Report Overview

United Kingdom E-Hailing Market Highlights

United Kingdom E-Hailing Market Size:

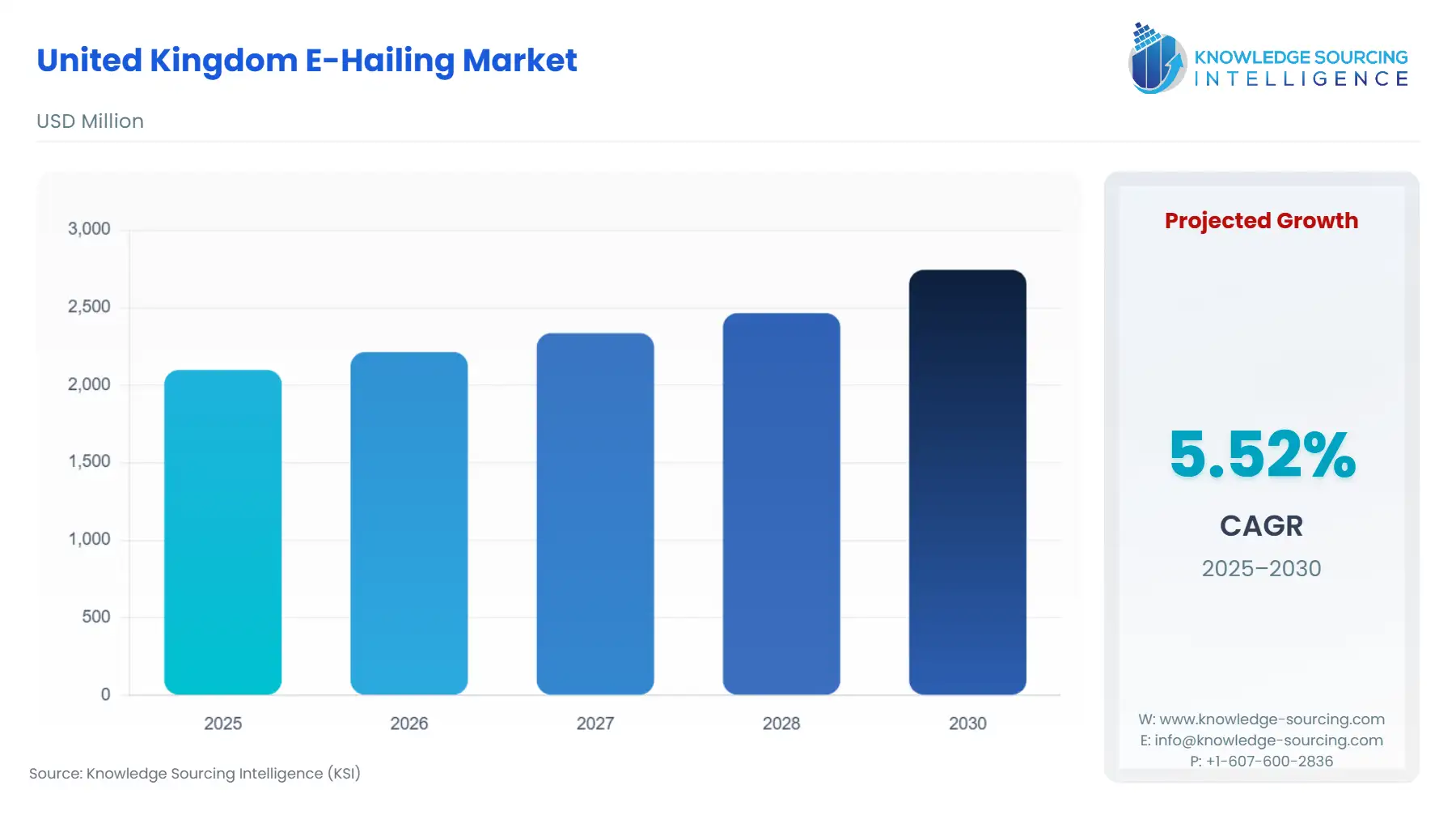

United Kingdom E-Hailing Market, sustaining a 5.51% CAGR, is anticipated to rise from USD 2.098 billion in 2025 to USD 2.744 billion by 2030.

Factors that may help drive e-hailing in the United Kingdom include the widely accepted incentives on vehicles that use electricity, coupled with the government measures to reduce emissions and high rates of digital payment migration, urbanisation, and the need for easy, economical personal transport. New features such as AI implementation and Mobility-as-a-Service are further increasing the use and market penetration.

United Kingdom E-Hailing Market Overview & Scope:

The United Kingdom E-Hailing market is segmented by:

- By Service Type: The most popular of the service sub-categories in the United Kingdom is the ride-hailing service, with the advantages of convenience and efficiency offered by ride booking apps like Uber and Free Now.

- By Device Type: Smartphones are by far the most used device to access e-hailing services in the United Kingdom, and this is due to the high popularity of ownership of mobile devices and the ease of use of booking/tracking routes and payment through dedicated applications. Tablet computers and other devices are a trivial part of the business, used primarily for specialized fleet bookings or corporate customers.

- By Vehicle Type: Four-wheelers dominate the e-hailing market, accounting for more than two-thirds of total rides. The factors that make them popular include comfort, safety, and suitability as a travel means to both individuals and businesses. Under this type, divisions are based on the use of a sedan, which is the most popular type of car, as it is not expensive and convenient, whereas sport-utility vehicles (SUVs) are in demand as luxury vehicles, being more spacious and increasingly being sold as an ecologically neutral vehicle.

- By End-User: The B2C category is the highest share, where people use e-hailing services as part of daily transportation, leisure, and ad-hoc urban mobility. In the meantime, the business-to-business (corporate) segment is growing continuously, particularly in employee transportation as well as business travel and events. Although its growth is experienced, individual consumers remain the most significant determinant of demand in the market.

- By Region: By city, the market has been segmented into London, Manchester, Birmingham, Leeds, Liverpool, Glasgow, and Others.

Top Trends Shaping the United Kingdom E-Hailing Market

- Mobility as a Service Integration

- UK-based e-hailing companies are taking steps to deliver Mobility-as-a-Service by producing seamless planning, booking, and charging of multiple transportation options such as buses, trains, e-scooters, and taxis, all in one convenient application. This trend promotes integrated, flexible urban mobility.

- High Technology Integration

- The concept of the innovative use of AI, the IoT, and big data analysis to tailor the corresponding experiences of the riders, to more effectively manage the fleet, and to enhance safety, as well as to enable the pilot projects involving autonomous vehicles, is also becoming more frequent. There is also an increase in Mobility-as-a-Service (MaaS) platforms that bring together various modes of transport in a single integrated system via a digital form of connectivity.

United Kingdom E-Hailing Market Growth Drivers vs. Challenges

Drivers:

- Increasing Urbanization: One of the major factors that contributes to the United Kingdom e-hailing market is urbanization, since it leads to the increased demand for flexible and convenient transport. Increased traffic jams and a dearth of parking are a few of the reasons why shared mobility seems highly attractive in this city expansion.

- Shift Toward Sustainability and Green Mobility: The increase in sustainability and green mobility is continuing to accelerate. Regulatory action, such as the introduction of the Ultra Low Emission Zone (ULEZ) in London and government pledges to meet net-zero goals, is influencing e-hailing operators to switch to electric and hybrid vehicles. This goes hand in hand with the consumer desire to utilize environmentally friendly means of transportation.

United Kingdom E-Hailing Market Competitive Landscape

The market is fragmented, with many notable players:

- Company Initiatives: In August 2025, Baidu, Inc., a leading AI company with a strong Internet foundation, and Lyft, Inc., one of Europe's largest transportation networks, today announced a strategic partnership for Lyft to deploy Baidu's Apollo Go autonomous vehicles (AVs) across key European markets through the Lyft platform.

United Kingdom E-Hailing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| United Kingdom E-Hailing Market Size in 2025 | USD 2.098 billion |

| United Kingdom E-Hailing Market Size in 2030 | USD 2.744 billion |

| Growth Rate | CAGR of 5.51% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | London, Manchester, Birmingham, Leeds, Liverpool, Glasgow, and Others |

| List of Major Companies in the United Kingdom E-Hailing Market |

|

| Customization Scope | Free report customization with purchase |

United Kingdom E-Hailing Market Segmentation:

- By Service Type

- Ride Sharing

- Ride Hailing

- Others

- By Device Type

- Smartphones

- Tablets

- Others

- By Vehicle Type

- Two-Wheeler

- Three-Wheeler

- Four-Wheeler

- Sedans

- SUVs

- Others

- By End-User

- Personal (B2C)

- Corporates (B2B)

- By Region

- London

- Manchester

- Birmingham

- Leeds

- Liverpool

- Glasgow

- Others

Our Best-Performing Industry Reports:

Navigation:

- United Kingdom E-Hailing Market Size:

- United Kingdom E-Hailing Market Key Highlights:

- United Kingdom E-Hailing Market Overview & Scope:

- Top Trends Shaping the United Kingdom E-Hailing Market

- United Kingdom E-Hailing Market Growth Drivers vs. Challenges

- United Kingdom E-Hailing Market Competitive Landscape

- United Kingdom E-Hailing Market Scope:

- Our Best-Performing Industry Reports: