Report Overview

Canada Baby Care Products Highlights

Canada Baby Care Products Market Size:

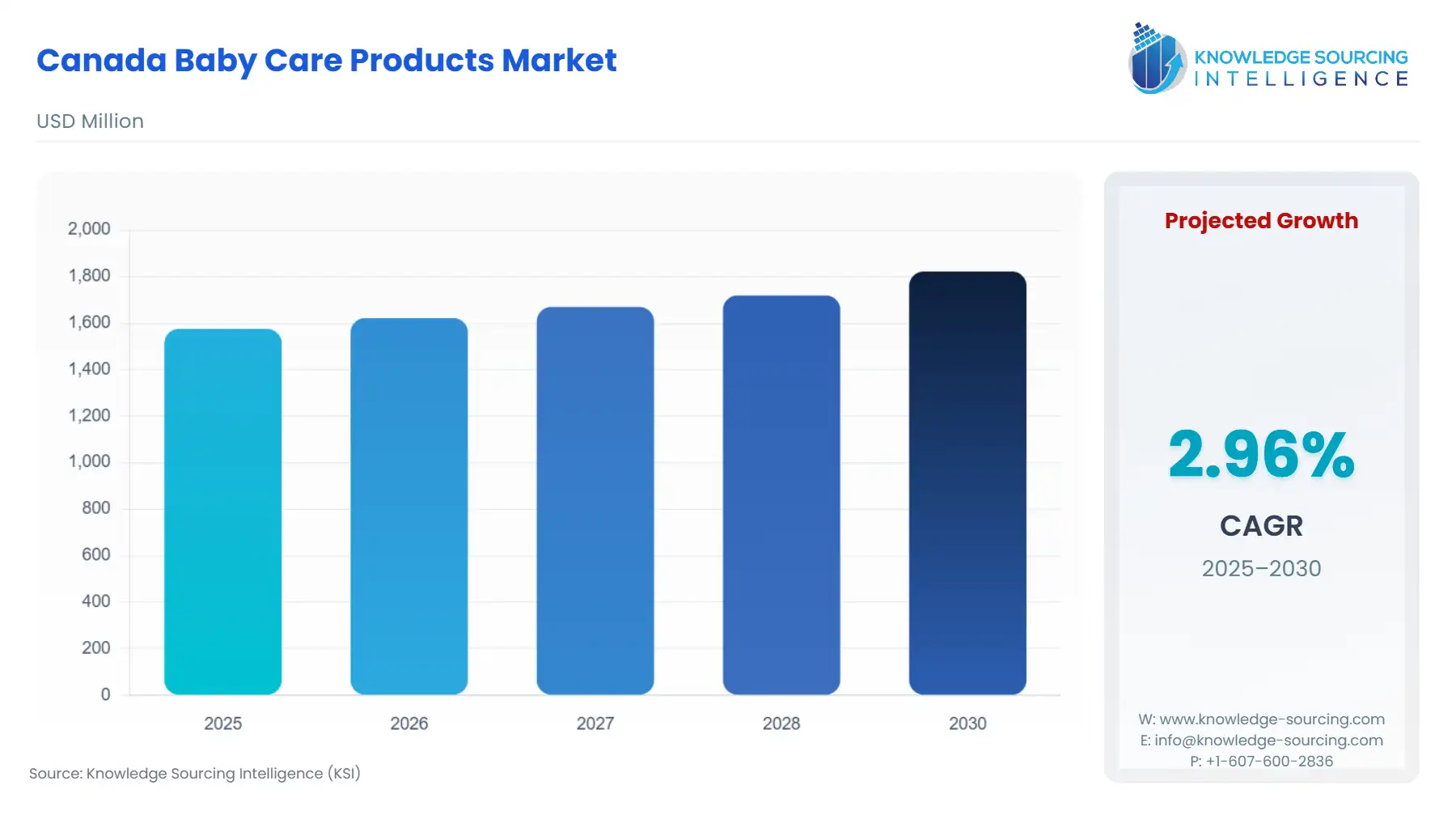

The Canada baby care products market is projected to grow from US$1,575.325 million in 2025 to US$1,822.363 million by 2030 at a CAGR of 2.96% during the forecasted period.

Canada Baby Care Products Market Trends:

The market is expected to grow during the forecast period owing to the increasing government initiatives in the childcare sector. For instance, according to the Canada Child Benefit (by Canada Revenue Agency (CRA)) latest updated data of January 2025, eligible families are provided with the costs of raising children through a tax-free monthly payout for a child under 18 years of age. This provision is inclusive of child disability benefits. Parents can receive up to $3,322 per year, which is $276.83 per month for a child with a disability. Meanwhile, the parent raising a child under the age of 18 can receive up to $7,787 per child yearly.

Additionally, the increasing awareness regarding better childcare facilities and products among parents, owing to the country's growing labor force participation rate, has also impacted the overall demand. For instance, as per the World Bank data, the labor force of Canada was recorded at 22.43 million in 2024, which witnessed an increase of 0.23 million over the number recorded in 2023.

Canada Baby Care Products Market Overview & Scope:

The Canada baby care products market is segmented by:

- Type: The Canadian baby care products market is segmented by type into Baby food & beverages, baby skincare, baby haircare, baby toiletries, and safety and convenience. Key drivers for the Canadian baby care product market differ by type, are driven by the rise in female labor force participation. The growing transition towards organic baby care products, especially food items, is another driving factor for the baby care products market in Canada.

- Distribution Channel: By distribution channel, the Canadian baby care products market has been segmented into online and offline. The offline channel is further divided into supermarkets/ hypermarkets, convenience stores, and drug stores. The online category of the distribution channel segment is projected to grow at a faster rate owing to the growth in e-commerce around the world.

- Region: The Canadian baby care products market has been segmented into Ontario, Quebec, British Columbia, Alberta, and others. Ontario is expected to have a significant market share. Canada's baby care products market is estimated to grow at a moderate rate, fuelled by the industry is expected to be affected by changing environmental and governmental regulations, which are anticipated to challenge market growth as well. In addition, the increasing advancements and market developments, including product launches, collaborations, agreements, acquisitions, and other related factors.

Canada Baby Care Products Market Growth Drivers vs. Challenges:

Drivers:

- Growing digitalization and expansion of E-commerce: Increasing awareness among parents about better products has been boosted due to the ongoing wave of digitalization. This has propelled new market players in the country to launch innovative product offerings, keeping the changing preferences of the audience. For instance, in September 2024, Dove Canada announced the launch of its baby Dove Eczema care product range for the baby skin protection and nurturing from eczema. The product portfolio is inclusive of Baby Dove Eczema Care Soothing Bath Treatment and Eczema Care Cream for managing and protecting the eczema-prone baby's skin through application of this cream, which is offered in both retail stores along online websites.

Additionally, digitalization has also expanded the E-commerce segment of the country. According to the International Trade Administration (ITA) data, the e-commerce sector in Canada accounted for US$2.34 billion as of March 2022. Meanwhile, this retail e-commerce sales is predicted to be valued at US$40.3 billion by 2025 in Canada. This is due to a rise in digital platforms in the country for the purchase of vast products, which is inclusive of baby care products. Consequently, many firms have witnessed potential business opportunities in the online baby care market and therefore have started offering products on E-commerce platforms to establish their presence.

- Rising demand for baby food and beverage products: The baby food and beverages product caters to the nutritional needs of infants and toddlers. The demand for baby food is expected to rise owing to an increasing female working population. As working mothers are left with less time for their babies, there has been an increased reliance on infant food formulas for their babies which are easy to make. According to the World Bank, female labour force participation increased from 60% in 2021 to 61% in 2024.

Another factor driving the demand for these products is the rising number of nuclear families, as well as the growing awareness of the importance of early nutrition. As a result, packaged baby food has gained popularity in recent years, owing to its longer shelf life while also maintaining nutritional value. This is expected to aid mothers with lactation problems in providing optimum amounts of nutrition to infants. Multiple key developments in the Canadian baby food segment are also driving market expansion. for instance, Nestle’s “Gerber Stage 2 Multigrain Oatmeal” baby cereal is ideal for babies aged 6 months and above and provides iron, calcium, and necessary probiotics, all of which assist in normal cognitive development.

Challenges:

- Economic Constraints: the country's changing economic condition, such as fluctuation in employment levels and inflation, could change the income of people, which could hinder their spending on baby care products and could impact the market expansion.

Canada Baby Care Products Market Regional Analysis:

Ontario: Ontario is one of the major Canadian provinces, having high purchasing power, and with the constant urbanization, the scale of people migrating to metro areas has witnessed a constant rise, which has impacted their marriage and family planning. According to the Office of the Registrar General, nearly 27,458 marriages were registered in Ontario in Q2 2024.

Moreover, to constant rise in the parent population, followed by improvement in living standards, has impacted the prevalence of live births in Ontario. According to Statistics Canada, in 2023, the estimated number of live births in Ontario stood at 140,718, which experienced a 4.47% increase over the number of births recorded in 2022. Likewise, the same source also specified that the number of male births witnessed a 4.48% growth over the preceding year, while female live births witnessed 4.47% growth.

Canada Baby Care Products Market Competitive Landscape:

The market is fragmented, with many notable players, including Johnson & Johnson, Nestle, Abbott, Procter & Gamble, Unilever PLC, Kimberly-Clark, Mattel, Private Brands Consortium, Rumina Naturals, Matter Company, and Else Nutrition, among others.

- Nestle: Nestlé is one of the major players serving the Canadian baby products market via its extensive portfolio of nutritional products, inclusive of “NIDO 1+” and “Gerber Multigrain Baby Cereal”. The company has established its corporate offices in Ontario, and through strategic partnerships with local retail stores and distributors, the company has improved its market presence in Canada.

Canada Baby Care Products Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Canada Baby Care Products Market Size in 2025 | US$1,575.325 million |

| Canada Baby Care Products Market Size in 2030 | US$1,822.363 million |

| Growth Rate | CAGR of 2.96% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | Ontario, Quebec, British Columbia, Alberta, Others |

| List of Major Companies in the Canada Baby Care Products Market |

|

| Customization Scope | Free report customization with purchase |

Canada Baby Care Products Market Segmentation:

By Type

- Baby Food and Beverages

- Infant Formula

- Baby Cereals

- Others

- Body Toiletries

- Diapers And Wipes

- Baby Toilet Seats

- Others

- Baby Skincare

- Creams & Lotions

- Massaging Oil

- Powder

- Others

- Baby Haircare

- Shampoos

- Conditioners

- Baby Hair Oil

- Others

- Safety and Convenience

- Prams and Strollers

- Car Seat

By Distribution Channel

By Province

- Ontario

- Quebec

- British Columbia

- Alberta

- Others