Report Overview

Indonesia E-Hailing Market - Highlights

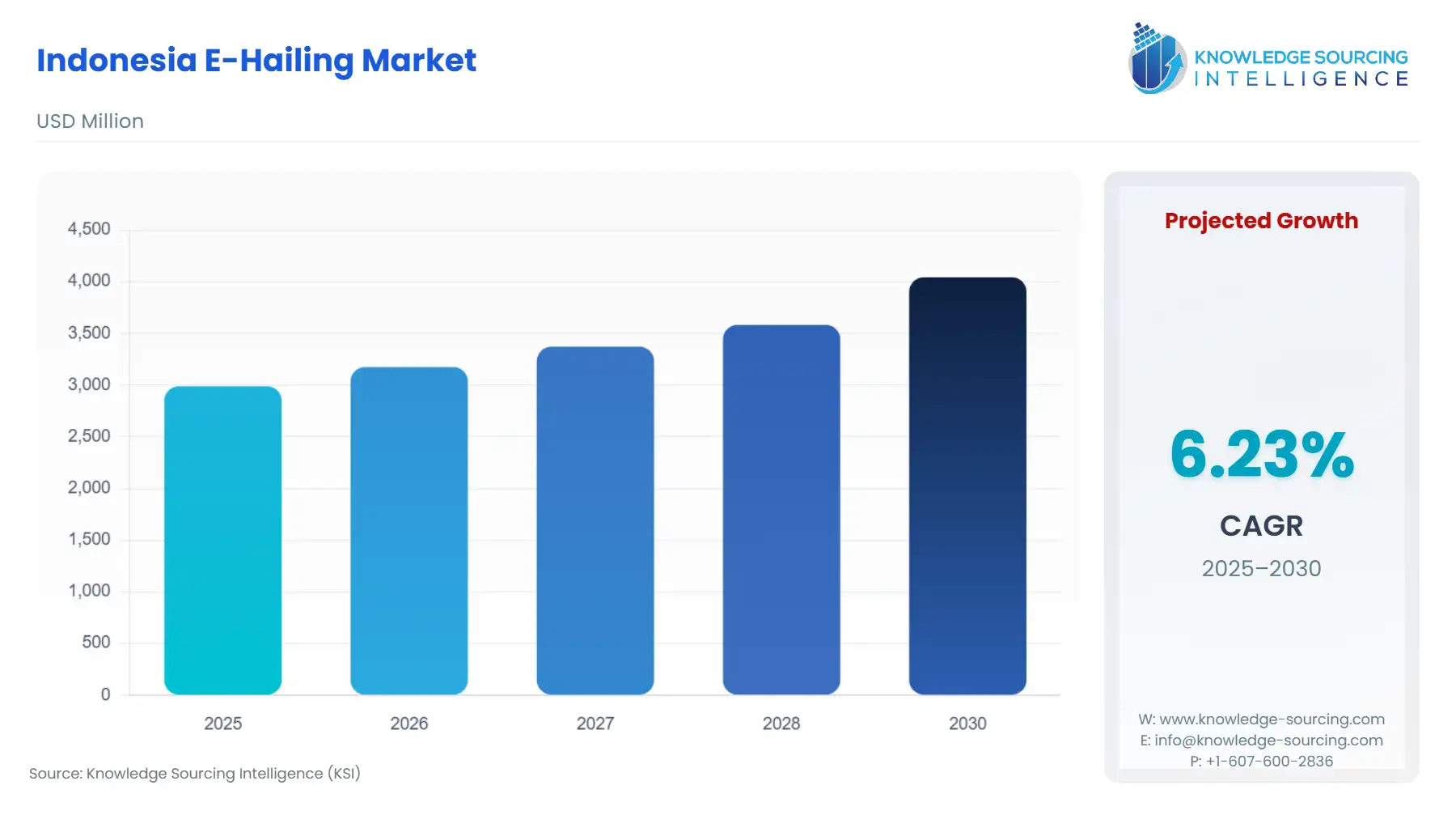

Indonesia E-Hailing Market Size:

Indonesia E-Hailing Market is anticipated to grow at a 6.23% CAGR, increasing from USD 2.989 billion in 2025 to USD 4.044 billion by 2030.

The growing internet connectivity in the country, with a rise in smartphone users, is leading to an increase in the adoption of seamless app-based booking platforms with tracking and a cashless payment process, which is predicted to make e-hailing a preferable choice among commuters in Indonesia. Moreover, the growing population demanding and urban population will also promote consumers to shift towards e-hailing services.

Indonesia E-Hailing Market Overview & Scope

The Indonesia E-Hailing Market is segmented by:

- Service Type: The ride-hailing segment is expected to witness the fastest growth due to cost-effectiveness, convenience, coupled with a cultural rise among budget-conscious consumers in India.

- Device Type: The smartphones segment is anticipated to grow at a significant rate in the device type due to high smartphone penetration, which is promoting their ubiquity and app compatibility.

- Vehicle Type: The two-wheeler segment is predicted to hold the largest market share in the vehicle type. This segment is growing, particularly the motorcycles, due to manoeuvrability in traffic, and affordability for commuters.

- End User: The personal is the major segment in the end user segment of the market due to the increase in demand by regular commuters and the cost-effectiveness of transport alternatives to public transport.

- Region: Bali is expected to witness a stable growth in demand for e-hailing services due to robust tourism in the city, along with an increase in airport transfer and premium ride service demand.

Top Trends Shaping the Indonesian E-Hailing Market

- Growth of Electric Vehicles:

- The rise in the sustainability trend in automation, along with government subsidies for electric vehicles, is prompting the e-hailing companies to invest significantly in these vehicles.

Indonesia E-Hailing Market Growth Drivers vs. Challenges

Drivers:

- Urbanization and Population Density: The growing population, especially across the populated cities like Jakarta and Surabaya, will lead to an increase in demand for convenient transportation solutions in the country. For instance, the World Bank reported that the population in Indonesia was 281.190 million in 2023, which increased to 283.488 million in 2024. The growing urbanization with inadequate public transportation facilities and traffic congestion in the region is also promoting the demand for e-hailing services in Indonesia.

- Rise in Smartphone Users and Internet Accessibility: The rise in smartphone users in the country, along with the growing internet penetration, is predicted to increase the accessibility of users to e-hailing platforms. According to the GSMA report titled ‘The Mobile Economy Asia Pacific 2024’ stated that smartphone connections in Indonesia are expected to reach 387 million by 2030. This will boost the adoption of seamless booking, payment processes, which will fuel the e-hailing adoption among commuters.

Challenges:

- Regulatory Hurdles: The strict regulation by the Indonesian government regarding pricing, driver's license, and driver welfare can challenge the market player penetration in the country. Further, the compliance with standard operations would limit the energy of smaller players due to increased cost.

Regional Analysis of the Indonesia E-Hailing Market

- Jakarta: it is the capital of Indonesia and the largest city with high population density and severe traffic congestion, which will propel the e-hailing platforms.

Indonesia E-Hailing Market Competitive Landscape

The market is fragmented, with many notable players, including GoTo Group, Maxim Service, Grab, Bluebird Group, and inDrive, among others.

- Partnership: In June 2025, Gojek announced a partnership with Green SM for the launch of green sm services under its application, which will increase its range of four-wheeler electric vehicles on its Gojek platform.

- Service Launch: In December 2025, PT Xanh SM Green collaborated with Smart Mobility for the launch of Xanh SM in Indonesia. It is an electric taxi rising service with an innovative mobility system by offering all-electric taxis under its go green global strategy.

Indonesia E-Hailing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Indonesia E-Hailing Market Size in 2025 | USD 1.357 billion |

| Indonesia E-Hailing Market Size in 2030 | USD 2.859 billion |

| Growth Rate | CAGR of 16.07% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Jakarta, Bali, Surabaya, and Others |

| List of Major Companies in the Indonesia E-Hailing Market |

|

| Customization Scope | Free report customization with purchase |

Indonesia E-Hailing Market Segmentation:

- By Service Type

- Ride Sharing

- Ride Hailing

- Others

- By Device Type

- Smartphones

- Tablets

- Others

- By Vehicle Type

- Two-Wheeler

- Three-Wheeler

- Four-Wheeler

- Sedans

- SUVs

- Others

- By End-User

- Personal (B2C)

- Corporates (B2B)

- By Province

- Jakarta

- Bali

- Surabaya

- Others

Our Best-Performing Industry Reports:

Navigation:

- Indonesia E-Hailing Market Size:

- Indonesia E-Hailing Market Key Highlights:

- Indonesia E-Hailing Market Overview & Scope

- Top Trends Shaping the Indonesian E-Hailing Market

- Indonesia E-Hailing Market Growth Drivers vs. Challenges

- Regional Analysis of the Indonesia E-Hailing Market

- Indonesia E-Hailing Market Competitive Landscape

- Indonesia E-Hailing Market Scope:

- Our Best-Performing Industry Reports: