Report Overview

Japan E-Hailing Market - Highlights

Japan E-Hailing Market Size:

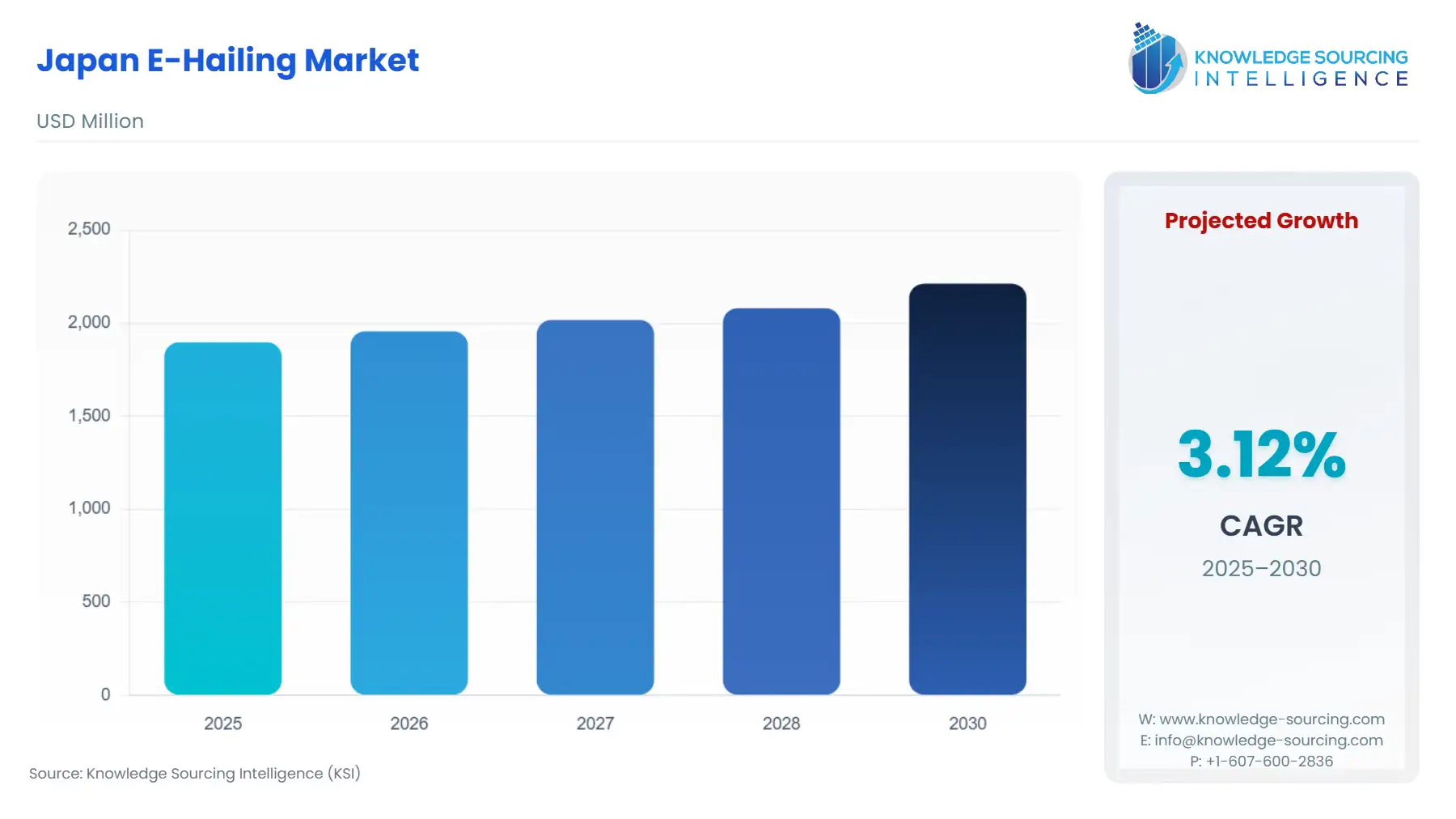

Japan E-Hailing Market, sustaining a 3.12% CAGR, is forecasted to rise from USD 1.897 billion in 2025 to USD 2.212 billion by 2030.

The Japanese e-hailing service is expected to grow due to the growing necessity of on-demand transportation services and growing smartphone penetration, which is leading to the e-hailing platforms, such as mobile apps. The growing population residing in urban areas is leading to demand for effective alternatives to personal and public transport methods in the country, which is also fuelling the market.

Japan E-Hailing Market Overview & Scope

The Japan E-Hailing Market is segmented by:

- Service Type: The ride-hailing segment is expected to expand at a major rate in the market, driven by the offering of point-to-point ride options aligned with real-time interaction with apps.

- Device Type: The smartphone device type will hold a significant share of the market due to high adoption and easy access to mobile apps like Android and iOS, which offer easy booking and cashless payment.

- Vehicle Type: The four-wheeler segment is anticipated to hold the largest growth in the vehicle type of the market, due to the affordability with the premium rise experience in comparison to owning a car.

- End User: The personal is estimated to hold a major share in the end-user segment of the Japanese e-hailing market due to increased utilization by regular commuters and leisure travel across the country.

- Region: Osaka is predicted to hold a significant share of the Jana e-hailing market as it is a strong tourist hub of the country and is also known for intercity travel for business travel, which will promote the usage of e-hailing services.

Top Trends Shaping the Japan E-Hailing Market

- Rise of Autonomous and Electric Vehicles:

- The trend towards a zero-emission fleet and to address the shortage of drivers is leading to the adoption of electric vehicles and self-driving vehicles in Japan.

Japan E-Hailing Market Growth Drivers vs. Challenges

Drivers:

- Growing Smartphone Penetration and Digital Adoption: The rise in smartphone ownership in the country, followed by an increase in adoption of high-speed internet connectivity, is leading to an increase in app-based booking and cashless payment in Japan. In the GSMA report, about 80 percent of the population in the country is connected to mobile internet as of 2023. Moreover, the mobile data traffic in GB per month for per connection is expected to grow in the country from 18 to 87 in the period of 2023 to 2030. Similarly, the number of smartphone connections in the country was estimated to account for 183 million by 2030.

- Rise in Traffic Congestion and Urbanization: The high urban density in Japan, especially in major cities such as Tokyo, Osaka, and Kyoto, is leading to a shortage in vehicle parking spaces and causing traffic congestion, which is expected to promote the market. For instance, the urban population in the country is 92 percent in 2024, according to World Bank data.

Challenges:

- Regulatory Restriction: The restriction towards strict driving rules along with driver licenses, and vehicle usage for the protection of traditional transportation in the country, can limit the ride-hailing market.

Regional Analysis of the Japan E-Hailing Market

- Tokyo: the city has the largest demand for tourists and commuters, which increases the utilization of e-hailing services for convenience and flexible transportation.

Japan E-Hailing Market Competitive Landscape

The market is fragmented, with many notable players, including Uber Technologies Inc., Grab, GO Inc., Kokusai Motorcars Co.Ltd, among others.

- Collaboration: In September 2024, PARK24 Co Ltd collaborated with Uber to announce the pilot ride-hailing service offering in Japan, along with along building scheme to utilize Times car sharing service, which is provided by the PARK24 group.

Japan E-Hailing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Japan E-Hailing Market Size in 2025 | USD 1.357 billion |

| Japan E-Hailing Market Size in 2030 | USD 2.859 billion |

| Growth Rate | CAGR of 16.07% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Tokyo, Osaka, Kyoto, Nagoya, and Others |

| List of Major Companies in the Japan E-Hailing Market |

|

| Customization Scope | Free report customization with purchase |

Japan E-Hailing Market Segmentation:

- By Service Type

- Ride Sharing

- Ride Hailing

- Others

- By Device Type

- Smartphones

- Tablets

- Others

- By Vehicle Type

- Two-Wheeler

- Three-Wheeler

- Four-Wheeler

- Sedans

- SUVs

- Others

- By End-User

- Personal (B2C)

- Corporates (B2B)

- By Province

- Tokyo

- Osaka

- Kyoto

- Nagoya

- Others

Our Best-Performing Industry Reports:

Navigation:

- Japan E-Hailing Market Size:

- Japan E-Hailing Market Key Highlights:

- Japan E-Hailing Market Overview & Scope

- Top Trends Shaping the Japan E-Hailing Market

- Japan E-Hailing Market Growth Drivers vs. Challenges

- Regional Analysis of the Japan E-Hailing Market

- Japan E-Hailing Market Competitive Landscape

- Japan E-Hailing Market Scope:

- Our Best-Performing Industry Reports: