Report Overview

Global Seasoning And Spices Highlights

Seasoning And Spices Market Size:

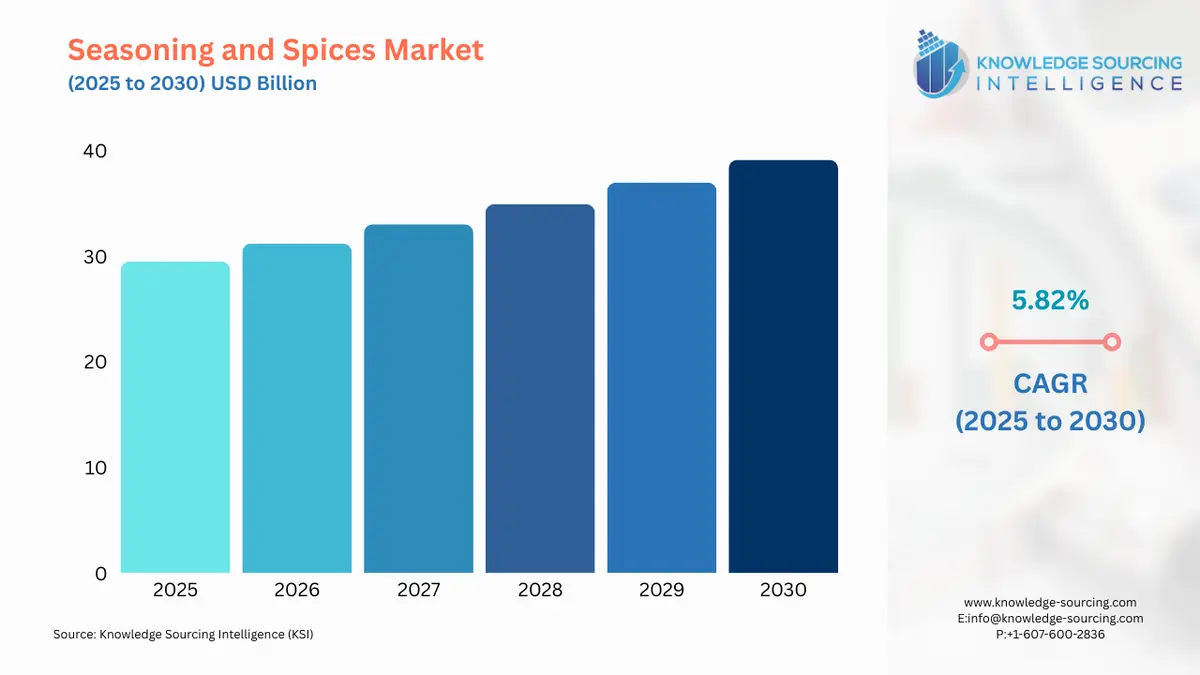

Global Seasoning And Spices Market, sustaining a 5.65% CAGR, is anticipated to rise from USD 29.478 billion in 2025 to USD 40.983 billion in 2031.

Seasoning and spices are something that is commonly used worldwide for enhancing flavour and improving the characteristics of a food product. They are ingredients that can be added to food and in return, improve the taste, smell and texture of food to be consumed. Seasonings and spices are almost similar since seasonings are made with the combination of several spices and other components and are added when the food has finished cooking. Spices are added during the cooking process to increase or improve the flavour and texture of the food.

Seasoning And Spices Market Trends:

Seasoning and spices are essential to improve the cooking process and the food products. Seasoning improves the taste of food, modifies it to be better and can also add a completely new taste to the food. Seasonings can include salt, pepper, aromatic herbs, spices and bouquet garni, which are common and popular in cooking. Some fermented products that have impactful flavours and aromas are also existing in the market, including soy sauce, Nuoc mam, and many others. Some spices, herbs and aromatic plants have been proven to provide medicinal properties. For instance, Cinnamon is a great spice that is popular worldwide and is known for its properties of reducing blood sugar. Another popular health benefit is from ginger, which helps in the prevention and elimination of nausea and has proven to be good for the heart.

Spices are generally sold in the form of powder and dried form and are stored in glass jars or opaque tins. Ground spices tend to oxidize more quickly compared to other types of spices because of their large exposure area and can lose flavour within a few months. Whole spices can last up to a year since only less amounts are being used at a time. A few popular examples of spices that are used in the kitchens of restaurants and hotels include black pepper, garlic powder, thyme, cinnamon, oregano, rosemary, cayenne powder, cumin, nutmeg, and paprika.

Seasoning And Spices Market Growth Drivers:

Gaining traction on health benefits: Spices have been used for many purposes, which include culinary and medical purposes. They not only improve the flavours, texture and aroma of the food but also provide a certain level of immunity from acute and chronic diseases. It has been proven to contain bioactive molecules, such as sulfur-containing compounds, phenolic diterpenes, alkaloids, tannins, and vitamins, as well as their anti-inflammatory, antioxidant, anticarcinogenic, and antitumorigenic properties. As more people explore the benefits of the use of spices and seasoning increase, so does the market for seasonings and spices.

Change in taste preference due to increasing disposable income: There is an increase in the disposable income of every household worldwide. As disposable increases, demand for convenience and taste from food increases as well. As of 2023, the disposable income is 3% higher in Hungary and is only increasing. As this increases, people would prefer to eat food for taste rather than survival. This will increase the growth in the seasoning and spices market with the factor being increasing disposable income and taste preferences.

List of Top Seasoning And Spices Companies:

Ajinomoto Co, Inc.: One of the leaders and a Japanese ingredients and nutrition company that is known for their Monosodium Glutamate (MSG) production.

Associated British Foods PLC: A British multinational food processing company known for the production of sugar and baker’s yeast.

Everest Spices: An Indian manufacturer, distributor and exporter of spice mixtures and ground spices under the brand name EVEREST.

Seasoning And Spices Market Geographical Outlook:

The Asia Pacific region is expected to grow in the forecasted period of 2025-2030. Asia is one of the leading spices and herbs importer and consumers in the world. Most trade and consumption occur from developing countries and the average pricing of spices in Asia is half the price compared to that of Europe. It is expected for the Asia Pacific to hold the dominating position in the global seasoning and spices market and is expected to grow at a steady pace.

Global Seasoning and Spices Market Segmentation

By Product

Spices

Herbs

Salt & Salt Substitutes

By Form

Whole

Powder

Others

By Distribution Channel

Online

Offline

Supermarket & Hypermarket

Convenience Stores

By Application

Meat Products

Bakery & Confectionery

Snacks & Convenience Food

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others

Our Best-Performing Industry Reports:

Navigation:

Seasoning And Spices Market Scope:

Report Metric Details Total Market Size in 2026 USD 29.478 billion Total Market Size in 2031 USD 39.117 billion Growth Rate 5.82% Study Period 2021 to 2031 Historical Data 2021 to 2024 Base Year 2025 Forecast Period 2026 – 2031 Segmentation Form, Distribution channel, Product, Geography Geographical Segmentation North America, South America, Europe, Middle East and Africa, Asia Pacific Companies - Baria Pepper

- Dohler Group

- DS Group

- Everest Spices

- Bart Ingredients

Page last updated on: September 25, 2025