Report Overview

India Electric Commercial Vehicles Highlights

India Electric Commercial Vehicles Market Size:

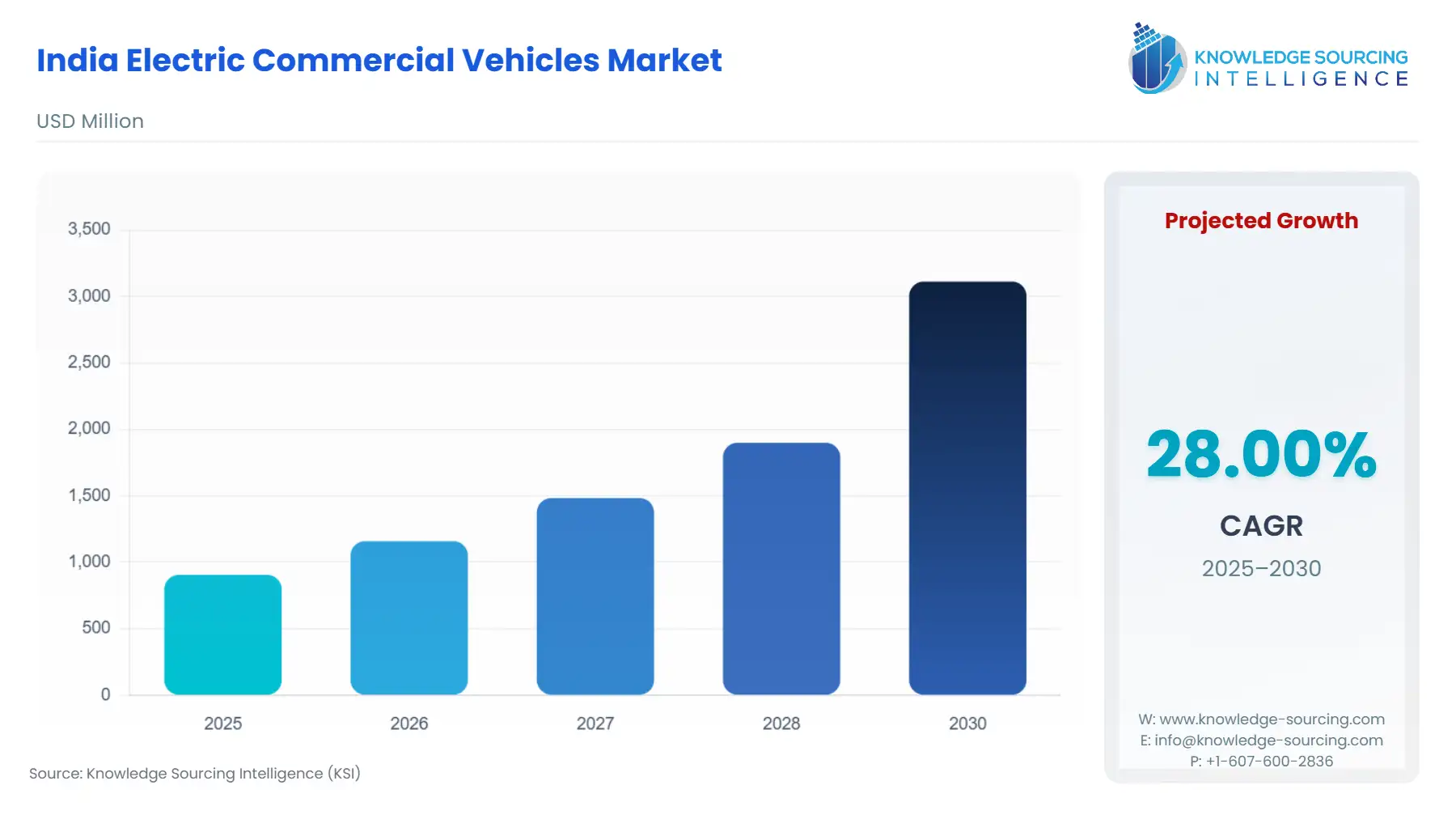

The India Electric Commercial Vehicles Market is anticipated to surge at a CAGR of 28.00%, reaching USD 3.113 billion in 2030 from USD 0.906 billion in 2025.

The Indian Electric Commercial Vehicles (eCV) market is navigating a decisive transformation, pivoting from nascent policy-driven adoption to a more structurally integrated commercial alternative. This transition is predicated on supportive federal and state policies that directly address the initial capital expenditure barrier. By prioritizing public and commercial fleet electrification, the government has established a foundational market for specific vehicle categories. The critical shift now involves scaling this success across medium and heavy-duty segments by leveraging favourable operating economics, primarily driven by reduced fuel and maintenance costs. The market trajectory is increasingly defined by the ability of Original Equipment Manufacturers (OEMs) to deliver competitive TCO, operational uptime, and adequate charging infrastructure solutions to commercial customers.

India Electric Commercial Vehicles Market Analysis:

- Growth Drivers

Government incentives are the primary catalyst, specifically through the Faster Adoption and Manufacturing of Electric Vehicles (FAME-II) scheme. This policy allocated significant capital toward demand-side incentives for electric three-wheelers, e-buses, and electric four-wheelers used for commercial purposes. This direct subsidy creates immediate and substantial requirement by bridging the price gap between electric and ICE vehicles, making eCVs financially viable for price-sensitive fleet owners. Furthermore, the imperative for fleet owners to mitigate the volatile cost of diesel and reduce the high maintenance expenses associated with ICE vehicles directly propels demand for eCVs, whose predictable energy costs and fewer mechanical parts result in a demonstrably lower TCO for high-utilization commercial applications.

- Challenges and Opportunities

A primary challenge is the high upfront capital cost of Medium and Heavy Commercial Vehicles (M&HCVs), where an electric truck can be approximately four times the price of its diesel equivalent. This disparity constrains expansion, as fleet operators face financing obstacles due to the perceived risk and high collateral requirements from financiers. The core opportunity lies in the burgeoning battery-as-a-service (BaaS) and leasing models. By separating the high-cost battery from the vehicle, these models convert the capital expenditure into a usage-linked operating expense, effectively lowering the entry barrier and instantly increasing demand from small-to-medium fleet owners. The high proportion of overaged buses (estimated at 0.6 million by 2030) presents a significant fleet replacement opportunity for electric models in the public and private transport sectors.

- Raw Material and Pricing Analysis

As a market for physical products, the eCV segment is fundamentally tied to the raw material dynamics of the battery supply chain. The price trajectory of lithium-ion batteries is a primary determinant of vehicle affordability. The price of battery packs dropped significantly in recent periods, a trend primarily attributed to falling prices for critical minerals like lithium. This continuous cost reduction directly impacts the ex-showroom price of eCVs, making them more cost-competitive and driving consumer demand. The increasing adoption of Lithium Iron Phosphate (LFP) chemistry for e-buses and light commercial vehicles, due to its lower cost and enhanced safety profile, further reduces the cost barrier for commercial fleet adoption.

- Supply Chain Analysis

The Indian eCV supply chain exhibits a significant dependency on the global market for high-value components, particularly lithium-ion cells, controllers, and advanced electronics. While domestic assembly and manufacturing for lower-value components are increasing, the reliance on imported battery cells introduces trade and currency risks. China and other East Asian countries remain the dominant production hubs for battery cells. Logistical complexity arises from transporting these sensitive, high-energy-density components. This dependence necessitates a domestic manufacturing policy focus to localize the production of battery cells and packs to mitigate supply chain vulnerabilities and ensure uninterrupted manufacturing output required to meet rising domestic demand.

India Electric Commercial Vehicles Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

Central Government (Ministry of Heavy Industries) |

FAME-II Scheme (Phase II) |

Created direct demand for approximately 7,000 e-Buses and 5 lakh e-3 Wheelers by offering upfront purchase incentives, significantly reducing the initial acquisition cost for fleet operators. |

|

Central Government (Ministry of Heavy Industries) |

PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) Scheme (Sep 2024) |

Sustains the demand momentum from FAME-II by allocating funds for the procurement of e-Buses, e-Trucks, and EV charging infrastructure, ensuring continued public sector demand and ecosystem support. |

|

State Governments |

Road Tax and Registration Fee Waivers |

Reduces the operational cost and administrative friction of owning an ECV, providing an immediate financial incentive for commercial fleet owners to shift their purchases toward electric models. |

India Electric Commercial Vehicles Market Segment Analysis:

- By Application: Public Transportation

The necessity of electric commercial vehicles in the public transportation segment, specifically electric buses, is primarily driven by government-led procurement programs and the imperative to reduce urban air pollution. Schemes like FAME-II and the PM E-DRIVE directly allocate substantial funds for State Transport Undertakings (STUs) to procure e-buses under a Gross-Cost Contract (GCC) model. This shifts the financial risk from the public entity to private operators, who are compensated on a per-kilometer basis. This structure provides a stable, long-term revenue stream for operators, thereby creating reliable, large-scale demand for e-bus manufacturers. Furthermore, e-buses offer up to a 31% reduction in operating costs compared to diesel buses, providing a strong economic rationale for public transit agencies to replace their ageing diesel fleets and satisfy their mandate for clean, affordable urban mobility.

- By Vehicle Type: Trucks (Light-Duty Trucks)

The Light-Duty Electric Trucks (e-LCVs) segment is surging, catalyzed by the rapid expansion of e-commerce and third-party logistics (3PL) providers for last-mile and middle-mile urban logistics. These operators demand high-frequency, low-emission vehicles for intra-city movement. E-LCVs are ideally suited for this application due to their lower TCO over fixed, predictable routes, which is significantly enhanced by lower maintenance and fuel costs. The economic case is further strengthened by the rise of battery swapping ecosystems tailored for e-LCVs, which dramatically minimize vehicle downtime and address range anxiety, leading logistics firms like Blinkit and Swiggy to integrate them into their fleets to meet service-level emission targets and optimize delivery efficiency.

India Electric Commercial Vehicles Market Competitive Analysis:

The competitive landscape in the Indian eCV market is dominated by incumbent domestic manufacturers leveraging their extensive service networks and localized manufacturing capabilities. The primary battleground is in the electric bus and Light Commercial Vehicle segments, where the focus is on maximizing TCO advantages and ensuring reliable operational uptime.

Tata Motors maintains a strong strategic position as India's largest commercial vehicle manufacturer, underpinned by the vertical integration of its electric mobility ecosystem. Its strategy centers on offering a diverse, multi-fuel product portfolio. A key product is the Tata Ace EV, an electric variant of its iconic mini-truck, which targets the burgeoning last-mile logistics sector. The company's connected vehicle platform, Fleet Edge, enhances its value proposition by offering real-time vehicle diagnostics and fleet management capabilities, directly supporting fleet operators in optimizing their operations and increasing asset utilization.

Ashok Leyland is strategically focused on the heavy-duty and bus segments, pioneering new-energy technologies beyond Battery Electric Vehicles (BEV). Its flagship electric products include the BOSS Electric Truck in the Intermediate Commercial Vehicle (ICV) category and the AVTR 55T Electric Tractor, which is the first 4x2 electric tractor commercially offered by an Indian CV manufacturer. The company is actively moving toward multiple alternative fuels, including Hydrogen Internal Combustion Engine (H2-ICE) and Fuel Cell Electric Vehicles (FCEV), positioning itself for the future transition of long-haul logistics.

India Electric Commercial Vehicles Market Developments:

- June 2025 (Tata Motors): Tata Motors officially launched the Tata Ace Pro, a four-wheel mini-truck, available in electric, petrol, and bi-fuel variants. The electric variant features an advanced EV architecture with an estimated 155km range, strategically aiming to capture the demand from a new wave of entrepreneurs in the small cargo mobility segment.

- October 2024 (Ashok Leyland): Ashok Leyland commenced the delivery of 180 electric trucks, including the AVTR 55T Electric Tractor and the BOSS Electric Truck, to Billion Electric Mobility. This marked the commencement of the largest single order for electric trucks in India and reinforced the commercial viability of electric vehicles in the heavy and intermediate commercial segments.

India Electric Commercial Vehicles Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 0.906 billion |

| Total Market Size in 2031 | USD 3.113 billion |

| Growth Rate | 28.00% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Vehicle Type, Propulsion Type, Power Output, Application |

| Companies |

|

India Electric Commercial Vehicles Market Segmentation:

- BY VEHICLE TYPE

- Buses and Coaches

- Trucks

- Light-Duty Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Vans

- BY PROPULSION TYPE

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

- Fuel Cell Electric Vehicles (FCEV)

- BY POWER OUTPUT

- Up to 150 kW

- 150-250 kW

- Above 250 kW

- BY APPLICATION

- Logistics and Transportation

- Public Transportation

- Construction (Excavators, Loaders, Others)

- Mining

- Agriculture (Tractors, Harvesters, Others)

- Others