Report Overview

5G Base Station Equipment Highlights

5G Base Station Equipment Market Size:

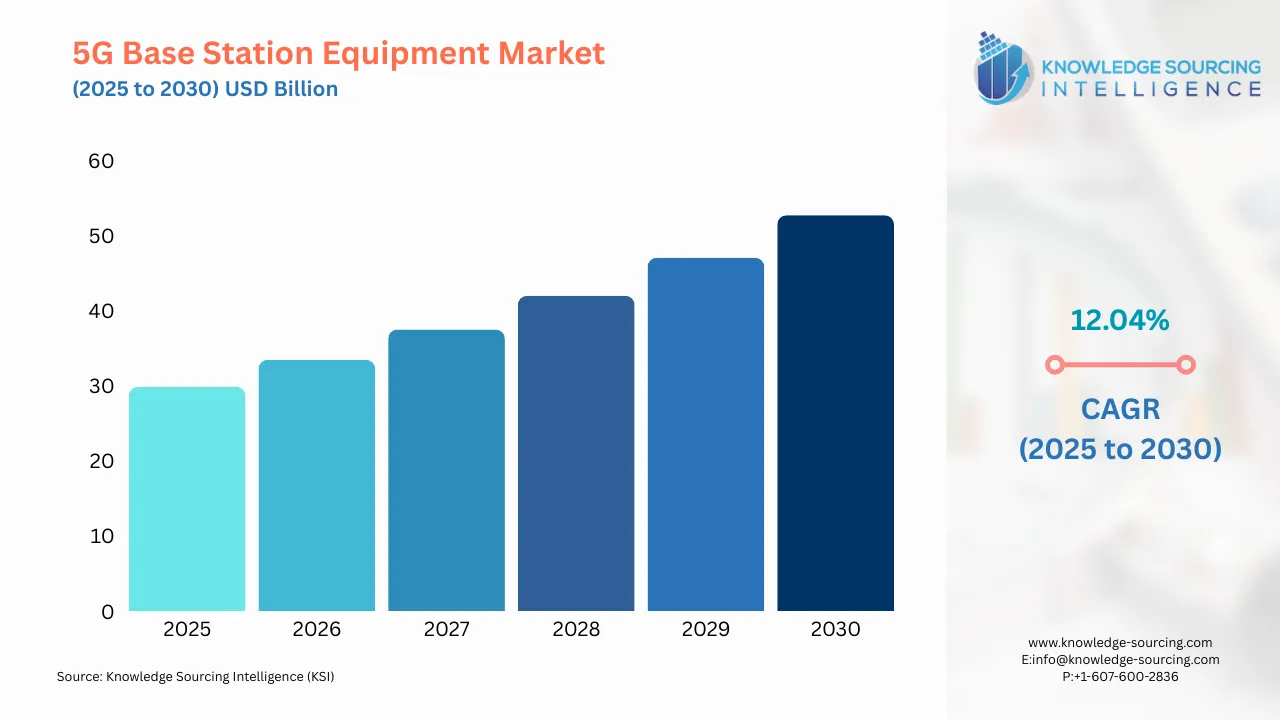

The 5G base station equipment market is estimated to reach US$52.733 billion by 2030 from US$29.865 billion in 2025, growing at a CAGR of 12.04%.

5G Base Station Equipment Market Highlights:

- Expanding 5G network coverage is driving demand for advanced base station equipment.

- Enhancing urban connectivity is boosting 5G base station deployments in cities.

- Asia-Pacific is leading the 5G base station market with significant investments.

- Innovating MIMO technologies is improving 5G network bandwidth and reliability.

5G base station equipment or 5G base station is among the core equipment in the 5G network technology. This equipment helps in providing wireless coverage and enhances wireless signal transmission. It offers key benefits in the global telecommunication market, which include enhancing the bandwidth of the 5G network and ensuring lower latency. The 5G base station equipment also helps in increasing the coverage and reliability of the 5G network. The increasing global demand for smartphones is expected to boost the global 5G base station equipment market growth during the estimated timeline.

The International Telecommunication Union, in its global report, stated that in 2023, global mobile phone ownership was recorded at 78%. The agency further stated that in Europe and the Americas region, the total mobile ownership was recorded at 93% and 88%, respectively.

5G Base Station Equipment Market Growth Drivers:

- Rising demand for internet utilization across the globe

In the global 5G base station equipment market, under the deployment segment, the urban category is expected to grow significantly, mainly with the increasing mobile coverage of the 5G network in urban areas worldwide. The rising internet utilization in these regions is among the key factors propelling the segment's growth during the forecasted timeline. With this rising utilization of the internet, the demand for 5G network technology is also expected to grow significantly.

The International Telecommunication Union, in its global report, stated that the number of individuals using the internet in the urban region increased significantly in 2023. The agency stated that in the urban region, the internet population was 81%, whereas about 50% of the rural population uses the internet. The agency further stated that in the European region, the population using the internet in 2023 was recorded at 92%. In contrast, it was recorded at 90% and 80% in the Americas and the Asia Pacific regions, respectively. The increasing urban population is also expected to boost the demand for the deployment segment of the 5G base station equipment in these regions. The rising urban population worldwide increases the demand for 5G network coverage.

The World Bank, in its global report, stated that the total urban population increased significantly over the past few years. It further reported that the global urban population was recorded at 4.46 billion in 2021, which increased to 4.54 billion in 2022 and 4.61 billion in 2023.

- Increasing global 5G Internet coverage

The increasing global 5G network coverage is among the key factors propelling the global 5G base station equipment market growth during the forecasted timeline. The 5G base station equipment helps in enhancing the bandwidth and coverage of the 5G network. It helps in improving spectrum use. The global coverage of the 5G mobile network in 2023 was 38%, while the global mobile coverage of 5G in Europe and the Americas was recorded at 68% and 59%, respectively, in 2023. The 5G mobile network coverage in the Asia Pacific region was 42% in 2023. The International Telecommunications Union further stated that the total global 5G mobile coverage in 2021 was 18%, which increased to 31% in 2022 and 38% in 2023.

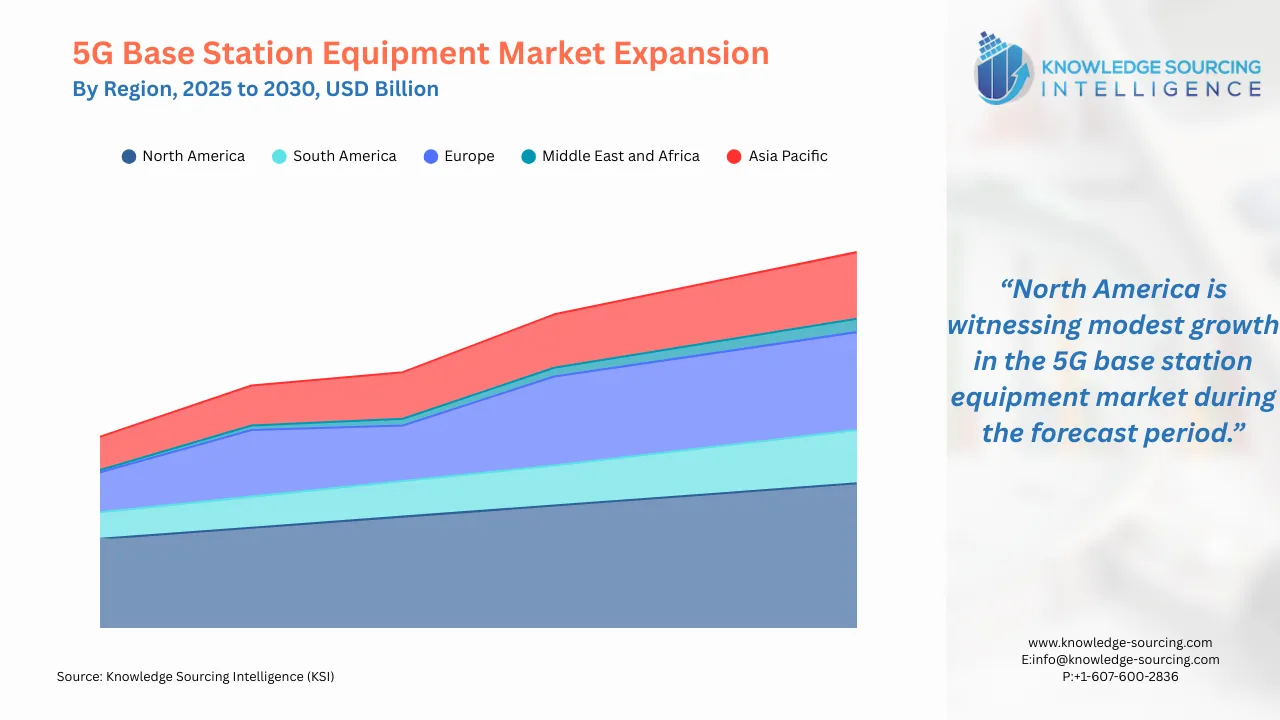

5G Base Station Equipment Market Geographical Outlook:

- The Asia Pacific region is expected to witness significant market growth

The Asia Pacific region is estimated to attain a greater share in the global 5G base station equipment market during the forecasted timeline. The demand for the 5G base station equipment market in India is expected to witness significant growth during the forecasted timeline, mainly due to its rising IT and network technology development. The Ministry of Communication of the Indian government, in its press release, stated that in the nation, the adoption of 5G technology witnessed significant growth. The ministry stated that the nation's total coverage of the 5G network is recorded at 90%. The introduction of key policies and investment opportunities by the Government of India is among the major factors boosting the demand for 5G base station equipment. The government introduced multiple key policies and investment opportunities, increasing the nation's overall usage of 5G internet.

5G Base Station Equipment Market Key Developments:

- In November 2024, the Ministry of Communication of the government unveiled its 5G plans to boost the deployment of usages of 5G network technology in the nation by 2030. In its press release, the ministry stated that the 5G technology is expected to contribute about INR 36.4 trillion or about US$455 billion to the nation's economy between 2023 and 2024. The Ministry of Communication further introduced key initiatives to boost its 5G network coverage, which includes various key initiatives like indigenous telecom stack, Digital Communications Innovation Square (DCIS) & Telecom Technology Development Fund (TTDF), Spectrum Auctions and Policy Reforms, and 5G Test Beds, among others. The rising utilization of mobile devices for the internet is also among the key factors boosting the demand for India's 5G base station equipment market. The utilization of mobile devices for accessing the Internet in the nation was recorded at 82%, as stated by the Internet and Mobile Association of India.

- In October 2024, in partnership with Cisco, NEC, a global leader in the IT and network solution market, launched a private 5G solution offering enhanced connectivity solutions for enterprises.

List of Top 5G Base Station Equipment Companies:

- NEC

- Fujitsu

- Huawei Technologies Co., Ltd.

- Samsung

- ZTE

5G Base Station Equipment Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| 5G Base Station Equipment Market Size in 2025 | US$29.865 billion |

| 5G Base Station Equipment Market Size in 2030 | US$52.733 billion |

| Growth Rate | CAGR of 12.04% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in 5G Base Station Equipment Market |

|

| Customization Scope | Free report customization with purchase |

The 5G base station equipment market is analyzed into the following segments:

- By Deployment

- Urban

- Rural

- By Architecture

- AAU

- BBU

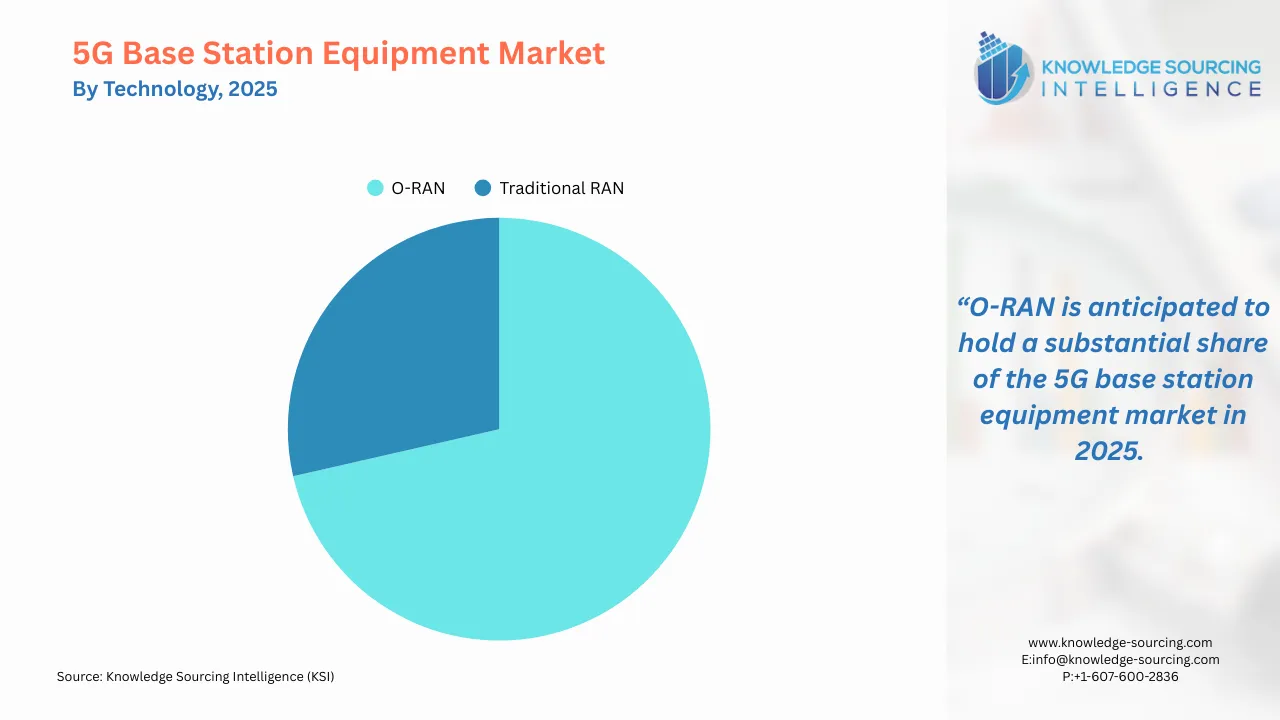

- By Technology

- O-RAN

- Traditional RAN

- By Configuration

- Standalone

- Non-Standalone

- By Frequency Band

- Sub-6-Ghz

- mmWave

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific Region

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Taiwan

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

- 5G Base Station Equipment Market Size:

- 5G Base Station Equipment Market Highlights:

- 5G Base Station Equipment Market Growth Drivers:

- 5G Base Station Equipment Market Geographical Outlook:

- 5G Base Station Equipment Market Key Developments:

- List of Top 5G Base Station Equipment Companies:

- 5G Base Station Equipment Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: