Report Overview

India Electric Vehicle Components Highlights

India Electric Vehicle Components Market Size:

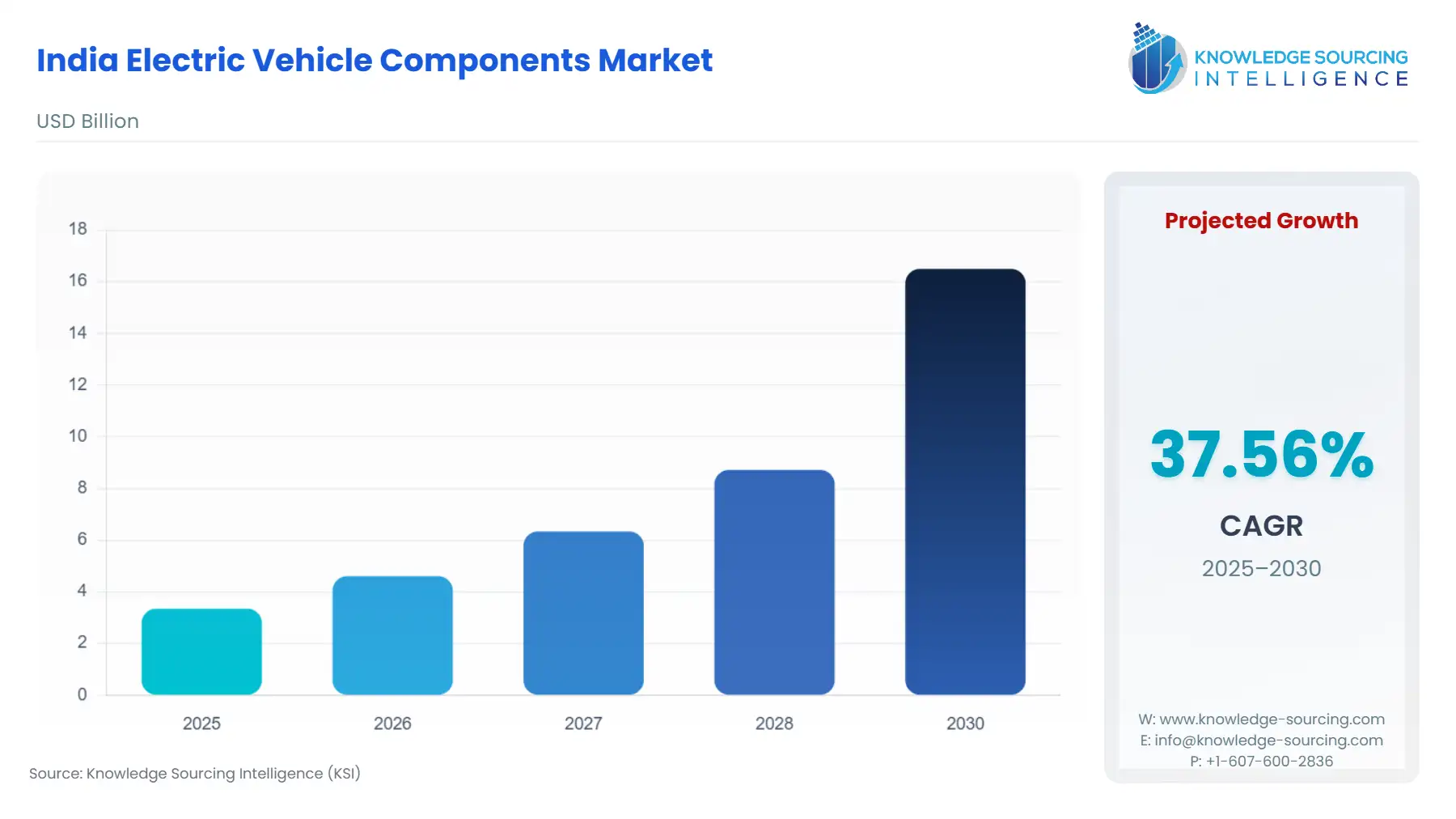

The India Electric Vehicle Components Market is anticipated to witness strong growth at a CAGR of 37.56%, reaching USD 16.5 billion in 2030 from USD 3.35 billion in 2025.

The Indian electric vehicle (EV) components market is transitioning from an import-dependent ecosystem to one with mandated domestic manufacturing capability, catalyzed by comprehensive national policy interventions. This structural shift moves beyond simple EV adoption rates to create a deep-rooted domestic industrial base for core EV subsystems. Policy-driven incentives and tightening localization norms are the primary forces reorganizing the supply chain for battery packs, power electronics, and thermal management systems. The high-volume two-wheeler and three-wheeler segments disproportionately lead the market’s current growth, although substantial government investment in e-bus deployment signals a strategic drive to build capacity for larger, more technologically complex commercial vehicle components. This foundation is establishing a long-term manufacturing imperative for domestic players, necessitating capital investment and technology acquisition to meet mandated DVA targets.

India Electric Vehicle Components Market Analysis:

- Growth Drivers

Government demand-side subsidies act as a primary catalyst for component production. The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME-II) scheme offers a direct upfront reduction in the purchase price of electric vehicles, linked to the vehicle's battery capacity. This mechanism directly increases the volume requirement for electric two-wheelers and three-wheelers, which in turn escalates the purchase orders for essential components like low-to-medium voltage Battery Packs and Electric Motors from domestic OEMs. Furthermore, the Production Linked Incentive (PLI) Scheme for Advanced Chemistry Cell (ACC) battery storage, with a substantial budgetary outlay, directly creates demand for domestic capacity creation in Battery Cell and Ancillary Component manufacturing by guaranteeing incentives linked to domestic production and value addition.

- Challenges and Opportunities

A significant constraint remains the limited supply chain for specialized raw materials, particularly the critical minerals required for battery cell and power electronics manufacturing. This import dependency poses a volatility risk to component pricing, placing a constraint on stable supply for domestic OEMs. The primary opportunity lies in the government's strategic focus on localizing battery cell production through the ACC PLI scheme. This is an explicit signal to component manufacturers to transition from assembling imported cells to undertaking end-to-end cell production, which will eventually secure the supply of the most value-intensive component, thereby mitigating price risk and creating a new demand vertical for integrated domestic suppliers.

- Raw Material and Pricing Analysis

The Electric Vehicle Components Market, a physical product market encompassing items like battery packs, electric motors, and inverters, is critically exposed to global raw material supply chain dynamics. Lithium, Nickel, and Cobalt, essential for high-performance Lithium-ion battery cathode chemistries, are not mined domestically, creating a complete import reliance. This dependency subjects the pricing of the Battery Pack component—which can constitute 40-50% of an EV's cost—to international commodity price fluctuations and geopolitical supply chain stability, compelling domestic component manufacturers to manage procurement risk aggressively. This upstream volatility prevents domestic OEMs from securing stable, long-term component pricing, challenging the goal of achieving price parity with Internal Combustion Engine (ICE) vehicles and suppressing mass-market adoption.

- Supply Chain Analysis

The current supply chain for high-value EV components, such as power semiconductors for Inverters and Converters (DC-DC), exhibits a heavy global dependency. Key production hubs are concentrated in East Asia, necessitating long-distance maritime logistics to reach Indian ports. This complexity introduces significant lead times and logistics costs, compounded by global semiconductor shortages. Domestic manufacturing, therefore, is primarily focused on final assembly (e.g., assembling imported cells into a Battery Pack), a structure that runs counter to the government's DVA targets. The dependency on imported components limits the flexibility of Indian OEMs to rapidly iterate design or quickly scale production in response to sudden changes in domestic demand, creating a structural dependency that the PLI schemes are explicitly designed to dismantle.

India Electric Vehicle Components Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

India |

FAME-II Scheme (Department of Heavy Industries) |

Growth incentives directly stimulate volume sales of electric vehicles, creating immediate, high-volume demand for core components like Electric Motors and Battery Packs from domestic vehicle manufacturers. |

|

India |

PLI Scheme for Advanced Chemistry Cell (ACC) Battery Storage (Ministry of Heavy Industries) |

Provides financial incentives contingent on achieving a minimum Domestic Value Addition, directly mandating and subsidizing the establishment of domestic Battery Cell and Module manufacturing capacity. |

|

India |

Phased Manufacturing Programme (PMP) (Ministry of Heavy Industries) |

Enforces rising localization thresholds over time for multiple EV subsystems, fundamentally shifting the demand preference of OEMs away from imported finished components towards localized sub-assemblies and raw materials. |

India Electric Vehicle Components Market Segment Analysis:

- By Component Type: Battery Pack

The battery pack segment is the primary growth driver for the entire component market due to its high-value composition and indispensable role. Government demand-side incentives under FAME-II, which link subsidies directly to battery capacity (kWh), create a non-linear spike in purchase volume, translating immediately into component orders. Specifically, the success of the electric two-wheeler segment (1.2 million units sold in 2024) drives the need for low-voltage, modular battery packs typically in the 2-4 kWh range. Furthermore, the strategic national push via the ACC PLI scheme specifically targets the localization of this segment's manufacturing. This policy creates demand not just for the final pack assembly but for the upstream production of its subcomponents—cells, thermal management systems, and Battery Management Systems (BMS)—thereby deepening the domestic industrial base.

- By End-User: OEMs

Original Equipment Manufacturers (OEMs) represent the dominant and most strategic growth segment, primarily due to their direct access to government incentives and compliance with localization mandates. The FAME-II incentives are processed through OEMs, making them the direct purchasers of components. For instance, the significant electric vehicle production volumes by companies like Tata Motors, the number one EV manufacturer in India, necessitates large-scale, consistent demand for standardized components. Furthermore, the OEM segment is the target of the PMP and PLI localization requirements; compliance mandates that they establish long-term sourcing contracts with domestic component suppliers to meet DVA criteria. This regulatory pressure shifts OEM requirements away from transactional imports to strategic, long-term localization partnerships, creating stable demand forecasts for domestic component producers.

India Electric Vehicle Components Market Competitive Analysis:

The competitive landscape is bifurcating into legacy automotive suppliers and new-age, integrated energy players, all aggressively moving to localize production in response to policy incentives. Competition is intensifying across the value chain, focusing on economies of scale and technology licensing.

- Tata Auto Components (TACO): A key player leveraging its deep automotive sector experience, TACO is strategically positioned as a critical supplier to its group company, Tata Motors, the largest domestic EV manufacturer. TACO is actively collaborating with Tata Motors to localize the supply of EV powertrains and Battery Packs, utilizing the synergy within the Tata UniEVerse initiative to secure high-volume, captive demand and meet DVA targets.

- Reliance New Energy Solar Limited (RNESL): RNESL represents a major new entrant, positioning itself to dominate the upstream, high-value segment. The company has been selected as a beneficiary under the ACC PLI scheme, committing to establish giga-scale manufacturing of Advanced Chemistry Cell batteries. This strategic move aims to capture the critical Battery Cell market, reducing India’s import dependency and directly competing with global battery manufacturers by focusing on LFP chemistry, which is proven at scale for safety and cost-effectiveness.

India Electric Vehicle Components Market Developments:

- January 2024: Tata Motors unveiled the Punch.ev, the company's first EV built on its new platform, 'acti.ev'. This product launch directly translates into high-volume component demand for the new architecture, specifically for the Battery Pack, motor, and associated power electronics tailored for a mass-market compact SUV.

- August 2023: Reliance Industries, at its 46th Annual General Meeting, announced its intention to establish its battery giga factory by 2026, focusing on Lithium Iron Phosphate (LFP) chemistry for battery chemicals, cells, and packs. This is a critical development, signalling a significant domestic capacity addition that will fundamentally alter the import-dominated supply for Battery Cell components.

India Electric Vehicle Components Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 3.35 billion |

| Total Market Size in 2031 | USD 16.5 billion |

| Growth Rate | 37.56% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component Type, Vehicle Type, Technology, End User |

| Companies |

|

India Electric Vehicle Components Market Segmentation:

- BY COMPONENT TYPE

- Battery Pack

- Electric Motor

- Power Electronics

- Inverter

- Converter (DC-DC)

- On-Board Charger

- Thermal Management System

- Body & Chassis

- Other Components

- BY VEHICLE TYPE

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers & Three-Wheelers

- BY TECHNOLOGY

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

- Fuel Cell Electric Vehicle (FCEV)

- BY END-USER

- OEMS

- Aftermarket