Report Overview

Global Bitterness Suppressors and Highlights

Bitterness Suppressors And Flavor Carriers Market Size:

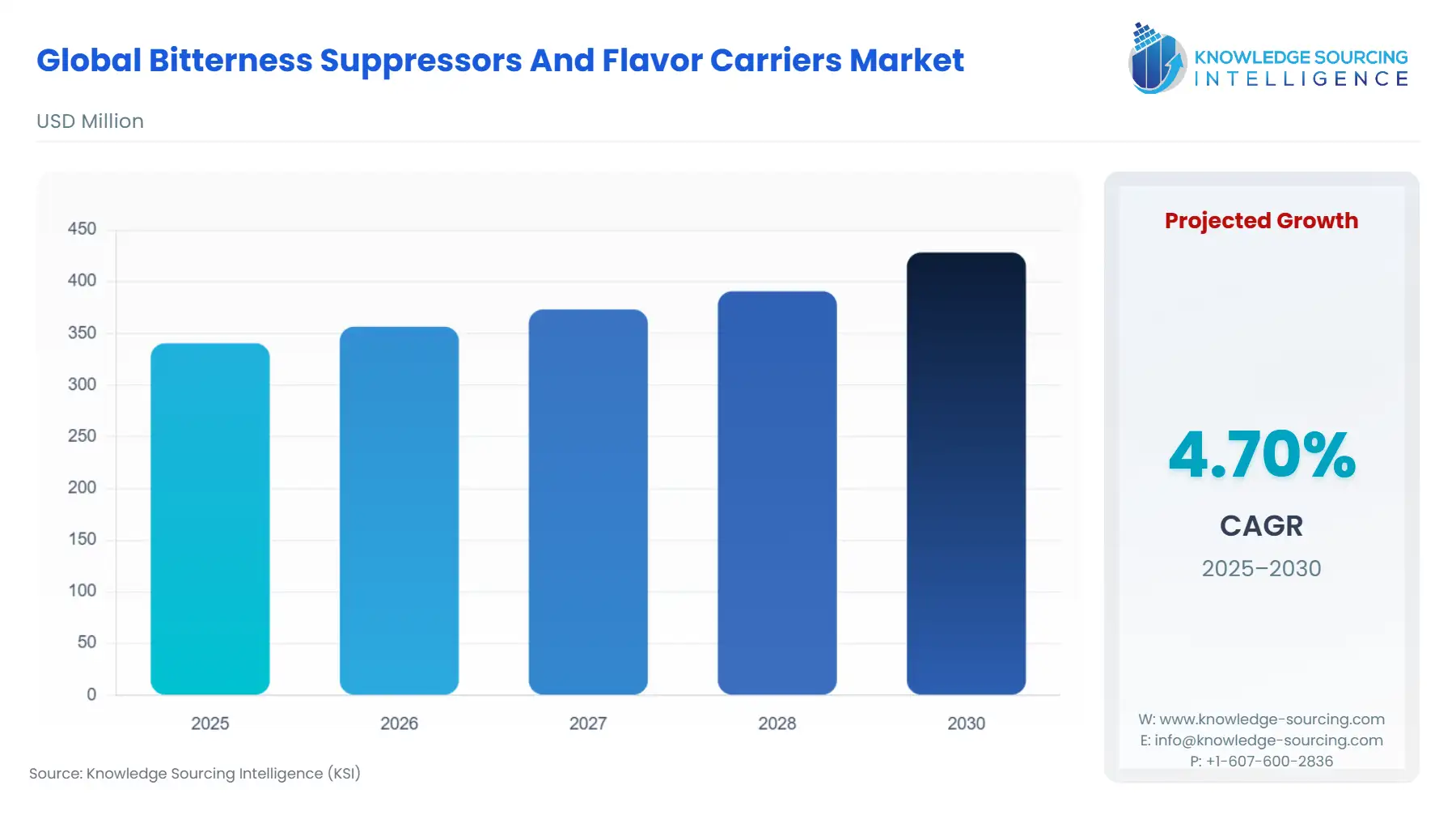

Global Bitterness Suppressors And Flavor Carriers Market is expected to grow at a 4.70% CAGR, increasing to USD 428.448 million by 2030 from USD 340.591 million in 2025.

The global market for bitterness suppressors and flavor carriers is a specialized but fundamental segment of the wider food ingredients and pharmaceutical excipients industry. Its growth trajectory is intrinsically linked to two parallel, non-negotiable industry imperatives: the consumer drive for healthier product profiles and the manufacturer's need for stable, palatable formulations. The increasing integration of functional ingredients—such as high-intensity sweeteners, plant proteins, or active pharmaceutical ingredients (APIs)—that inherently introduce undesirable bitter or astringent off-notes establishes a continuous technical challenge.

Global Bitterness Suppressors And Flavor Carriers Market Analysis

- Growth Drivers

The market's expansion is propelled by several macro-level trends that exert a direct and quantifiable influence on product demand. These trends necessitate sophisticated taste modification and delivery systems to successfully bring new-generation products to market.

The Functional Foods and Beverages Imperative: The accelerating consumer focus on preventative health drives a relentless increase in demand for functional foods, sports nutrition, and dietary supplements. These products often incorporate high concentrations of bioactive ingredients, including vitamins, minerals, herbal extracts, and high-intensity artificial or natural sweeteners like Stevia and monk fruit. A core technical challenge of these ingredients is their pronounced, lingering bitter or metallic aftertaste. The demand for bitterness suppressors is therefore directly proportional to the growth of the functional food sector; without effective masking, consumer rejection rates for products like protein bars, enhanced water, or no-sugar-added beverages would be commercially untenable. Formulators require advanced suppressor systems to achieve a palatable final product, making these solutions a non-negotiable cost of entry for functional product development.

Shifting to Plant-Based and Alternative Protein Sources: The structural movement away from animal-derived proteins toward plant-based alternatives—such as pea, soy, and rice proteins—is a significant demand catalyst. Plant proteins inherently possess distinct, often undesirable, earthy, beany, or bitter notes. Manufacturers of meat alternatives, dairy substitutes, and protein powders are heavily reliant on highly effective bitterness suppressors to neutralize these native off-flavors. This reliance is particularly acute in new-market segments like CBD-infused edibles, where the cannabidiol extract introduces a high degree of astringency and bitterness.

Regulatory Push for Sugar and Salt Reduction: Global public health initiatives and government mandates targeting the reduction of sugar and sodium intake, such as the voluntary targets set by the U.S. Food and Drug Administration (FDA) or specific sugar taxes across Europe, directly escalate the demand for taste modulation technologies. When sugar, a natural flavor modulator, is removed, it often exposes or intensifies latent bitterness from other ingredients or the product base itself. To achieve target reductions without compromising the consumer’s sensory experience, formulators must employ bitterness suppressors and flavor carriers to rebuild the lost body, mouthfeel, and balanced taste profile. The market for suppressors thus functions as a critical enabler for compliance with public health policies, driving consistent demand for low-sugar and low-sodium product lines.

Innovation in Pharmaceutical Palatability and Adherence: In the pharmaceutical sector, poor palatability is a leading cause of non-adherence, particularly for oral solid dosage forms and suspensions prescribed to pediatric and geriatric patients. Many APIs, especially antibiotics and certain antiretrovirals, possess intensely bitter characteristics. The development of patient-centric drug formulations mandates superior taste-masking solutions. This creates a specific, high-value demand for pharmaceutical-grade bitterness suppressors and highly stable flavor carriers. This demand is further amplified by the shift toward Over-The-Counter (OTC) drugs and nutritional supplements, where consumer choice heavily favors products with an acceptable sensory profile. Effective bitterness suppression is not merely a preference in this sector; it is a clinical and commercial imperative for ensuring therapeutic efficacy.

Advanced Flavor Encapsulation Technologies: The increasing use of sophisticated carrier systems, particularly encapsulation techniques (both micro- and nano-), drives demand for advanced carrier materials. Encapsulation is necessary to protect volatile flavor compounds from degradation (e.g., due to light, heat, or oxidation), ensure controlled release over time, and physically separate flavor from reactive matrix components. This technology addresses issues of flavor stability and shelf-life extension in complex food systems like powdered drink mixes, fortified cereals, and long-shelf-life savory products. The technical complexity and need for tailored carrier matrices, such as modified starches, gums, and specialty lipids, creates sustained demand for high-performance flavor carriers.

- Challenges and Opportunities

The primary challenge facing the market is the lack of a harmonized global regulatory framework for novel taste modulators. This forces manufacturers to invest heavily in multi-jurisdictional approvals, leading to protracted and costly R&D cycles. This regulatory uncertainty creates a significant time-to-market constraint, slowing the adoption of breakthrough technologies. A consequential opportunity, however, resides in the Natural/Clean-Label trend. The explicit consumer preference for recognizable, naturally-derived ingredients creates a high-growth pathway for suppressors and carriers sourced from botanical extracts or fermentation processes. Companies that can verify and scale these natural alternatives will capture premium pricing and dominate emerging clean-label product lines, thereby translating a consumer preference into increased and sustained market demand.

- Raw Material and Pricing Analysis

The Global Bitterness Suppressors and Flavor Carriers Market is a physical product market, relying on specialized raw materials such as gums (e.g., gum arabic, acacia), modified starches (e.g., maltodextrin), specialty lipids (e.g., vegetable oils, lecithin), and sugar alcohols. Pricing dynamics are complex, influenced by the volatility of agricultural commodity markets and geopolitical factors impacting crop yields and logistics. The shift toward natural materials introduces a supply chain dependency on specific botanical sourcing, often located in Asia-Pacific or South America. This concentration can lead to price spikes during adverse weather events or trade disruptions. The highly functional nature of the finished ingredients, however, allows manufacturers to maintain pricing power, as the value derived from successful taste masking often outweighs the raw material cost fluctuations, ensuring profit margins remain stable despite commodity volatility.

- Supply Chain Analysis

The supply chain is characterized by a high-value, low-volume flow of specialized chemical and natural ingredients, moving from agricultural processors and specialty chemical producers (Tier 3) to flavor houses (Tier 2), and finally to Food & Beverage and Pharmaceutical manufacturers (Tier 1). Key production hubs are concentrated in North America and Europe, leveraging advanced synthetic and fermentation capabilities. The major logistical complexity is maintaining the quality and stability of high-purity, often perishable, raw and intermediate materials, such as botanical extracts. The ongoing geopolitical tension and associated tariffs, particularly impacting trade between major economic blocs, introduce cost pressure and lead-time variability. Tariffs imposed on specialty chemicals and intermediate food ingredients disrupt the predictable flow of essential raw materials, forcing Tier 2 manufacturers to either diversify their sourcing geographically, absorbing higher qualification costs, or carry larger, more expensive safety stocks. This results in direct cost inflation that is ultimately passed along the value chain, impacting the market's overall growth rate.

Bitterness Suppressors And Flavor Carriers Market Government Regulations

Government regulation significantly shapes the demand landscape by defining acceptable ingredients and use levels.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union (EU) |

European Food Safety Authority (EFSA) / Regulation (EC) No 1334/2008 (Flavourings) |

Strict pre-market approval processes, especially for novel or synthetic suppressors, necessitate extensive toxicology data. This slows down the introduction of new technologies but drives demand for existing, approved "clean-label" carriers and suppressors. |

|

United States |

Food and Drug Administration (FDA) / Generally Recognized As Safe (GRAS) |

The GRAS self-affirmation process allows for faster market entry of new flavor carriers and suppressors, provided a scientific consensus on safety is achieved. This accelerates innovation and increases early-market demand for novel solutions. |

|

China |

National Health Commission (NHC) / GB Standards for Food Additives |

Stringent positive list system for approved additives. Demand for flavor carriers and suppressors must align strictly with approved substances, constraining product diversity but creating high demand for compliant, scaled ingredients. |

Global Bitterness Suppressors And Flavor Carriers Market In-Depth Segment Analysis

- By Application: Pharmaceuticals

The Pharmaceutical segment is poised for significant acceleration, driven by the patient-centric healthcare paradigm. This application requires the most technically advanced and rigorously tested taste-masking solutions due to the potency and often extreme bitterness of Active Pharmaceutical Ingredients (APIs). The demand driver here is directly linked to two primary factors: regulatory focus on pediatric medicine palatability and the commercial imperative of improving adherence for chronic disease management. For pediatric formulations, such as suspensions and chewable tablets, effective bitterness suppression is not optional; regulatory agencies scrutinize taste-masking data to ensure consumption compliance. In the chronic care sector, where daily medication is necessary, a more pleasant-tasting oral dose significantly increases the likelihood of long-term adherence. This sector’s demand is for high-purity, low-excipient, and solvent-free carriers, often utilizing micro-encapsulation to ensure controlled release and isolate the bitter API from the taste receptors until ingestion.

- By Type: Bitterness Suppressors

The Bitterness Suppressors segment is experiencing a higher-velocity growth curve than Flavor Carriers, primarily due to the ubiquitous adoption of functional ingredients that generate off-notes. The central demand driver is the technical challenge posed by sugar and fat reduction and the rise of plant-based proteins. Bitterness suppressors function through highly specific mechanisms—either by blocking bitter taste receptors or by complexing with bitter molecules—a complex task that generic flavor maskers cannot achieve. This segment's demand is uniquely tied to the increasing difficulty of formulating healthier, yet palatable, products. The development of next-generation suppressors, particularly those classified as natural flavorings derived from fermentation or natural extracts, is critical. This innovation directly solves the industry's most pressing sensory challenge: delivering a 'better-for-you' product that consumers will repurchase. The superior margin and technical specificity of bitterness suppressors will continue to drive strategic R&D and market focus.

Global Bitterness Suppressors And Flavor Carriers Market Geographical Analysis

- US Market Analysis

The US market for bitterness suppressors and flavor carriers is characterized by high innovation and rapid product adoption, driven by a robust dietary supplement and functional food sector. The local demand factor is the consumer's aggressive embrace of low-sugar, high-protein, and cannabis/CBD-infused products. The relative flexibility of the FDA's GRAS status allows new masking agents and carrier systems to enter the market quickly, propelling a fast development cycle. US manufacturers prioritize natural and Non-GMO Project Verified status for these ingredients, creating specific, high-specification demand for natural carrier systems like proprietary starches and vegetable glycerins.

- Brazil Market Analysis

In Brazil, the market growth is underpinned by the country's large and expanding processed food and beverage industry and a rising middle class with increasing disposable income. Local demand is heavily influenced by the consumption of regional functional beverages (e.g., yerba mate-based products) and the push to reformulate traditional food and drink to meet new national nutritional guidelines, often requiring sugar reduction. The demand is focused on cost-effective, high-efficacy flavor carriers and suppressors that can withstand the high-heat processing conditions typical of mass-market, shelf-stable goods.

- Germany Market Analysis

The German market is dictated by a strong adherence to 'Reinheitsgebot' (purity) principles and the rigorous interpretation of EU regulations. Demand for flavor carriers and suppressors is driven by the country's dominant premium functional food and dairy-alternative sectors. Manufacturers show a strong preference for ingredients that comply with the EU's strict flavoring and food additive positive lists. This preference translates into high demand for highly-qualified, natural carriers and suppressors with a clean-label profile that can meet the discerning German consumer's expectation of ingredient simplicity and transparency.

- Saudi Arabia Market Analysis

The Saudi Arabian market is growing, primarily fueled by significant government investment in the healthcare sector and an expanding, health-conscious, young population. Local demand is concentrated in the dietary supplement and fortified food segments, specifically for products addressing lifestyle diseases. The hot climate and long logistical chains emphasize the need for highly stable and encapsulated flavor carriers to prevent degradation during storage and transport. Religious compliance is paramount, necessitating the use of strictly Halal-certified ingredients.

- China Market Analysis

The Chinese market is one of the fastest-growing in the world, propelled by rapid urbanization and the massive scale of its domestic food, beverage, and traditional Chinese medicine (TCM) industries. The primary demand factor is the need for sophisticated taste masking in TCM formulations, which often possess profound bitterness. Furthermore, the massive production of functional food and nutritional supplements for its vast domestic market creates colossal demand for both scaled, cost-effective flavor carriers and natural bitterness suppressors that comply with the NHC's evolving GB standards for food additives.

Global Bitterness Suppressors And Flavor Carriers Market Competitive Environment and Analysis

The Global Bitterness Suppressors and Flavor Carriers market exhibits a moderately concentrated competitive landscape, dominated by a few multinational flavor and ingredient houses that leverage extensive R&D, global regulatory expertise, and integrated supply chains. The competitive edge is found in proprietary technologies, specifically advanced encapsulation and receptor-blocking mechanisms, which are difficult for smaller firms to replicate. Competition revolves around the ability to offer natural, clean-label alternatives and provide co-development services to assist CPG and pharmaceutical clients with complex taste challenges.

- Givaudan

Givaudan, a global leader in the flavor and fragrance industry, strategically positions itself through its Taste & Wellbeing division. The company’s core strategy is to integrate its flavor creation expertise with proprietary taste modulation technology, including bitterness suppressors marketed under its comprehensive portfolio.

- Symrise AG

Symrise competes through a focus on natural, sustainable, and integrated ingredient solutions. The company’s taste solutions segment positions its bitterness suppression and flavor carrier offerings within a broader platform of 'culinary expertise' and natural ingredient sourcing.

Bitterness Suppressors and Flavor Carriers Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 340.591 million |

| Total Market Size in 2031 | USD 428.448 million |

| Growth Rate | 4.70% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Technology, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Bitterness Suppressors and Flavor Carriers Market Segmentation:

- GLOBAL BITTERNESS SUPPRESSORS AND FLAVOR CARRIERS MARKET BY TYPE

- Bitterness Suppressors

- Flavor Carrirers

- GLOBAL BITTERNESS SUPPRESSORS AND FLAVOR CARRIERS MARKET TECHNOLOGY

- Encapsulated

- Non-Encapsulated

- GLOBAL BITTERNESS SUPPRESSORS AND FLAVOR CARRIERS MARKET BY APPLICATION

- Food & Beverage

- Pharmaceuticals

- Others

- GLOBAL BITTERNESS SUPPRESSORS AND FLAVOR CARRIERS MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America