Report Overview

France Electric Commercial Vehicles Highlights

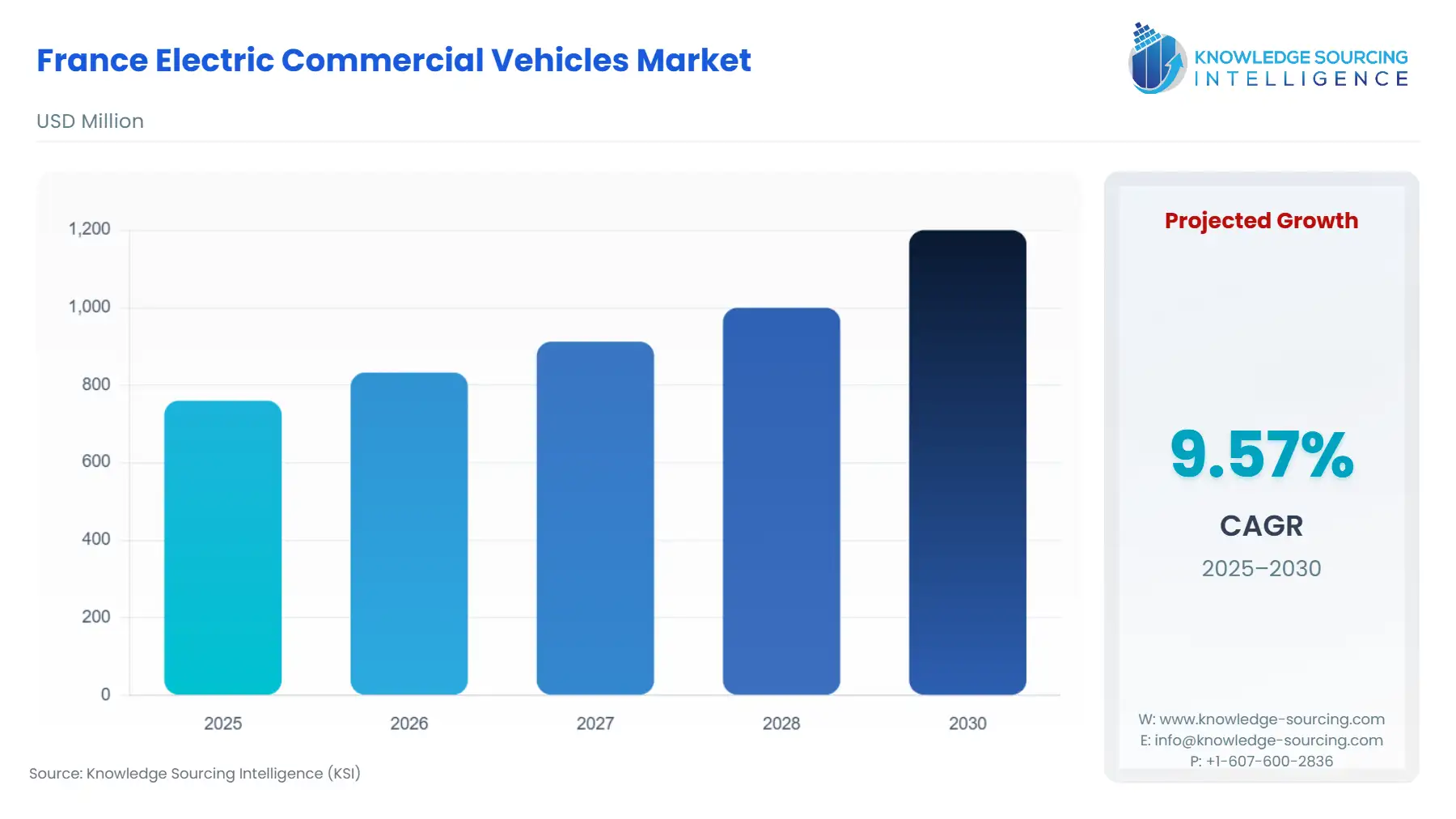

France Electric Commercial Vehicles Market Size:

The France Electric Commercial Vehicles Market is forecast to grow at a CAGR of 9.57%, climbing to USD 1.20 billion in 2030 from USD 0.76 billion in 2025.

The French Electric Commercial Vehicles (eCV) market is in a critical transition phase, demonstrating a strong regulatory push and financial support from the government, yet facing immediate headwinds in new registrations. The divergence between the passenger car and commercial vehicle segments is notable: while the overall passenger car BEV market achieved a 16.9% share in 2024, the electric LCV segment saw a sales contraction. This suggests that fleet operators are currently prioritizing compliance in public transport and tax benefits for company cars over a complete overhaul of the commercial logistics fleet, especially for trucks, where the high investment cost and infrastructure readiness remain acute constraints. The market imperative for fleet renewal is clear, driven by urban access restrictions, which ensure that demand, while volatile in the short term, possesses a strong regulatory floor.

France Electric Commercial Vehicles Market Analysis:

- Growth Drivers

Regulatory pressure is the primary factor propelling market expansion for electric commercial vehicles. The rollout of Low Emission Zones (ZFEs) in France's major cities, notably Paris and Lyon, dictates that high-emitting commercial vehicles will be progressively excluded from central urban areas. This creates a direct, existential necessity for zero-emission alternatives, compelling logistics and transportation companies operating in these hubs to transition their fleets to Electric Commercial Vehicles to maintain operational continuity. Simultaneously, the Bonus Écologique and substantial tax deductions, such as the ability for companies to deduct up to €30,000 from taxable income for each electric vehicle purchased, significantly de-risk the investment. This direct financial support accelerates the total cost of ownership (TCO) parity with diesel models, thereby increasing the immediate and verifiable demand for electric vans and trucks from fleet managers.

- Challenges and Opportunities

The primary challenge constraining expansion is the disparity between the high initial capital expenditure for eCVs and the immediate decline in registrations, particularly in the truck segment, which saw a 57.4% decrease in 2024. This signals that fleet operators are still confronting issues related to battery cost, vehicle payload capacity, and charging infrastructure availability for heavy-duty applications. The core opportunity lies in the public transportation segment, where municipal fleet operators are heavily incentivized to electrify. New opportunities also emerge from technological shifts, such as the increasing commercialization of Fuel Cell Electric Vehicles (FCEVs). For instance, the new Master H2-Tech prototype from Renault Pro+ and the SymphonHy gigafactory by Symbio (a joint venture involving Stellantis) point to a growing FCEV ecosystem, which can address the range and refuelling time constraints currently limiting demand for long-haul and heavier battery electric commercial vehicles.

- Raw Material and Pricing Analysis

As electric commercial vehicles are physical products, their pricing dynamics are fundamentally tied to the raw material supply chain. The primary cost-driver is the lithium-ion battery pack, which relies on critical raw materials such as lithium, nickel, cobalt, and manganese. Europe remains heavily reliant on external sources for these battery minerals. However, efforts to localize the value chain, such as Viridian Lithium's 2023 announcement to establish France's first lithium manufacturing plant, are crucial steps toward mitigating geopolitical and supply risk. Battery costs have demonstrated a consistent declining trend globally, and continued reductions are essential, as the high battery expense remains the single largest impediment to achieving price parity with internal combustion engine (ICE) commercial vehicles and thereby boosting mass market requirements.

- Supply Chain Analysis

The French eCV supply chain is characterized by strong regionalization but significant dependence on international battery inputs. Key domestic production hubs for eCVs and their components are being established, exemplified by the Stellantis Electric Drive Module (EDM) production in Tremery-Metz and the Renault Group's ElectriCity complex. This vertical integration within France and Europe aims to secure the manufacturing process and reduce logistical complexities. However, the core vulnerability remains the reliance on imported processed battery materials (lithium, cobalt, etc.) and cells, mainly from Asia. The focus on establishing European-based gigafactories, including those supported by local French manufacturers, is a strategic imperative to de-risk the supply chain, control pricing, and ensure a stable flow of components necessary to meet escalating domestic manufacturing and demand targets.

France Electric Commercial Vehicles Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

France (National/Local) |

Low Emission Zones (ZFEs) established by the 2021 Climate and Resilience Act (Loi Climat et Résilience) |

Creates non-discretionary replacement demand by restricting the most polluting commercial vehicles (e.g., future restrictions on Crit'Air 3) from city centers like Paris and Lyon, forcing fleet operators to adopt zero-emission vehicles to maintain last-mile logistics access. |

|

France (National) |

Bonus Écologique and Tax Deductions (up to €30,000) for Electric Vehicles |

Directly addresses the high upfront cost of ECVs for fleet owners, improving the total cost of ownership (TCO) and increasing immediate purchase demand by lowering the financial barrier to entry. |

|

France (National) |

France 2030 Plan (Allocations for EV production and Charging Infrastructure) |

Provides multi-year financial certainty for manufacturers and infrastructure developers, supporting capacity expansion and the deployment of public charging points, which alleviates range anxiety and facilitates fleet operations, thereby enabling demand. |

France Electric Commercial Vehicles Market Segment Analysis:

- By Application: Logistics and Transportation

The Logistics and Transportation segment is the primary growth factor for Electric Commercial Vehicles, driven almost exclusively by the imperative of maintaining access to urban centers. The implementation of ZFEs in key French agglomerations is a non-negotiable policy catalyst. Logistics firms rely on LCVs (vans) and light-duty trucks for time-critical, last-mile deliveries. As ZFE restrictions progressively target older diesel vehicles, these companies face a choice: either pay penalties or renew their fleets with electric alternatives. This regulatory stick creates a captive, mandatory demand pool for electric vans and light-duty trucks. Furthermore, the operational profile of last-mile logistics—characterized by short, predictable daily routes and return-to-base charging—perfectly aligns with current battery technology limitations, making electrification a logistically sound and economically incentivized choice when factoring in government subsidies and lower running costs.

- By Vehicle Type: Buses and Coaches

The Buses and Coaches segment is propelled by public procurement and a clear political mandate for decarbonizing public services. French municipalities and regional transport authorities are the primary purchasers, using national and regional grants to fund fleet transitions. This segment is experiencing a significant rise in Electrically Chargeable Bus registrations, fueled by the government's environmental strategy and ambitious targets for reducing urban greenhouse gas emissions. The zero-emission performance of electric buses directly addresses the public imperative for improved urban air quality and reduced noise pollution in densely populated areas. The necessity is further structured by the market's increasing adoption of high-capacity, above 40-seater electric buses, which are necessary to manage increasing urbanization and commuter volumes on regional and intercity routes while simultaneously meeting sustainability goals.

France Electric Commercial Vehicles Market Competitive Analysis:

The French Electric Commercial Vehicles market is dominated by incumbent European players, particularly domestic powerhouses with an established industrial presence and extensive dealership networks.

- Stellantis N.V.: As a key market leader in the European Light Commercial Vehicle sector, Stellantis leverages its multi-brand strategy (Citroën, Peugeot, Opel, Fiat) to cover the full spectrum of electric van demand with models like the e-Partner/e-Rifter and their equivalents. Their strategic positioning is focused on the 'Pro One' commercial vehicles offensive, aiming for global leadership in LCVs through a fully electrified portfolio. The company is vertically integrating component supply, as demonstrated by its joint venture Symbio, which inaugurated the SymphonHy gigafactory for hydrogen fuel cells in December 2023, signalling a crucial hedge against the limitations of battery-only technology for heavier vehicle categories.

- Renault Group: Renault is a historic pioneer in European electric mobility and maintains a significant share in the domestic ECV market. Their strategy centers on a rapid and complete electrification of their core product line, including the new generation of Master vans (Master E-Tech electric and the FCEV prototype Master H2-Tech). The company leverages its domestic manufacturing and engineering complex, ElectriCity, to control costs and production capacity. Renault's focus on both Battery Electric and hydrogen (via the HYVIA joint venture with Plug) demonstrates an agile strategy aimed at capturing the light-duty segment (BEV) while positioning for the future of medium and heavy-duty applications (FCEV).

France Electric Commercial Vehicles Market Developments:

- October 2024: Renault Group unveiled the new Renault 4 E-Tech 100% electric at the Paris Motor Show. While primarily a passenger car, its design emphasized versatility and generous cabin space, hinting at potential derivatives or adaptations for micro-utility/last-mile delivery applications, aligning with the brand's electric offensive in the compact segment.

- February 2024: Stellantis announced a €103 million investment to increase the production capacity of Electric Drive Modules (EDMs) by adding a facility in Szentgotthard, Hungary, targeted to begin in late 2026. This capacity expansion, which complements existing EDM production in Tremery-Metz, France, is a crucial strategic step to secure the necessary supply of propulsion units for its growing European and French electric commercial vehicle lineup.

- December 2023: Symbio, a joint venture between Forvia, Michelin, and Stellantis, inaugurated SymphonHy, Europe's largest integrated site producing hydrogen fuel cells in Saint-Fons, France. This capacity addition significantly reinforces the domestic supply chain for FCEV components, directly supporting the future roll-out of hydrogen-powered commercial vehicles, including those from Stellantis and its partners.

France Electric Commercial Vehicles Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 0.76 billion |

| Total Market Size in 2031 | USD 1.20 billion |

| Growth Rate | 9.57% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Vehicle Type, Propulsion Type, Power Output, Application |

| Companies |

|

France Electric Commercial Vehicles Market Segmentation:

- BY VEHICLE TYPE

- Buses and Coaches

- Trucks

- Light-Duty Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Vans

- BY PROPULSION TYPE

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

- Fuel Cell Electric Vehicles (FCEV)

- BY POWER OUTPUT

- Up to 150 kW

- 150-250 kW

- Above 250 kW

- BY APPLICATION

- Logistics and Transportation

- Public Transportation

- Construction (Excavators, Loaders, Others)

- Mining

- Agriculture (Tractors, Harvesters, Others)

- Others