Report Overview

Semolina Market - Strategic Highlights

Semolina Market Size:

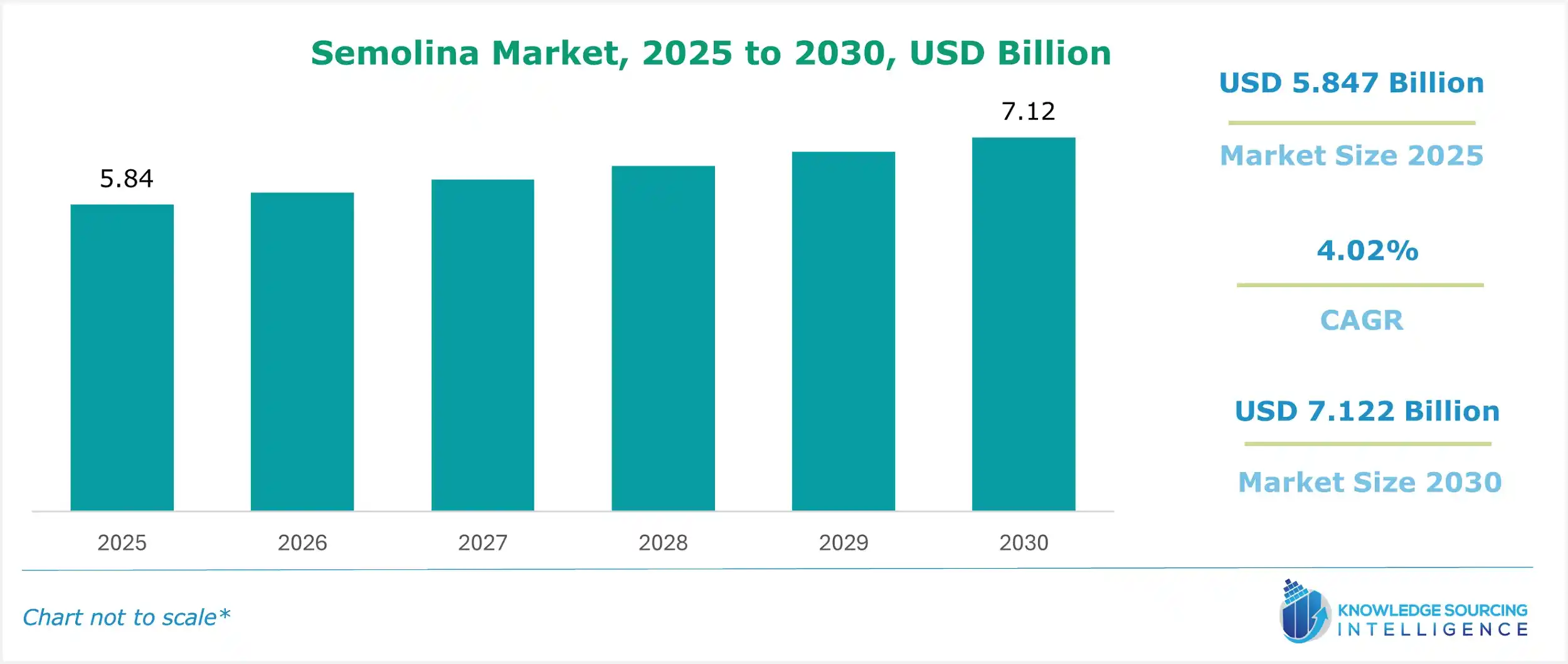

The global semolina market is experiencing steady growth at a CAGR of 4.02%. It is expected to reach USD 7.122 billion in 2030, from a projected size of USD 5.847 billion in 2025.

Semolina Market Introduction:

Semolina is a type of flour that is produced from the milling process of durum wheat and is coarse when compared with regular flour. Semolina is often used in various dishes, which include pasta, couscous, and bread. When compared with other types of flour, semolina flour has various health benefits, which makes it a great alternative to other, less nutritious flours. Semolina is known for containing a rich number of vitamins B1 and B3 and is also a good source of folate, which is essential for the development of babies. They also contain rich protein content, which consists of all the essential amino acids and can meet the daily protein needs of a person.

Rising demand for high-protein food products (durum has a high protein content of 12.0% to 15.0%), increasing demand for pasta globally, and rising bakery consumption are significantly influencing the market growth of semolina. As it serves as a key ingredient in products like pasta, couscous, breakfast cereals, and various traditional dishes across different regions, its market is experiencing steady growth. Furthermore, with the food-processing sector’s expansion, the market is experiencing a further increase in demand.

The market is increasingly driven towards demand for durum-based products due to health consciousness. There is a rising demand for organic and clean-label non-GMO durum semolina. The market applications are growing beyond pasta, such as baby food, snack formulations, breakfast cereals, and ethnic foods.

Semolina Market Overview:

The semolina market is building momentum globally as consumer tastes evolve and agri-production adapts. The global semolina market in terms of supply and demand is following broader cereal trends. The FAO is forecasting a record grain crop in 2025 - about 2.925 billion tonnes, with wheat predicted to be about 805 million tonnes. Durum wheat, the raw ingredient for semolina, is following a similar trend. As USDA data indicates, carryover stocks are good, as well as durum stocks, even though lower than previous years, and are sufficient to allow processing and milling to continue.

Growth in the semolina market is directly linked to the rise of durum wheat-related pasta production globally. Durum wheat, also known as "pasta wheat," is valued for its hardness, protein level, and yellow pigments, which are also essential for good pasta quality. In the U.S., the USDA Agricultural Research Service developed a "soft spring durum" variety that not only expands the course of traditional durum but also improves both the potential for pasta making and milling flexibility. Research on pasta making explores how grain quality metrics (e.g., protein structure, pigment levels) can affect cooking performance, while guiding breeders and millers toward more and better-quality semolina.

Roughly 5% of global wheat acreage is durum production and is primarily located within Mediterranean and North American regions, where pasta manufacturing is booming. Improvements in yield, processing, and grain dynamics allow the supply of semolina to grow in tandem with the increase in pasta consumption. These developments set up the outlook for the market; durum varieties that satisfy supply-demand fits for both artisanal pasta and mass production determine the conditions of semolina market supply-demand relationships.

Progress is being made in policy and innovation, as resilient wheat, through improved seed genetics, drought tolerance, is being pushed forward via various supports from multilateral institutions and national agricultural systems. These developments provide long-term strength to semolina supply chains while reducing regional inequalities, particularly as farm systems innovate in major areas in the EU, the Americas, and parts of Africa.

In markets with established cultural trends, especially the pasta and couscous culture across Europe, semolina remains a staple; however, growth is also occurring in developing culinary destinations. Healthiness, challenging lifestyles, and rising incomes in the Asia-Pacific are expanding consumption corridors.

In 2023, Durum Wheat production fell to 0.059 billion bushels, significantly below the normal levels, resulting in a supply crunch. This implies that semolina processors had narrower margins on products containing semolina, a greater reliance on foreign-grown production, or perhaps even reduced production of pasta and other wheat-based food products. However, with the increases forecasted in 2024 reaching 0.080 billion bushels, the recovery of domestic durum wheat production suggests on reassuring supply, which can be planned for purchases and production planning. There is forecasted stable durum wheat production amounting to 0.0797 billion bushels over the next two years, which is a resounding good sign. The outlook for the durum wheat market is quite stable for the years 2023-2025, providing a baseline for durum-based manufacturers and exporters regarding visible durum quality and quantity. This provides the basis to lower raw material price risk in raw materials while also offering a platform for innovation of downstream products, and encourages trade flows while signalling reliability to the downstream semolina wheat food value chain.

These figures primarily assist semolina producers and suppliers in effectively planning, whether it involves scaling up production, managing inventory, or preparing for potential future supply issues.

Semolina Market Growth Drivers:

- Increasing Pasta Consumption

Pasta is one of the major users of semolina in the market. Semolina is a well-known ingredient that is used in the production of pasta, couscous, noodles, and several other products. Semolina has been linked to various health benefits as well, which can include the promotion of weight loss, high folate content, a source of iron and magnesium, and heart health. The use of semolina increases the health awareness of pasta products, which further increases the demand and consumption of pasta.

The increase in consumption of pasta will, therefore, provide the necessary fuel for the global semolina market growth. The UN AFPA states that the E.U. pasta industry displayed an increase in growth of production and consumption, which is an increase from 4,739 to 5,004 thousand tonnes in production and from 2,944 to 3,011 thousand tonnes in consumption between the years 2021 and 2022, respectively. It also states that the number of people employed in the pasta industry displayed a substantial increase from 13,914 to 31,215 people in 2021 and 2022, respectively, which shows an increase in growth of the pasta industry. The increase in the consumption and production of pasta can be linked to the increase in the growth of the pasta industry, which further boosts the global semolina market growth during the forecasted period.

- Productivity gains through improved durum wheat genetics

A significant growth factor in the global market for semolina is that advances in the genetic improvement of durum wheat are enhancing both its production and product quality. The USDA Agricultural Research Service (ARS) has demonstrated recently, with major advances in 2025, that the team can now identify and develop durum wheat accessions to improve yield traits and resistance; resistance to Hessian fly pest problems is particularly important, given the past significant annual losses in durum wheat growing regions. These improvements in genetic quality are not only about protecting durum wheat varieties, but also improve yield stability and therefore the semolina market supply and cost.

Moreover, the USDA ARS is developing a new variety called "soft spring durum", which offers milling advantages to the miller because they can create semolina with functional characteristics that are broader in applicability, for example, specialty pastas and enriched bakery products. Furthermore, these downstream opportunities secure the market and product innovation. New varieties are also being bred for climate-stress resistance factors, specifically heat and drought, as well as resistance to emerging diseases. Many of these projects are supported along the supply chain through active USDA projects that are supporting cereal crop improvement. Overall, these factors provide a more resilient durum wheat supply chain that is less sensitive to environmental shocks.

Globally, there is anticipated durum production growth. For farmers, these genetic advancements lower their overall cost-of-production and help maintain or increase farm outputs with reduced per-bushel production inputs. In terms of trading and distribution, reliability in durum production significantly reduces volatility in the semolina market and gives millers and food processors the confidence to make commitments and hold durum wheat in inventory. Predictability in durum further provides predictable quality, particularly related to protein strength and golden yellow colour, all of which represent premium product tier categories that are evolving in an increasingly global marketplace. These are all strong building blocks in granting semolina a higher position within a premium food category. Better genetics lead to more reliable crops, better quality for premium processing, and lower risk for the manufacturer and exporter. This carries traction through the value chain and repositions semolina from a product with little value added to a transforming product that can be used as a malleable commodity for advancement and innovation in a market that seeks better quality, more transparency, and continuity of supply.

In line with this, the increases in both planted and harvested acres of durum wheat in 2025 indicate that farmers are scaling up production practices efficiently in response to rising demand for semolina. A reduction in the gap between planted and harvested acres suggests improved crop management practices with minimal crop loss, which allows the supply of raw material used for semolina production to stabilise. This supply-side stability creates a favorable investment environment for rationalizing processing investments. This supports continuous production for pasta and bakery operations while addressing consumer demand for evolving diets/trends globally, maximizing volume and market value.

Semolina Market Key Players:

The market is highly fragmented, with numerous players involved across production, milling, and end-use applications. The market is farmer-driven, with many regional milling and processing companies. At the same time, there are some global players such as ADM, Cargill, Olam Agri, and others. As semolina is used in pasta, bakery, ethnic foods, and other applications, there is a large number of players across all applications. However, in terms of the end-use products segment, the market is moderately consolidated, particularly in North America and Europe. Companies such as Barilla S.p.A., Ebro Foods S.A., Grupo Nutresa, and Poiatti S.p.A. are major end-use market players.

This variety of players across the supply chain creates strong opportunities for growth and investment. Companies can focus on improving milling technology, offering organic or specialty semolina products, and building strong local brands, especially in emerging markets. This also opens up space for new entrants to enter the market and compete in different parts of the value chain.

- Archer Daniels Midland Company (ADM): A global leader and a multinational company that is known for the production, processing, transport, and marketing of agricultural products, commodities, and ingredients.

- Conagra Brands, Inc.: An American company that is known for the manufacturing and distribution of food and food service products, which include shelf-stable food, meals, sauces, seafood, frozen foods, and custom-manufactured culinary foods. They are also known for the production of semolina-based products in the market, such as King Midas No. 1 Semolina.

Semolina Market Segment Analysis:

- The durum semolina segment is growing in popularity

By type, the global Semolina market is segmented into durum semolina, soft wheat semolina, and others. Durum semolina holds the largest share in the global semolina market owing to its high protein and gluten content, making it ideal for pasta, couscous, and premium bakery products. This semolina is derived from Triticum durum, a hard wheat variety, making semolina coarser and more granular.

According to various sources, it contains 12% to 15%, i.e., about 12 grams of protein per 100 grams. Additionally, its high-gluten content makes it perfect for use in pasta and noodles. With the growing demand for pasta and Mediterranean cuisine globally, especially in countries like Italy, the United States, and Canada, it is significantly boosting the market for durum semolina. At the same time, the growing health consciousness is driving the demand for durum semolina for its rich dietary fiber and protein content. Further, in recent years, rising interest in traditional and artisanal food products has also bolstered the demand for durum-based semolina in both retail and foodservice channels.

According to the International Grains Council, global durum wheat production was recorded at 31.4 million metric tons (MMT) in the 2023/24 season. During the same period, global consumption reached 34 million metric tons, resulting in a consumption surplus of approximately 2.6 MMT over production. The majority of production is concentrated in North America and the Mediterranean basin, with Canada being a major producer and exporter.

Global durum wheat supplies were notably constrained at the beginning of the 2023/24 marketing year, primarily due to adverse weather conditions in key producing regions. Droughts in the Middle East and Canada, combined with quality issues in the European Union (EU), significantly reduced overall durum availability. These supply limitations created upward pressure on global durum prices, directly impacting downstream industries reliant on high-quality durum, such as the semolina and pasta manufacturing sectors.

Semolina Market Geographical Outlook:

- North America is expected to lead the market growth

The semolina market is poised for significant growth, with North America expected to lead during the forecast period, driven by rising pasta consumption, durum wheat production, and food industry innovation. Semolina, a coarse flour derived from durum wheat, is a key ingredient in pasta, noodles, couscous, and baked goods, fueling its demand globally.

In North America, the United States and Canada drive market expansion due to high pasta production and durum wheat cultivation. The United States produced approximately 2 million tonnes of pasta in 2023, reflecting strong consumer demand (UN AFPA, 2023). The U.S. Wheat Association reports durum wheat production averaged 1.5 million metric tonnes over five years, reaching 1.6 million metric tonnes in 2023 (USWheatAssoc, 2025). Canada, the world’s top durum wheat exporter, shipped 4.69 billion kilograms valued at $1.5 billion in 2021 (World Bank WITS, 2021). This robust agricultural output supports semolina production, meeting the needs of the food processing industry and boosting market growth. Urbanization and health-conscious trends, such as demand for whole grain products, further enhance semolina’s popularity in North America.

Europe is another key market, driven by the cultural significance of pasta, particularly in Italy, a global leader in pasta consumption. Italy’s pasta industry relies heavily on semolina flour, with the country producing millions of tonnes annually. Germany and France also contribute, with growing demand for healthy food options and premium pasta. European regulations promoting sustainable agriculture and R&D investments in food technology support market expansion.

Asia-Pacific, including India and China, sees rising demand due to Western dietary influences and urban lifestyles. South America, and Middle East and Africa are emerging markets, driven by food industry growth. Challenges like wheat price volatility persist, but sustainable farming mitigates these issues. The semolina market thrives on pasta demand, durum wheat production, and culinary trends, with North America and Europe leading the charge.

Semolina Market Developments:

- Increased Demand for Organic Semolina Products (2025): Growing consumer preference for organic and minimally processed foods has driven a surge in demand for organic semolina, particularly for pasta and baked goods. This trend reflects health-conscious choices and a shift toward sustainable, eco-friendly products, prompting manufacturers to expand organic semolina offerings to meet evolving dietary preferences.

- Technological Advancements in Milling Processes (2024): Innovations in milling technology have improved semolina production efficiency, enhancing texture consistency and quality for pasta and couscous applications. These advancements allow producers to meet rising global demand for high-quality semolina-based products, particularly in regions with growing culinary diversity like Asia and Africa.

List of Top Semolina Companies:

- Archer-Daniels-Midland Company

- Grupo Nutresa

- Conagra Brands, Inc

- Ebro Foods, S.A.

- Cargill, Incorporated

Semolina Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Semolina Market Size in 2025 | USD 5.847 billion |

| Semolina Market Size in 2030 | USD 7.122 billion |

| Growth Rate | CAGR of 4.02% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Semolina Market |

|

| Customization Scope | Free report customization with purchase |

Segmentation:

- By Type:

- Durum Semolina

- Soft Wheat Semolina

- Others

- By Application:

- Pasta

- Couscous

- Bakery Products

- Soups and Sauces

- Others

- By Distribution Channel:

- Hypermarkets and Supermarkets

- Convenience Stores

- Online Retail

- Others

- By Geography:

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America

Our Best-Performing Industry Reports:

Navigation:

- Semolina Market Size:

- Semolina Market Key Highlights:

- Semolina Market Introduction:

- Semolina Market Overview:

- Semolina Market Growth Drivers:

- Semolina Market Key Players:

- Semolina Market Segmentation Analysis:

- Semolina Market Developments:

- List of Top Semolina Companies:

- Semolina Market Scope:

Page last updated on: September 25, 2025