Report Overview

Antimony Market - Strategic Highlights

Antimony Market Size:

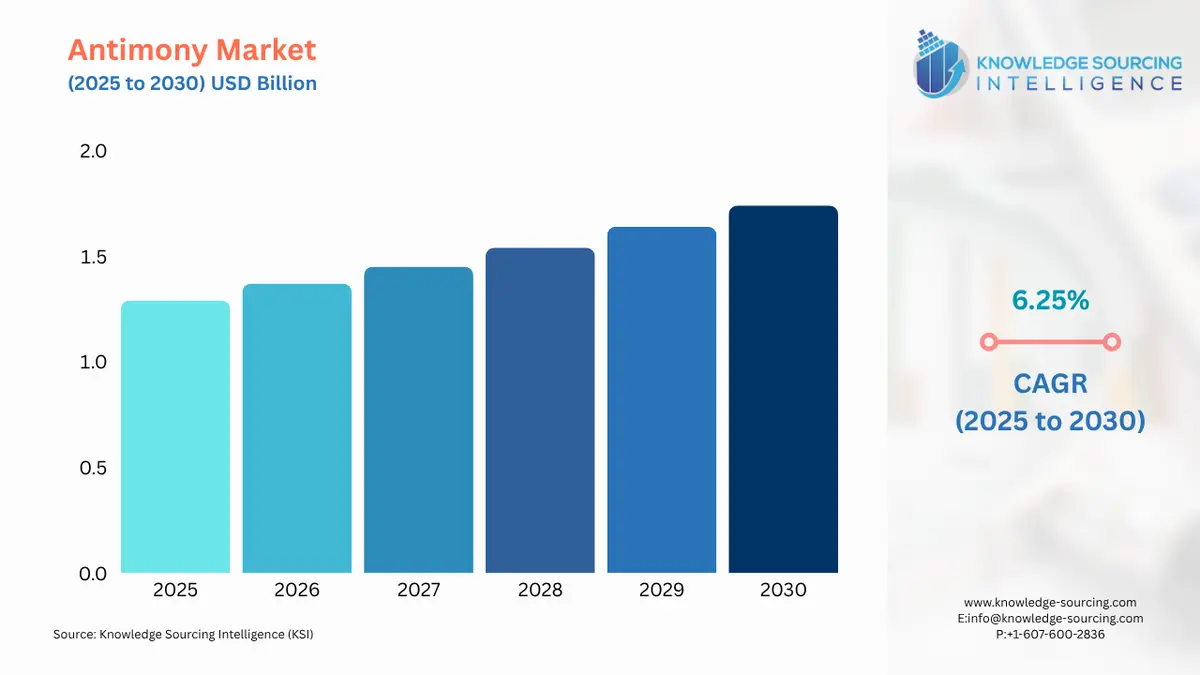

The Antimony Market is expected to grow at a CAGR of 6.25%, reaching USD 1.743 billion in 2030 from USD 1.287 billion in 2025.

The antimony market is on an upsurge owing to a spike in global demand for antimony-based products on a large scale in key industries such as construction, automotive, aerospace, electronics, and energy storage.

Antimony Market Overview & Scope:

The Antimony Market is segmented by:

- Type: Antimony is majorly classified into five types, the most prevalent being Antimony Trioxide(ATO), which takes up the largest share of the demand because it is used as a flame-retardant synergist in plastics, textiles, and electronic components. Another important group is the Antimony Alloys that are commonly used in lead-acid batteries, ammunition, bearings, and solders, which give lead and tin greater strength and durability. Other more specific uses of Antimony Metal include semiconductors, infrared use, and niche alloys. Antimony Pentoxide, on the other hand, is a catalyst used in PET plastics, glass, and rubber compounding applications, where its demand has steadily increased in specialty chemicals sectors. Several additional forms are in ceramics, glass, friction materials, and pyrotechnics, such as sodium antimonate and antimony sulfides, but their proportion is still lower than ATO. Moreover, ATO is anticipated to dominate due to the regulatory fire safety demands, as well as its necessity in the flame-retardant applications that cannot be neglected.

- Application: Flame retardants are the most competitive in terms of usage, as they are the largest part of the entire world antimony production, since it is a critical material in the construction materials, electronics, textile, and transportation sectors, where fire safety regulations are highly observed. Another major use is the lead-acid batteries, where antimony alloys give the required mechanical strength and longevity, which is why it is still needed in the automotive and industrial industries, even as lithium-ion batteries have taken over. A smaller, but significant segment consists of chemicals and catalysts, with antimony pentoxide in PET resins in packaging, glass, and rubber compounding. There are other applications like pigments, explosives, and friction materials in brake pads and clutches, which also lead to overall consumption in the market. It is expected to be dominated by the flame retardant segment, which is mostly due to increased safety standards globally, and also by the development of urban infrastructure.

- End-Use Industry: Electrical and electronics is the major consumer in end-use sectors with an increasing need for antimony-based flame-retardant plastics in circuit boards, housings, cables, and insulation, in response to growing consumer electronics and electric vehicle demand. The automotive industry has been next in line, consuming antimony in lead-acid batteries, brake pads, flame-retardant interiors, and continues to do so with the EVs. Another important end-use is construction, where very strict fire safety standards have increased the demand for antimony-based flame-retardants in insulation, flooring, and coating. Antimony alloy is used in defense and aerospace in ammunition, explosives, and special semiconductors to generate night-vision and infrared products. An improved antimony-based battery technology is making headway in the energy storage industry, which is targeted at grid-scale storage of renewable energy. Other industries, such as textiles, ceramics, rubber, and glass, also contribute, albeit on a smaller scale. Among all, electrical and electronics are anticipated to dominate, supported by rising global demand for safe, durable, and fire-resistant materials.

- Region: The antimony market is composed of North America, South America, Europe, the Middle East & Africa, and the Asia Pacific. Asia Pacific is the leading producer and consumer, and China is the leader in terms of global supply chains. Europe and North America are the more advanced markets with high regulatory norms, but South America and MEA are new markets where industrial demand is rising and there is a lack of domestic industrial capacity.

Top Trends Shaping the Antimony Market:

- Dominance of Antimony Trioxide

Antimony Trioxide (ATO) is a highly concentrated component in the global antimony market, and it is the primary source of consumption because of its critical use in plastics, textiles, and electronic parts as a flame-retardant synergist. It relies on one derivative, so the entire market structure is quite vulnerable to changes in fire safety laws or technological advances that may substitute ATO for flammable use. - Heavy Dependence on Flame Retardant Applications

The flame-retardant uses of antimony in the world, particularly in construction, motor, and consumer electronics, meet over half of the world's antimony demand. Such over-dependence has produced an application-level concentration where the trend in fire safety standards determined in large part the performance of the whole market. The presence of any meaningful transition to non-halogenated or other flame-retardant material would upset this segment and expose the market. - Rising Demand from Energy Storage and Advanced Batteries

Even though still in its early stages, the production of antimony-based high-technology batteries, including liquid metal and sodium-antimony batteries, is starting to open up the demand beyond conventional use. With the upsurge in energy storage technologies, it is likely that these technologies would lead to a decrease in concentration in flame retardants and lead-acid batteries, and the expansion of the end-use industries overall, redesigning the overall dependency structure of the market.

Antimony Market Growth Drivers vs. Challenges:

Drivers:

- Strong Demand for Flame Retardants: The high demand for flame-retardant materials in the world is one of the main factors that contribute to the concentration of the antimony market. Antimony trioxide (ATO) is a critical synergist in the halogenated flame retardants, which are common in plastics, textiles, construction materials, and electronics. As more stringent fire safety regulations come into effect in nearly every part of the world, industries are being required to move to the use of flame-retardant solutions that are in compliance with the new rules. This has created a heavy reliance on ATO, making flame retardants the single largest application segment in the market. The concentration is therefore reinforced by regulation-led demand, which ensures that a substantial portion of antimony consumption remains tied to this end-use, giving it dominance in the overall market structure.

- Expanding Use in Lead-Acid Batteries: Another significant use of antimony alloys is in lead-acid batteries, especially in motor vehicle and industrial energy storage systems. Even though the lithium-ion technologies have been making inroads in developed economies, lead-acid batteries remain dominant in the emerging economies because they are cheaper, reliable, and can be recycled. The lead plates are hardened with the help of antimony, and the battery life and service under harsh conditions are prolonged. The automotive sector, including conventional cars and heavy machinery, depends on these batteries to start and as backup power, keeping the need for antimony alloys. This segment also focuses on market utilization, in that it occupies a huge and consistent market share of the total demand, and that no easy alternative is available in the short run.

Challenges:

- Geographic Supply Risks: While China’s dominance in antimony production has supported growth, it also creates significant supply risks. Heavy reliance on a single country means that global markets are vulnerable to Chinese export policies, environmental crackdowns, and geopolitical factors. Any supply restriction or production halt in China could cause severe shortages and price spikes, leaving dependent regions like North America and Europe exposed.

Antimony Market Regional Analysis:

- Asia-Pacific: Asia-Pacific dominates the global antimony market, with China as the clear leader in both mining and refining, accounting for significant global supply. The region’s concentration is not only supply-driven but also demand-driven, as China, Japan, South Korea, and India are key consumers of flame retardants, electronics, and batteries. China’s export policies, environmental regulations, and production quotas significantly shape global pricing and availability, giving the region outsized influence. Beyond China, countries like Vietnam and Myanmar are emerging as secondary producers, but their output remains small compared to Chinese capacity. This makes Asia-Pacific the most concentrated region, both in terms of supply and demand, leaving the rest of the world highly dependent on it.

- Europe: Europe represents one of the largest import-dependent markets for antimony, with limited domestic mining or processing capacity. The region’s demand is heavily concentrated in flame retardants for construction materials, electrical insulation, and automotive safety components, driven by some of the strictest fire safety regulations globally. Europe also consumes antimony in PET packaging, glass, and ceramics. However, the region’s lack of a supply base makes it highly vulnerable to market concentration in Asia, particularly China. As a result, European industries are actively exploring recycling initiatives and alternative flame-retardant chemistries to reduce reliance on imported antimony.

Antimony Market Competitive Landscape:

The market is fragmented, with many notable players:

- Agreement: In August 2025, Locksley Resources Limited announced it had formally signed a strategic Research & Development Agreement with Houston-based Rice University to develop domestic processing of U.S.-sourced antimony. The agreement represents Locksley's initiation of its U.S. Critical Minerals and Energy Resilience Strategy to accelerate "mine-to-market" deployment of antimony in the U.S.

- Company Initiatives: In May 2025, Americas Gold and Silver Corporation, a growing North American precious metals producer, announced promising results from recent metallurgical testing at its Galena Complex in Idaho, confirming high recoveries of antimony alongside strong silver and copper recoveries from ore currently being processed.

Antimony Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1.287 billion |

| Total Market Size in 2031 | USD 1.743 billion |

| Growth Rate | 6.25% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Application, End-Use Industry, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Antimony Market Segmentation:

- By Type

- Antimony Trioxide

- Antimony Alloys

- Antimony Metal

- Antimony Pentoxide

- Others

- By Application

- Flame Retardants

- Lead-Acid Batteries

- Chemicals and Catalysts

- Others

- By End-Use Industry

- Electrical & Electronics

- Automotive

- Construction

- Defense and Aerospace

- Energy Storage

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

- North America