Global Biophotonics Market Report, Size, Share, Opportunities, and Trends By Technology, Application, End-User, and Geography – Forecast from 2025 to 2030

Description

Biophotonics Market Size:

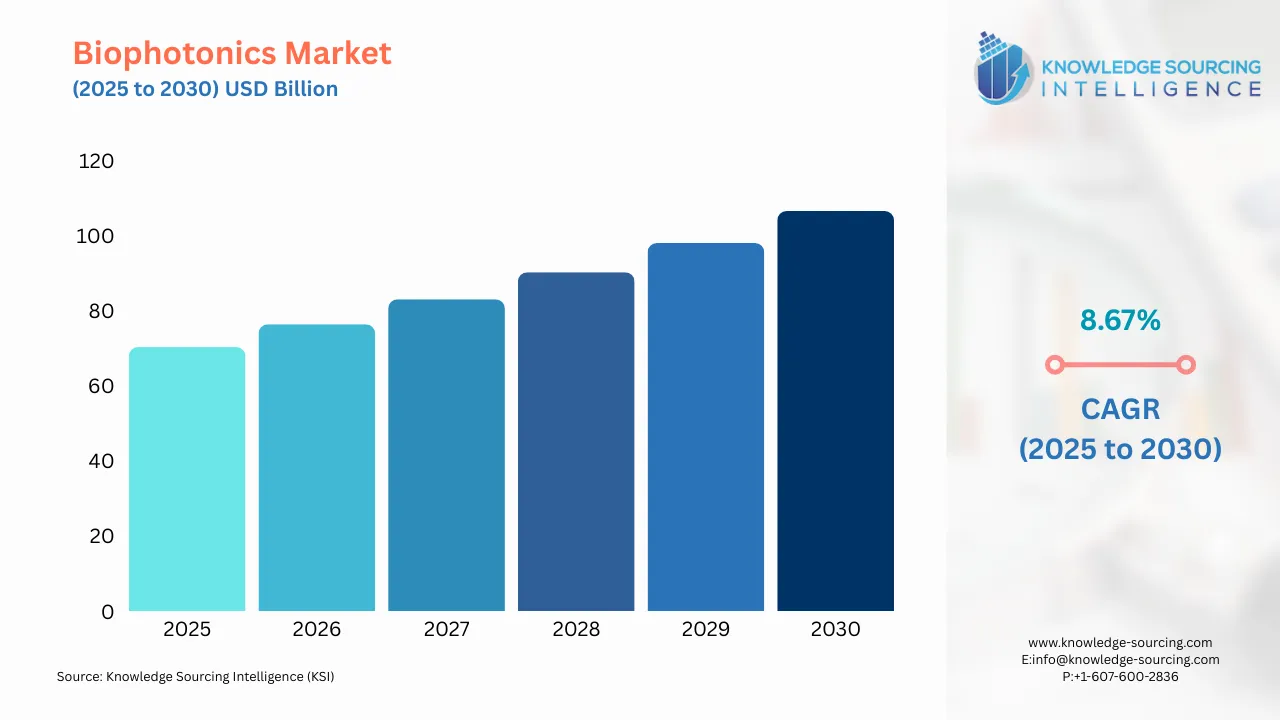

The biophotonics market is evaluated at US$70.310 billion in 2025 and is projected to grow at a CAGR of 8.67% to reach US$106.571 billion in 2030.

Biophotonics Market Key Highlights:

- Biophotonics enables non-invasive diagnostics, enhancing patient safety and comfort in healthcare.

- Advanced optical technologies like Raman spectroscopy improve early disease detection accuracy.

- Integration with AI and nanotechnology drives innovation in imaging and diagnostics.

- Expanding applications in agriculture and environmental monitoring broaden market potential.

Biophotonics, an interdisciplinary field at the intersection of photonics and biological sciences, leverages light-based technologies to study, manipulate, and image biological materials at the molecular, cellular, and tissue levels. This rapidly evolving domain combines principles of optics, lasers, nanotechnology, and biotechnology to address critical challenges in healthcare, diagnostics, therapeutics, and beyond. By harnessing photons—the fundamental particles of light—biophotonics enables non-invasive, high-resolution techniques that have transformed medical diagnostics, personalized medicine, and life sciences research. Its applications span from advanced imaging systems like optical coherence tomography (OCT) to therapeutic modalities such as photodynamic therapy (PDT), making it a cornerstone of modern biomedical innovation.

To learn more about this report, request a free sample copy

Biophotonics Market Introduction:

The global biophotonics market is experiencing robust growth, driven by the increasing demand for precise, non-invasive diagnostic tools and the integration of advanced optical technologies into healthcare and other industries. Biophotonics facilitates real-time monitoring and analysis of biological processes, offering solutions that are safer, more efficient, and less invasive than traditional methods. For instance, techniques like fluorescence spectroscopy and Raman spectroscopy enable early detection of diseases such as cancer, while laser-based therapies support minimally invasive treatments. Beyond healthcare, biophotonics is gaining traction in environmental monitoring, agriculture, and food safety, broadening its market potential. The field’s ability to provide high-resolution imaging and molecular-level insights positions it as a critical enabler of precision medicine and interdisciplinary research.

Recent advancements underscore the dynamic growth of the biophotonics market. In 2024, researchers at the University of Edinburgh achieved a 98% accuracy rate in detecting early breast cancer using AI-integrated Raman spectroscopy, highlighting the potential for non-invasive diagnostics. Similarly, Olympus America received FDA clearance for its BF-UC190F bronchoscope, an endobronchial ultrasound device that enhances lung cancer diagnosis through biophotonics-based imaging. These developments reflect the market’s focus on improving diagnostic precision and patient outcomes.

Additionally, significant research funding is driving innovation. In 2024, Science Foundation Ireland allocated EUR 5.3 million to Prof. Stefan Andersson-Engels to advance biophotonics-based diagnostics for cancer and inflammatory bowel diseases, signaling strong institutional support for the field. Partnerships, such as the collaboration between the Salk Institute’s Waitt Advanced Biophotonics Center and ZEISS, are also accelerating the development of cutting-edge microscopy technologies.

Biophotonics Market Overview:

The use of biophotonics in the healthcare sector has been increasing. The demand for quality healthcare, the growing prevalence of personalized medicine, and the development of healthcare instruments with a photonic component for higher accuracy and sensitivity are some of the key factors driving the market growth of biophotonics and are anticipated to propel the market growth further during the forecast period. Moreover, government and private funding for research and development activities, and the emergence of non-medical applications such as prevention of unauthorized access to confidential data and pathogen detection in agricultural products, have a positive impact on the market and are expected to bolster the market growth in the coming years.

A major factor fueling the biophotonics market is its increasing use in healthcare and defense. Endoscopic applications, which enable minimally or non-invasive surgeries, dominate the market due to early adoption. Biophotonics plays a crucial role in medical diagnostics, therapeutic treatments, and research.

- Diagnostics: Biophotonics-based devices are widely used for early disease detection.

- Therapeutics: Advanced biophotonics tools aid in treating various medical conditions.

- Research: Ongoing developments aim to introduce more innovative biophotonics devices in the coming years.

North America is projected to hold a dominant market share, driven by advanced research, strong funding (both government and private), and early technology adoption. The rise of nanotechnology in the U.S. is also expected to propel market expansion. Meanwhile, the Asia-Pacific region is anticipated to register the highest growth rate during the forecast period, supported by increasing investments and technological advancements.

Some of the major players covered in this report include Carl Zeiss AG, Hamamatsu Photonics K.K., Nikon Corporation, PerkinElmer, Inc., IPG Photonics Corporation, Horiba, Ltd., among others.

Biophotonics Market Growth Drivers:

- Rising Demand for Non-Invasive Diagnostics

The global healthcare sector is increasingly prioritizing non-invasive diagnostic techniques due to their safety, patient comfort, and ability to reduce recovery times. Biophotonics technologies, such as optical coherence tomography (OCT) and fluorescence imaging, enable high-resolution imaging and real-time analysis without surgical intervention. For instance, OCT is widely used in ophthalmology to detect conditions like diabetic retinopathy and macular degeneration early, improving patient outcomes. The World Health Organization highlights the growing burden of non-communicable diseases, which necessitates advanced diagnostic tools to manage conditions like cardiovascular diseases and cancer effectively. Additionally, biophotonics supports point-of-care diagnostics, allowing for rapid disease detection in resource-limited settings. Recent advancements, such as portable OCT devices, are making these technologies more accessible, further driving market growth. The emphasis on patient-centric care and early diagnosis continues to fuel the adoption of biophotonics in clinical settings worldwide.

- Advancements in Optical Technologies

Rapid innovations in optical technologies, including lasers, photonic integrated circuits (PICs), and advanced spectroscopy, are enhancing the capabilities of biophotonics tools. These advancements enable deeper tissue penetration, higher resolution, and faster data processing, expanding applications in diagnostics and therapeutics. For example, near-infrared II (NIR-II) fluorescence imaging has improved tumor localization during cancer surgeries, as demonstrated in recent studies published in Nature Photonics. The integration of biophotonics with artificial intelligence (AI) further enhances diagnostic accuracy by automating image analysis and identifying subtle patterns in optical data. In 2024, researchers at the University of California, Los Angeles, developed an AI-enhanced Raman spectroscopy system for real-time cancer detection, showcasing the synergy between biophotonics and emerging technologies. These technological leaps are attracting significant research funding and industry investment, positioning biophotonics as a critical component of next-generation healthcare solutions.

- Growing Prevalence of Chronic Diseases

The increasing incidence of chronic diseases, such as cancer, diabetes, and neurological disorders, is a major driver of the biophotonics market. These conditions require precise diagnostic and therapeutic tools for early detection and personalized treatment. Biophotonics technologies, such as Raman spectroscopy and photodynamic therapy (PDT), offer targeted solutions for managing chronic diseases. For instance, a 2024 study from the University of Edinburgh demonstrated that Raman spectroscopy achieved high accuracy in detecting early-stage breast cancer, reducing the need for invasive biopsies. Similarly, PDT is gaining traction for treating skin and esophageal cancers with minimal side effects, as supported by clinical trials reported by the National Cancer Institute. The global rise in aging populations and lifestyle-related diseases further amplifies the demand for biophotonics-based solutions, as healthcare systems seek efficient ways to address these challenges.

Biophotonics Market Restraints:

- High Costs of Biophotonics Systems

The development, manufacturing, and deployment of biophotonics technologies, such as high-resolution imaging systems and laser-based devices, involve substantial financial investment. These costs can limit adoption, particularly in developing regions with constrained healthcare budgets. For example, advanced OCT systems or confocal microscopy setups require expensive components like high-precision lasers and detectors, making them unaffordable for smaller hospitals or clinics. A 2021 study published in the National Center for Biotechnology Information (NCBI) highlighted that cost barriers restrict the scalability of biophotonics tools in low-resource settings. Additionally, ongoing maintenance and calibration of these systems add to the financial burden, further deterring adoption. While innovations like polymeric PICs aim to reduce costs, as noted in recent research from the Photonics Research journal, the high upfront investment remains a significant challenge for market expansion.

- Regulatory Hurdles

The commercialization of biophotonics devices is subject to stringent regulatory processes, which can delay market entry and increase development costs. Regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) require extensive testing and clinical validation to ensure safety and efficacy. For instance, the FDA’s 510(k) clearance process for medical devices, including biophotonics-based imaging systems, involves rigorous documentation and trials, often taking years to complete. An article in Frontiers in Physics noted that regulatory complexities pose a barrier to the rapid deployment of biophotonics innovations, particularly for novel applications like neural imaging. These hurdles discourage smaller companies from entering the market and slow the pace of innovation, as resources are diverted to compliance rather than research and development.

Biophotonics Market Segmentation Analysis:

- Imaging Technologies are gaining traction

Imaging technologies represent the largest segment in the biophotonics market due to their widespread adoption in healthcare for non-invasive, high-resolution visualization of biological structures. These technologies include optical coherence tomography (OCT), fluorescence microscopy, confocal microscopy, and near-infrared (NIR) imaging, which enable precise diagnostics and real-time monitoring at the cellular and tissue levels. OCT, for instance, is extensively used in ophthalmology to detect retinal disorders like diabetic retinopathy and age-related macular degeneration, offering micron-level resolution without invasive procedures. A 2024 study from the National Institutes of Health (NIH) highlighted OCT’s role in improving early detection of glaucoma, enhancing patient outcomes. Fluorescence microscopy, another key imaging modality, supports cancer research by enabling visualization of molecular processes, as demonstrated in recent work at the University of California, San Francisco. The integration of imaging technologies with artificial intelligence (AI) further enhances their diagnostic accuracy, with AI algorithms analyzing complex optical data to identify disease markers. For example, a 2024 development at Stanford University combined AI with NIR imaging to improve tumor detection during surgeries. The versatility of imaging technologies extends beyond healthcare to applications like food safety inspection, where hyperspectral imaging detects contaminants, as noted in a 2023 study in Food Control. Continuous innovations, such as portable OCT devices and advanced photonic integrated circuits, are making these technologies more accessible, solidifying their dominance in the biophotonics market.

- Medical Diagnostics are expected to lead the market growth

Medical diagnostics is the leading application segment in the biophotonics market, driven by the growing demand for early, accurate, and non-invasive disease detection. Biophotonics-based diagnostic tools, such as Raman spectroscopy, fluorescence spectroscopy, and OCT, enable clinicians to identify diseases like cancer, cardiovascular conditions, and neurological disorders at their earliest stages. Raman spectroscopy, for instance, has shown high accuracy in detecting breast cancer non-invasively, as evidenced by a 2024 study from the University of Edinburgh, which integrated AI to enhance diagnostic precision. Similarly, fluorescence spectroscopy is used to monitor glucose levels in diabetic patients, offering a less invasive alternative to traditional blood tests, according to research from the American Diabetes Association. The global rise in chronic diseases, as reported by the World Health Organization, underscores the need for advanced diagnostics to manage conditions like cancer and diabetes, which account for significant morbidity worldwide. Biophotonics also supports point-of-care diagnostics, enabling rapid testing in remote or resource-limited settings. Recent advancements, such as handheld spectroscopic devices, are expanding access to diagnostics, particularly in underserved regions, as noted in a 2024 article in Nature Biomedical Engineering. The segment’s growth is further fueled by collaborations between academic institutions and industry, such as the Salk Institute’s partnership with ZEISS to develop advanced microscopy for diagnostic applications. Medical diagnostics remains a cornerstone of the biophotonics market, addressing critical healthcare challenges with innovative solutions.

- North America is leading the market expansion

North America, encompassing the United States, Canada, and Mexico, dominates the biophotonics market due to its advanced healthcare infrastructure, robust research ecosystem, and significant investment in biophotonics technologies. The United States, in particular, leads the region with a strong presence of academic institutions, such as MIT and Stanford, and industry players driving innovation. For example, MIT’s Spectroscopy Lab recently developed a compact Raman spectroscopy system for point-of-care diagnostics, as reported in 2024. The region benefits from substantial government funding, such as the National Institutes of Health’s (NIH) $1.5 billion allocation for biomedical imaging research in 2024, which includes biophotonics applications. The U.S. Food and Drug Administration (FDA) also plays a pivotal role by approving biophotonics devices, such as Olympus America’s BF-UC190F bronchoscope for lung cancer diagnosis, cleared in 2024. Canada contributes through initiatives like the University of Toronto’s biophotonics research on fluorescence-guided surgery, enhancing cancer treatment precision. Mexico, while emerging, is adopting biophotonics in diagnostics, supported by collaborations with U.S. institutions, as noted in a 2023 study in Optics Express. North America’s high prevalence of chronic diseases, coupled with a focus on personalized medicine, drives demand for biophotonics solutions. The region’s leadership in AI integration and regulatory frameworks further cements its position as the market’s epicenter.

Biophotonics Market Key Developments:

- November 2024: Carl Zeiss Meditec AG entered a strategic partnership with the Singapore Eye Research Institute (SERI) to advance biophotonics applications in ophthalmology. This collaboration focuses on improving surgical outcomes in refractive and cataract surgeries through enhanced imaging technologies, such as optical coherence tomography (OCT). The partnership includes funding under Singapore’s Research, Innovation, and Enterprise program, aiming to develop innovative diagnostic and therapeutic tools for eye care. This development strengthens the integration of biophotonics in precision medicine, particularly in Asia’s growing healthcare market.

- May 2024: Bruker Corporation, a U.S.-based leader in scientific instruments, acquired NanoString Technologies for $392.6 million to bolster its biophotonics portfolio. NanoString’s advanced spatial biology and single-molecule imaging technologies, which leverage fluorescence-based biophotonics, enhance Bruker’s capabilities in molecular diagnostics and life sciences research. This acquisition strengthens the market’s focus on integrating biophotonics with AI-driven data analysis for applications like cancer research and personalized medicine, expanding the scope of high-resolution imaging in clinical settings.

- April 2024: Becton, Dickinson, and Company (BD) introduced the FACSDiscover S8 Cell Sorters, an advanced image-enabled spectral cell sorting system, in April 2024. This biophotonics innovation uses fluorescence-based imaging to provide deeper insights into cellular heterogeneity and functionality, particularly for immunology and cancer research. The system’s ability to combine spectral flow cytometry with real-time imaging enhances the precision of cell analysis, supporting applications in personalized medicine and drug discovery. This launch underscores the growing role of biophotonics in research and clinical diagnostics.

Biophotonics Market Scope:

| Report Metric | Details |

| Biophotonics Market Size in 2025 | USD 70.310 billion |

| Biophotonics Market Size in 2030 | USD 106.571 billion |

| Growth Rate | CAGR of 8.67% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Biophotonics Market |

|

| Customization Scope | Free report customization with purchase |

Biophotonics Market Segmentations:

Biophotonics Market Segmentation by technology

The market is analyzed by technology into the following:

- Imaging Technologies

- Spectroscopy Technologies

- Light-Based Therapeutics

- Biosensors and Bioassays

Biophotonics Market Segmentation by application

The report analyzes the market by application as below:

- Medical Diagnostics

- Therapeutics

- Research and Development

- Environmental Monitoring

Biophotonics Market Segmentation by end-user

The market is segmented by end-user:

- Hospitals and Clinics

- Research Institutions and Laboratories

- Pharmaceutical and Biotechnology Companies

- Environmental Agencies

Biophotonics Market Segmentation by regions:

The study also analysed the biophotonics market into the following regions, with country level forecasts and analysis as below:

- North America (US, Canada, and Mexico)

- South America (Brazil, Argentina, and Others)

- Europe (Germany, UK, France, Spain, Italy, and Others)

- Middle East and Africa (Saudi Arabia, UAE, and Others)

- Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)

Our Best-Performing Industry Reports:

Frequently Asked Questions (FAQs)

The biophotonics market is expected to reach a total market size of US$106.571 billion by 2030.

Biophotonics Market is valued at US$70.310 billion in 2025.

The biophotonics market is expected to grow at a CAGR of 8.67% during the forecast period.

The biophotonics market growth is driven by rising healthcare demand, advancements in optical tech, and increasing R&D investments.

The North American region is anticipated to hold a significant share of the biophotonics market.

Table Of Contents

1. EXECUTIVE SUMMARY

2. MARKET SNAPSHOT

2.1. Market Overview

2.2. Market Definition

2.3. Scope of the Study

2.4. Market Segmentation

3. BUSINESS LANDSCAPE

3.1. Market Drivers

3.2. Market Restraints

3.3. Market Opportunities

3.4. Porter’s Five Forces Analysis

3.5. Industry Value Chain Analysis

3.6. Policies and Regulations

3.7. Strategic Recommendations

4. TECHNOLOGICAL OUTLOOK

5. GLOBAL BIOPHOTONICS MARKET BY TECHNOLOGY

5.1. Introduction

5.2. Imaging Technologies

5.3. Spectroscopy Technologies

5.4. Light-Based Therapeutics

5.5. Biosensors and Bioassays

6. GLOBAL BIOPHOTONICS MARKET BY APPLICATION

6.1. Introduction

6.2. Medical Diagnostics

6.3. Therapeutics

6.4. Research and Development

6.5. Environmental Monitoring

7. GLOBAL BIOPHOTONICS MARKET BY END-USERS

7.1. Introduction

7.2. Hospitals and Clinics

7.3. Research Institutions and Laboratories

7.4. Pharmaceutical and Biotechnology Companies

7.5. Environmental Agencies

8. GLOBAL BIOPHOTONICS MARKET BY GEOGRAPHY

8.1. Introduction

8.2. North America

8.2.1. United States

8.2.2. Canada

8.2.3. Mexico

8.3. South America

8.3.1. Brazil

8.3.2. Argentina

8.3.3. Others

8.4. Europe

8.4.1. Germany

8.4.2. France

8.4.3. United Kingdom

8.4.4. Spain

8.4.5. Others

8.5. Middle East and Africa

8.5.1. Saudi Arabia

8.5.2. UAE

8.5.3. Others

8.6. Asia Pacific

8.6.1. China

8.6.2. India

8.6.3. Japan

8.6.4. South Korea

8.6.5. Indonesia

8.6.6. Thailand

8.6.7. Others

9. COMPETITIVE ENVIRONMENT AND ANALYSIS

9.1. Major Players and Strategy Analysis

9.2. Market Share Analysis

9.3. Mergers, Acquisitions, Agreements, and Collaborations

9.4. Competitive Dashboard

10. COMPANY PROFILES

10.1. Thermo Fisher Scientific Inc.

10.2. Becton, Dickinson and Company

10.3. Carl Zeiss AG

10.4. Hamamatsu Photonics K.K.

10.5. Olympus Corporation

10.6. PerkinElmer Inc.

10.7. Bruker Corporation

10.8. Danaher Corporation

10.9. Oxford Instruments Plc

10.10. Lumenis Be Ltd.

10.11. IPG Photonics Corporation

10.12. Nikon Corporation

10.13. Bio-Rad Laboratories, Inc.

11. APPENDIX

11.1. Currency

11.2. Assumptions

11.3. Base and Forecast Years Timeline

11.4. Key benefits for the stakeholders

11.5. Research Methodology

11.6. Abbreviations

LIST OF FIGURES

LIST OF TABLES

Companies Profiled

Becton, Dickinson and Company

Carl Zeiss AG

Hamamatsu Photonics K.K.

PerkinElmer Inc.

Bruker Corporation

Oxford Instruments Plc

Lumenis Be Ltd.

IPG Photonics Corporation

Nikon Corporation

Bio-Rad Laboratories, Inc.

Related Reports

| Report Name | Published Month | Download Sample |

|---|---|---|

| Smart Sensors Market Insights: Size, Share, Trends, Forecast 2030 | April 2025 | |

| Photonic Sensor Market Insights: Share, Trends, Forecast 2030 | March 2025 | |

| Optical Imaging Market Report 2030 | Industry Insights and Growth | April 2025 | |

| Silicon Photonics Market Report: Size, Share, Forecast 2030 | March 2025 | |

| ZigBee-Enabled Lighting Market Report: Size, Share, Forecast 2030 | April 2025 |