Report Overview

Germany 5G Network Infrastructure Highlights

Germany 5G Network Infrastructure Market Size:

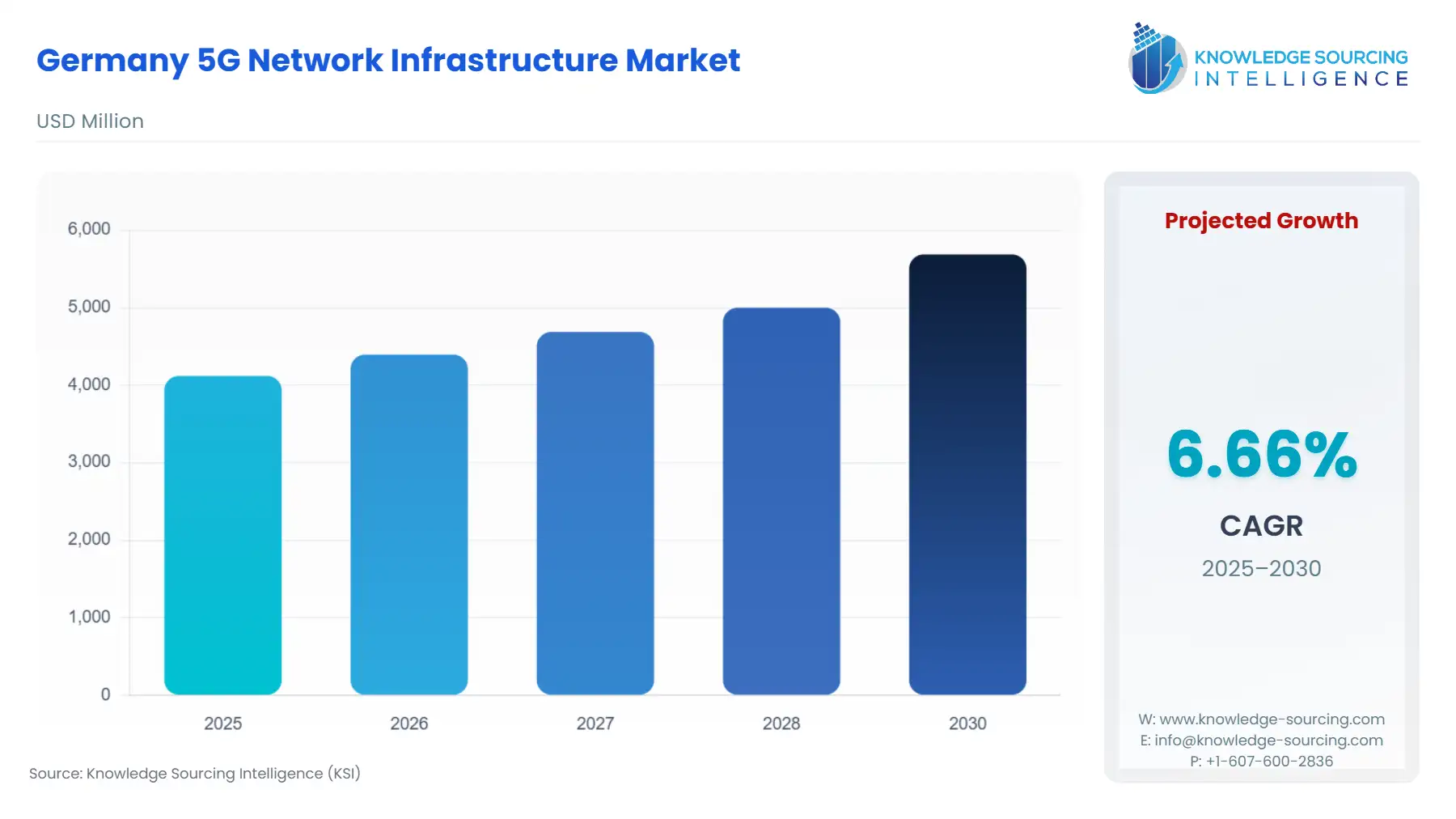

The Germany 5G Network Infrastructure Market is projected to expand at a CAGR of 6.66%, attaining USD 5.687 billion in 2030 from USD 4.12 billion in 2025.

The German 5G Network Infrastructure Market is defined by a rigorous regulatory environment and aggressive commercial deployment strategies by the country's major Mobile Network Operators (MNOs). Following the 2019 spectrum auctions, the market transitioned from Non-Standalone (NSA) to a strategic Standalone (SA) rollout, positioning the national infrastructure to support advanced enterprise use cases. This shift, coupled with the Federal Government's overarching Gigabit Strategy aimed at universal fiber and latest mobile technology coverage by 2030, places Germany at a critical juncture in its digital transformation. The sustained capital expenditure, primarily concentrated in RAN expansion and cloud-native Core modernization, reflects the imperative to deliver both national broadband coverage and high-performance, low-latency connectivity for Industry 4.0 applications.

Germany 5G Network Infrastructure Market Analysis:

- Growth Drivers

Regulatory mandates are a primary catalyst, directly accelerating the demand for new infrastructure. The BNetzA’s coverage obligations, requiring specific throughput speeds across defined geographic percentages, compel MNOs to deploy additional cell sites and active RAN equipment to fill coverage gaps, particularly in rural and transportation corridor areas. Furthermore, the German model of allocating localized 3.7-3.8 GHz spectrum for Private 5G networks directly stimulates demand for small cells, dedicated core appliances, and specialized edge infrastructure among large enterprises, especially within the high-value manufacturing and automotive sectors. This regulatory foresight creates a distinct, premium-priced enterprise segment for network builders and software vendors.

- Challenges and Opportunities

A significant constraint is the stringent regulatory environment around site acquisition and permit granting, which can slow the physical deployment timeline for new macro and micro cell sites, creating a bottleneck for RAN capacity expansion and delaying demand realization.

Conversely, the transition to 5G Standalone presents a major opportunity; the cloud-native architecture allows MNOs to implement network slicing, a capability critical for generating new revenue streams from enterprise-specific service level agreements (SLAs). This capability, once unlocked, shifts demand from simple network hardware sales to sophisticated Network Management and Orchestration (NMO) software and services, enabling higher-margin business models.

- Raw Material and Pricing Analysis

The 5G network infrastructure market, encompassing RAN and Core hardware, is critically dependent on the global supply chain for high-performance electronic components. Key raw materials include specialized semiconductors (e.g., Gallium Nitride/GaN for power amplifiers), high-purity metals, and optical fiber. Pricing dynamics are influenced by global chip shortages, geopolitical constraints, and rising energy costs impacting manufacturing and logistics. The shift to Open RAN (O-RAN) architectures aims to introduce competition and potentially lower equipment costs over the long term, but current capital expenditure remains high due to the rapid deployment pace and reliance on proprietary hardware/software stacks from traditional vendors.

- Supply Chain Analysis

The global supply chain for 5G network infrastructure is highly centralized, with a reliance on key production hubs in East Asia for semiconductor fabrication and equipment assembly. This creates logistical complexities and exposes the German market to significant geopolitical dependencies and disruption risks. For the core and transport segments, optical fiber and specialized switching/routing gear are sourced globally. Germany's strategic decision to diversify vendor sourcing in the RAN and Core, driven by security concerns, translates into an increased need for complex supply chain management and integration services, further fueling demand for local systems integrators and professional services.

Germany 5G Network Infrastructure Market Government Regulations:

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Germany | Bundesnetzagentur (BNetzA) – Spectrum Auctions & Obligations | Directs infrastructure investment towards rural areas and transport routes; the 2019 auction imposed strict coverage requirements, directly boosting demand for low-band (long-range) RAN equipment. |

| Germany | BNetzA – Local 5G Spectrum (3.7-3.8 GHz) | Created a dedicated market for Private 5G network infrastructure; drives demand for small cell hardware, core network appliances, and specialized edge infrastructure for vertical industries. |

| Germany | Telekommunikationsgesetz (TKG) – Right to Gigabit Connectivity | Mandates the provision of high-speed services, reinforcing the necessity for MNOs to maintain aggressive 5G and fiber rollout programs, thereby sustaining long-term capital expenditure in Transport and Core infrastructure. |

Germany 5G Network Infrastructure Market Segment Analysis:

- By Deployment Mode: Standalone (SA) The transition to the 5G Standalone (SA) deployment mode is the single most important technical catalyst for immediate demand in the core network segment. Unlike Non-Standalone (NSA), which relies on the existing 4G/LTE core, SA architecture necessitates a complete overhaul of the control and user plane with a cloud-native 5G Core Network. This directly propels demand for specific infrastructure: virtualized network functions (VNF), containerized software, cloud orchestration platforms, and high-capacity, low-latency Transport or Backhaul Network components. Vodafone and Telefónica Deutschland’s commercial SA launches, with millions of migrated customers, underscore the immediate need for Ericsson's dual-mode 5G Core and Nokia's cloud-native solutions, as they must build out new, redundant, and geographically distributed core data centers. The primary growth driver is the requirement for features such as true network slicing and ultra-low latency, which are only possible in an SA environment and are essential for securing high-value contracts in the manufacturing and automotive sectors. This is an imperative for MNOs to shift from being mere connectivity providers to service enablers.

- By End-User: Manufacturing and Industrial Automation The German manufacturing sector, the backbone of its economy and a global leader in Industry 4.0, is the primary source of premium demand for 5G infrastructure. This necessity is intrinsically linked to the necessity for ultra-reliable, low-latency communication (URLLC) to support mission-critical applications such as autonomous guided vehicles (AGVs), predictive maintenance utilizing massive sensor arrays, and remote-controlled robotic systems. The availability of locally licensed spectrum (3.7-3.8 GHz) from BNetzA is a critical, verifiable growth driver, as it empowers companies like Siemens and Bosch to deploy their own Private 5G Networks, bypassing public network congestion and guaranteeing security and dedicated quality of service (QoS). This specific end-user demand segment pulls infrastructure purchases toward Edge Infrastructure, which is needed to process data locally within the factory floor environment, reducing latency to single-digit milliseconds and creating a high-growth market for specialized small cell RAN and integrated computing solutions.

Germany 5G Network Infrastructure Market Competitive Environment and Analysis:

The German 5G network infrastructure market is dominated by a competitive triad of MNOs—Deutsche Telekom, Vodafone, and Telefónica Deutschland (O2)—whose investment strategies dictate the demand for equipment and software provided by a globally diverse group of vendors. The core and RAN equipment segments are a high-stakes arena, where Nokia and Ericsson maintain a significant footprint. Strategic vendor selection is heavily influenced by the government's security guidelines, which mandate multi-vendor core networks, effectively ensuring market diversification. Competition among MNOs centers on a race to achieve market-leading 5G Standalone availability and capacity, which directly translates into accelerated infrastructure purchase orders.

- Deutsche Telekom AG: Deutsche Telekom AG (DT) is the incumbent and dominant MNO in Germany, maintaining a lead in 5G population coverage, which it reported at approximately 99% of households as of late 2025. DT’s strategic positioning is predicated on a dual-pronged infrastructure strategy: using low-band frequencies for comprehensive national coverage and mid-band (3.6 GHz) in urban and industrial centers for high-capacity service. This approach drives robust demand for a diverse portfolio of RAN hardware and a comprehensive Transport or Backhaul Network utilizing fiber. Key initiatives include its commitment to Open RAN principles and the rollout of its own 5G Standalone Core, often utilizing a mix of vendor solutions for resilience and technological flexibility, thereby maintaining its market share through rapid deployment and technological advancement.

- Ericsson GmbH Ericsson GmbH is a principal infrastructure vendor, acting as a critical technology partner for the major German MNOs, notably in the rapid deployment of cloud-native 5G Core. The company's strategic positioning is rooted in its proven ability to deliver end-to-end 5G solutions, including advanced RAN equipment (Massive MIMO) and the dual-mode 5G Core software solution. Ericsson played a foundational role in Vodafone Germany's commercial launch of 5G Standalone, demonstrating its capability to handle complex network modernization projects that involve migrating millions of subscribers to a new core architecture. This focus on 5G Standalone and network slicing software positions Ericsson to capture recurring demand from MNOs seeking to commercialize advanced, high-margin enterprise services.

- Nokia Solutions and Networks GmbH & Co. KG Nokia maintains a formidable presence as a key infrastructure vendor, supplying high-performance RAN and core network components. The company's strategic focus in Germany includes significant involvement in the 5G rollout for multiple MNOs, providing both radio access and crucial Transport and Core Network elements. Nokia is actively engaged in the German private 5G market, supplying campus network solutions to industrial enterprises, often in partnership with MNOs or directly. This diversification into the Private 5G segment, providing both the physical infrastructure and the necessary Edge Infrastructure to support Industry 4.0 applications, secures a vital demand stream independent of the public MNO coverage race.

Germany 5G Network Infrastructure Market Developments:

- August 2025 - Deutsche Telekom - Network Capacity Expansion: Deutsche Telekom reported adding 132 new mobile radio sites and upgrading the capacity at 533 existing locations in a single month. This capacity addition, which included activating 5G for the first time at 128 sites, demonstrates the ongoing, aggressive capital expenditure required to meet the BNetzA's coverage obligations and address surging mobile data traffic, thereby sustaining robust demand for RAN and Transport Network equipment.

- November 2024 - Telefónica Deutschland (O2) - 5G Cloud Core Milestone: O2 Telefónica announced that one million customers in Germany were actively using their advanced, cloud-based core network just six months after the launch of the innovative 5G Cloud Core. This achievement validates the rapid migration toward cloud-native core architectures, which drives the demand for software-defined networking, network management, and orchestration solutions to handle the disaggregated, containerized network functions.

- October 2024 - O2 Telefónica - 5G Standalone Carrier Aggregation: O2 Telefónica achieved peak download speeds exceeding 1.7 Gbit/s by successfully bundling four frequency bands in 5G Standalone mode. This technical development, involving advanced RAN and software integration, is a direct market development aimed at unlocking higher capacity and faster speeds for subscribers, thereby creating an immediate demand for advanced RAN software features and robust backhaul capacity to support the increased throughput.

Germany 5G Network Infrastructure Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 4.12 billion |

| Total Market Size in 2031 | USD 5.687 billion |

| Growth Rate | 6.66% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Spectrum Band, Deployment Type, End-User |

| Companies |

|

Germany 5G Network Infrastructure Market Segmentation:

- BY COMPONENT

- RAN

- 5G Core Network

- Transport or Backhaul Network

- Edge Infrastructure

- Network Management and Orchestration

- Others

- BY SPECTRUM BAND

- Low-band (<1 GHz)

- Mid-band (1-6 GHz)

- High-band/ mmWave (>24 GHz)

- BY DEPLOYMENT TYPE

- Public Carrier Networks

- Private 5G Networks

- Shared Infrastructure

- Hybrid

- BY DEPLOYMENT MODE

- Standalone

- Non-Standalone

- BY END-USER

- Telecom Operators

- Manufacturing and Industrial Automation

- Transportation & Logistics

- Energy and Utilities

- Healthcare

- Education

- Retail and Hospitality

- Public Sector

- Other Enterprises