Report Overview

Japan AI in Finance Highlights

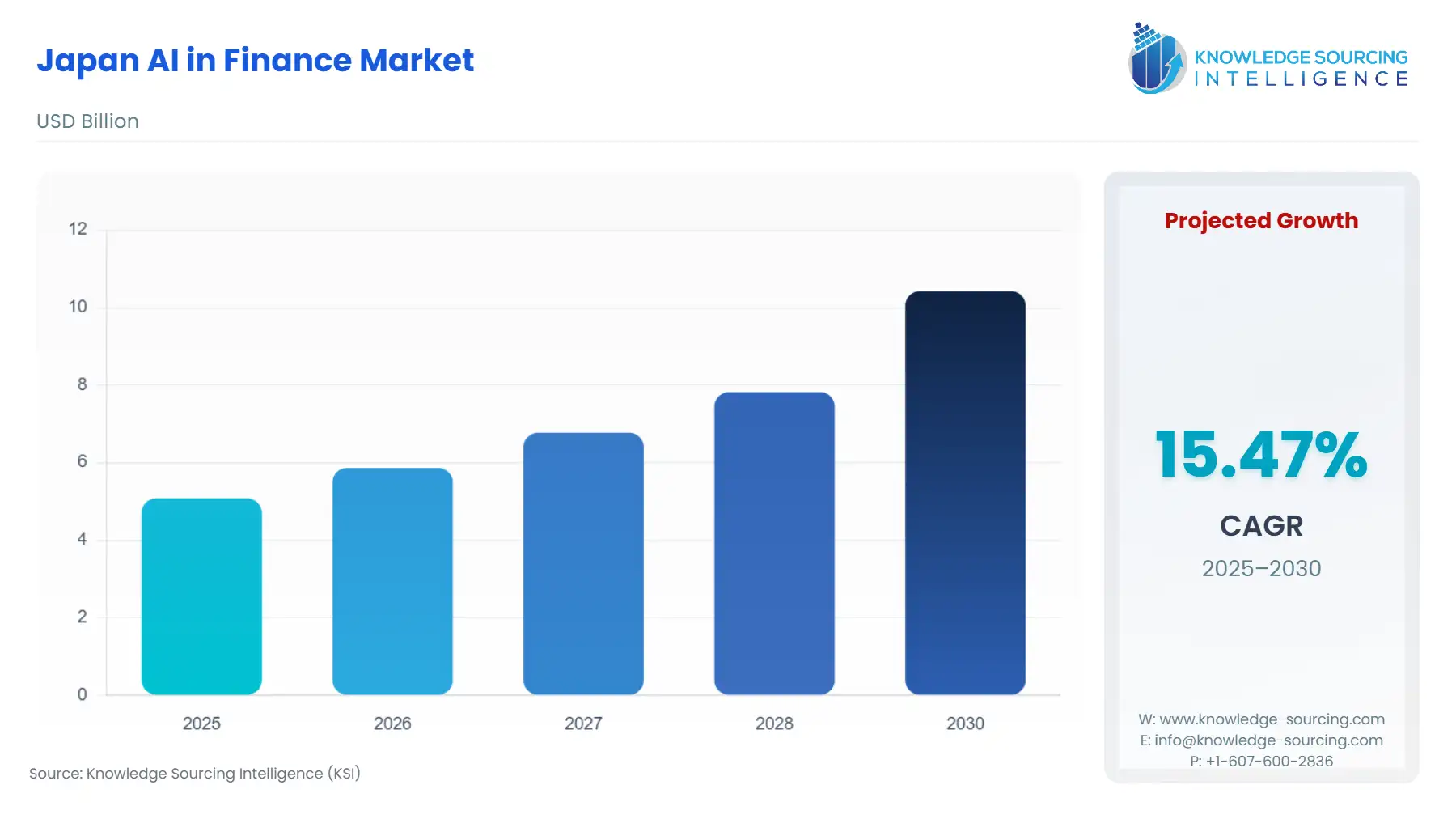

Japan AI in Finance Market Size:

The Japan AI in Finance Market is expected to grow at a CAGR of 15.46%, reaching USD 10.426 billion in 2030 from USD 5.080 billion in 2025.

The Japanese AI in Finance market represents a strategic nexus where the nation's digital transformation mandate intersects with its legacy of rigorous operational standards. Financial institutions, navigating an increasingly complex global compliance environment and the imperative for cost optimization, are actively integrating Artificial Intelligence to maintain a competitive edge. This adoption is characterized by a cautious, partnership-driven approach, prioritizing data integrity, security, and governance before large-scale deployment.

The market is propelled by a dual need: enhancing front-office personalization to capture the evolving consumer base and fortifying back-office operations against escalating financial crime, creating sustained demand for sophisticated, domain-specific AI solutions that can deliver both operational efficiency and risk mitigation. The ongoing government efforts to define and regulate the use of generative AI are simultaneously creating a compliance market, positioning providers of auditable AI solutions favorably within the ecosystem.

Japan AI in Finance Market Analysis:

Growth Drivers

- The escalating need for robust fraud detection and Anti-Money Laundering (AML) capabilities represents a primary growth catalyst. Strict global regulatory requirements compel Japanese financial institutions to monitor transactions with forensic precision; AI solutions utilizing deep learning for anomaly detection offer superior performance over legacy rule-based systems, directly increasing demand for AI-driven risk platforms. Concurrently, the drive for operational efficiency and automation within the back office creates substantial demand. AI automates repetitive, high-volume tasks such as document processing and initial loan underwriting, significantly reducing human error and overhead, thereby shifting the demand profile toward sophisticated workflow optimization and Robotic Process Automation (RPA) tools integrated with Natural Language Processing (NLP).

Challenges and Opportunities

- A critical market challenge is the prevalent data security and privacy concern, which mandates that financial AI adoption proceed cautiously. This reticence constrains the pace of cloud-based AI deployment, thereby limiting the immediate market size for large-scale, public cloud solutions. However, this challenge creates a distinct opportunity for providers of secure, domain-specific Large Language Models (LLMs) that can be deployed on-premise or via hybrid cloud environments, addressing security mandates while leveraging local Japanese language and cultural nuances. The opportunity lies in providing AI governance frameworks and specialized audit tools that convert regulatory compliance—a core institutional challenge—into a value-added, demand-generating service.

Supply Chain Analysis

The supply chain for the Japan AI in Finance market is primarily technological, centering on three dependencies: high-performance AI compute infrastructure, the availability of high-quality financial data sets for model training, and the access to specialized AI talent. The core production hubs are not geographical but are dominated by major US-based cloud providers (for general LLMs) and domestic Japanese technology partners (for localized LLMs). Logistical complexity arises from the cross-border movement of data and the stringent data sovereignty requirements imposed by Japanese financial institutions, which necessitate local data centers or dedicated virtual private clouds. This creates a critical supply dependency on local data infrastructure providers and a technical dependency on sophisticated data anonymization and governance tools to ensure compliance while enabling necessary cloud processing.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Japan | Financial Services Agency (FSA) - AI Discussion Paper | Directly increases demand for AI-based risk management systems capable of detecting and mitigating algorithmic herding effects to prevent financial market instability. Promotes the use of AI for enhanced regulatory compliance. |

| Japan | Ministry of Economy, Trade and Industry (METI) & MIC - AI Guidelines for Business Ver 1.0 (Apr 2024) | Establishes a framework for trustworthy AI development, compelling developers to prioritize safety and fairness. This drives specific demand for explainable AI (XAI) tools that can provide audit trails for financial decisions. |

| Japan | Government of Japan - Act on the Promotion of Research and Development and Utilization of AI-Related Technologies (May 2025) | Creates a foundational framework to foster AI innovation, especially in domestic technology. This acts as a catalyst, supporting collaborations (like SBI/PFN) and increasing capital flow toward Japanese AI technology firms, thereby expanding the supply of local AI products. |

Japan AI in Finance Market Segment Analysis:

By Application: Front Office

The Front Office segment, encompassing customer-facing operations such as robo-advisory, personalized investment recommendations, and intelligent chatbots, demonstrates explosive demand driven by the imperative for enhanced customer experience. Japanese banks and securities firms face intense competitive pressure to deliver hyper-personalized digital services that rival major global technology companies. This necessity is not for simple chatbots, but for sophisticated Natural Language Processing (NLP) and Large Language Model (LLM)-driven agents capable of handling complex financial inquiries, executing transactions, and providing dynamic portfolio adjustments in real-time. The need to overcome the cultural preference for human interaction also drives demand for AI that can deliver 'human-like' empathy and high-precision Japanese language comprehension, accelerating the adoption of specialized generative AI services like those recently launched by Rakuten. The aging population further fuels the need for easily accessible, intuitive digital financial planning tools, making the Front Office a critical growth vector.

By User: Corporate Finance

The Corporate Finance segment, which primarily deals with risk management, treasury operations, and sophisticated investment decisions for large corporations and financial institutions, sustains high-value demand for AI. The core driver is the necessity for predictive analytics and enhanced due diligence to navigate global supply chain volatility and complex credit risk exposures. Traditional models struggle with the volume and velocity of unstructured data required for comprehensive credit scoring and counterparty risk assessment. AI and machine learning models are directly demanded to analyze vast data sets, including market data, news sentiment, and corporate filings, to forecast financial distress with greater accuracy and speed. Furthermore, the complexity of corporate governance and compliance with rapidly changing environmental, social, and governance (ESG) reporting standards fuels the demand for AI tools that automate the collection and analysis of non-financial corporate data, positioning AI as an indispensable tool for strategic financial oversight.

Japan AI in Finance Market Competitive Environment and Analysis:

The competitive landscape is defined by the strategic maneuvering of major financial conglomerates and established fintech pure-plays, focusing on deep vertical integration and strategic technological alliances. Competition centers on securing superior data sets and achieving faster, more localized model development.

SBI Holdings

SBI Holdings, a major financial conglomerate with interests spanning banking, securities, and cryptocurrency, has focused its AI strategy on infrastructural independence and vertical integration. A key verifiable move was the capital and business alliance with Preferred Networks, Inc. (PFN), to jointly research and develop PFN's next-generation AI semiconductors. This action demonstrates a strategic positioning to secure high-performance, low-power AI compute capacity domestically, circumventing global supply chain dependencies and directly supporting the training of large, proprietary AI models crucial for high-frequency trading and sophisticated risk modelling in their securities and banking divisions. This unique positioning provides an infrastructural competitive advantage over firms reliant solely on third-party cloud AI resources.

Rakuten Bank

Rakuten Bank, part of the broader Rakuten Group ecosystem, leverages its vast user data and digital platform reach to drive its AI strategy. The company's key competitive advantage is the seamless integration of financial services with e-commerce, mobile, and other lifestyle offerings. Rakuten's strategy, as detailed in its corporate news, involves democratizing AI access across its entire ecosystem. This is manifested through the full-scale launch of Rakuten AI and the targeted January 2025 launch of "Rakuten AI for Business". These products are LLM-driven agentic tools designed not just for customer interaction but for corporate users, aiming to automate complex business processes across their platform, from sales to engineering, thus locking in corporate clients through an affordable, all-in-one AI utility.

Japan AI in Finance Market Recent Developments:

- July 2025: The Rakuten Group announced the full-scale launch of Rakuten AI, a new cutting-edge AI agent designed to centralize AI capabilities across the Rakuten Ecosystem. The platform moves beyond a typical chatbot to act as a seamless, intelligent entry point across various services, including its FinTech offerings. This represents a significant product launch focused on creating an 'agentic' experience that executes complex tasks for the user, drawing on trillions of interactions across its platforms.

- January 2025: Rakuten Mobile launched the "Rakuten AI for Business" generative AI service. This product is specifically targeted at corporate clients, offering a compelling mix of affordability and utility to help various businesses with their operations in sales, marketing, or engineering. This product launch expands the corporate segment's AI offering, utilizing the Group's proprietary technology.

- August 2024: SBI Holdings and Preferred Networks, Inc. (PFN) reached an agreement to form a capital and business alliance focused on the joint research and development and productization of PFN's next-generation AI semiconductors. The agreement, which included an investment of a maximum of 10 billion yen by SBI, is a critical capacity addition initiative aimed at supporting the domestic semiconductor industry and securing the high-performing, low-power AI infrastructure necessary for advanced financial modelling.

Japan AI in Finance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 5.080 billion |

| Total Market Size in 2031 | USD 10.426 billion |

| Growth Rate | 15.46% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Deployment Model, User, Application |

| Companies |

|

Japan AI in Finance Market Segmentation:

- BY TYPE

- Natural Language Processing

- Large Language Models

- Sentiment analysis

- Image recognition

- Others

- BY DEPLOYMENT MODEL

- On-Premise

- Cloud

- BY USER

- Personal Finance

- Consumer Finance

- Corporate Finance

- BY APPLICATION

- Back Office

- Middle office

- Front Office