Report Overview

Global Mint Market - Highlights

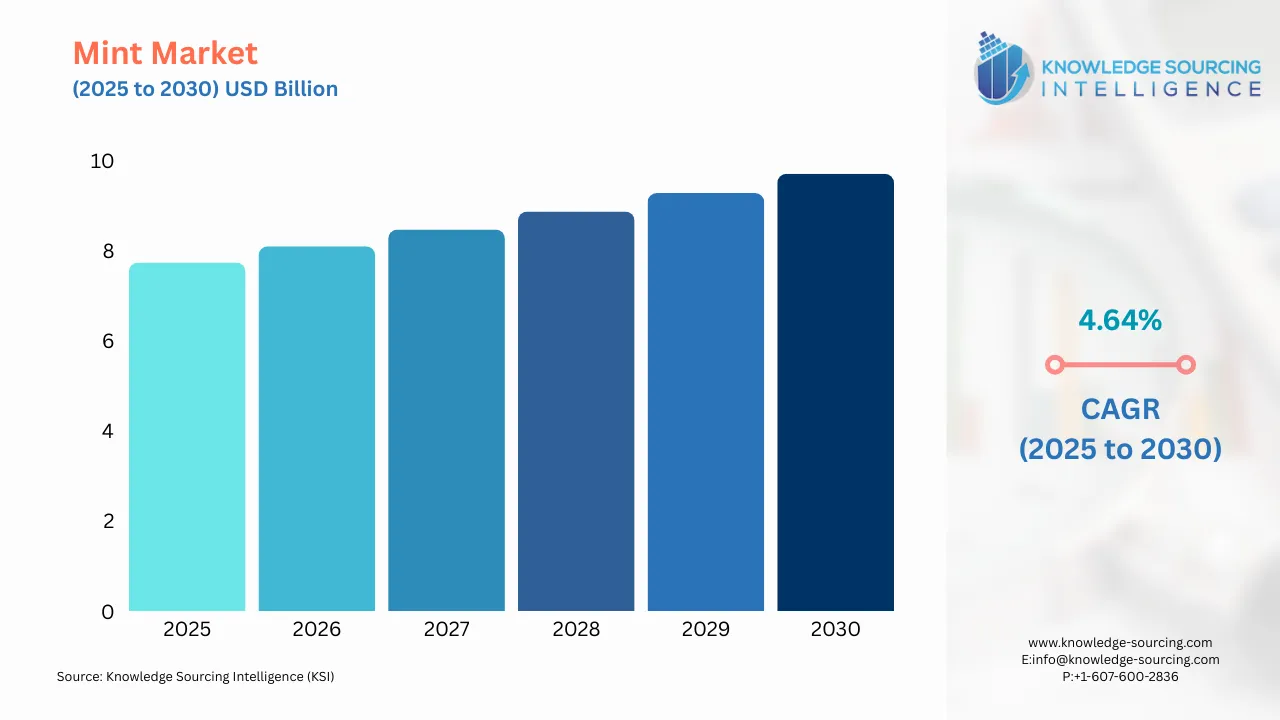

Mint Market Size:

The global mint market is projected to grow at a CAGR of 4.64%, from US$7.740 billion in 2025 to US$9.709 billion in 2030.

Mint is a very widely used herb, valued for its refreshing aroma and flavor. It is commonly used in culinary, medicinal, and cosmetic applications. Under the genus Mentha come different species, such as spearmint (Mentha spicata), peppermint (Mentha × piperita), and wild mint (Mentha arvensis). Mint is cool and refreshing because of the menthol, which it contains as its primary active component. In cooking, it adds flavor to beverages, desserts, sauces, or other savory dishes. Medicinally, it is known to assist in digestion, relieve headaches, and soothe respiratory conditions. Its essential oils are widely used in toothpaste, mouthwash, and skincare products, which makes mint a versatile and widely cherished plant.

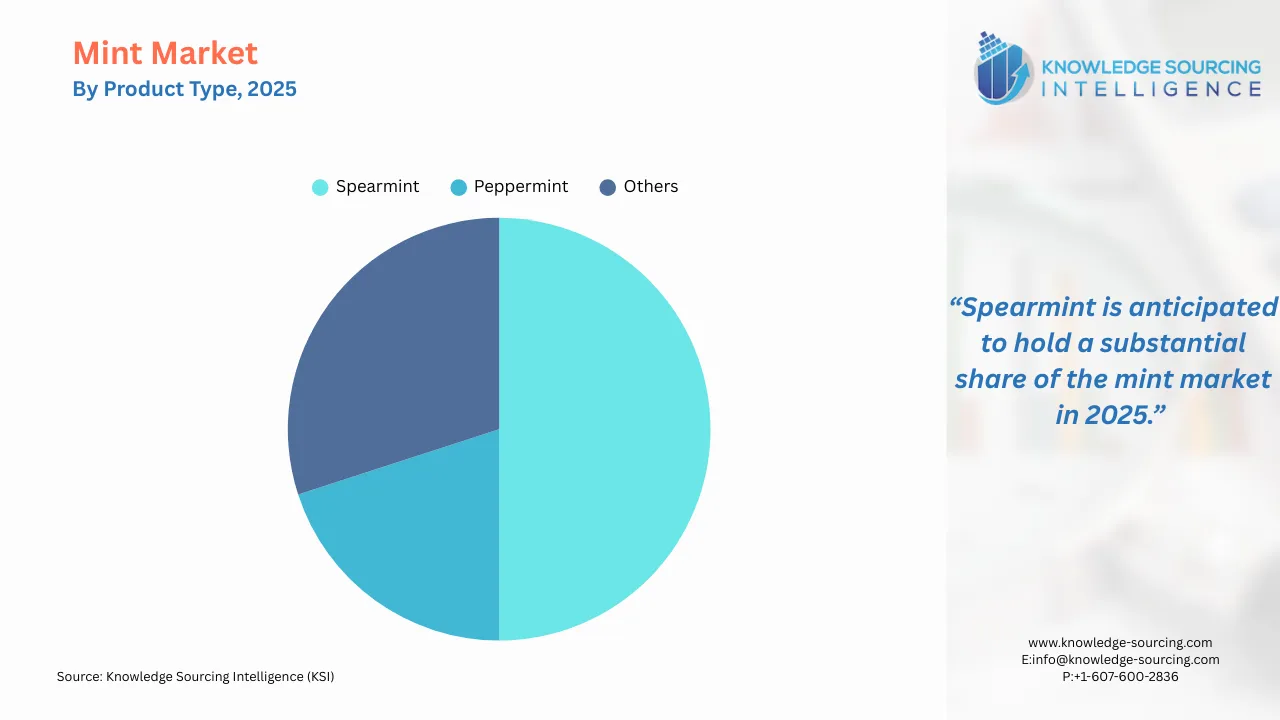

The mint market is growing because of its widespread use in food, beverages, cosmetics, and pharmaceuticals. Mint, especially the types of peppermint and spearmint, is used for its essential oils as flavoring agents in confectionery, chewing gums, teas, and beverages. Its medicinal properties, such as digestive aid and cooling effects, make it popular in traditional and modern medicine and aromatherapy.

Mint Market Growth Drivers:

- Increasing concerns among individuals to consume healthy food and improve oral hygiene

Most consumers these days prefer to consume sugar-free mints to maintain oral health and keep their teeth and gums healthy by consuming breath mints and chewing gums. These gums sometimes contain substances such as Xylitol, among others, to aid in teeth whitening.

Therefore, these factors are increasing the demand for mint and bolstering the market growth over the forecast period. In addition, some individuals are consuming power mints or stronger mints due to the prevalence of bad breath or other symptoms to mask the odours and keep their mouths fresh and free from bacteria.

Furthermore, the usage of mint in different foods and beverages is associated with many health benefits. Its usage is being promoted by chefs, restaurants, and people globally. Some health benefits include relief from conditions such as nausea, headaches, respiratory disorders (for example, coughs), and depression. Additionally, it is preferred in beauty and cosmetic products to aid in improving skin texture and removing acne.

Mint is an increasingly popular condiment used in different cuisines to provide a distinct taste to various dishes and improve their flavor profile. Mint is used in dips to serve different types of chips, or mint can be used as a garnish on meat with a spicy and earthy taste to provide a cool zing.

In addition, mint is used in bakery items and desserts with chocolate and other sweeter ingredients to provide a cool but sweet flavor. Consequently, mint is cool and is extensively used in countries with hotter climates to cool beverages to provide a fresh and cooling sensation and help lower perspiration levels and the body's temperature. Thus, these widespread uses contribute to market growth over the forecast period.

- Increasing focus of market players on products being offered

The offering of better varieties of mint with enhanced properties, such as quality and flavor, among others, by existing and new players is increasing its adoption and propelling the market growth further over the forecast period. For instance, McCormick & Company, Inc., which is among the leading producers and sellers of herbs and spices, offers their product “MCCORMICK GOURMET ORGANIC MINT.” This is an organic product that can add a subtle and sweeter taste to the food and a cooling and soothing effect to beverages and vegetables, among other items. Moreover, KEYA FOODS, an India-based company that deals with producing and selling spices and herbs, offers a wide range of products under its portfolio. It offers a product called the “KEYA Mint.” This product is extensively used in Mughlai and North Indian cuisines to impart robust flavors to meat, chicken, salads, and desserts globally, such as ice cream and some beverages, among others.

Perfetti Van Melle, one of the leading companies involved in producing and selling confectionery and other products, offers different types of breath mints under their product portfolio. Some of the products they offer are “Mentos NOW Mints,” which are available in three flavors: Orange, Sweetmint, and Eucamenthol. All of these products are offered in sugar-free variants. It is also the parent brand of Happydent, among the famous brands of Xylitol-added Chewing Gums, and is available in different flavors such as Spearmint, Fruit, and others.

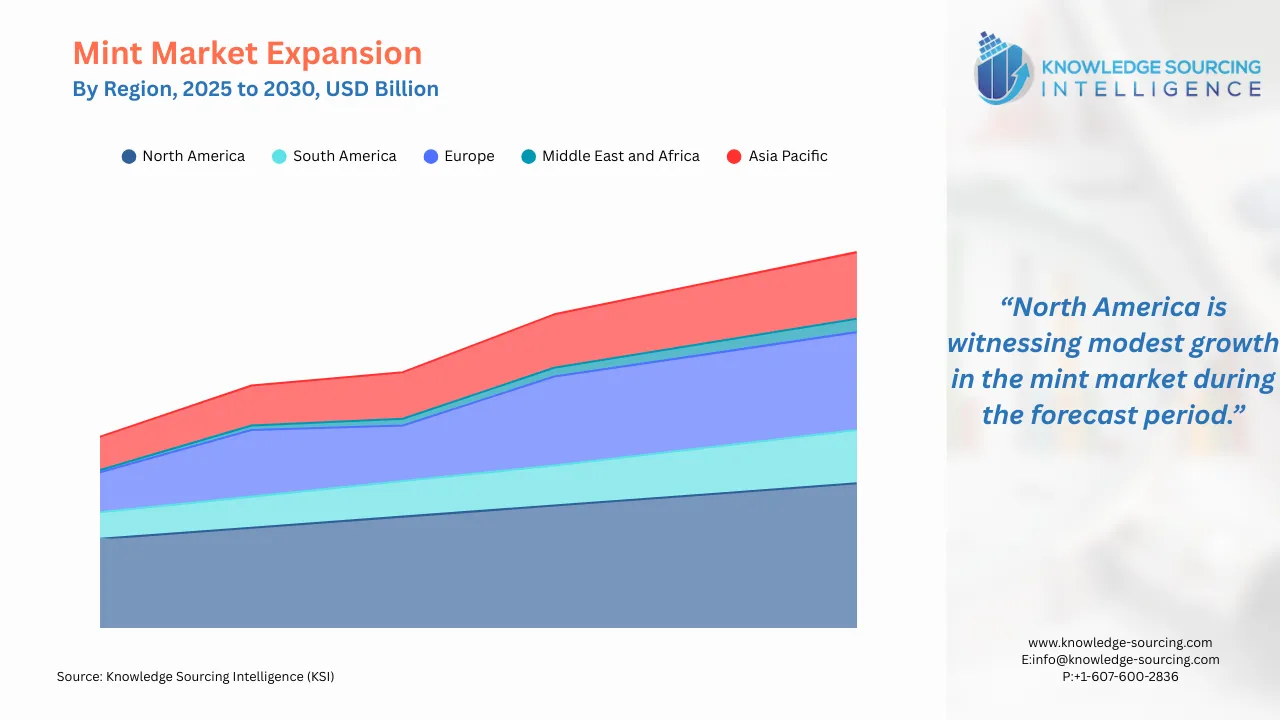

Mint Market Geographical Outlook:

- The global mint market is segmented into five regions worldwide

Geography-wise, the global mint market is divided into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The North American region is expected to hold a noteworthy market share over the forecast period owing to the market players involved in catering to the demands of the consumers by launching different varieties of mints, including herbs and spices and breath mints.

Moreover, the usage of mints and mouthwashes is increasing among individuals who are involved in activities such as smoking and consuming alcohol to mask the smell or users with a busy life and have less time to follow proper oral hygiene and use mouthwashes as an alternative.

Additionally, the Asia-Pacific mint market is driven by several factors, the first being the region's strong agricultural base, especially in countries like India and China, which are among the leading producers of mint and its derivatives. There is a growing demand for natural and herbal products in food, beverages, and personal care items, and the use of mint in this region has seen significant increases. Rising health awareness among consumers has also increased the demand for mint-based products, such as herbal teas, digestive aids, and aromatherapy oils.

The confectionery and oral care industries, where mint is a key ingredient, continue to grow well, as do pharmaceutical applications for therapeutic purposes. In addition, expanding urbanization, increasing disposable income, and an export market for mint derivatives such as menthol are also rising, propelling Asia-Pacific’s mint market expansion.

List of Top Mint Companies:

- McCormick & Company, Inc.

- Keya Foods

- The Hershey Company

- Perfetti Van Melle

- Impact Mints.

Mint Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Mint Market Size in 2025 | US$7.740 billion |

| Mint Market Size in 2030 | US$9.709 billion |

| Growth Rate | CAGR of 4.64% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Mint Market |

|

| Customization Scope | Free report customization with purchase |

Global Mint Market Segmentation:

- By Product Type

- Peppermint

- Spearmint

- Others

- By Distribution Channel

- Online

- Offline

- Supermarkets/Hypermarkets

- Grocery Stores

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America