Report Overview

Germany Shampoo Market - Highlights

Germany Shampoo Market Size:

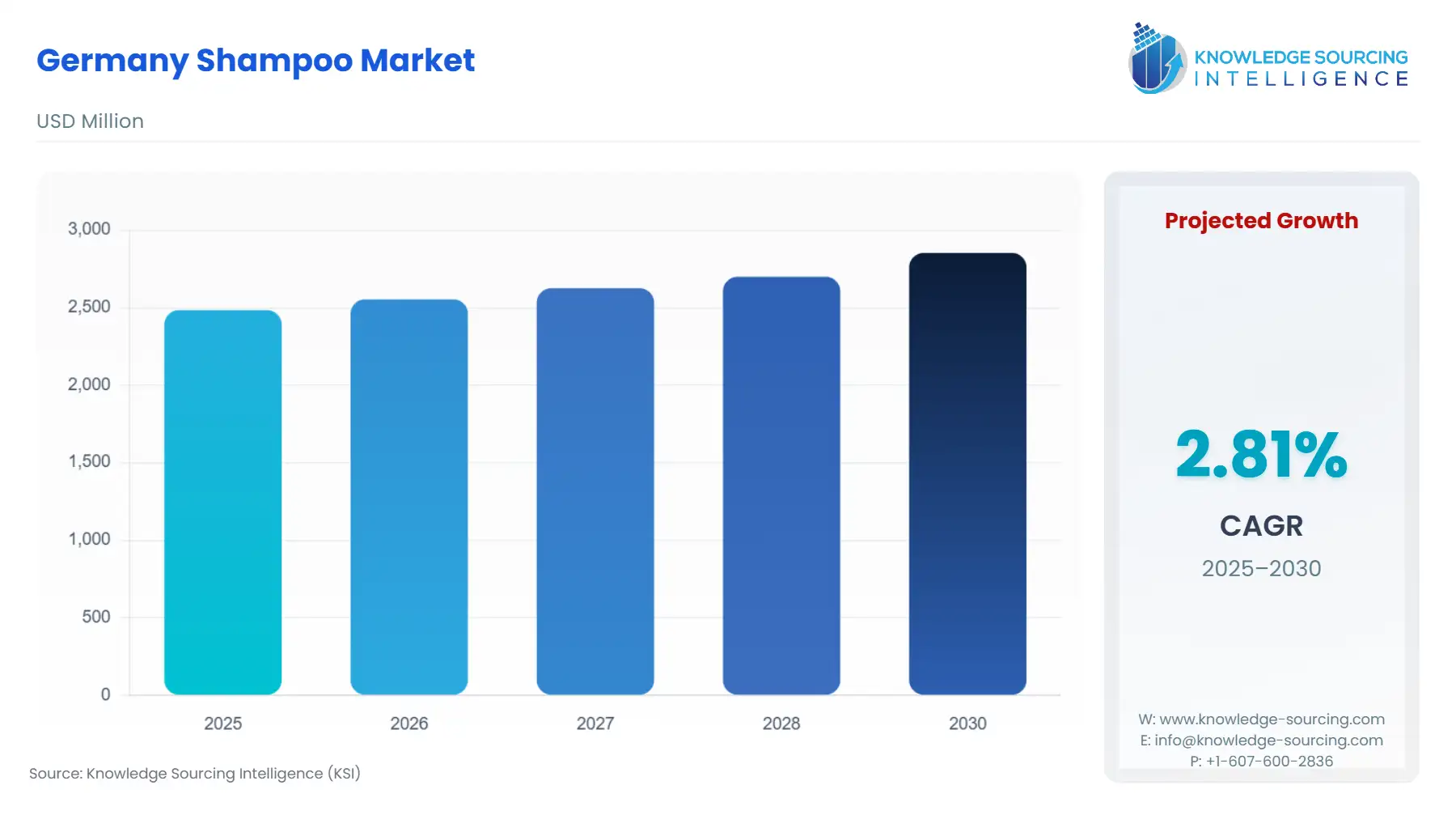

The Germany shampoo market is projected to grow at a CAGR of 2.81% during the projected period (2025-2030), reaching a market size of USD 2.853 billion by 2030 from USD 2.484 billion by 2025.

The dynamic environment of the German shampoo industry is driven by consumer preferences for varied formulas, sustainability, and ease of use. In Germany, dry shampoos have become quite popular as a major part of the larger personal care sector, meeting the changing needs and preferences of consumers. Consumer decisions in Germany are increasingly influenced by sustainability and environmental concerns, and the shampoo business is no exception. Companies use biodegradable formulations, ecological packaging, and natural and organic components to meet consumer demand for eco-friendly products. German consumers' eco-consciousness has led shampoo companies to respond to this trend by emphasizing their commitment to clean and eco-friendly beauty.

Germany Shampoo Market Overview & Scope:

The German shampoo market is segmented by:

- Product: The German shampoo market is divided into two segments based on product, non-medicated/regular and medicated/special purpose. It is expected that the non-medicated/regular sector would lead the German shampoo market share because of its broad availability and growing global acceptability of mass-produced goods. Non-medicated products are extensively utilized since they are less expensive and easier to find than their counterparts. The increasing availability of over-the-counter alternatives at pharmacies and drug stores contributes to the non-medicated shampoo segment's revenue.

- Application: The market is separated into two segments based on application, domestic and commercial. The household segment is anticipated to lead the market because of the wide range of products available.

- Distribution Channel: The market is divided into convenience stores, online stores, hypermarkets, supermarkets, and others based on the distribution channel. The availability of a wide range of products on supermarket shelves allowed hypermarkets and supermarkets to dominate the market. This enables customers to know their alternatives and purchase a specific product or combination of products based on their hair care requirements. The segment's rise was aided by the new trend of buying personal care goods in bulk at department stores and supermarkets.

- Manufacturers: The market is divided into private label, toll manufacturing, and multinational segments based on manufacturers. The multinational segment's growth in the market is propelled by the consistent supply of branded goods, the distribution networks of major multinational corporations, and a strong clientele. In Europe, Germany (€15.9 billion), France (€13.7 billion), Italy (€12.5 billion), the United Kingdom (€11.0 billion), Spain (€10.4 billion), and Poland (€5.2 billion) have the biggest national markets for cosmetics and personal care items.

Top Trends Shaping the German Shampoo Market:

- Personalization for various hair types

Customization is essential in the varied German shampoo industry to accommodate different hair types. Brands have adopted a customized approach to formulation and marketing for recognition of the requirements of German consumers. To solve the issue of excessive oiliness in finer hair types, manufacturers have produced variations with oil-absorbing qualities. For people who need moisture preservation and have thicker or curly hair, the market provides special dry shampoos. These formulas often contain moisturizing ingredients like aloe vera or argan oil to keep hair healthy and fight dryness. Consequently, the dry shampoo industry in Germany shows interest in meeting the unique requirements of different hair types. Customers can choose items specifically suited to their hair types and issues with confidence due to the clear customization in formulation and marketing techniques.

- The desire for organic and natural components

Products with natural and organic ingredients are becoming increasingly popular in Germany's shampoo industry. This demand is being driven by the German consumer, who is known for emphasizing sustainability and health-conscious options. As consumers look for cleaner and more environmentally responsible options, natural shampoos that are free of dangerous chemicals and artificial additives are becoming more and more popular. Customers are growing increasingly aware of the impact of personal care products on both their health and the environment, which is in line with the broader trend toward eco-friendly beauty and wellbeing. The natural substances appeal to German consumers, who value goods that support better hair and scalp without sacrificing morality or the environment.

Germany Shampoo Market Growth Drivers vs. Challenges:

Opportunities:

- Broad product availability to boost market expansion: Personal grooming with an emphasis on hair care is growing, which is making a substantial contribution to product sales. Companies that make hair care products are successfully addressing several hair-related problems, including dandruff, hair thinning, sebum secretions, and severe hair loss, by introducing anti-hair fall and anti-dandruff shampoos. Product sales will rise even more because of this trend's impressive growth. To broaden their portfolios, several well-known companies are releasing new items.

- A greater emphasis on product customization by manufacturers to promote market expansion: A growing number of industry players are moving toward personalization to accommodate a wide range of customer preferences and hair care requirements. Important market players are experimenting with new substances that could improve the quality of their goods. The market for protein- and vitamin-based products with many health advantages grows, and ingredients including biotin, probiotics, and fruit vitamins are being investigated.

Challenges:

- Restrictive Laws to Stop Growth: The German government enforces stringent laws on the cosmetics sector, such as limitations on ingredients and specifications for packaging. The tight laws of the nation, as well as EU-wide rules such as the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) directive, force brands to make sure that their goods adhere to exacting safety and ingredient standards. Manufacturers may have to spend more money on testing and reformulation to comply with these rules, which can impede product development and raise costs. Businesses are additionally challenged to strike a balance between product innovation and environmental responsibility by laws about sustainability and eco-friendly packaging.

Germany Shampoo Market Competitive Landscape:

The market is moderately fragmented, with many key players including Henkel AG & Co. KGaA, L'Oreal S.A., Procter & Gamble, Beiersdorf AG, and Unilever.

- Company Investment: In July 2024, the multinational skin care business Beiersdorf invested more than €200 million to start building a new logistics facility in Leipzig, Germany. By the time the facility is finished in 2027, it should generate about 450 additional jobs.

- Product Launch: In June 2024, Kao broadened its recognizable Guhl brand with the launch of Guhl Kids, a range of certified natural cosmetics created especially for kids. The products are pH skin-neutral and devoid of colorants, mineral oils, and silicones so that young scalps can be gently cared for. The line contains options for 2-in-1 shampoo and shower gel as well as 3-in-1 shampoo, conditioner, and shower gel.

Germany Shampoo Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Germany Shampoo Market Size in 2025 | US$2.484 billion |

| Germany Shampoo Market Size in 2030 | US$2.853 billion |

| Growth Rate | CAGR of 2.81% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Berlin, Bavaria, North Rhine-Westphalia, Hesse, Rhineland-Palatinate, Others |

| List of Major Companies in the Germany Shampoo Market |

|

| Customization Scope | Free report customization with purchase |

Germany Shampoo Market Segmentation:

- By Product

- By Application

- By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Stores

- Others

- By Manufacturers

- By Region