Report Overview

UK Additive Manufacturing Market Highlights

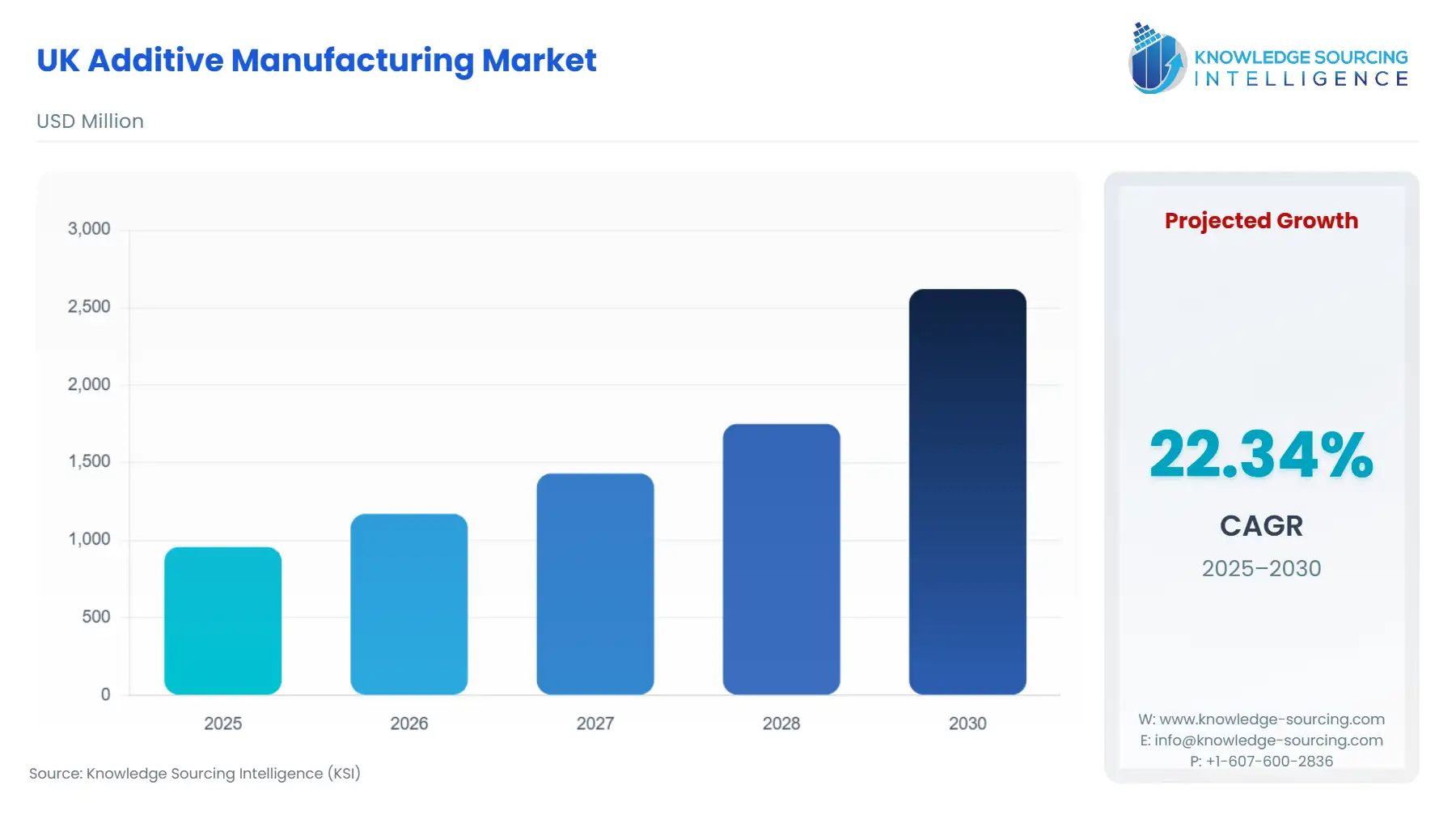

UK Additive Manufacturing Market Size:

The UK Additive Manufacturing Market is projected to expand at a CAGR of 22.34%, reaching USD 2.62 billion in 2030 from USD 0.956 billion in 2025.

The UK Additive Manufacturing (AM) market is evolving from a prototyping technology into a critical industrial production methodology. This transition is fundamentally altering the nation's high-value manufacturing base, leveraging AM's core advantages of design complexity, rapid iteration, and supply chain resilience. The market's trajectory is intrinsically linked to government support for advanced manufacturing and the imperative across key sectors—such as aerospace and healthcare—to produce highly customized, low-volume, and geometrically complex components not feasible with conventional techniques. This shift is propelling the market toward greater adoption of industrial-grade metal and polymer systems, necessitating a sustained investment in hardware, advanced materials, and specialized services.

UK Additive Manufacturing Market Analysis:

- Growth Drivers

The move toward product complexity and consolidation serves as a direct growth catalyst for AM. Conventional manufacturing is ill-suited for monolithic parts that combine multiple functionalities. AM enables engineers to consolidate complex assemblies into a single, lighter component, a key design imperative in the aerospace sector. This design freedom directly increases the need for specialized AM software and high-precision metal AM hardware (e.g., Electron Beam Melting) to produce these intricate geometries. Furthermore, the pursuit of supply chain resilience following global disruptions has heightened the need for localized, on-demand production capability. By adopting AM, businesses can re-shore or localize component production, reducing logistical complexities and lead times, thereby creating consistent demand for AM service bureaus and materials within the UK.

- Challenges and Opportunities

A primary challenge remains the substantial initial capital outlay for industrial-grade AM equipment and the associated skilled labor training. This financial hurdle acts as a constraint, particularly for Small and Medium Enterprises (SMEs), which often represent the flexible manufacturing capacity of the UK economy. This friction decelerates the rate of new hardware adoption. However, a significant opportunity lies in the integration of artificial intelligence (AI) and machine learning for process optimization. AI integration can analyze large datasets from the printing process, optimizing print parameters and predicting defects, thereby increasing material yield and part consistency. This enhancement directly addresses concerns about part quality and repeatability, which, if resolved, will substantially increase industrial demand for high-volume, end-use parts.

- Raw Material and Pricing Analysis

Additive Manufacturing, a physical product market encompassing hardware and material, is highly sensitive to the supply chain of its key feedstocks, particularly metal powders (e.g., titanium, nickel superalloys). These materials, often produced via energy-intensive atomization, introduce a significant cost component to the final part, making material cost the biggest continuous expense throughout the life of an AM machine. The supply chain has historically been centralized globally. However, UK initiatives, such as the CASCADE program, aim to develop a national supply chain for high-grade metal powder production. This effort, if successful, reduces external logistical dependencies and supplier risk, which could stabilize pricing and thus drive down the cost-per-part, directly boosting the commercial viability and demand for metal AM services.

- Supply Chain Analysis

The global AM supply chain is characterized by a high-value focus, with key production hubs for industrial hardware concentrated in a few global regions. The UK market is, therefore, dependent on the import of capital equipment (hardware) from these international manufacturers. A key domestic dependency is the highly specialized nature of the consumables, such as high-performance polymers and metal alloys. Logistical complexities arise from the requirement for specific handling, storage, and quality control of these sensitive feedstocks. The high-value nature of the final components and the need for stringent quality assurance (e.g., in Aerospace & Defense) necessitate a robust, auditable supply chain, leading UK companies to prioritize certified suppliers, which can limit immediate sourcing options and create dependency on a select few global material atomizers.

UK Additive Manufacturing Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

UK |

High Value Manufacturing Catapult (HVM Catapult) |

Provides R&D expertise, facilities, and collaborative projects, directly lowering the financial and technical barrier to AM adoption for manufacturers, thereby stimulating demand for advanced AM services and hardware trials. |

|

UK |

Innovate UK Funding Competitions |

Offers grants to incentivize the development of novel AM solutions and applications. This targeted financial support accelerates commercialization timelines for AM service providers and equipment manufacturers, increasing the overall pace of market expansion. |

|

Global/UK |

ISO/ASTM Additive Manufacturing Standards |

Establishes crucial quality and process repeatability benchmarks. Formal standardization increases industrial confidence in AM parts, particularly in regulated sectors like Aerospace and Healthcare, creating a foundational demand for validated AM technologies and services. |

UK Additive Manufacturing Market Segment Analysis:

- By End-User Industry: Aerospace & Defense

The Aerospace & Defense (A&D) sector is a cornerstone of UK AM market, driven by an unequivocal need for weight reduction and performance enhancement. A&D mandates the use of AM for parts like fuel nozzles, turbine blades, and structural brackets made from high-performance alloys such as titanium and nickel-based superalloys. The growth driver is not primarily cost reduction but rather the ability to achieve complex internal geometries, which optimizes thermal performance and minimizes material use. This directly fuels the need for powder bed fusion technologies, such as Selective Laser Sintering (SLS) and Electron Beam Melting (EBM), and the specialized services (e.g., post-processing, quality inspection) required to certify these mission-critical, end-use components. The long product lifecycle and stringent regulatory environment in A&D translate into sustained, high-value demand for certified AM capacity.

- By Technology: Electron Beam Melting (EBM)

Electron Beam Melting (EBM) is a crucial technology segment with a focused market profile. Unlike laser-based fusion methods, EBM operates in a vacuum, which is optimal for processing highly reactive metal powders like titanium alloys, the material of choice in medical implants and critical aerospace structures. The technology's key growth driver is its ability to produce parts with minimal residual stress and superior material properties, including enhanced fatigue life. This capability is paramount for sectors where component failure is catastrophic, such as high-stress aerospace applications and bespoke orthopedic implants in Healthcare. The unique thermal environment in EBM also facilitates the creation of complex lattice structures, which significantly reduces part weight and is a core demand feature for lightweighting in regulated industries.

UK Additive Manufacturing Market Competitive Analysis:

The UK AM competitive landscape features a mix of global hardware manufacturers, specialist service bureaus, and materials developers. Competition is centered on system reliability, material compatibility, and the provision of end-to-end solutions, particularly for high-reliability production.

- Renishaw PLC: As a UK-headquartered global engineering technologies company, Renishaw holds a significant strategic position by offering integrated systems that span the entire manufacturing process, from metal AM systems (e.g., RenAM series) to precision measurement and metrology products. Their strategy focuses on closed-loop manufacturing, ensuring quality and repeatability. This vertical integration directly addresses a key market pain point—the need for validated, consistent AM production—thereby positioning them as a preferred supplier in quality-conscious sectors.

- 3D Systems: A major global player, 3D Systems provides a broad portfolio across hardware, materials, and software (e.g., 3D Sprint). Their strategic emphasis is on production-grade AM solutions, with a strong focus on both industrial and healthcare markets. This diversification positions them to capture demand across different segments, with their Healthcare solutions driving specific requirements for bio-compatible materials and patient-specific devices.

UK Additive Manufacturing Market Developments:

- December 2024 (Hexagon/3D Systems): Hexagon announced the acquisition of 3D Systems' Geomagic suite of software capabilities. This acquisition, which includes Geomagic Design X and Control X, focused on 3D metrology and re-engineering software. This strategic move highlights a consolidation in the AM software space, aiming to strengthen interoperability for design, scanning, and inspection—a critical need for integrating AM into mainstream digital manufacturing workflows.

- June 2024 (Renishaw PLC): Renishaw announced the availability of the RMP24-micro, described as the world's smallest wireless machine tool probe. While a metrology product, its launch is a capacity addition to the broader 'smart manufacturing' ecosystem, enabling high-precision measurement on compact machine tools. This supports the move toward high-precision miniature components often produced by AM.

UK Additive Manufacturing Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 0.956 billion |

| Total Market Size in 2031 | USD 2.62 billion |

| Growth Rate | 22.34% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Technology, End-Use Industry |

| Companies |

|

UK Additive Manufacturing Market Segmentation:

- BY COMPONENT

- Hardware

- Software

- Services

- Material

- BY TECHNOLOGY

- Selective Laser Sintering (SLS)

- Laser Sintering (LS)

- Electron Beam Melting (EBM)

- Fused Disposition Modelling

- Stereolithography (SLA)

- BY END-USER INDUSTRY

- Aerospace & Defense

- Healthcare

- Automotive

- Construction

- Consumer

- Others