Report Overview

Germany E-Hailing Market - Highlights

Germany E-Hailing Market Size:

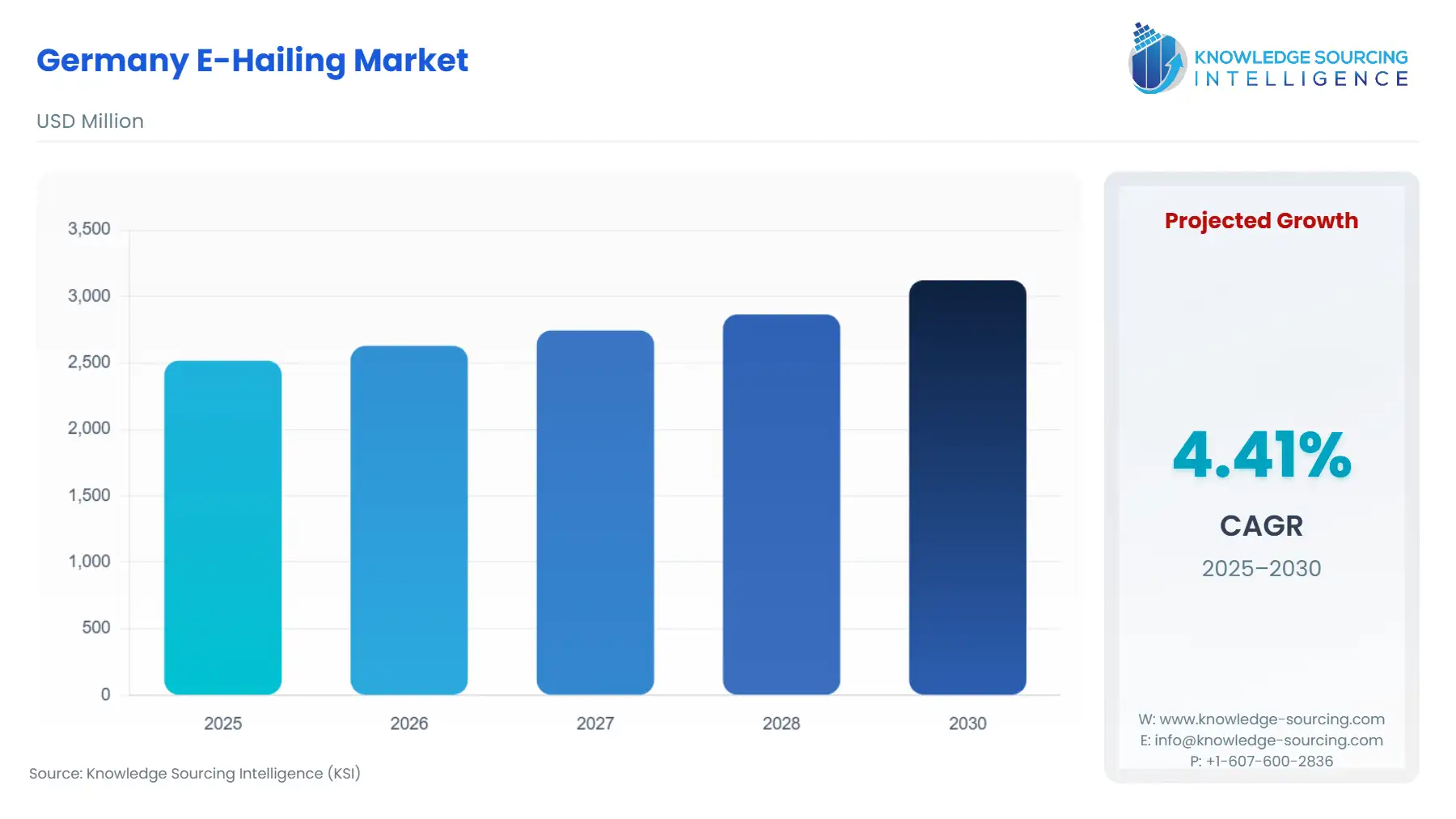

Germany E-Hailing Market is projected to grow at a 4.41% CAGR, reaching USD 3.124 billion by 2030 from USD 2.518 billion in 2025.

Germany E-Hailing Market Key Highlights:

- High urbanization, digital integration (AI, IoT, MaaS), and increasing smartphone usage are accelerating adoption and improving customer experience in ride-hailing, especially in cities like Berlin, Bavaria, and Baden-Württemberg.

- The market is represented by key players such as Uber and Free Now along with local taxi collaborations and continuous electrification of fleets that bring a variety of opportunities in terms of investments, green mobility and advanced mobility services.

Factors that may help drive e-hailing in Germany include the widely accepted incentives on vehicles that use electricity coupled with the government measures to reduce emitted emissions and high rates of digital payment migration, urbanisation, and the need of easy, economical personal transport. New features such as AI implementation and Mobility-as-a-Service increasing the use and market penetration.

Germany E-Hailing Market Overview & Scope:

The Germany E-Hailing market is segmented by:

- By Service Type: The most popular of the service sub-categories in Germany is the ride hailing with the advantages of convenience and efficiency offered by ride booking apps like Uber and Free Now. The most popular and rising part of ride sharing and other specialty services is the on-demand, and point-to-point ride hailing option.

- By Device Type: Smartphones are by far the most used device to access e-hailing services in Germany and this is due to the high popularity of ownership of mobile devices and the ease of use of booking/tracking routes and payment through dedicated applications. Tablet computers and other devices are a trivial part of the business, used primarily as specialized fleet bookings or corporate customers.

- By Vehicle Type: The vehicle type with the majority of the e-hailing rides is the four-wheelers that constitute over two-thirds of rides, because of their comfort, safety, and versatility (rider-to-business and rider-to-rider). Particularly popular in this category of cars are sedans, whereas the SUVs are becoming more popular to serve as more environmentally friendly and premium-priced utilities.

- By End-User: Personal (B2C) Representing the majority end-user group, individual consumers use e-hailing to travel on a daily basis, during leisuredays, and have the flexibility of commuting in the urban market. The corporate (B2B) business is on the rise, especially by volume in employee travel and events but the predominant user is still the individual.

- By Region: Bavaria and Baden-Wurttemberg stand out as prominent e-hailing markets in Germany due to high urbanization of the cities such as Munich and Stuttgart and being keen on digital mobility.

Top Trends Shaping the Germany E-Hailing Market

- Electrification and Sustainability Focus

- The intentional increase in electric and hybrid vehicles in e-hailing fleets is heavily encouraged by government subsidies along with the self-motivation of customers to strive to reach the goals set by Germany on the reduction of such emissions and the improvement of climate standards.

- High Technology Integration

- AI, the IoT, and big data analysis are also becoming more common to customize the experiences of the riders, better manage fleet, improve safety, and allow the pilot projects involving autonomous vehicles. Mobility-as-a-Service (MaaS) solutions are also on the rise to comprehensively interlace different means of transport through digital connectivity in a single system.

Germany E-Hailing Market Growth Drivers vs. Challenges

Drivers:

- Increasing Urbanization: Urbanization is a driving factor in the Germany e-hailing market as it promotes the growth in demand of transportation that is flexible and convenient. This city expansion is leading to increased traffic jams and limited parking reasons that are making shared mobility very appealing.

- Technological Advancements: Advances in technology, such as Artificial Intelligence (AI) and Mobility-as-a-Service (MaaS) frameworks, enhance wonderful personalization and ride optimization. These inventions provide the possibility to have more efficient fleet management, safety measures, and the ability to integrate with other transport options.

Germany E-Hailing Market Competitive Landscape:

The market is fragmented, with many notable players:

- Company Initiatives: In August 2025, Baidu, Inc., a leading AI company with a strong Internet foundation, and Lyft, Inc. one of Europe's largest transportation networks, today announced a strategic partnership for Lyft to deploy Baidu's Apollo Go autonomous vehicles (AVs) across key European markets through the Lyft platform.

Germany E-Hailing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Germany E-Hailing Market Size in 2025 | USD 2.518 billion |

| Germany E-Hailing Market Size in 2030 | USD 3.124 billion |

| Growth Rate | CAGR of 4.41% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Berlin–Brandenburg, North Rhine-Westphalia, Bavaria, Baden-Württemberg, Hesse, Others |

| List of Major Companies in the Germany E-Hailing Market |

|

| Customization Scope | Free report customization with purchase |

Germany E-Hailing Market Segmentation:

- By Service Type

- Ride Sharing

- Ride Hailing

- Others

- By Device Type

- Smartphones

- Tablets

- Others

- By Vehicle Type

- Two-Wheeler

- Three-Wheeler

- Four-Wheeler

- Sedans

- SUVs

- Others

- By End-User

- Personal (B2C)

- Corporates (B2B)

- By Region

Our Best-Performing Industry Reports:

Navigation:

- Germany E-Hailing Market Size:

- Germany E-Hailing Market Key Highlights:

- Germany E-Hailing Market Overview & Scope:

- Top Trends Shaping the Germany E-Hailing Market

- Germany E-Hailing Market Growth Drivers vs. Challenges

- Germany E-Hailing Market Competitive Landscape:

- Germany E-Hailing Market Scope:

- Our Best-Performing Industry Reports: