The Impact of Dietary Trends on the Glucose Syrup Market: Sugar Alternatives and Substitutes

Glucose syrups are derived from plant sugars extracted from cereals, primarily wheat and maize. They are added to foods to provide an additional factor of texture, flavor, and glossiness. They are characterized as clear and viscous liquid, sweet taste, and a calorific level of 4kcal/g. They are extracted from starch by a process using water and enzymes to break down carbohydrates after treatment with acids. They are utilized in several cookery applications such as bakery goods and confectioneries. It helps provide volume, taste, stability improvement, and extended shelf-life. It assists in the control of the viscosity of sweetness in products manufactured for quality reasons in industrial production and product testing. Further, the smoothness and texture qualities of ice creams are enhanced by glucose syrup.

Moreover, glucose syrup is utilized in beverages, jams, and sauces. They are very suitable for dosing and blending with other ingredients and mix well with other ingredients. They can give rise to energetic content along with relatively less sweetening, much lower than sucrose. Glucose syrup is among the most demanded sweeteners in the food and beverage industry and is witnessing a growth in demand due to health-conscious consumers wanting alternatives to traditional sweeteners because of the growing consciousness of health and wellness. Some challenges may confront the glucose syrup market due to the battling competitors who have come up with new sugar alternatives. However, it is observed that the manufacturers can retain their dominant place in the industry by keeping pace with the market requirements and innovations.

Rising changes in consumer lifestyles such as increased health awareness are going to positively impact the glucose syrup market whereby consumers prefer reduced-sugar or sugar-free products from other sugary alternatives because they expose individuals to health risks such as obesity, type 2 diabetes, and cardiovascular diseases. Besides, the number of adults affected by diabetes will increase hugely according to estimates by International Diabetes Federation data(IDF), with there being around 537 million adults aged 20-79 living with the disease in 2021, equating to 1 in 10 adults, projected to increase to value 643 million by 2030 and further amount to 783 million in 2045. Furthermore, over 541 million adults have impaired Glucose Tolerance (IGT) disorders as of 2021 and remain at high risk of developing type-2 diabetes. More consumers are adopting organic and natural substitutes for processed food and opt for sustainable sweetener alternatives including glucose syrup.

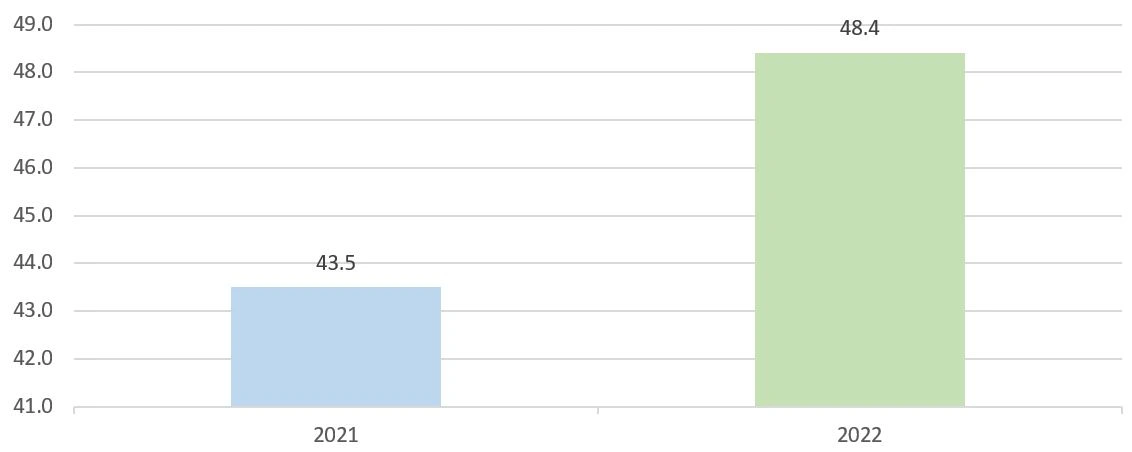

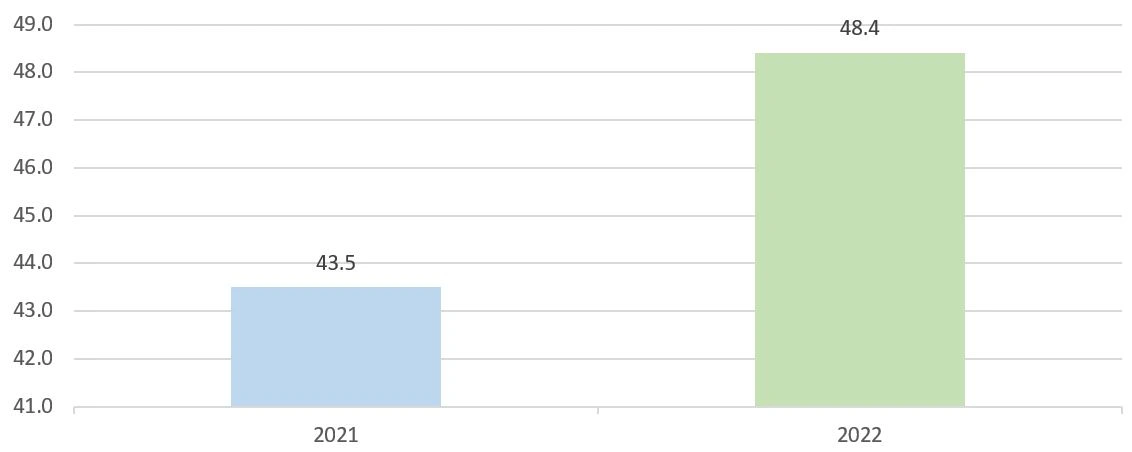

Moreover, from 2021 to 2022, the baked goods exports increased by 11.4 % to $48.4 billion from $43.5 billion in 2021, according to OEC. The top countries exporting baked goods include Germany, Canada, Italy, France, and Poland. The total values for the exports of these countries are as follows: $4.92B, $4.75B, $3.5B, $2.93B, and $2.67B respectively. Such development would be expected to favor glucose syrup, an important ingredient in a wide variety of baked products.

In addition, glucose syrup is being used in soft drinks and energy drinks to improve their sweetness and flavor to promote their demand in the market as consumers have increased their intake of such beverages. For instance, in 2023, non-alcoholic beverages were among the leading foods exported from Spain, with a phenomenal increment of 82 percent. Further, the Spanish beverage processing sector was worth $20,433 million in 2022 according to USDA data, an increase of 28.4 percent over the previous year.

Increase in Export of Baked Goods in the World, in US$ Billion, in 2021 and 2022

Source: OECD

Glucose syrup also has applications in pharmaceuticals and personal care products, thereby increasing the diversification beyond the food and beverage industry. According to the Dubai World Trade Center January 2023, the pharma market of UAE will be around US$4.7 billion by 2025 and these have about 23 manufacturing centers and nearly 2,500 medicines produced locally by 2023. In addition, as income increases, household spending on convenience foods, snacks, and ready-to-eat processed meals becomes more apparent, with glucose syrup being a major key ingredient in such products. It also drives the mindset of moving towards premium and specialty products as consumers are willing to pay better for the texture and quality of the items.

Furthermore, the International Energy Outlook showed 2023 source-wide overall disposable income figures that reflected 10,136 US dollars per capita for 2022. The number will develop to US$10,677 by 2025 to finally attain US$11,862 by 2030. In the meantime, Asia Pacific will be valued at US$11,152 per capita, while the Americas region will be predicted to be valued at US$23,240 per capita in 2030, whereas Europe and Eurasia would amount to US$21,974 per capita by 12030, thus contributing to market growth. This growing middle class in developing economies leads to increasing consumption of processed foods and opening new market opportunities for glucose syrup while also increasing the application of glucose syrup in non-food sectors like pharmaceuticals and personal care.

Sugared alternatives and substitutes are expected to make a positive impact on the glucose syrup market. Factors such as a high-lifestyle adoption of healthier living will demand for the syrup while increasing competition will most likely decrease prices for glucose syrup. Manufacturers are also investing and developing new products formulated with less sugar or more functional ingredients to meet marketing conditions. For example, Cargill and ENOUGH have a unique partnership for the European Union-funded PLENITUDE consortium project, which involves ENOUGH's production facility of 160,000 square feet in Sas van Gent, Netherlands, specifically built in 2022 and co-located alongside Cargill's facility. Cargill provides glucose syrup and utilities, and ENOUGH is involved in the EU-funded PLENITUDE consortium project. New functional applications for glucose syrup will also include areas where sweetening is of less importance than the value of functional properties.

Key Developments:

Source: OECD

Glucose syrup also has applications in pharmaceuticals and personal care products, thereby increasing the diversification beyond the food and beverage industry. According to the Dubai World Trade Center January 2023, the pharma market of UAE will be around US$4.7 billion by 2025 and these have about 23 manufacturing centers and nearly 2,500 medicines produced locally by 2023. In addition, as income increases, household spending on convenience foods, snacks, and ready-to-eat processed meals becomes more apparent, with glucose syrup being a major key ingredient in such products. It also drives the mindset of moving towards premium and specialty products as consumers are willing to pay better for the texture and quality of the items.

Furthermore, the International Energy Outlook showed 2023 source-wide overall disposable income figures that reflected 10,136 US dollars per capita for 2022. The number will develop to US$10,677 by 2025 to finally attain US$11,862 by 2030. In the meantime, Asia Pacific will be valued at US$11,152 per capita, while the Americas region will be predicted to be valued at US$23,240 per capita in 2030, whereas Europe and Eurasia would amount to US$21,974 per capita by 12030, thus contributing to market growth. This growing middle class in developing economies leads to increasing consumption of processed foods and opening new market opportunities for glucose syrup while also increasing the application of glucose syrup in non-food sectors like pharmaceuticals and personal care.

Sugared alternatives and substitutes are expected to make a positive impact on the glucose syrup market. Factors such as a high-lifestyle adoption of healthier living will demand for the syrup while increasing competition will most likely decrease prices for glucose syrup. Manufacturers are also investing and developing new products formulated with less sugar or more functional ingredients to meet marketing conditions. For example, Cargill and ENOUGH have a unique partnership for the European Union-funded PLENITUDE consortium project, which involves ENOUGH's production facility of 160,000 square feet in Sas van Gent, Netherlands, specifically built in 2022 and co-located alongside Cargill's facility. Cargill provides glucose syrup and utilities, and ENOUGH is involved in the EU-funded PLENITUDE consortium project. New functional applications for glucose syrup will also include areas where sweetening is of less importance than the value of functional properties.

Key Developments:

Find some of our related studies:

Source: OECD

Glucose syrup also has applications in pharmaceuticals and personal care products, thereby increasing the diversification beyond the food and beverage industry. According to the Dubai World Trade Center January 2023, the pharma market of UAE will be around US$4.7 billion by 2025 and these have about 23 manufacturing centers and nearly 2,500 medicines produced locally by 2023. In addition, as income increases, household spending on convenience foods, snacks, and ready-to-eat processed meals becomes more apparent, with glucose syrup being a major key ingredient in such products. It also drives the mindset of moving towards premium and specialty products as consumers are willing to pay better for the texture and quality of the items.

Furthermore, the International Energy Outlook showed 2023 source-wide overall disposable income figures that reflected 10,136 US dollars per capita for 2022. The number will develop to US$10,677 by 2025 to finally attain US$11,862 by 2030. In the meantime, Asia Pacific will be valued at US$11,152 per capita, while the Americas region will be predicted to be valued at US$23,240 per capita in 2030, whereas Europe and Eurasia would amount to US$21,974 per capita by 12030, thus contributing to market growth. This growing middle class in developing economies leads to increasing consumption of processed foods and opening new market opportunities for glucose syrup while also increasing the application of glucose syrup in non-food sectors like pharmaceuticals and personal care.

Sugared alternatives and substitutes are expected to make a positive impact on the glucose syrup market. Factors such as a high-lifestyle adoption of healthier living will demand for the syrup while increasing competition will most likely decrease prices for glucose syrup. Manufacturers are also investing and developing new products formulated with less sugar or more functional ingredients to meet marketing conditions. For example, Cargill and ENOUGH have a unique partnership for the European Union-funded PLENITUDE consortium project, which involves ENOUGH's production facility of 160,000 square feet in Sas van Gent, Netherlands, specifically built in 2022 and co-located alongside Cargill's facility. Cargill provides glucose syrup and utilities, and ENOUGH is involved in the EU-funded PLENITUDE consortium project. New functional applications for glucose syrup will also include areas where sweetening is of less importance than the value of functional properties.

Key Developments:

Source: OECD

Glucose syrup also has applications in pharmaceuticals and personal care products, thereby increasing the diversification beyond the food and beverage industry. According to the Dubai World Trade Center January 2023, the pharma market of UAE will be around US$4.7 billion by 2025 and these have about 23 manufacturing centers and nearly 2,500 medicines produced locally by 2023. In addition, as income increases, household spending on convenience foods, snacks, and ready-to-eat processed meals becomes more apparent, with glucose syrup being a major key ingredient in such products. It also drives the mindset of moving towards premium and specialty products as consumers are willing to pay better for the texture and quality of the items.

Furthermore, the International Energy Outlook showed 2023 source-wide overall disposable income figures that reflected 10,136 US dollars per capita for 2022. The number will develop to US$10,677 by 2025 to finally attain US$11,862 by 2030. In the meantime, Asia Pacific will be valued at US$11,152 per capita, while the Americas region will be predicted to be valued at US$23,240 per capita in 2030, whereas Europe and Eurasia would amount to US$21,974 per capita by 12030, thus contributing to market growth. This growing middle class in developing economies leads to increasing consumption of processed foods and opening new market opportunities for glucose syrup while also increasing the application of glucose syrup in non-food sectors like pharmaceuticals and personal care.

Sugared alternatives and substitutes are expected to make a positive impact on the glucose syrup market. Factors such as a high-lifestyle adoption of healthier living will demand for the syrup while increasing competition will most likely decrease prices for glucose syrup. Manufacturers are also investing and developing new products formulated with less sugar or more functional ingredients to meet marketing conditions. For example, Cargill and ENOUGH have a unique partnership for the European Union-funded PLENITUDE consortium project, which involves ENOUGH's production facility of 160,000 square feet in Sas van Gent, Netherlands, specifically built in 2022 and co-located alongside Cargill's facility. Cargill provides glucose syrup and utilities, and ENOUGH is involved in the EU-funded PLENITUDE consortium project. New functional applications for glucose syrup will also include areas where sweetening is of less importance than the value of functional properties.

Key Developments:

| Year | Development |

| February 2024 | Cargill and the food technology enterprise known as ENOUGH collaborated to lend support to consumers in innovative, sustainable protein options. Cargill is making an investment in the growth funding campaign of ENOUGH and has entered into a commercial agreement for the use and marketing of the fermented protein ABUNDA mycoprotein. This new protein is derived from a zero-waste fermentation process and is made using Cargill's glucose syrup as a main feedstock. The partnership is focused on developing healthy and sustainable alternative meat and dairy solutions. |

| January 2024 | Holland & Barrett introduced new food lines under Life Kitchen. It is intended for people who are having changes in taste or smell as a result of illnesses that last for a short or long time. One such is Citrus Sensation Spritz, a combination of vinegar, glucose syrup, yuzu juice, rice koji, and natural ginger flavorings, perfect for fish or grilled vegetables. |

Get in Touch

Interested in this topic? Contact our analysts for more details.

Latest Blogs

Solar Control Window Films Market expected to reach USD 1,224.951 million by 2030

RecentlyTop Companies Leading the Silicon-Based Capacitor Revolution

Recently

The Role of Chemical Blowing Agents in Sustainable Foaming Solutions

Recently

Top 10 Emerging Beverages Set to Dominate the Market in the Coming Years

Recently