Report Overview

Electric Vehicle Drivetrain Market Highlights

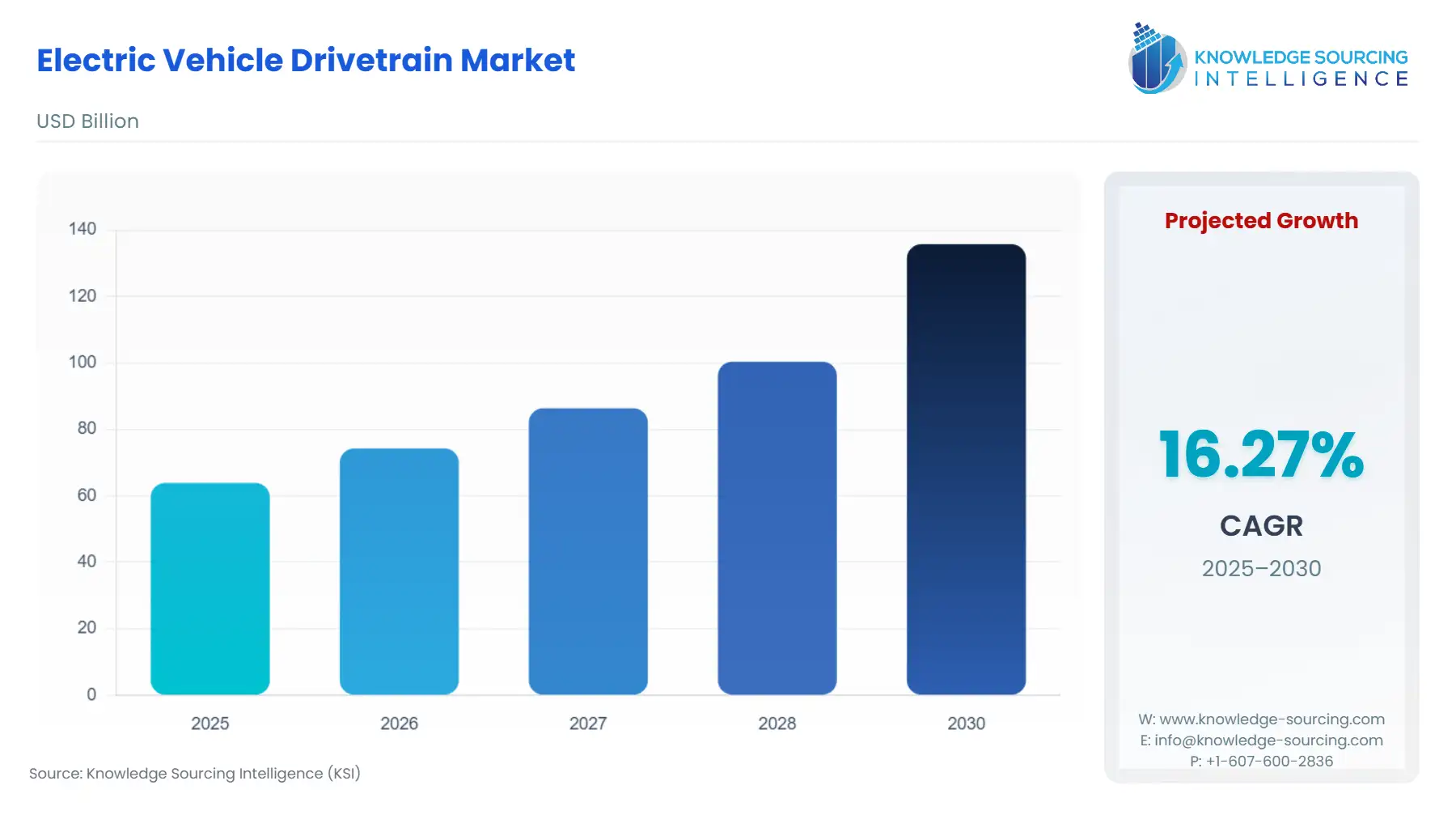

Electric Vehicle Drivetrain Market Size:

The electric vehicle drivetrain market is projected to expand from USD 63.905 billion in 2025 to USD 135.769 billion in 2030 at a CAGR of 16.3%.

Electric Vehicle Drivetrain Market Overview:

The electric vehicle (EV) drivetrain is the system that includes all the parts of an EV that transmit the power from the batteries to the driving wheels, including the electric motors, controllers, batteries, etc. It varies according to the EV system and is essential in connecting the wheels of the vehicle to its primary power source. The growing trend towards electric mobility, accompanied by strategic funding aimed at nurturing it, is the primary factor responsible for the upsurge in demand for drivetrain systems.

Moreover, the increasing technological innovations in EV driving, in addition to government support and incentives for rising EV uptake, have improved the market's growth prospects. This technological penetration is also forecasted due to the anticipated growing economies with high possibilities of EV penetration. Additionally, the design of the EV drivetrain is different from that of the conventional vehicle’s drivetrains in that it is well-balanced to control speed and torque. Therefore, the extensive defaulting technology may be a persistent hindrance to the market.

The EV drivetrain market is pivotal in advancing sustainable mobility, leveraging silicon carbide (SiC) inverters and gallium nitride (GaN) power electronics to enhance efficiency. Wide bandgap (WBG) semiconductors in EVs enable higher voltage and thermal performance, optimizing power delivery. Axial flux motor EVs offer compact, high-torque designs, while radial flux motors and permanent magnet synchronous motors (PMSM) dominate for their motor power density and reliability. Induction motors in EVs provide cost-effective alternatives for specific applications. This market drives innovation in performance, range, and cost-efficiency, supporting the global transition to electrification in the automotive and commercial vehicle sectors.

Electric Vehicle Drivetrain Market Trends:

The electric vehicle drivetrain market is advancing with EV performance optimization, leveraging lightweight EV drivetrain designs to enhance efficiency and reduce energy consumption. EV range extension technology, including advanced SiC inverters, maximizes driving distance. Fast charging EV drivetrain systems integrate high-power electronics for rapid recharging, improving user convenience. NVH in EVs (noise, vibration, harshness) reduction technologies ensure quieter, smoother rides, elevating the consumer experience. Software-defined vehicle drivetrain solutions enable over-the-air updates, optimizing performance and adaptability. These trends reflect a focus on efficiency, user comfort, and technological integration, positioning the market to meet evolving demands in the dynamic EV industry.

Electric Vehicle Drivetrain Market Growth Drivers:

The accelerated market expansion can be attributed to the growing EV transition.

Carbon emissions have been rising over the years, increasing air pollution and global warming. In a bid to control such occurrences, many strategies are being employed, one of them being a change from traditional internal combustion engines to cleaner fuels, which has seen a rise in the uptake of EVs. As such, some leading economies, including China, the US, and the EU, are witnessing a booming upsurge in this shift.

As per statistics obtained from the International Energy Agency, it was estimated that by 2023, about 14 million EVs would be registered worldwide, which would compound the total on-the-road volume to 40 million. Moreover, EV sales in the same year were 3.5 million more than in 2022, thus displaying a 35% growth yearly. In addition to this, the same source also indicated that the proportion of electric cars to total global vehicle sales surged from 14% in 2022 to 18% in the current year, marking a rise in the use of EVs.

Further, the EV drivetrain market is analyzed based on vehicle type into PHEV, BEV, FCEV, and HEV. Battery Electric Vehicle (BEV) is expected to occupy a considerable market share. It is ready for healthy growth because this type of vehicle, in contrast with PHEV and HEV, uses only electric batteries, which are replaceable and recharged by power from the mains.

The current adoption of zero-emission policies and initiatives supplemented with government support has increased the acceptance of such zero-emission vehicles. For example, the IEA 2023 report indicates that 70% of registered EVs were BEVs in 2023, and the sales volume reached nearly 9.5 million BEV units.

Furthermore, the projection for PHEV forecasts is favorable, constant growth is expected, and it will be the second-best account. Additionally, PHEV registration in the same year totaled 4.3 million units, which is 30 percent of global electric vehicle sales, according to the same source. HEVs and FEVs will register positive growth but command a small market share.

Technological innovations in driving technology have opened a new market segment for its growth.

With advanced and emerging technologies, especially infotainment systems and sensors used more frequently, EVs are a great way to achieve future mobility. Correspondingly, the EV powertrain components and technologies have immense importance because they convert the energy from an electric motor used for vehicle propulsion. Tesla, BYD Inc., General Motors, Volkswagen, BMW, and Volvo are the primary EV manufacturers working to expand their EVs' performance by pouring in new technologies while signing up contracts with electric solutions tier 1 suppliers.

These joint ventures caused the development of a new scheme that facilitates the efficient use of drivetrain components, enhancing demand in the market. Besides, other technologies like the Advanced Driving Assistance System (ADAS) and self-driving car technology are also causing an increase in the need for an efficient drivetrain system. This is because speed and torque management are relevant to the external environment and determine the mobility efficiency of the vehicle.

Electric Vehicle Drivetrain Market Geographical Outlook:

Asia Pacific is anticipated to have a significant share of the electric vehicle drivetrain market.

The electric vehicle drivetrains market is segmented by geography into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. The APAC market is expected to witness high growth prospects and the highest market share. Some of the major economies in this region, such as China, contribute to a greater share of EV growth globally. As reported in the ‘Global EV Outlook 2024’, China registered the highest number of new EVs with about a 60% share, an equivalent of 8.1 million units in 2023.

Further, the same source also indicated that the rapid growth of the country’s automotive industry has mainly been because of the increasing consumer demand for EVs. Thus, the positive investment environment enhances EV manufacturing and usage, in addition to the existing presence of major EV players such as BYD INC. And Xpeng Inc. is also propelling the regional market growth.

Other countries like India and Japan are expected to witness a significant rise in growth due to the aggressive strategies employed by EV manufacturers in enhancing their EV fleet and driving systems. In the forecast period, APAC is expected to have a considerable share owing to the mentioned factors as well as government-supportive policies and initiatives, resulting in regional market expansion.

Electric Vehicle Drivetrain Market Key Developments:

In June 2025, ZF launched the SELECT e-drive platform for passenger cars, offering 96% peak drivetrain efficiency and modular 400V/800V compatibility, streamlining production and enhancing EV performance.

In May 2024, Vitesco Technologies announced its plan to supply its EMR3 axle drive to Honda for its CR-V and e-FCEV vehicles that will launch in Japan and the USA markets later in 2024. This drive technology comprises power electronics, a reducer, and an electric motor, broadening mobility operations.

In April 2024, BMW Group entered into an agreement with Rimac Technology for the joint creation of high-voltage batteries and innovative drive technology for electric vehicles. This technology is expected to be used for some selected BEVs. Moreover, Rimac will become a Tier 1 automotive supplier of electrification solutions at scale.

In October 2023, Continental AG partnered with DeepDrive to construct a novel driving system that combines Continental’s brake system with DeepDrive’s electric motors. The cooperation is set to extend the portfolio of EVs and help both companies deepen their reach in the EV mobility market.

List of Top Electric Vehicle Drivetrain Companies:

AISIN CORPORATION

DENSO CORPORATION

Hexagon AB

ZF Friedrichshafen AG

Magna International Inc.

Electric Vehicle Drivetrain Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 63.905 billion |

| Total Market Size in 2030 | USD 135.769 billion |

| Forecast Unit | Billion |

| Growth Rate | 16.3% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Component, Type, Vehicle, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Electric Vehicle Drivetrain Market Segmentation:

By Component

Battery

Controller

Transmission

Electric Motor

By Type

Front-wheel drive (FWD)

Rear-wheel drive (RWD)

All-wheel drive (AWD)

Four-wheel drive (4WD)

By Vehicle

PHEV

BEV

FCEV

HEV

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

UK

Germany

France

Italy

Others

Middle East and Africa

Saudi Arabia

Israel

Others

Asia Pacific

Japan

China

India

South Korea

Indonesia

Thailand

Others