Report Overview

Canada Application-Specific Integrated Circuits Highlights

Canada Application-Specific Integrated Circuits (ASIC) Market Size:

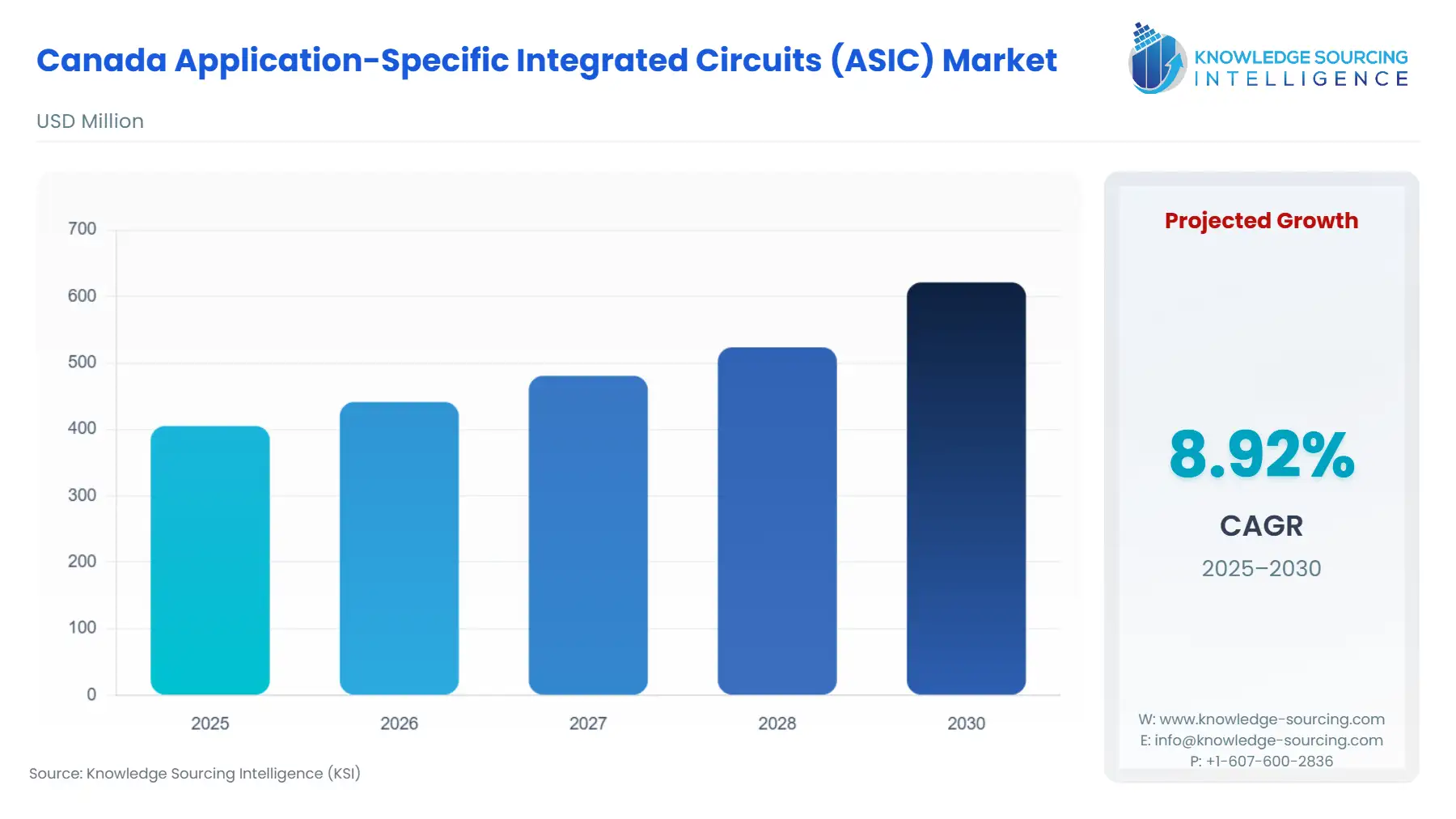

The Canada Application-Specific Integrated Circuits (ASIC) Market is projected to increase at a CAGR of 8.92%, attaining USD 621.343 million in 2030 from USD 405.233 million in 2025.

The Canadian Application-Specific Integrated Circuits (ASIC) market is experiencing a focused period of transformation, driven less by domestic fabrication scale and more by a strategic national pivot towards high-value design, advanced packaging, and domain-specific computing. This ecosystem distinguishes itself through deep integration with the burgeoning Artificial Intelligence (AI), data center, and specialized telecommunications sectors, creating a robust, demand-side pull for customized silicon. The strategic investments by the federal government and key multinational corporations into advanced nodes, particularly for AI acceleration and quantum research, solidify Canada's role as a vital design and intellectual property hub within the broader North American semiconductor corridor.

Canada Application-Specific Integrated Circuits (ASIC) Market Analysis:

- Growth Drivers

The paramount growth driver for the Canada ASIC market is the unprecedented national push for Artificial Intelligence compute sovereignty and capacity. In early 2024, the government announced a substantial $2.4 billion investment into the AI ecosystem, including the AI Compute Access Fund. This direct capital injection compels the creation of sophisticated, energy-efficient data centers and supercomputing infrastructure within Canada. General-purpose CPUs and GPUs are fundamentally inefficient for the repetitive, large-scale matrix multiplications inherent in AI model training and inference. Consequently, this governmental and private-sector effort directly increases demand for custom and semi-custom ASICs—such as dedicated AI accelerators—that deliver superior performance-per-watt and lower latency, essential for locally developed, high-impact AI systems.

A second critical driver is the increasing complexity and demand for network security in telecommunications infrastructure. Canadian telecommunications providers are continuously upgrading their networks to manage exponential data growth and adhere to stringent national cyber resilience mandates. This environment mandates custom silicon to implement complex, high-speed encryption, deep packet inspection, and network function virtualization with maximum throughput and minimal power overhead. The specialization offered by ASICs over standard field-programmable gate arrays (FPGAs) or general-purpose processors propels demand for customized chips tailored for low-latency, high-security network processing units (NPUs) and cryptographic accelerators.

- Challenges and Opportunities

A significant challenge remains limited domestic wafer fabrication capacity, which creates a material dependence on international foundries, primarily in Asia. This constraint subjects Canadian ASIC design houses and fabless firms to the geopolitical and logistical complexities of the global supply chain, which can lead to higher non-recurring engineering (NRE) costs and extended time-to-market. This reliance acts as a constraint on scalable, high-volume ASIC deployment. Conversely, this constraint presents a clear opportunity: a strategic focus on advanced packaging and heterogeneous integration. Canada's investment in advanced packaging facilities, such as the capabilities at IBM Canada and C2MI, positions Canadian firms to specialize in integrating chiplets (ASIC blocks) from various global sources onto a single package, creating a high-value, domestically-finished product that mitigates full-scale fabrication risk while maximizing specialization. This enhances the demand for complex, high-density interposers and bonding ASICs.

- Raw Material and Pricing Analysis:

Application-Specific Integrated Circuits are physical electronic products. Their pricing dynamics are fundamentally tied to the costs of key inputs and the capital expenditure intensity of the global foundry market. Key raw materials include ultra-pure silicon wafers, specialty gases, and rare earth elements for doping and metallization processes. Pricing for these materials, particularly high-purity polysilicon, is subject to global commodity and energy market volatility. Critically, the cost of an ASIC is disproportionately influenced by NRE (Non-Recurring Engineering) charges for mask sets and design verification, which escalate exponentially at advanced nodes (7nm and 5nm). The high NRE costs necessitate volume production to amortize the upfront expense. For the Canadian market, which focuses on specialized, low-volume applications, the demand is for ASICs that offer such a significant performance or power efficiency gain that it justifies the high NRE premium, essentially shifting the value proposition from unit cost to proprietary performance.

- Supply Chain Analysis:

The Canadian ASIC supply chain is structured as a classic 'fabless-design-centric' model. The initial stages—IP core development, architectural design, and electronic design automation (EDA)—are concentrated in major Canadian technology hubs like Ottawa, Toronto, and Montreal, leveraging the country's strong R&D base. The mid-stream process, wafer fabrication, occurs predominantly outside Canada, primarily in foundries located in Taiwan, South Korea, and the U.S. This dependence constitutes the primary logistical complexity and vulnerability. The final stage, assembly, testing, and packaging (ATP), is where Canada maintains a strategic domestic presence, evidenced by investments in advanced packaging at C2MI and IBM Bromont. The domestic focus on ATP and design for advanced packaging creates a crucial dependency on highly specialized logistics for transporting sensitive, high-value wafers and finished ASICs across international borders, necessitating secure and expedited air freight corridors.

Canada Application-Specific Integrated Circuits (ASIC) Market Government Regulations:

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Canada | Canada's Environmental Protection Act (CEPA) | CEPA regulates the environmental footprint of manufacturing processes, including hazardous substances in ASICs. Companies are increasingly incentivized to design environmentally friendly chips, encouraging innovation in low-power, low-emission ASICs and boosting demand for eco-friendly semiconductors. |

| Canada | Innovation, Science and Economic Development Canada (ISED) | ISED promotes research, development, and investment in advanced semiconductor technologies. Through programs like the Strategic Innovation Fund (SIF), ISED supports the growth of Canada's semiconductor ecosystem, encouraging the development of custom ASICs for industries such as automotive, telecommunications, and data centers. |

| Canada | CIRA (Canadian Internet Registration Authority) and Privacy Regulations | As data privacy becomes increasingly critical, ASICs designed for cybersecurity applications are in higher demand. CIRA regulations influence the need for specialized chips that can address data protection and secure communications, particularly in industries like telecommunications, healthcare, and finance. |

| Canada | Canada's National Defence Policy | The National Defence policy mandates the integration of advanced technology in defense and aerospace systems, driving the demand for highly specialized ASICs in military applications. These chips must meet stringent performance and security standards, fostering innovation in sectors such as secure communications and surveillance systems. |

| Canada | Canadian Radio-television and Telecommunications Commission (CRTC) | The CRTC regulates the telecommunications sector in Canada, including network infrastructure and service delivery. This regulation impacts the demand for ASICs tailored to high-speed communications, 5G infrastructure, and broadband applications. ASIC manufacturers are encouraged to produce chips optimized for next-generation networks and low-latency communication. |

Canada Application-Specific Integrated Circuits (ASIC) Market Segment Analysis:

- By Application – Data Centers & Cloud Computing: The Data Centers & Cloud Computing segment is a fundamental driver for high-end ASIC demand in Canada. The national focus on building a 'sovereign AI compute' infrastructure directly translates into a requirement for custom accelerators designed to manage the specific workloads of large language models and other complex AI algorithms. Hyperscale operators and large Canadian enterprises seek to deploy ASICs tailored for functions such as video transcoding, data compression, and especially machine learning inference acceleration to improve data center efficiency and reduce total cost of ownership. The requirement is not for generic silicon but for specialized chips—often implemented in leading-edge nodes (5nm, 7nm)—that reduce latency for real-time cloud services and provide vastly superior power efficiency compared to off-the-shelf CPUs/GPUs. This specialization compels the procurement of full-custom ASIC designs, which is the only route to achieving the required performance density and power envelope.

- By Application – Defense & Aerospace: The Defense & Aerospace segment in Canada drives demand for ASICs characterized by extreme reliability, prolonged operational lifecycles, and radiation-hardening capabilities. This market requires semi-custom and full-custom ASICs for highly specific, mission-critical tasks, including secure communication, real-time signal processing in radar/sonar systems, and flight control. The necessity is intrinsically tied to domestic defense procurement and R&D cycles. Given the stringent qualification and certification processes (e.g., meeting military-grade specifications), designers prioritize established, mature process nodes (e.g., 22nm and above) for maximum reliability and supply chain predictability over bleeding-edge performance. Furthermore, the imperative for national security and data integrity mandates a focus on chips designed and verified within a trusted, secure supply chain, often involving Canadian-based IP and design teams.

Canada Application-Specific Integrated Circuits (ASIC) Market Competitive Environment and Analysis:

The Canadian ASIC competitive landscape is characterized by a reliance on global fabless and foundry giants for manufacturing, while domestic firms specialize in cutting-edge design and niche applications. Competition exists at two levels: the global foundries competing for Canadian design volume, and the domestic design firms vying for high-value contracts.

- Intel: Intel's strategic positioning shifted with its announcement to become a major foundry player (Intel Foundry Services), creating a direct, verifiable competitor to TSMC. Their strategic moves focus on regaining process leadership and building a geographically diverse, integrated design and manufacturing model. Intel's official newsrooms highlight a focus on advanced packaging technologies like Foveros, which directly competes with Canadian R&D in heterogeneous integration. A key product strategy includes the expansion of its programmable solutions group (PSG), which offers FPGAs and customizable structured ASICs, appealing to Canadian end-users seeking a semi-custom solution with a faster design cycle than a full-custom ASIC.

- TSMC (Taiwan Semiconductor Manufacturing Company): TSMC is the dominant global pure-play foundry and an indispensable partner for nearly all Canadian fabless ASIC firms. Their strategic positioning is defined by unassailable technological leadership in advanced process nodes, particularly 5nm and 3nm. TSMC's role is not as a direct market competitor in Canada but as the most critical supply chain enabler. Its product/service is its fabrication capacity and advanced process technology, which Canadian design houses require to realize their high-performance AI and networking ASIC designs. Their continuous process refinements represent the physical limitation and key opportunity for Canada's high-end ASIC designers.

- Untether AI: Untether AI is a Canadian-headquartered company focused on the rapidly growing AI acceleration segment. Their strategic positioning centers on energy-efficient, high-performance inference ASICs, developed specifically to address the computational demands of AI at the edge and in the data center. Their product, the runAI device, is a verifiable ASIC accelerator that utilizes a proprietary architecture to move data directly onto memory near the processing elements, minimizing movement and energy consumption. This focus directly taps into the core Canadian government and private sector imperative for developing high-performance, energy-efficient AI compute infrastructure.

Canada Application-Specific Integrated Circuits (ASIC) Market Developments:

- April 2024: The Prime Minister announced a federal investment of $59.9 million through the Strategic Innovation Fund to support projects by IBM Canada and the MiQro Innovation Collaborative Centre (C2MI). This investment, with a total value of $226.5 million, is specifically targeted at expanding manufacturing capacity and capabilities in advanced semiconductor packaging at IBM Canada's facility in Bromont, Quebec. This represents a verifiable capacity addition in the high-value back-end of the ASIC supply chain within Canada.

Canada Application-Specific Integrated Circuits (ASIC) Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 405.233 million |

| Total Market Size in 2031 | USD 621.343 million |

| Growth Rate | 8.92% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Process Technology, Product Type, Application |

| Companies |

|

Canada Application-Specific Integrated Circuits (ASIC) Market Segmentation:

- BY PROCESS TECHNOLOGY

- Advanced Nodes

- 3 nm and below

- Leading-Edge Nodes

- 5 nm

- 7 nm

- Mid-Range Nodes

- 10 nm

- 12 nm

- 14 nm

- 16 nm

- Mature Nodes

- 22 nm and above

- Advanced Nodes

- BY PRODUCT TYPE

- Full-Custom ASIC

- Semi-Custom ASIC

- Standard Cell-Based ASIC

- Gate-Array Based ASIC

- Programmable ASIC

- Others

- BY APPLICATION

- Consumer Electronics

- Automotive

- Networking & Telecommunications

- Data Centers & Cloud Computing

- Healthcare

- Industrial & IoT

- Defense & Aerospace

- Others