Report Overview

France Electric Vehicle Components Highlights

France Electric Vehicle Components Market Size:

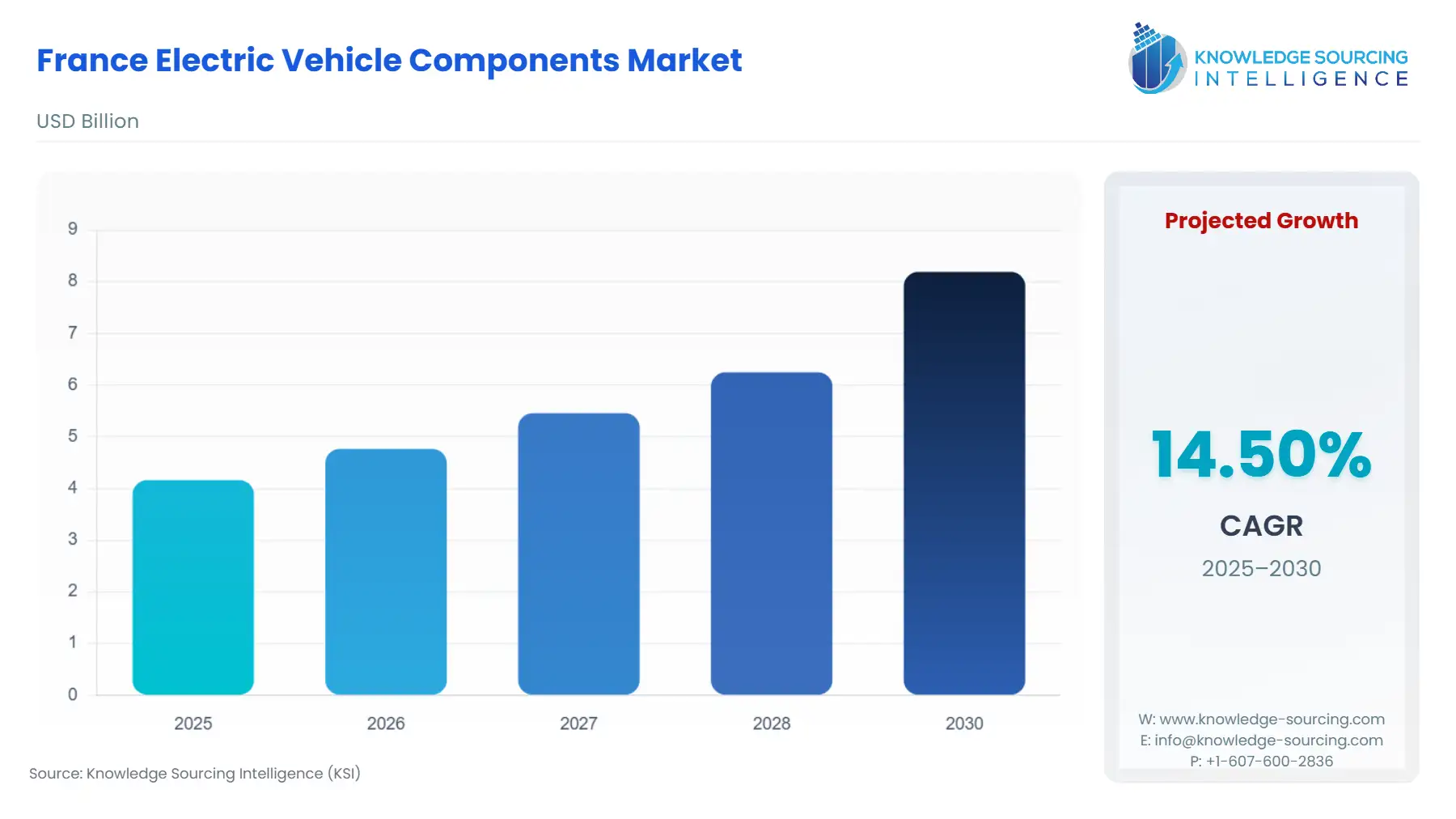

The France Electric Vehicle Components Market is projected to expand at a CAGR of 14.50%, reaching USD 8.193 billion in 2030 from USD 4.163 billion in 2025.

The French Electric Vehicle (EV) components market is undergoing a fundamental re-industrialization, transitioning from a consumption-focused structure to a high-value manufacturing hub. This pivot is predicated on large-scale public and private capital deployment aimed at securing the most critical and expensive component of an EV: the battery. France's established automotive manufacturing base and strong governmental support for industrial transition act as the primary structural levers, creating a localized demand imperative for advanced EV power systems. The market is defined by a high-stakes competition among multinational Tier 1 suppliers to align with the production ramp-up schedules of new gigafactories, where supply chain proximity is becoming a critical competitive advantage.

France Electric Vehicle Components Market Analysis:

- Growth Drivers

The primary catalyst propelling the market is the massive, co-located industrial investment into battery manufacturing capabilities. The operational start of AESC's gigafactory in Douai and ACC's in Billy-Berclau Douvrin, alongside Verkor's planned facility in Dunkirk, creates immediate, high-volume localized demand for battery cells and modules. This vertical integration shortens the supply chain and acts as a gravitational force, drawing secondary component suppliers (e.g., thermal management systems, Battery Management Systems (BMS), and power electronics) to establish French or proximate European operations. This proximity enables "just-in-time" supply logistics and compliance with regional content mandates, directly accelerating component demand. Furthermore, the persistent need for longer driving ranges, with average battery pack sizes expected to increase from approximately 50 kWh to 75 kWh, directly mandates greater complexity and volume in related components like the thermal management system and advanced power electronics for efficient energy transfer.

- Challenges and Opportunities

A key constraint facing the market is the significant volatility and geopolitical concentration of critical raw material supply chains. The European Union relies heavily on external sources for lithium, cobalt, and natural graphite, with refining capacity predominantly clustered in Asia. This dependence introduces profound cost instability and supply risk, which translates to a higher, more volatile component cost for battery pack manufacturers. Conversely, this challenge presents a distinct opportunity for specialized French firms focusing on closed-loop circular economy solutions, such as battery recycling and remanufacturing (exemplified by Renault Group's 'The Future Is NEUTRAL' strategy), and advanced battery chemistry research. These initiatives directly drive demand for component technologies built for disassembly and material recovery, mitigating future raw material price shocks and establishing France as a leader in sustainable component life-cycle management.

- Raw Material and Pricing Analysis

The battery cell accounts for approximately 30% to 40% of an EV's total value, rendering the component market acutely sensitive to the pricing of critical raw materials. Lithium, cobalt, nickel, and graphite prices directly influence the Bill of Materials (BOM) cost for battery packs, which are the market’s largest value component. Global value chains for these materials are characterized by geographically diverse mining/extraction but a highly concentrated refining/processing stage, primarily in China. This clustering dictates that French manufacturers, despite local assembly, remain exposed to global price fluctuations. The market response involves a shift toward nickel-free and cobalt-free LFP batteries, a move championed by OEMs like Stellantis, which aims to diversify the raw material input to achieve greater cost stability and reduce reliance on geopolitically sensitive materials, thereby changing the demand profile for specific cathode precursor components.

- Supply Chain Analysis

The EV components supply chain is rapidly regionalizing, moving away from a long-haul global model. France’s "Battery Valley" in the Hauts-de-France region has emerged as a key European production hub, clustering cell manufacturing (ACC, AESC, Verkor) near major OEM final assembly plants (e.g., Renault ElectriCity). Logistical complexity is primarily related to the cross-border movement of partially processed battery materials (e.g., cathode and anode materials) from Asian refiners to European gigafactories. A major dependency is the availability of cost-competitive, low-carbon electricity, which is critical for the energy-intensive cell manufacturing process, thereby impacting the final cost and "green eligibility" of the component. The strategic location of the Dunkirk gigafactory near a major port is designed to streamline the import of raw materials and the export of finished cells to carmakers.

France Electric Vehicle Components Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

France / Government |

Ecological Bonus with Green Eligibility Criteria (since 2024) |

Directly drives demand for French/European-made components. Vehicles exceeding a set production carbon footprint are excluded from the subsidy, forcing OEMs to prioritize localized component sourcing to maintain end-user price competitiveness, especially for mass-market models. |

|

European Union |

Batteries Regulation (Regulation (EU) 2023/1542) |

Mandates minimum levels of recycled content for cobalt, lithium, and nickel by a set date, and introduces carbon footprint declaration requirements. This structural shift creates demand for new processes, traceable components, and recycling infrastructure, profoundly impacting the design and material sourcing of all battery-related components. |

|

France / Government |

France 2030 Investment Plan (Specific EV/Battery Funding) |

Provides targeted capital to support the construction of domestic manufacturing capacity (gigafactories). This supply-side intervention creates verified, guaranteed demand for specialized industrial components, machinery, and skilled labour needed to support the new production lines. |

France Electric Vehicle Components Market Segment Analysis:

- By Component Type: Battery Pack

The battery pack segment represents the epicenter of value creation and is the primary growth driver for the entire French EV component market. Its expansion is dictated by two core drivers: the sheer volume ramp-up of domestically assembled EVs and the continuous technological push for energy density and cost reduction. The local commissioning of gigafactories by ACC, AESC, and Verkor creates a definitive and substantial demand floor for fully integrated battery packs. This concentration of manufacturing draws in suppliers of subordinate, high-value components, such as the Battery Management System (BMS), high-voltage wiring, and module casings. Furthermore, the OEM push for platform standardization—where a single battery architecture can serve multiple vehicle segments—specifically accelerates the demand for highly modular, flexible component designs. The shift towards LFP chemistry by players like Stellantis is driving demand for new thermal and safety components designed specifically for LFP's unique performance characteristics, displacing certain legacy components used in higher-nickel chemistries.

- By End-User: OEMS

Original Equipment Manufacturers (OEMs) represent the dominant and most technically stringent end-user segment for EV components in France. A dual imperative: regulatory compliance and local content requirements fundamentally drive this demand. The French government's introduction of the ecological bonus with green eligibility criteria has created a critical cost barrier for non-compliant imported EVs, compelling domestic OEMs (e.g., Renault, Stellantis) to source a greater proportion of components locally. This market dynamic forces a strategic pivot towards local Tier 1 suppliers, which directly increases domestic demand for high-spec, certified components. Furthermore, the OEM strategy to transition entire model lineups—such as Renault's focus on electrifying its core models like the Renault 5—establishes secure, long-term procurement contracts, thereby creating stable and predictable high-volume demand for everything from electric motors and inverters to onboard chargers.

France Electric Vehicle Components Market Competitive Analysis:

The competitive landscape is characterized by a mix of established European Tier 1 automotive suppliers and newly formed battery powerhouses, often backed by Asian expertise. The market is consolidating around the three major gigafactory projects, forcing suppliers to choose sides or diversify across the newly formed hubs.

- Automotive Cells Company (ACC): A joint venture between Stellantis, TotalEnergies/Saft, and Mercedes-Benz, ACC is positioned as a key European battery technology champion. Its strategic positioning is to secure localized, high-performance battery supply for its parent OEMs. The company inaugurated its first gigafactory in Billy-Berclau Douvrin, France, in May 2023. This facility is central to Stellantis's push for battery self-sufficiency and its commitment to a dual-chemistry strategy, which includes high-nickel and LFP chemistries. ACC’s strategy is not focused on an off-the-shelf product but a deeply integrated, highly specified component designed for the platforms of its OEM partners.

- AESC (Automotive Energy Supply Corporation): AESC, a global green tech company, operates a gigafactory in Douai, France, with a planned capacity of 24 GWh by 2030. AESC’s strategic positioning centers on supplying Renault Group's ElectriCity hub with cost-competitive, low-carbon batteries for high-volume models like the future Renault 5. The company leverages long-standing expertise from its origins to provide batteries engineered for both performance and manufacturability, directly supporting Renault’s ambition to produce one million electric vehicles in Europe by 2030. The Douai investment, a maximum of €2 billion, underscores its commitment to establishing France as a foundational element of its European supply strategy.

France Electric Vehicle Components Market Developments:

- September 2025: The French government announced an exceptional additional bonus of €1,000 for the purchase of electric vehicles that are assembled in Europe and equipped with a European battery, effective October 1, 2025. This policy shift is a major driver for the entire French EV component supply chain, explicitly favouring local or regional battery and assembly plants. It signals a governmental effort to secure the domestic supply chain and directly impacts component sourcing decisions for automakers selling in France.

- June 2024: Renault's performance brand, Alpine, debuted the all-electric A290, which is part of the future "Dream Garage" of electric sports cars. The A290, built on the CMF-B EV platform shared with the Renault 5, and the high-performance Alpine 390 GTS (470 HP, 89 kWh battery, 345 miles WLTP range) represent a significant internal product launch, showcasing French engineering's move into high-performance electric components. This accelerates the development and deployment of advanced battery thermal management, electric motor control, and specialized chassis components within the Renault/Alpine industrial ecosystem.

- May 2024: Chinese EV manufacturer XPENG officially announced its expansion into the French market in May 2024, launching its premium battery-powered G9 and G6 mid-size SUV models. Although XPENG is a foreign company, its entry represents a crucial component of market dynamics. To compete effectively, XPENG relies on localized distribution and service networks, often leading to partnerships and component sourcing from French or European Tier 1 suppliers for minor parts, servicing, and potentially future localized production or platform sharing to comply with upcoming incentives.

France Electric Vehicle Components Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 4.163 billion |

| Total Market Size in 2031 | USD 8.193 billion |

| Growth Rate | 14.50% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component Type, Vehicle Type, Technology, End User |

| Companies |

|

France Electric Vehicle Components Market Segmentation:

- BY COMPONENT TYPE

- Battery Pack

- Electric Motor

- Power Electronics

- Inverter

- Converter (DC-DC)

- On-Board Charger

- Thermal Management System

- Body & Chassis

- Other Components

- BY VEHICLE TYPE

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers & Three-Wheelers

- BY TECHNOLOGY

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

- Fuel Cell Electric Vehicle (FCEV)

- BY END-USER

- OEMS

- Aftermarket