Report Overview

India Electric Vehicle Battery Highlights

India Electric Vehicle Battery Market Size:

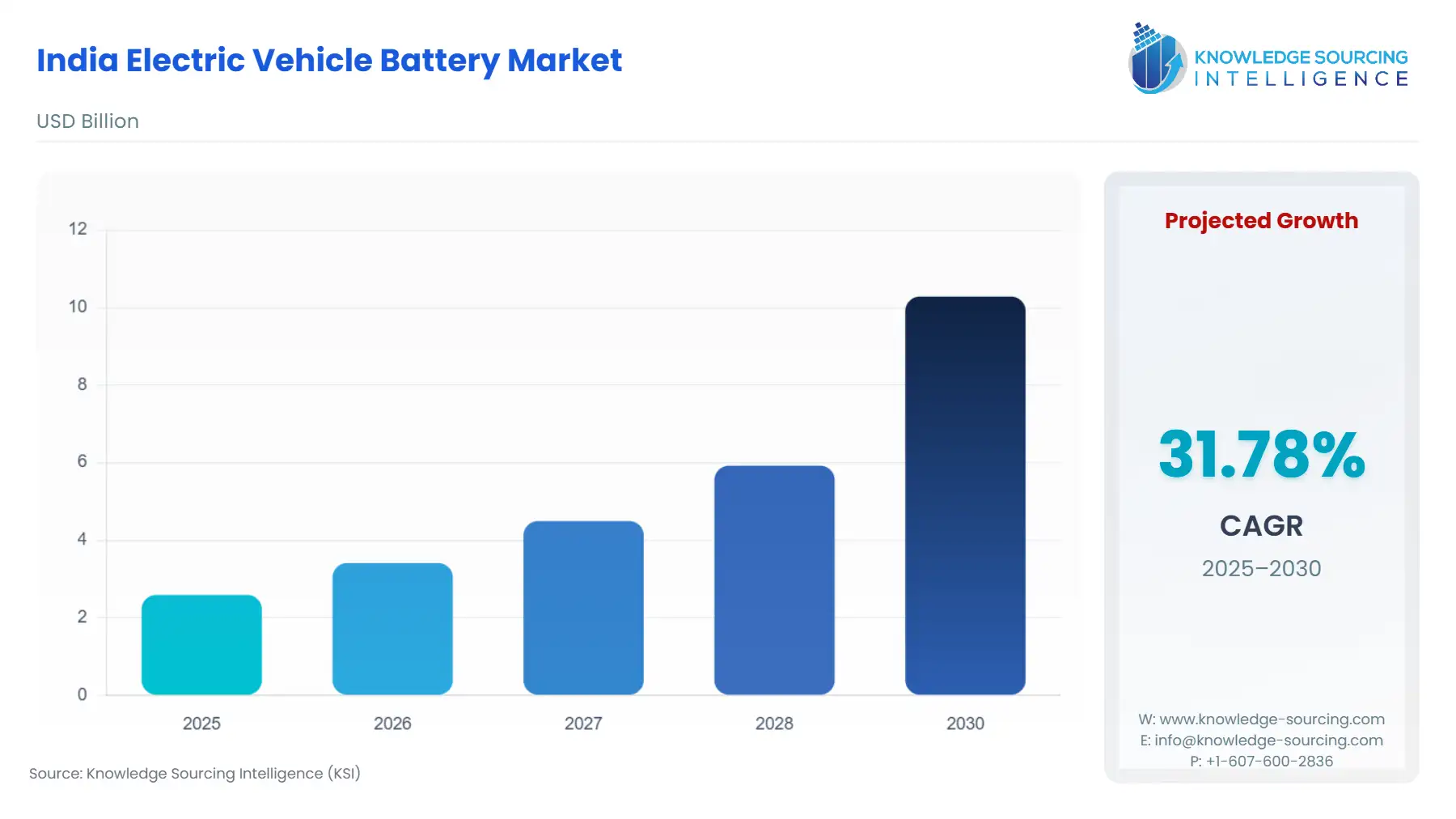

The India Electric Vehicle Battery Market is forecast to rise at a CAGR of 31.78%, attaining USD 10.286 billion in 2030 from USD 2.588 billion in 2025.

The Indian Electric Vehicle (EV) battery market is transitioning from an assembly-centric model to a domestically integrated manufacturing ecosystem, underpinned by strong government mandates. As the battery is the single most expensive component of an EV, the market’s trajectory is inextricably linked to technological advances, raw material pricing volatility, and the strategic push for localized cell production. The current landscape is characterized by accelerating demand for electric mobility solutions in a bid to mitigate vehicular emissions and reduce reliance on imported crude oil, thus creating a fertile ground for high-energy-density battery technologies.

India Electric Vehicle Battery Market Analysis:

- Growth Drivers

Governmental policy directly catalyzes demand for advanced batteries. The FAME II scheme is a primary catalyst, having allocated a significant portion of its budget to subsidize the purchase of electric two-wheelers, three-wheelers, and buses. This targeted incentive structure instantly raises the volume demand for batteries, specifically those suited for smaller vehicle formats like Li-ion and, to a lesser extent, lead-acid for the entry-level E3W segment. Simultaneously, the PLI scheme for ACC Battery Storage incentivizes large-scale domestic gigafactories by offering financial rewards on sales of manufactured batteries, thereby boosting the supply and indirectly driving down future battery pack costs, which will propel mass EV adoption and, in turn, battery demand.

Challenges and Opportunities

The primary challenge is the capital-intensive nature of cell manufacturing. India's heavy reliance on imported battery cells accounts for a substantial portion of the final EV cost, acting as a major constraint on consumer demand. Fluctuations in global raw material prices, particularly lithium, nickel, and cobalt, introduce pricing instability for domestic manufacturers, making long-term procurement and stable pricing strategies difficult. Conversely, the opportunity lies in vertical integration and technology diversification. The push for domestic cell production under the PLI scheme presents a unique opportunity to insulate the supply chain from geopolitical risks, reduce logistics costs, and tailor battery chemistries, such as Lithium Iron Phosphate (LFP), specifically for India’s high-temperature operating conditions and lower-range, cost-sensitive vehicle segments, which would significantly increase the total addressable battery demand.

- Raw Material and Pricing Analysis

The EV battery market, a physical product market, is intensely sensitive to raw material costs. Lithium-ion battery cells, which constitute over half of an EV’s cost, are predominantly imported, exposing the domestic market to global price volatility. While a global stabilization of key battery metal prices, including cobalt and nickel, has been observed, India’s dependence on imports means the final price of a battery pack remains high. The recent, substantial discovery of domestic lithium reserves, once operationalized, holds the potential to disrupt the pricing dynamics by providing a localized, cheaper source, which would directly reduce the cost of battery manufacturing and trigger a corresponding increase in EV sales and, therefore, battery demand.

- Supply Chain Analysis

The global supply chain for EV batteries is highly centralized, with East Asia dominating both cell and component production. India operates as a downstream player, primarily involved in battery pack assembly using imported cells. This structure creates significant logistical complexities, increasing both lead times and capital lock-up. The current strategy focuses on transitioning from this assembly model to full-scale cell manufacturing by encouraging the establishment of gigafactories. This will shift the value capture onshore, create a more resilient domestic supply chain, and reduce dependency on international production hubs, which is essential for scaling to the projected demand volumes.

India Electric Vehicle Battery Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

Central Government |

Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) II Scheme |

Direct financial subsidies lower the upfront cost of EVs, most notably two and three-wheelers, immediately translating into higher volume demand for batteries. |

|

Central Government |

Production Linked Incentive (PLI) Scheme for Advanced Chemistry Cell (ACC) Battery Storage |

Incentivizes domestic cell manufacturing with a target of 50 GWh capacity, attracting multi-billion-dollar investments, which will fundamentally shift the market from import-dependency to self-sufficiency and stabilize long-term supply. |

|

Ministry of Power |

Charging Infrastructure Guidelines |

Mandates the establishment of Public Charging Stations (PCS), reducing 'range anxiety' for consumers, a critical barrier to EV adoption, which directly unlocks the latent demand for higher-range batteries, particularly in the passenger car segment. |

India Electric Vehicle Battery Market Segment Analysis:

- By Battery Type: Lithium Ion

Lithium-ion (Li-ion) technology is the unequivocal market leader, driven by its superior energy density and lifecycle compared to alternatives like lead-acid. This technology directly satisfies the performance imperatives of the passenger car and commercial vehicle segments, where extended range and fast-charging capabilities are non-negotiable growth drivers. The push for premium, high-voltage vehicle platforms, particularly in the Battery Electric Vehicle (BEV) segment, necessitates high-nickel content Li-ion chemistries (like NMC and NCA). Furthermore, the cost reduction trajectory of LFP cells, better suited for the high-volume, low-speed E2W and E3W segments due to their inherent safety and robustness, fuels their rapid proliferation, consolidating Li-ion's dominance across the mobility spectrum. The ongoing development of solid-state technology promises a future leap in energy density and safety, posing a long-term demand shift within this segment.

- By Vehicle Type: Passenger Cars

The passenger car segment is a high-value, high-performance driver for the EV battery market. This segment’s growth is less sensitive to initial cost than the two-wheeler segment, but is highly sensitive to vehicle range and charging time. Consumers expect parity with ICE vehicle convenience, directly translating into demand for large-capacity, high-energy-density Li-ion battery packs, typically ranging from 40 kWh to over 60 kWh. Government policies, such as reduced Goods and Services Tax (GST) on EVs and tax waivers on road tax, reduce the total cost of ownership, making EVs more competitive. The introduction of attractive models from major original equipment manufacturers (OEMs) and the rapid, albeit still limited, expansion of fast-charging infrastructure significantly mitigate range anxiety, which is the primary accelerant for demand in this premium, high-performance battery category.

India Electric Vehicle Battery Market Competitive Analysis:

The competitive landscape is rapidly evolving from one dominated by traditional automotive component suppliers and pure-play EV startups to one involving diversified industrial conglomerates. Competition is currently concentrated in battery pack assembly but is shifting towards cell manufacturing under the impetus of the PLI scheme. Major players are strategically positioning themselves to secure the core technology and raw material supply chains.

Reliance Industries Limited (RIL): RIL is establishing a comprehensive position in the new energy value chain through its Dhirubhai Ambani Green Energy Giga Complex in Jamnagar, Gujarat. RIL's strategy centers on deep vertical integration, encompassing solar, battery storage, and green hydrogen. The company is actively building a battery gigafactory with a planned capacity of 40 GWh, expandable to 100 GWh. This move positions RIL not merely as a supplier but as a foundational ecosystem enabler, directly addressing the core market constraint of cell import dependency.

India Electric Vehicle Battery Market Developments:

- September 2025: TDK Corporation Inaugurates Battery Plant. Union Minister Ashwini Vaishnaw inaugurated the TDK Corporation's lithium-ion battery manufacturing plant in Sohna, Haryana. This facility, established under the Electronics Manufacturing Cluster (EMC) scheme, will significantly boost the domestic capacity for Li-ion battery packs, primarily catering to the non-automotive electronics sector but establishing critical manufacturing infrastructure and supply chain maturity.

- August 2025: Ola Electric Receives PLI Certification. Ola Electric secured the domestic value addition certificate under the Production Linked Incentive (PLI) scheme for the automotive sector for its Gen 3 scooter portfolio. This certification is a key milestone, signalling the firm's successful compliance with the domestic value addition norms, which enables it to receive incentives and validates its progress toward a fully integrated manufacturing model at its Futurefactory.

India Electric Vehicle Battery Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 2.588 billion |

| Total Market Size in 2031 | USD 10.286 billion |

| Growth Rate | 31.78% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Battery Type, Propulsion, Cell Form, Vehicle Type |

| Companies |

|

India Electric Vehicle Battery Market Segmentation:

- BY BATTERY TYPE

- Lithium Ion

- Solid-state

- Lead-Acid

- Hybrid Nickel Metal

- Others

- BY PROPULSION TYPE

- Battery Electric Vehicle (BEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

- Fuel Cell Electric Vehicle (FCEV)

- BY BATTERY CELL FORM

- Cylindrical cells

- Prismatic cells

- Others

- BY VEHICLE TYPE

- Passenger Cars

- Commercial Vehicles

- Others