Report Overview

India E-Hailing Market - Highlights

India E-Hailing Market Size:

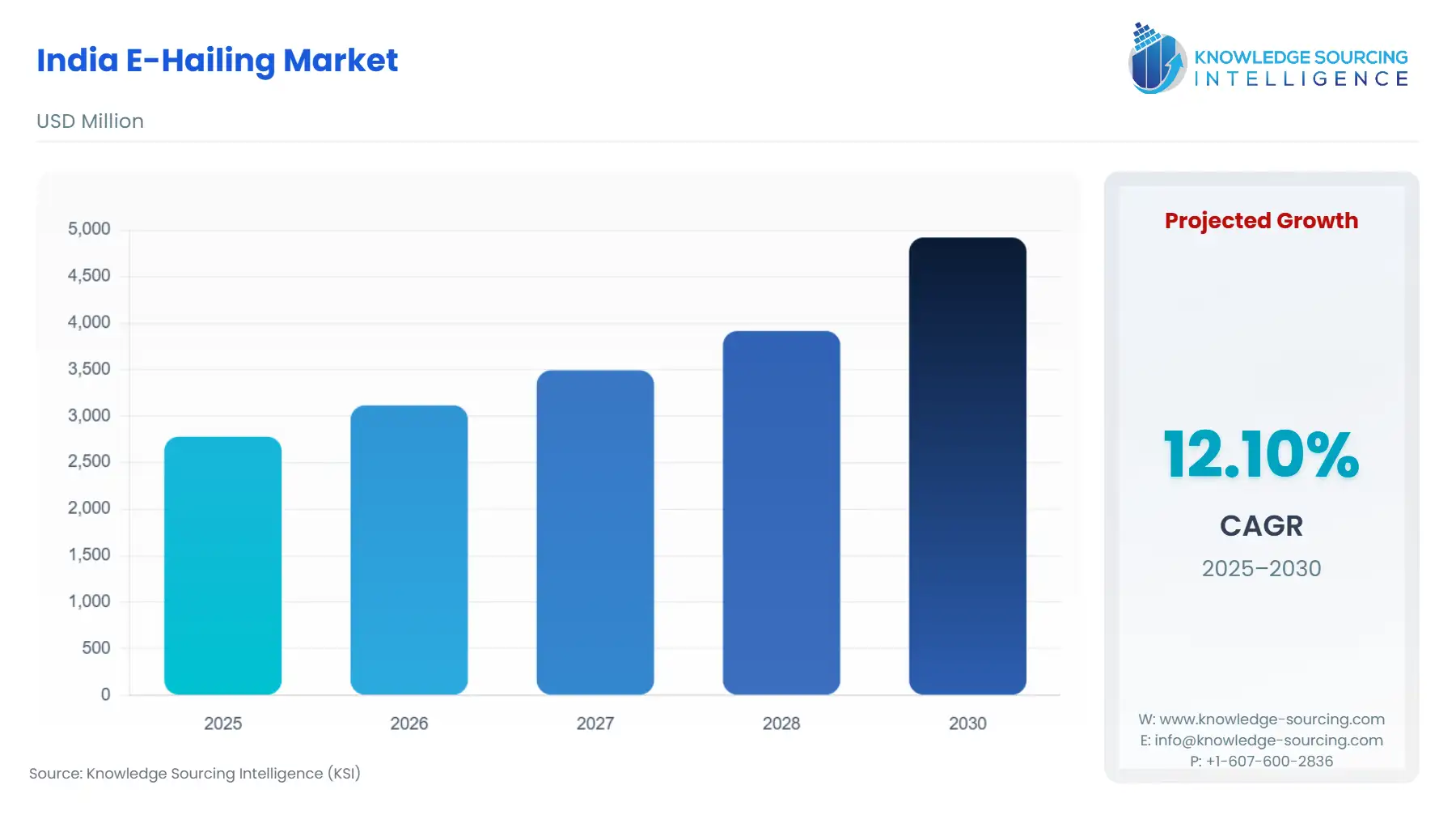

India E-Hailing Market is set to expand at a 12.10% CAGR, growing from USD 2.780 billion in 2025 to USD 4.921 billion by 2030.

The consistent traffic issue, along with the rapid rise in population and urbanization in India, is promoting the demand for e-hailing services. Further, the presence of diverse major players in the country is enhancing the market penetration, which is also promoted by sustainability trends like EV adoption.

India E-Hailing Market Overview & Scope

The India E-Hailing Market is segmented by:

- Service Type: The ride-sharing segment is expected to witness the fastest growth due to cost-effectiveness and a cultural rise among budget-conscious consumers in India.

- Device Type: The smartphones segment is anticipated to hold the largest share in the device type due to low-cost mobile data plans and increased penetration of smartphones in the country.

- Vehicle Type: The four-wheeler segment is predicted to hold major market share in the vehicle type, due to comfort and capacity, along with corporates utilizing these services for employee transportation.

- End User: The corporate is the fastest growing segment in the end user segment of the market due to the increase in corporate partnerships with e-haling providers for a reliable and trackable e-haling solution for their employees.

- Region: Delhi is a major city that demands e-hailing services driven by a growing population, airport connectivity requirements, and traffic congestion.

Top Trends Shaping the India E-Hailing Market

- Increase in Two-Wheeler Ride-Hailing Services:

- There is an increasing trend of two-wheeler services like bike rides, which are provided by Uper, Rapido, and Ola in India, especially in congested areas, to navigate effectively.

India E-Hailing Market Growth Drivers vs. Challenges

Drivers:

- Growing Urbanization and Population: The increase in urbanization, especially in metropolitan cities such as Mumbai, Bangalore, and Delhi, is leading to a rise in traffic congestion and high parking costs, which is contributing to the growing demand for alternatives like e-hailing. For instance, according to the Traffic Index report, the traffic congestion Index (TCI) in Indian cities from July to August of 2025 was 42.43 average TCI, while 134.87 was the maximum TCI in Mumbai, and in Bangalore it was 39.32 as average, and 117.22 was the maximum TCI.

- Rise in Smartphone Penetration: There is a rapid rise in smartphone adoption in the country, which is followed by cost-effective mobile data plans which is leading to increased accessibility of e-hailing services across India. For instance, the data cost ranges from ?8.7 to ?10.4, which is the average cost per subscriber per gigabyte in India as per the TRAI report of August 2024, which is the most affordable across the globe.

Challenges:

- High Competition and Profitability Issues: The presence of a large number of e-hailing providers in the country, such as Ola, Uber, inDrive, and Rapido, is leading to fierce competition across the region, which is challenging the profitability of the players.

Regional Analysis of the India E-Hailing Market

- Bangalore: the region is a prominent tech-hub of the country, leading to a large volume of tech-savvy population and a high urban population, leading to growing adoption of e-hailing services.

India E-Hailing Market Competitive Landscape

The market is fragmented, with many notable players, including Uber Technologies Inc., Ola Cabs, BlaBlaCar, Indecab Technology Services Pvt. Ltd., Grab, Mahindra Logistics Ltd., Savaari, FastTrack Call Taxi, Carzorent, Mega, inDrive, and Rapido Transportation, among others.

- Brand Launch: In March 2025, the Indian Government announced the plan to launch Sahkar Taxi, which is a cooperative ride-hailing service platform that will include two-wheeler taxis, four-wheelers, and autorickshaws.

- Investment: In February 2025, Uber announced the signing of a Memorandum of Understanding (MoU) with the Assam government for INR 120 crore investment in the state in the coming three years and went live with ‘Uber Sarthi’.

India E-Hailing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| India E-Hailing Market Size in 2025 | USD 2.780 billion |

| India E-Hailing Market Size in 2030 | USD 4.921 billion |

| Growth Rate | CAGR of 12.10% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Delhi, Kolkata, Hyderabad, Chennai, Bangalore, Mumbai, and Others |

| List of Major Companies in the India E-Hailing Market |

|

| Customization Scope | Free report customization with purchase |

India E-Hailing Market Segmentation:

- By Service Type

- Ride Sharing

- Ride Hailing

- Others

- By Device Type

- Smartphones

- Tablets

- Others

- By Vehicle Type

- Two-Wheeler

- Three-Wheeler

- Four-Wheeler

- Sedans

- SUVs

- Others

- By End-User

- Personal (B2C)

- Corporates (B2B)

- By Cities

- Delhi

- Kolkata

- Hyderabad

- Chennai

- Bangalore

- Mumbai

- Others

Our Best-Performing Industry Reports:

Navigation:

- India E-Hailing Market Size:

- India E-Hailing Market Key Highlights:

- India E-Hailing Market Overview & Scope

- Top Trends Shaping the India E-Hailing Market

- India E-Hailing Market Growth Drivers vs. Challenges

- Regional Analysis of the India E-Hailing Market

- India E-Hailing Market Competitive Landscape

- India E-Hailing Market Scope:

- Our Best-Performing Industry Reports: