Report Overview

Italy Shampoo Market Size, Highlights

Italy Shampoo Market Size:

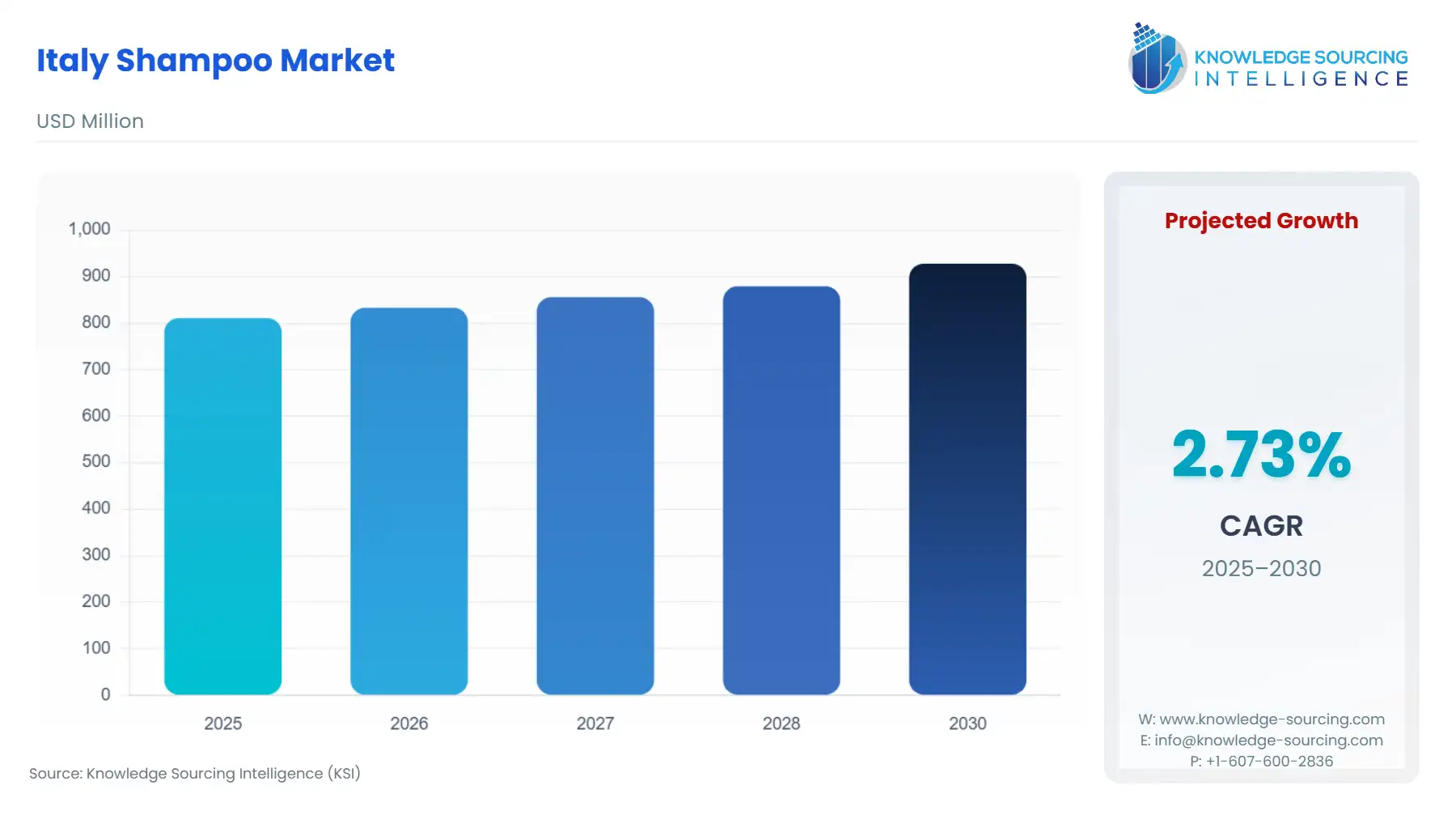

The Italy shampoo market is projected to grow at a CAGR of 2.73% during the projected period (2025-2030), reaching a market size of USD 0.928 billion by 2030 from USD 0.811 billion by 2025.

Products for maintaining healthy hair and scalp are sold in Italy's hair and scalp care market, which is a component of the beauty and personal care sector. It contains products for hydrating, nourishing, and treating hair and scalp problems, such as shampoos, conditioners, hair oils, serums, and scalp treatments. The market's clientele includes people looking for items to strengthen, style, and take care of their hair as well as people with needs such as dandruff, hair loss, or sensitive scalps. Two of the primary elements propelling this business are consumer knowledge of hair health and the need for natural and organic goods. The use of biologically generated or plant-based materials in products is growing in popularity.

Italy Shampoo Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope:

The Italy shampoo market is segmented by:

- Product: The Italy shampoo market is divided into two segments based on product, medicated/special purpose and non-medicated/regular. The non-medicated/regular segment is expected to hold the largest market share in Italy due to its broad availability and growing acceptability of mass-produced products. Non-medicated shampoos are more extensively used than their counterparts since they are more affordable and easier to locate. Additionally, the increasing availability of counter alternatives at pharmacies and drug stores is driving the income of the non-medicated shampoo category.

- Application: The two market types based on application are domestic and commercial. The domestic segment is expected to dominate the market. The reasons driving the growth of the domestic segment include the increasing number of toddlers and babies using baby shampoos and the significant product use for personal hygiene purposes in the home. It is anticipated that the increasing number of companies advertising their hair grooming products on social media and through celebrity endorsements would increase demand from Italy home consumers.

- Distribution Channel: The market is divided into convenience stores, online stores, hypermarkets and supermarkets, and others based on the distribution. The availability of a wide range of products on supermarket shelves allowed hypermarkets and supermarkets to dominate the market. This enables customers to know their alternatives and purchase a specific product or combination of products based on their hair care requirements. The segment's rise was aided by the new trend of buying personal care goods in bulk at department stores and supermarkets.

- Manufacturers: The market is divided into private label, toll manufacturing, and multinational segments based on manufacturers. The multinational segment's growth in the market is propelled by the consistent supply of branded goods, the distribution networks of major multinational corporations, and a strong clientele. Across Italy, these factors made a substantial contribution to the revenue generated by multinational corporations. The segment's growth is driven by expanding projects and capacity-building initiatives carried out by international corporations.

Top Trends Shaping the Italy Shampoo Market:

- Increase in "Made-in-Italy" Products Using Local Ingredients

Natural products are popular throughout the world, but in Italy, there is a noticeable shift towards ingredients that are sourced locally and have a traditional value. Sicilian citrus, Tuscan olive oil, and Alpine herbs are examples of regional Italian botanicals that brands are using not only for their effectiveness but also to reflect the pride that Italians take in their "Made in Italy" quality. These substances provide businesses with an appealing authenticity because they are frequently supported by traditional herbal expertise.

- Trichology's incorporation into mass-market goods

Drugstore shampoo products are increasingly including trichology, the study of the hair and scalp. For customers in Italy, where dermatological care and scalp health are highly valued, shampoos with clinical support and doctor recommendations are used. Nowadays, several companies work with dermatological clinics and trichologists to jointly create shampoos that target conditions including psoriasis, seborrheic dermatitis, and aging of the scalp.

Italy Shampoo Market Growth Drivers vs. Challenges:

Opportunities:

- Fashion and Design's Effect on Packaging: Italy is a world leader in fashion and industrial design, and its visual culture contributes in a special way to shampoo sales. Even for mass-market shampoos, product packaging, shelf appearance, and branding aesthetics have a significant impact on purchasing decisions. Italian consumers are more likely to select it if its packaging is sophisticated, understated, or innovative. For international or less expensive brands that disregard regional design preferences, it raises the entry hurdle.

- Increasing Domestic Prestige Brands through Tourism and Export: Through its exposure to local haircare products in hotels, shops, and spas, Italy's booming tourism industry indirectly propels the shampoo business. Luxury Italian shampoos are frequently bought by tourists as a memento of the "Made in Italy" way of life. This inward exposure helps local companies get international recognition and boost exports, which in turn helps domestic prestige branding and price justification.

Challenges:

- Nationwide Scaling Is Limited by a Fragmented Retail Environment: The retail landscape in Italy is still very dispersed, particularly outside of large cities. Instead of shopping at national chains, many Italians prefer to shop at individual, local establishments. Mass marketing campaign reach is restricted by this decentralization, which also makes it difficult to standardize products, manage supply chains, and maintain prices across geographical boundaries. Regional performance discrepancies and increased distribution expenses result from the inability of even well-funded companies to secure consistent shelf presence. In contrast to more centralized marketplaces, this results in slower and more resource-intensive market penetration.

Italy Shampoo Market Competitive Landscape:

The market is moderately fragmented, with many key players including Alfaparf Milano, Framesi, Alter Ego Italy, Oway, Fanola, and Farmagan.

- Acquisition: In March 2024, Bluegem Capital Partners, the current owner of the Italian hair care platform Beautynova, sold most of the company to private equity firm PAI Partners. Aside from creating professional hair care products like shampoos, conditioners, and styling products, Beautynova also owns the brands Milk_Shake, Z.one Concept, and Medavita.

Italy Shampoo Market Scope:

| Report Metric | Details |

| Italy Shampoo Market Size in 2025 | USD 0.811 billion |

| Italy Shampoo Market Size in 2030 | USD 0.928 billion |

| Growth Rate | CAGR of 2.73% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Lombardy, Lazio, Campania, Sicily, Veneto, Others |

| List of Major Companies in the Italy Shampoo Market |

|

| Customization Scope | Free report customization with purchase |

Italy Shampoo Market Segmentation:

- By Product

- By Application

- By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Stores

- Others

- By Manufacturers

- By Region