Report Overview

China E-Hailing Market - Highlights

China E-Hailing Market Size:

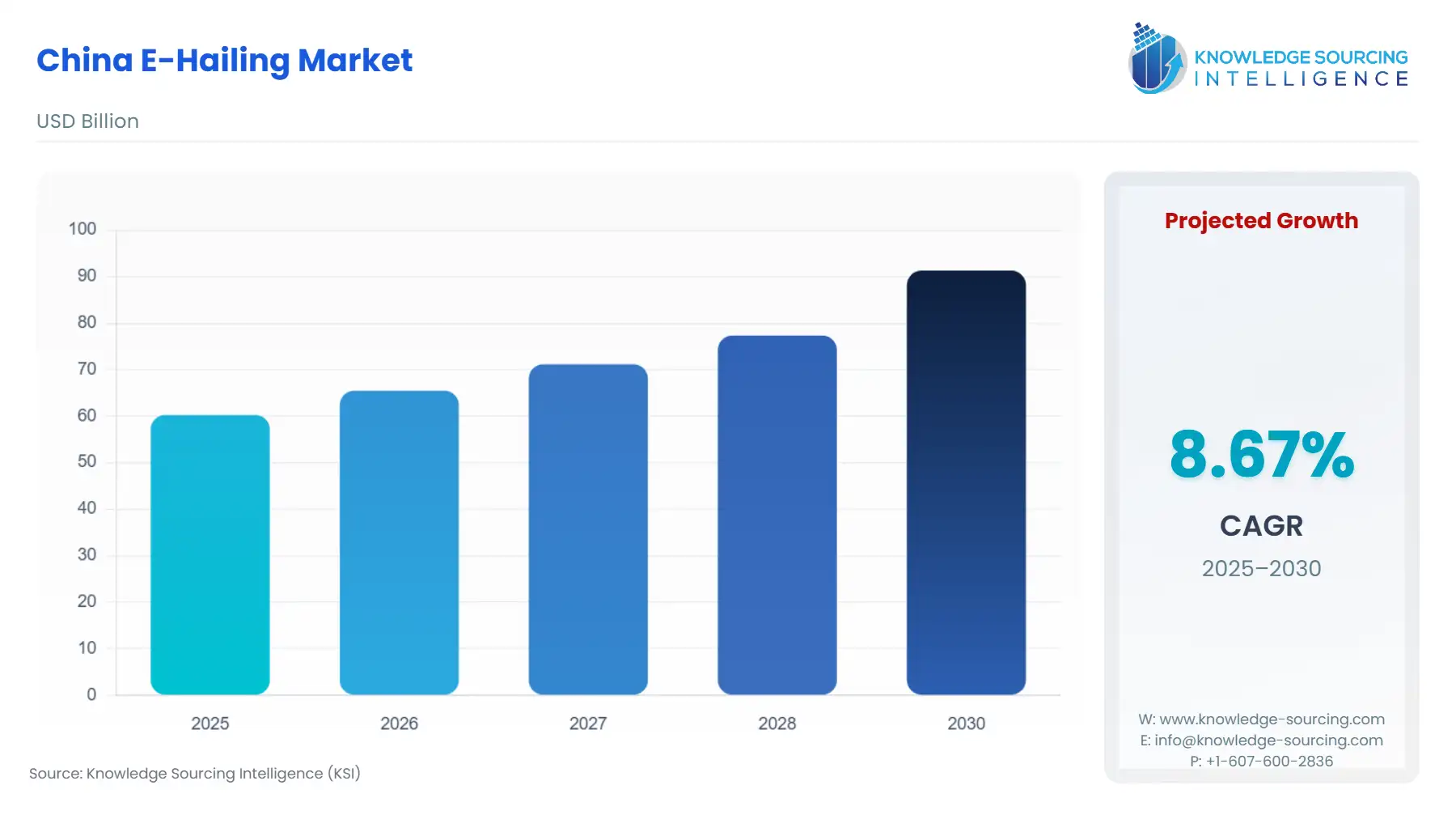

China E-Hailing Market, with a 8.67% CAGR, is projected to increase from USD 60.258 billion in 2025 to USD 91.319 billion by 2030.

The growing focus on the Urbanization rate in the country, followed by a rise in smartphone adoption among people, is leading to a growing shift towards tech-enabled transportation like e-hailing services. These services are growing in demand in the region due to the convenience and personalized traveling experience among people.

China E-Hailing Market Overview & Scope

The China E-Hailing Market is segmented by:

- Service Type: The ride-hailing segment is anticipated to witness the largest segment in the market, due to the increase in adoption of ride-hailing applications and widespread presence of major players like Didi Global, which provide convenience for customers.

- Device Type: The smartphones segment is expected to grow at a substantial rate in the device type due to increased penetration of mobile internet across the region and the easy option of cashless payment for the users.

- Vehicle Type: The four-wheeler segment is anticipated to witness the fastest growth in the vehicle type, due to the lower cost of e-riding services over owning and the rise in congested cities.

- End User: The personal is expected to hold a significant share in the end-user segment of the china e-hailing market because increase in business travel and individual risers for diverse work or leisure purposes.

- Region: Shanghai is expected to hold a significant share of the market because of the growing urban population in the region, along with growing travel in the region, which boosts the demand for e-hailing services like Didi and Uber.

Top Trends Shaping the China E-Hailing Market

- Adoption of Electric Vehicles:

- There is a growing trend of adoption in electric and hybrid vehicles in China, which is leading to the integration of these vehicles by e-hailing providers to meet the national emission goals requirement.

China E-Hailing Market Growth Drivers vs. Challenges

Drivers:

- Rise in Traffic Congestion and Urbanization: The increase in urban population of the region is leading to a requirement for efficient options for owned vehicles to decrease the traffic congestion, while also not relying on parking. For instance, according to the World Bank data, the urban population of China is expected to account for close to 1 billion by 2030, which is about 70 percent of the total population. This will contribute to Chinese people opting for alternatives like e-hailing to commute easily and efficiently.

- Growing Demand for e-hailing car services: The growing adoption of smart devices along with internet and disposable income in the country is leading to people opting for e-hailing cars in place of traditional riding options like taxis or other methods of public transport.

Challenges:

- Government Regulatory Uncertainties: The frequent policy changes and crackdowns that involve license requirements and other data privacy mandates can contribute to operational instability among e-riding companies.

Regional Analysis of the China E-Hailing Market

- Beijing: the region is a major city of China, which leads to high commuting and business travel, leading to an increase in e-hailing services demand.

China E-Hailing Market Competitive Landscape

The market is fragmented, with many notable players, including Uber Technologies Inc., Didi Chuxing Technology Co., Meituan Dache, Alibaba Group Holding, Zhejiang Geely Holding Group, T3 Mobility, and Apollo Go, among others.

- Launch: In June 2025, DiDi Global announced the integration of AI +one one-stop business travel assistance for a seamless end-to-end customer experience.

- Launch: In March 2204, Baidu announced the launch of upgradation 24/7 autonomous riding services of Apollo Go in selected regions of Wuhan of China.

China E-Hailing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| China E-Hailing Market Size in 2025 | USD 60.258 billion |

| China E-Hailing Market Size in 2030 | USD 91.319 billion |

| Growth Rate | CAGR of 8.67% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Beijing, Shanghai, Guangzhou, and others |

| List of Major Companies in the China E-Hailing Market |

|

| Customization Scope | Free report customization with purchase |

China E-Hailing Market Segmentation:

- By Service Type

- Ride Sharing

- Ride Hailing

- Others

- By Device Type

- Smartphones

- Tablets

- Others

- By Vehicle Type

- Two-Wheeler

- Three-Wheeler

- Four-Wheeler

- Sedans

- SUVs

- Others

- By End-User

- Personal (B2C)

- Corporates (B2B)

- By Province

- Beijing

- Shanghai

- Guangzhou

- Others

Our Best-Performing Industry Reports:

Navigation:

- China E-Hailing Market Size:

- China E-Hailing Market Key Highlights:

- China E-Hailing Market Overview & Scope

- Top Trends Shaping the China E-Hailing Market

- China E-Hailing Market Growth Drivers vs. Challenges

- Regional Analysis of the China E-Hailing Market

- China E-Hailing Market Competitive Landscape

- China E-Hailing Market Scope:

- Our Best-Performing Industry Reports: