clinics, pharmacies, laboratories, and others. The EHR systems used in hospitals are the most sophisticated because hospitals typically address the most complex and data-centric patient care. EHRs for hospitals incorporate admission, emergency, surgical intervention, lab results, imaging, and discharge information all on one platform. This method provides better continuity of care, minimises redundant tests, and ultimately increases patient safety.

Top Trends Shaping the UAE Electronic Health Record Market

- Shift Toward Cloud-Based EHR

Hospitals and clinics in the UAE are moving toward cloud EHR platforms because they are scalable, can be accessed remotely, and integrate well with telemedicine. The government’s digital health efforts further support the move to cloud EHR.

- National Health Information Exchanges (Malaffi & NABIDH)

The launch of Malaffi in Abu Dhabi and NABIDH in Dubai demonstrate a stronger commitment from these two regions to interoperability. These platforms connect hospitals, clinics, and labs within each region to guarantee secure patient data sharing and to enable better care coordination.

UAE Electronic Health Record Market Growth Drivers vs. Challenges

Drivers:

- Government Digital Health Strategy: The national government is the largest influence on EHR adoption. Through initiatives like Malaffi and NABIDH are making electronic health records compulsory for hospitals and clinics. By developing EHR capabilities, within national digital health strategies, the UAE government aligns providers with a common set of capabilities. This alignment does not only standardize care for patients but also raises the bar for analytics, research and public health planning at a national level. Providers truly have no choice but to comply with regulations and modernize their care capabilities, which will mean safer and more coordinated care for patients. The strength of the top-down direction is why the UAE's EHR ecosystem is growing faster than other regional counterparts.

- Rising Demand for Integrated Patient Care: Health care in the UAE over the last few years has gradually shifted away from episodic, treatment-based perspectives to one that emphasizes ongoing, patient-centered care. Patients are increasingly communicating expectations for managed and integrated health care services during informal conversations with specialists, between the labs, hospitals, and their care team.

- Rising Prevalence of Chronic Diseases Driving Need for Data-Driven Care: As??? the healthcare system shifts to proactive, data-driven, and continuous care models, the UAE’s fast-growing chronic and lifestyle-related diseases, mainly caused by diabetes, cardiovascular disorders, obesity, hypertension, and respiratory ailments, are significantly driving the adoption of electronic health records (EHRs). Healthcare providers in the UAE are confronted with increasing clinical workloads, greater diagnostic complexity, and the need for extended patient monitoring, as the country has one of the highest rates of diabetes worldwide, and the number of aged residents at risk of multi-morbidity is also ???rising. There??? were 1,274,200 cases of diabetes in adults in 2024, out of a total adult population of 7,710,700 in the UAE, with a 20.7% prevalence of diabetes in ???adults.

The rising spending on precision medicine and population-health analytics by health authorities in the UAE is a major factor driving the significance of EHRs. This is made possible through AI-based risk stratification, early disease detection, and long-term outcome tracking. The UAE??? is planning to conduct clinical trials on a large scale to create personalized medicines that will be globally available for sale. It is very easy to locate the possible participants for clinical trials with the help of the Emirati Genome Project, which comprises 800,000 human samples, and the Abu Dhabi Department of Health Electronic Medical Record System, which has 2.6 million ???members.

Hence, the increasing prevalence of chronic diseases is overloading traditional care methods while also pushing the digital transformation to happen at a fast pace in the entire healthcare ecosystem of the UAE. EHR solutions are thus placed at the core of a healthcare infrastructure that can deliver efficient, scalable, and high-quality chronic disease ???management.

Challenges:

- Data Privacy and Cybersecurity: As health records migrate online, compliance with the UAE's strict data laws becomes more complicated. Cybersecurity threats are growing, and many healthcare providers (especially smaller providers) lack stable infrastructures to defend against attacks. All this makes it difficult to protect sensitive patient data and keeps patient information more vulnerable than it should be.

UAE Electronic Health Record Market Segmentation Analysis

- By Product: Cloud-based

The UAE Electronic Health Records Market, by product, is segmented into on-premise and cloud-based. The cloud-based product type is witnessing rapid growth in the UAE, driven by its flexibility and the growing digitalization in the healthcare system compared to on-premises solutions. The increasing government policies and initiatives towards healthcare digitalization will also promote the strengthening of EHR integration across the country's public and private sectors, while boosting cloud adoption for standard data management in the healthcare industry.

The UAE Vision 2031 is focusing on integrating digital infrastructure across all industries, including healthcare. Additionally, the UAE government allocated a federal budget of AED 5.745 billion for healthcare and community prevention services for the investment and development of smart infrastructure, cybersecurity, and digital services.

The presence of diverse global and regional market players providing cloud EHR products for cost-efficiency and integrated with AI and telehealth technology is also expected to expand due to the rising adoption of remote access in the country. In addition, in November 2025, Oracle collaborated with M42 for advancement in the health, longevity, and prevention of diseases in the UAE. This initiative focuses on the integration of data from Cloud-based Oracle Health and M42 from the Emirates Genome Program completely into EHR to provide pharmacogenomic recommendations.

- By End-user: Hospitals

By end-user, the UAE electronic health record market is segmented into hospitals, clinics, pharmacies, laboratories, and others. Hospitals??? are the biggest single group of end-users in the electronic health record (EHR) market in the UAE. This is primarily due to the country's rapid healthcare digitalization initiatives, increasing number of patients, and a shift towards integrated, value-based care. With top public and private hospitals in the UAE, especially in Abu Dhabi and Dubai, expanding their service capacities and introducing state-of-the-art clinical workflows, it has become necessary to have centrally located and interoperable EHR platforms for facilitating on-demand access to patient information and reducing operational ???inefficiencies. In??? the first quarter of 2023, Dubai gave health licenses to 143 different medical units, making the total number of healthcare units in Dubai 4609, 11.5% more than in Q1 of last year.

According to the Dubai Healthcare Authority (DHA) statistics, the Emirates is home to 52 hospitals, 77 specialized clinics, 58 one-day surgery centers, 82 dental clinics, 122 clinics, 1,325 pharmacies, 414 optics centers, 160 nursing homes, and 57 alternative medicine ???centers.

The??? Abu Dhabi Department of Health initiated the Healthcare Life Science Vision and Strategy in 2023, which aims to raise economic activity by $32 billion through improving the life sciences sector. The plan envisions the establishment of 290 biotech startups in Abu Dhabi, with more than 600 clinical trials, the establishment of at least 24 new life sciences manufacturing sites, and the creation of 22,000 new jobs in life ???sciences.

Driven??? by government funding, rigorous requirements for digital record-keeping, and an increase in hospital investments in AI-powered clinical documentation, population health management, and patient engagement portals, the hospital sector will be the main contributor to EHR adoption, thus influencing the long-term direction of the UAE’s digital health ???ecosystem.

UAE Electronic Health Record Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| UAE Electronic Health Records (EHR) Market Size in 2025 | USD 0.373 billion |

| UAE Electronic Health Records (EHR) Market Size in 2030 | USD 0.652 billion |

| Growth Rate | CAGR of 11.83% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| List of Major Companies in the UAE Electronic Health Records (EHR) Market |

|

| Customization Scope | Free report customization with purchase |

UAE Electronic Health Record Market Segmentation:

By Product

- On-Premise

- Cloud-Based

By Type

- Acute

- Ambulatory

- Post-Acute

By Application

- Clinical Applications

- Administrative Applications

- Reporting and Analytics

- Others

By End-Users

- Hospitals

- Clinics

- Pharmacies

- Laboratories

- Others

Our Best-Performing Industry Reports:

- Healthcare Natural Language Processing (NLP) Market

- Healthcare Compliance Software Market

- Healthcare Data Storage Market