Report Overview

Artificial Intelligence (AI) in Highlights

Artificial Intelligence (AI) in Precision Farming Market Size:

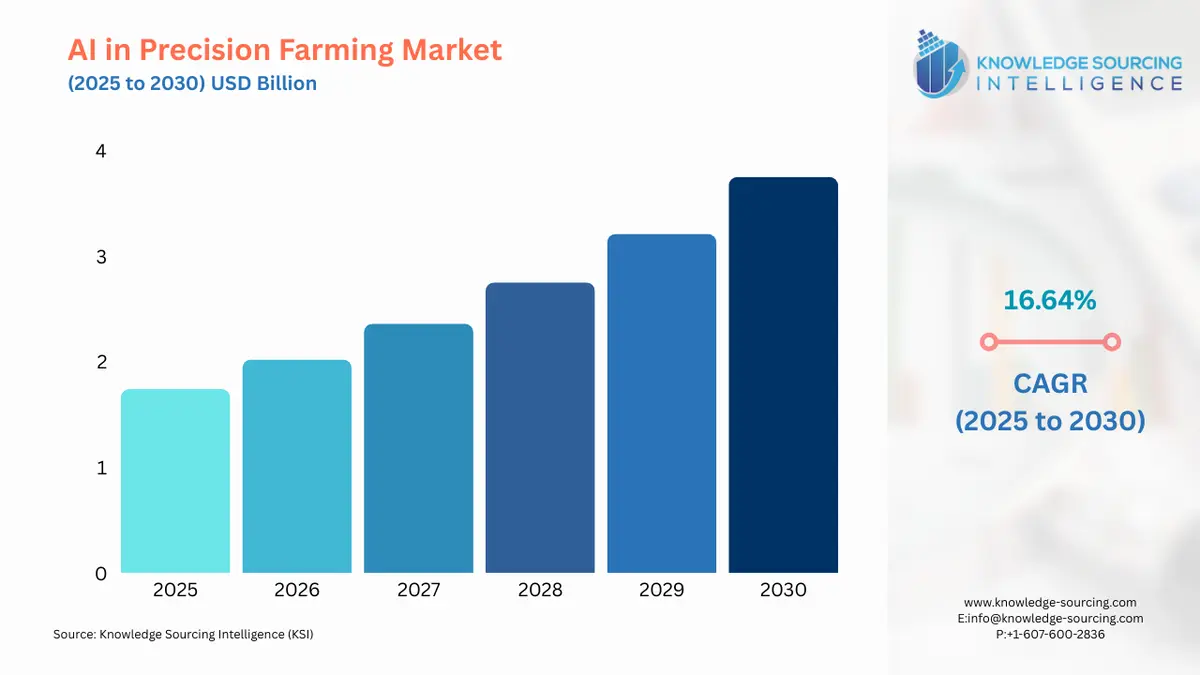

The Artificial Intelligence (AI) in Precision Farming Market is expected to grow at a CAGR of 16.64%, reaching a market size of USD 3.748 billion in 2030 from USD 1.736 billion in 2025.

Artificial Intelligence (AI) in Precision Farming Market Introduction:

The agritech market is undergoing a transformative shift, with artificial intelligence (AI) in agriculture emerging as a cornerstone of modern farming practices. Smart farming solutions, underpinned by digital agriculture, are redefining how farmers manage crops, livestock, and resources. By integrating precision agriculture technology, AI crop monitoring, yield optimization AI, predictive farming, agricultural drones, robotics in farming, computer vision agriculture, IoT in agriculture, data-driven farming, autonomous tractors, soil analysis AI, and irrigation automation, the agricultural sector is addressing global challenges such as food security, climate change, and resource scarcity.

Agriculture has evolved through multiple revolutions, from the domestication of plants and animals to the mechanization of the 19th century and the Green Revolution’s introduction of high-yield crops and chemical inputs. Today, the agritech market is in the midst of the Fourth Agricultural Revolution, driven by data-driven farming and precision agriculture technology. AI in agriculture leverages advanced algorithms, machine learning, and real-time data analytics to optimize every facet of farming, from planting to harvest. Unlike earlier revolutions that focused on physical or chemical advancements, this era enhances cognitive decision-making, enabling farmers to make precise, informed choices that maximize productivity while minimizing environmental impact.

The integration of IoT in agriculture has been instrumental, with interconnected sensors collecting real-time data on soil conditions, weather patterns, and crop health. These data streams, processed by agriculture analytics, empower farmers to monitor fields with unprecedented granularity. For instance, AI crop monitoring systems use computer vision agriculture to analyze images from agricultural drones or satellites, detecting plant stress, nutrient deficiencies, or pest infestations days before they are visible to the human eye. Similarly, soil analysis AI interprets sensor data to recommend precise fertilizer applications, while irrigation automation ensures water is delivered only where needed, reducing waste. Companies like John Deere have pioneered autonomous tractors that use robotics in farming to plant, till, and harvest with minimal human intervention, as demonstrated by their 2024 launch of the fully autonomous 8R tractor.

The AI in agriculture market spans a wide range of applications, each addressing specific challenges in smart farming solutions. Precision agriculture technology is at the forefront, enabling farmers to treat individual plants or small field zones with tailored inputs. Computer vision agriculture, for example, powers systems like Blue River Technology’s See & Spray, which uses AI to identify and target weeds, reducing herbicide use significantly. Agricultural drones equipped with multispectral cameras provide aerial imagery for AI crop monitoring, identifying issues like drought stress or fungal infections early. Bayer’s FieldView platform integrates IoT in agriculture and agricultural analytics to offer predictive insights on crop performance and pest risks.

Yield optimization AI is another critical application, using machine learning to forecast crop yields based on historical data, weather patterns, and real-time field conditions. These models help farmers plan harvests and optimize market timing. Predictive farming extends this capability to anticipate disease outbreaks or weather disruptions, as seen in IBM’s Watson Decision Platform, which provides hyper-local weather forecasts for farmers. Robotics in farming, including autonomous tractors and harvesting robots, addresses labor shortages by automating repetitive tasks, while irrigation automation systems, such as those developed by CropX, use soil analysis AI to optimize water use based on real-time soil moisture data.

Data-driven farming also enhances livestock management. For example, CattleEye’s AI-powered drones and cameras monitor cattle behavior, detecting health issues like lameness or birthing events with high accuracy. These applications collectively contribute to a more resilient and sustainable agricultural ecosystem, aligning with global demands for increased food production and environmental stewardship.

Several factors are propelling the growth of the AI in agriculture market. First, the rising global population, projected to reach 9.8 billion by 2050, necessitates a 63% increase in food production, pushing farmers to adopt smart farming solutions. Precision agriculture technology addresses this by optimizing yields on existing farmland. Second, climate change, with its unpredictable weather and increased pest pressures, drives demand for predictive farming and AI crop monitoring to mitigate risks. Third, labor shortages, particularly in regions with aging farm populations, fuel the adoption of robotics in farming and autonomous tractors. Finally, government support, such as the EU’s Horizon Europe initiative and India’s Digital Agriculture Mission, provides funding and subsidies to promote digital agriculture.

Despite its promise, the AI in agriculture market faces significant challenges. High upfront costs for IoT in agriculture infrastructure, agricultural drones, and agriculture analytics platforms remain a barrier, particularly for smallholder farmers. Limited internet connectivity in rural areas hinders real-time data transmission, critical for data-driven farming. Data privacy and ownership concerns also pose ethical challenges, as farmers worry about control over their field data. Finally, the complexity of integrating diverse data sources into unified precision agriculture technology systems requires standardized protocols and technical expertise, which may be lacking in developing regions.

The AI in agriculture market is reshaping the agritech market through smart farming solutions that leverage precision agriculture technology, AI crop monitoring, yield optimization AI, and data-driven farming. Innovations like agricultural drones, robotics in farming, computer vision agriculture, IoT in agriculture, autonomous tractors, soil analysis AI, and irrigation automation are addressing critical challenges in food production and sustainability. While market drivers like population growth, climate change, and government support fuel adoption, restraints such as high costs and connectivity issues must be addressed to ensure equitable access. As digital agriculture continues to evolve, industry experts must stay informed about these technologies to drive innovation and resilience in global agriculture.

Artificial Intelligence (AI) in Precision Farming Market Overview

Precision farming is a farming technique that uses technologies including IoT, remote sensing, Geographic Information Systems, and artificial intelligence to monitor and manage variability within the agricultural field. It leverages data insights from technologies such as soil health analysis, water usage optimization for irrigation, pest and disease control, and crop management, among others. It refers to a method of farming that is about more efficient utilization of agricultural resources, that is data-driven and environmentally sustainable.

AI in the precision farming market is transforming the AI in agriculture industry by leveraging precision farming AI to optimize crop production and resource use. Smart agriculture AI and agritech AI integrate data analytics, IoT, and machine learning for real-time insights, enhancing AI farm management. Digital farming AI drives efficiency in planting, irrigation, and harvesting, supporting sustainable agriculture AI practices that minimize environmental impact. By addressing food security AI challenges, this market enables higher yields and resilience against climate variability. Innovations in AI-driven solutions are revolutionizing agriculture, making it a cornerstone for scalable, sustainable global food systems.

Artificial Intelligence (AI) in Precision Farming Market Trends:

Surging AI Use in Agriculture to Boost Food Production: With global population growth driving higher food demand, the agricultural sector is increasingly turning to artificial intelligence (AI) to enhance crop yields. AI technologies analyze extensive historical data, weather patterns, soil conditions, and irrigation needs to optimize farming practices and ensure greater productivity. For example, Blue River Technology's smart sprayer employs a vision-based system and AI to identify weeds and plants, applying herbicide only where needed. The company claims this reduces herbicide use by over 90% compared to conventional sprayers, demonstrating AI's value in precision farming. By minimizing waste and improving efficiency, the rising adoption of AI is fueling growth in the AI precision farming market.

Focus on sustainability and efficiency: Climate-smart agriculture leverages AI to adapt to environmental changes, while resource efficiency farming optimizes the use of water and soil. Reduced chemical use in agriculture, supported by sustainable farming practices, minimizes environmental impact. Carbon footprint reduction in agriculture is prioritized through AI-driven insights, enhancing farm productivity with AI tools. AI as a Service in agriculture offers scalable, cloud-based solutions for farmers. Generative AI in farming designs optimized crop plans and predicts yields, driving innovation and scalability in sustainable, high-yield agricultural systems.

Technological Advancements Propel Market Growth: The market is being driven by rapid developments in AI, such as advanced predictive analytics, which enhance its application in precision farming. Beyond AI, innovations in complementary technologies like the Internet of Things (IoT) and remote sensors are amplifying AI's impact by enabling seamless integration, further accelerating its use in precision agriculture.

North America Set to Lead the Market: Geographically, North America is expected to dominate the AI precision farming market, led by the United States and Canada. The region's large-scale farms and widespread technology adoption among farmers are key growth drivers. Significant investments in AI research and development are also positioning North America as a frontrunner in embracing cutting-edge farming technologies.

Asia-Pacific Growth on the Horizon: The Asia-Pacific region is projected to experience market expansion during the forecast period, spurred by growing AI adoption in precision farming across countries like China, Japan, South Korea, and India. This growth is driven by rising populations, expanding economies, and increased government investments aimed at modernizing agriculture.

Artificial Intelligence (AI) in Precision Farming Market Drivers

Rising Global Food Demand: The AI in the precision farming market is driven by the urgent need to increase food production to feed a growing global population, projected to reach 9.8 billion by 2050. This demand pressures farmers to maximize yields on limited arable land, making precision agriculture technology essential. AI crop monitoring and yield optimization AI analyzes vast datasets from IoT in agriculture, such as weather patterns and soil conditions, to optimize planting and resource use. Agricultural drones and computer vision agriculture detect crop stress early, enabling targeted interventions that boost productivity. Governments, such as India, through its Digital Agriculture Mission, are investing in smart farming solutions to enhance food security, further accelerating AI adoption.

Climate Change Adaptation: Climate change, with its erratic weather, soil degradation, and rising pest pressures, is a significant driver for AI in the agriculture market. Predictive farming tools, powered by agriculture analytics, forecast weather events and pest outbreaks, allowing farmers to adapt strategies proactively. Soil analysis AI and irrigation automation optimize water and nutrient use, mitigating drought and flood impacts. For instance, AI crop monitoring systems, like those from Taranis, use high-resolution imagery to identify climate-induced crop stress, enabling timely action. As climate variability intensifies, data-driven farming becomes critical for resilient agriculture, supported by initiatives like the EU’s Horizon Europe program.

Labor Shortages: Labor shortages, particularly in regions with aging farming populations, drive the adoption of robotics in farming and autonomous tractors. AI-powered robotics automate tasks like planting, weeding, and harvesting, reducing reliance on manual labor. Companies like Deere & Company have introduced fully autonomous tractors, enhancing operational efficiency on large farms. Agricultural drones and computer vision in agriculture further streamline tasks like crop scouting, minimizing labor needs. This trend is critical in developed markets like North America, where labor costs are high, and in emerging markets, where rural workforce migration is increasing, making smart farming solutions indispensable.

Artificial Intelligence (AI) in Precision Farming Market Restraints

High Initial Investment Costs: The AI in the precision farming market faces significant barriers due to high upfront costs for hardware, software, and IoT in agricultural infrastructure. Agricultural drones, sensors, and autonomous tractors require substantial capital, often unaffordable for smallholder farmers, who manage 80% of global farms. Soil analysis AI systems and irrigation automation setups demand advanced connectivity, further increasing expenses in rural areas with limited infrastructure. For example, deploying computer vision agriculture solutions like Blue River Technology’s See & Spray involves costly hardware and software integration. Without subsidies or financing, these costs deter adoption, particularly in developing regions, slowing market growth.

Data Privacy and Cybersecurity Concerns: Data privacy and cybersecurity risks restrain the AI in the precision farming market, as data-driven farming relies on sensitive information from IoT in agriculture and agricultural analytics. Farmers fear misuse of data on crop yields, soil conditions, and farming practices by third parties. AI crop monitoring systems, like those using agricultural drones, transmit data to cloud platforms, raising vulnerability to cyberattacks. A recent USDA survey highlighted that 60% of farmers are concerned about data security, impacting adoption rates. Without robust data governance and cybersecurity measures, trust in precision agriculture technology remains limited, hindering market expansion, especially in regions with weak regulatory frameworks.

Artificial Intelligence (AI) in Precision Farming Market Segment Analysis

The use of Machine Learning technology is boosting the market growth: Machine learning dominates the AI in the precision farming market due to its ability to process vast datasets from IoT in agriculture and deliver actionable insights. It powers predictive farming by analyzing historical and real-time data on weather, soil, and crop health to forecast yields and optimize inputs. For example, IBM’s Watson AgriSense uses machine learning to predict soil nutrient needs, reducing fertilizer use while maintaining yields. AI crop monitoring systems leverage machine learning to identify patterns in computer vision agriculture data, detecting pest or disease risks early. Its adaptability across diverse crops and climates makes it indispensable, driving adoption in data-driven farming. As cloud-based platforms like Microsoft Azure FarmSync integrate machine learning, accessibility increases, enabling even small farms to benefit from advanced agriculture analytics and yield optimization AI, cementing its market leadership.

The software segment is expected to gain a large market share: The software segment leads the AI in the precision farming market due to its role in integrating and analyzing data from IoT in agriculture, agricultural drones, and sensors. Platforms like Bayer’s FieldView provide user-friendly dashboards for AI crop monitoring, soil health monitoring, and irrigation optimization, enabling farmers to make real-time decisions. Software solutions are scalable, cloud-based, and require minimal hardware investment, making them accessible to farms of all sizes. They support predictive analytics for weather forecasting and pest detection, enhancing efficiency. For instance, CropX’s software uses soil analysis AI to optimize irrigation, reducing water waste. The flexibility to integrate with existing farm equipment and robotics in farming further drives demand, positioning software as a cornerstone of smart farming solutions.

By application, the Precision Farming segment is leading the market growth: The precision farming application dominates the AI in precision farming market by enabling site-specific management of crops, resources, and inputs. It leverages AI crop monitoring, soil health monitoring, and disease and pest detection to optimize yields and reduce waste. Technologies like agricultural drones and computer vision agriculture allow farmers to monitor fields with high accuracy, applying fertilizers or pesticides only where needed. For example, Taranis’s AI platform uses high-resolution imagery for precision farming, identifying crop stress early to prevent yield loss. Irrigation optimization and climate and weather forecast tools further enhance efficiency, addressing climate challenges. Supported by government initiatives like India’s Digital Agriculture Mission, precision farming drives sustainable practices, making it the largest application segment in data-driven farming.

Artificial Intelligence (AI) in Precision Farming Market Key Developments

In August 2025, CipherSense AI, an AI and data company with a focus on African markets, launched its pioneering platform, CropSense. This platform is designed to provide African farmers and agribusinesses with data-backed recommendations to improve agricultural yields and reduce post-harvest losses. CropSense uses a precision agriculture toolkit that combines high-resolution satellite imagery with proprietary AI models. It can identify subtle changes in crop health, soil moisture, and growth patterns, often before they are visible to the naked eye. This allows for immediate interventions with timely irrigation, fertilization, and crop protection measures. The platform also offers real-time crop monitoring, early pest and disease alerts, and a precise yield prediction model, making advanced agri-intelligence more accessible to smallholder farmers and addressing some of the continent's most persistent agricultural challenges.

In June 2025, Deere & Company launched an advanced AI-powered precision farming platform integrating IoT in agriculture and satellite imagery. This platform provides real-time AI crop monitoring, enabling farmers to track crop health, detect nutrient deficiencies, and optimize resource use. By combining machine learning with agricultural drones it offers predictive insights for yield optimization AI, reducing fertilizer and water waste. The system’s automated field management features, such as variable-rate seeding, enhance efficiency on large farms. Compatible with autonomous tractors, it supports seamless integration with existing equipment, driving adoption in North America and beyond.

In March 2024, Bayer, a leading life sciences company, launched a pilot of an expert generative AI platform in partnership with Microsoft. This platform leverages Bayer's extensive agronomic data and Microsoft's AI capabilities to provide farmers and agronomists with rapid, precise answers to complex questions related to crop management and product use. Farmers can ask natural language questions and receive expert, data-backed recommendations in seconds. The goal of the platform is to improve decision-making on farms, leading to increased productivity and more efficient resource use. This development highlights a trend towards creating specialized, user-friendly AI tools that can synthesize vast amounts of agricultural data into actionable, easy-to-understand insights.

List of Top Artificial Intelligence (AI) in Precision Farming Companies:

Deere & Company

CNH Industrial N.V.

Trimble Inc.

AGCO Corporation

IBM Corporation

Artificial Intelligence (AI) in Precision Farming Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1.736 billion |

| Total Market Size in 2031 | USD 3.748 billion |

| Growth Rate | 16.64% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Offering, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Artificial Intelligence (AI) in the Precision Farming Market Segmentation:

By Technology

Machine Learning

Computer Vision

Predictive Analytics

AI-powered Robotics

Others

By Offering

Hardware

Software

Services

By Application

Crop Health Monitoring

Soil Health Monitoring

Disease and Pest Detection

Irrigation optimization

Climate and Weather Forecast

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

South Korea

Australia

India

Indonesia

Thailand

Others