Report Overview

Coupling Market Report, Size, Highlights

Coupling Market Size:

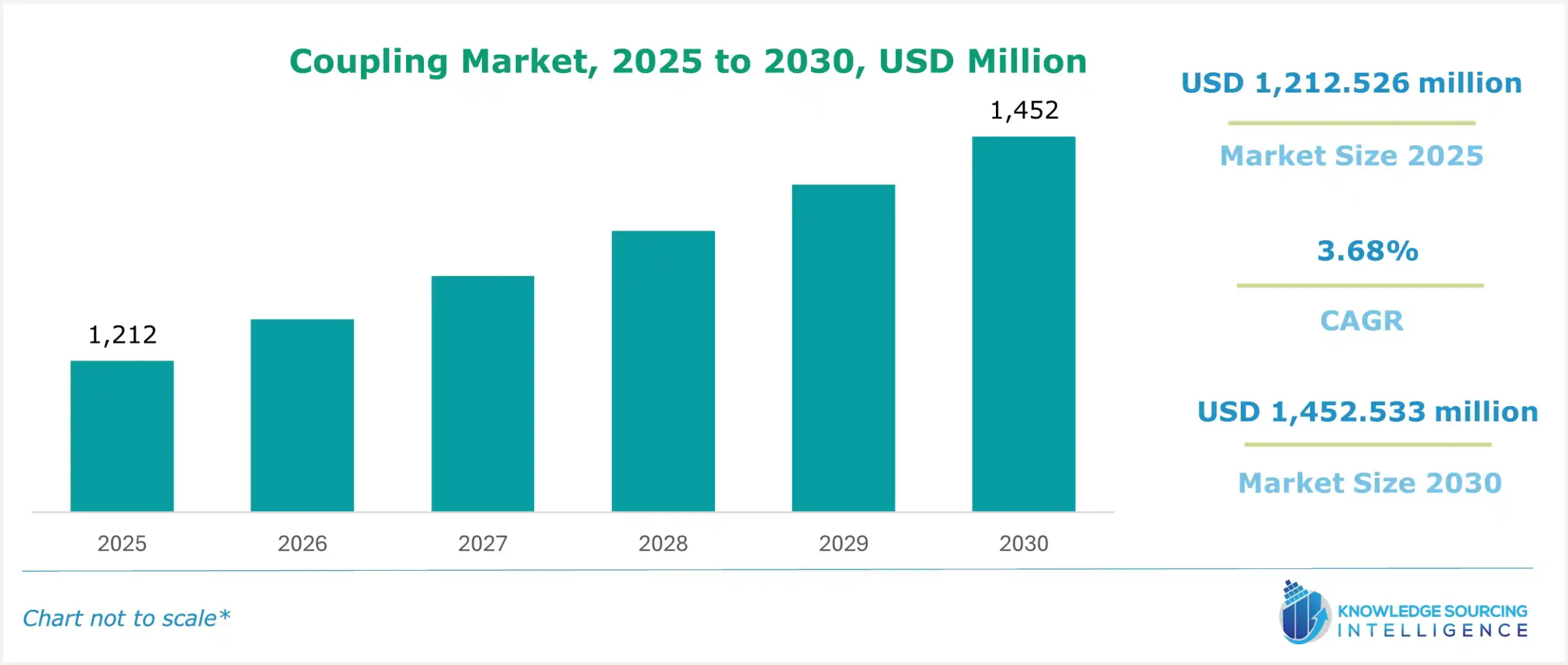

The global coupling market is expected to grow at a CAGR of 3.68%, reaching a market size of US$1,452.533 million in 2030 from US$1,212.526 million in 2025.

Couplings are devices used to connect two shafts with the sole purpose of power transmission, which makes them an integral part of energy transmission in industrial operations. Such devices find application in automotive, mining, oil & gas, and other sectors due to their high-performance features. Hence, the growing automotive industry, the increasing renewable energy, and the burgeoning oil and gas production, followed by rising renewable energy adoption due to its environmental benefits and cost-effectiveness, are propelling the global market expansion.

In September 2024, Flender demonstrated the gearbox, generator, and coupling devices in WindEnergy Hamburg for wind energy. The 10-megawatt gearbox for an onshore turbine measures 3.72 x 2.66 x 2.63 meters in length, width, and height. This weighs 57 tons in its original design.

Moreover, the increasing infrastructure development and rising demand for energy-efficient solutions are also fueling the coupling industry's growth globally. In April 2023, Stock Drive Products/Sterling Instrument expanded their selection of flexible couplings to include the single disk type couplings (short type), series S50XHS, and the double disk type couplings, series S50XHWM. It can be used for a variety of equipment, such as welding machines, 3D printers, and high-precision CNC equipment. These factors collectively contribute to the couplings market’s expansion.

Coupling Market Growth Drivers:

- Rising global automotive production is set to improve the market growth

Couplings are used in automotive applications to prevent misalignment and transmit power from the motor to the drive shaft, thereby providing tolerance for errors during transmission. The growing demand for vehicles offering high-fuel economy, quality features and comfort has propelled the global production of automotive, for instance, according to the International Organization of motor vehicle manufacturers, in 2023, the worldwide automotive production witnessed 10% growth in comparison to preceding year, with cars manufacturing reaching 67,133,570 and commercial vehicles reaching 26,413,029.

Coupling Market Restraints:

- The growing shift towards maintenance-free solutions is restraining the market growth.

Depending on the severity of applications, couplings, especially gear coupling, require time to time lubrication and structural checkups to maintain their performance and also keep contamination in control. Such relubrication intervals and checkup requires technical expertise that would keep the coupling functioning from fluctuating.

Employing such services and expenditure on new spare parts and maintenance has prompted the industrial sectors to opt for maintenance-free solutions or devices requiring maintenance after a long period of time, which is anticipated to slow down the market demand and usage of couplings in the coming time.

Coupling Market Segment Analysis:

- The automotive segment, based on end-user, will account for a considerable market share.

End-user-wise, the automotive sector is poised for a positive expansion and is expected to constitute a considerable share as couplings serve a crucial role in power transmission systems by connecting two shafts, thereby facilitating the transfer of torque while minimizing vibrations and preventing disconnection during operation. The growing emphasis on vehicle performance and safety has heightened the demand for high-quality couplings that can withstand operational stresses. Furthermore, compliance with standards such as CAFÉ (Corporate Average Fuel Economy) and Euro 6 dictates that advanced materials with high tensile strength should be utilized in coupling manufacturing for the industry's advancement.

Moreover, as manufacturers shift towards electric and hybrid vehicles, there is a need for specific couplings that can cater to different powertrains. This transition enhances the efficiency of electric vehicles and aligns with global sustainability goals, which triggers investments in innovative coupling technologies. Additionally, advanced safety features like ADAS increase the complexity of vehicle designs and demand reliable coupling solutions that ensure optimal performance under diversified operating conditions.

Coupling Market Geographical Outlook:

- Asia Pacific will continue to hold a considerable market share of the global coupling market during the forecast period

Geographically, the global coupling market has been segmented into North America, South America, Europe, the Middle East, Africa, and the Asia Pacific.

During the forecast period, the Asia Pacific is expected to constitute a significant market share fueled by the booming industrial productivity in major regional economies, namely China, India, Japan, and South Korea. Moreover, the region also accounts for 50% of global automotive production and, with the implementation of various production schemes such as "Made in China 2025," has further upgraded the manufacturing industry while continued investments in infrastructure propel the market further. Intelligent and durable couplings enabled by advanced materials and implemented Industry 4.0 technologies further play a significant role in boosting the market.

Moreover, China accounted for nearly half the world's distributed PV growth in addition to becoming the leading installed capacity by 2021. The country also led global growth in biofuel production owing to the ethanol blending rollout and an increase in the number of provinces, coupled with investments in production capacity. Such investment in renewable energy projects and biofuel production is acting as an additional driving factor for the regional market expansion.

Coupling Market Key Developments:

- In October 2024: Ruland Manufacturing extended its product line of jaw couplings by providing new sizes of 45 mm that have a torque capacity of 2,655 in-lbs. The new coupling is ideal for use in precision systems along with acceleration and deceleration curves in the warehouse automation, solar, conveyor, and semiconductor applications.

List of Top Coupling Market Companies:

- Altra Motion (Regal Rexnord)

- Challenge Group (Ammega Group)

- ALMA driving Elements GmbH

- KOREA COUPLING CO., LTD

- Lovejoy LLC (Timken Company)

Coupling Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Coupling Market Size in 2025 | US$1,212.526 million |

| Coupling Market Size in 2030 | US$1,452.533 million |

| Growth Rate | CAGR of 3.68% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Coupling Market |

|

| Customization Scope | Free report customization with purchase |

Coupling Market Segmentation:

- By Type

- Sleeve Coupling

- Split Muff Coupling

- Gear Coupling

- Others

- By Material

- Aluminum Alloy

- Stainless Steel

- Titanium

- By End-User

- Automotive

- Power & Energy

- Mining

- Oil & Gas

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- United Kingdom

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Others

- North America