Report Overview

Japan AI in Transportation Highlights

Japan AI in Transportation Market Size:

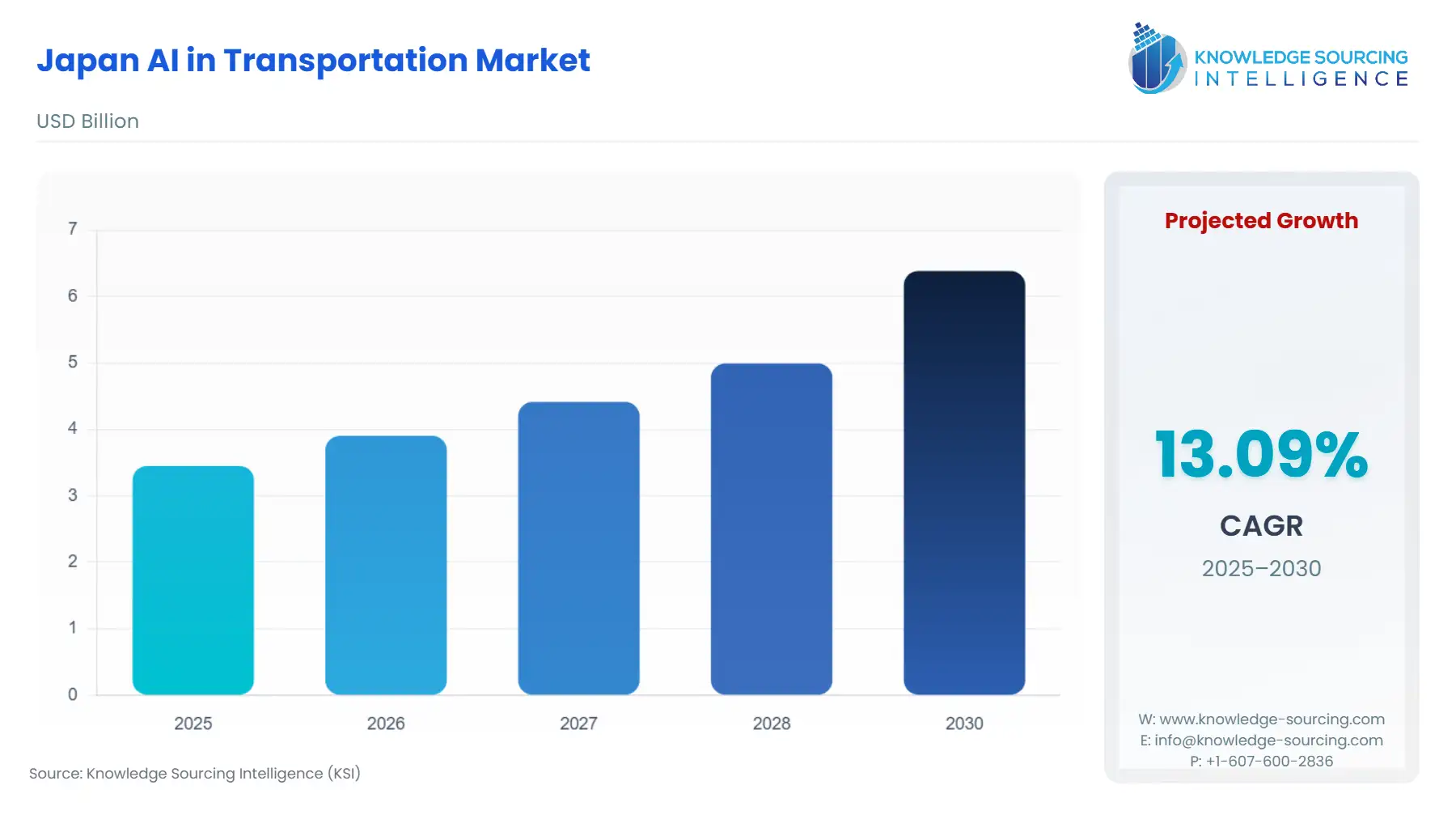

The Japan AI in Transportation Market is expected to grow at a CAGR of 13.09%, rising from USD 3.452 billion in 2025 to USD 6.386 billion by 2030.

The Japanese AI in Transportation Market is undergoing a rapid transition from incremental integration to systemic dependence, driven by an unassailable demographic imperative. Unlike markets where AI adoption is an efficiency gain, in Japan, it constitutes a core strategic mechanism to counteract severe, long-term labor shortages across logistics, fleet management, and public transit. This structural deficiency has shifted the market focus from merely automating discrete tasks to developing comprehensive, cloud-based AI platforms capable of coordinating complex transportation ecosystems.

Consequently, the strategic thrust by major domestic players—Toyota, Denso, Hitachi, and NEC—is overwhelmingly directed toward the development and deployment of Software-Defined Vehicle (SDV) architectures and advanced predictive maintenance services that fundamentally restructure operations rather than simply enhance them. This mandate, amplified by government policy supporting smart logistics and autonomous driving trials, places Japan at the forefront of AI-enabled mobility solutions designed for societal resilience.

Japan AI in Transportation Market Analysis:

Growth Drivers:

The most profound catalyst for market expansion is the nation’s severe demographic headwind, particularly the escalating labor shortage in logistics and manufacturing, where the workforce gap is projected to reach millions by 2040. This scarcity accelerates demand for AI-powered autonomous mobile robots (AMRs) and Automated Guided Vehicles (AGVs) in warehousing and last-mile delivery to sustain operational capacity. Furthermore, the government’s dedicated investment in the Strategic Innovation Promotion Program (SIP) and the Smart Mobility Challenge explicitly drives demand for Level 3 and Level 4 autonomous driving systems, which require high-fidelity perception AI (Deep Learning) and real-time control algorithms to be commercially viable. This systemic demographic and policy push mandates AI adoption for business continuity, not just marginal efficiency gains.

Challenges and Opportunities:

A principal constraint on growth is the persistent global semiconductor supply chain disruption, directly limiting the production and deployment of advanced sensing components (LiDAR, NPU) essential for L4/L5 autonomy solutions. Moreover, the integration complexity of disparate legacy IT infrastructure across different transportation modalities—rail, road, and port logistics—imposes a high friction cost on deploying unified, cloud-native AI platforms. This challenge, however, generates a significant opportunity: the demand for expert AI integration and consultative services to bridge the operational technology (OT) and information technology (IT) gap. The opportunity is further amplified by the push for SDVs, compelling software-centric firms to offer subscription-based, continuously updated AI applications, fundamentally changing the revenue model toward a recurring, service-based economy.

Supply Chain Analysis:

The AI in the Transportation supply chain in Japan is bifurcated between domestic dominance in critical hardware and an increasing reliance on global partnerships for specialized software and semiconductor IP. Japanese companies maintain a strong position in the supply of high-precision components vital for vehicular AI, specifically in the Advanced Driver Assistance Systems (ADAS) hardware layer, including LiDAR, CMOS Image Sensors, and Radar, with established manufacturing hubs located in regions like Nagoya. However, the specialized processing units required to run complex AI models—Neural Processing Units (NPUs) or General Purpose Neural Processing Units (GPNPUs)—are increasingly being sourced or co-developed through external partnerships. The inherent complexity of this vertical integration, coupled with the concentrated nature of the global semiconductor fabrication market, exposes the Japanese supply chain to international geopolitical and logistical constraints, necessitating dual-sourcing strategies for silicon and specialized compute IP.

Government Regulations:

Japan’s regulatory framework actively promotes the deployment of AI in transportation while establishing a foundation for safety and data governance.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Japan | Act on Promotion of Research and Development, and Utilization of AI-related Technology (AI Act - partial enactment June 2025) | Establishes the legal framework for AI governance, increasing corporate confidence in the legality and regulatory stability of deploying AI-based services. This formalization directly fuels market expansion for compliant, auditable AI solutions. |

| Japan | Cabinet Office’s Society 5.0 and Smart Logistics Policies | Mandates and incentivizes the use of smart-logistics platforms and platform interoperability. This creates explicit demand for AI-driven route optimization and shipping volume prediction software that can seamlessly integrate disparate data sources across the entire supply chain ecosystem. |

| Japan | Ministry of Land, Infrastructure, Transport and Tourism (MLIT) - Autonomous Driving Public Road Testing Guidelines | Sets the conditions for commercial testing and eventual deployment of L3 and L4 Autonomous Vehicles (AVs). This phased approval process directly stimulates demand for high-reliability, in-vehicle AI systems and the associated sensor hardware required to meet stringent safety certification standards. |

Japan AI in Transportation Market Segment Analysis:

By Technology: Machine Learning

The Machine Learning (ML) segment serves as the computational bedrock for non-linear, predictive applications within the Japanese transportation ecosystem, driven by the critical need to optimize infrastructure utilization and reduce operational costs. The necessity for ML is directly fueled by the logistics sector's imperative to bypass capacity constraints, such as the mandated work-hour caps for truck drivers, by leveraging algorithms for Route Optimization and Shipping Volume Prediction. ML algorithms analyze vast, historical data sets of weather patterns, traffic congestion, warehouse throughput rates, and delivery addresses to construct dynamic models. The resulting predictive intelligence minimizes empty miles, lowers fuel consumption, and, critically, allows operators to preemptively allocate scarce human and robotic labor resources, creating a measurable ROI that drives adoption independent of initial hardware expenditure. This function shifts procurement from a capital expenditure model (buying trucks) to an operational efficiency model (buying predictive intelligence).

By Application: Route Optimization

The need for AI-driven Route Optimization is critically high, serving as a direct countermeasure to the economic inefficiency and labor shortages pervasive in the Japanese logistics and transit sectors. The need to maintain service levels with a diminishing driver pool is the primary growth factor. Route Optimization AI, typically leveraging Deep Learning and reinforcement learning, moves beyond static GPS-based routing by incorporating real-time data from traffic loops, delivery schedules, and fleet telemetry. For public transportation, this translates to on-demand mobility services in rural, depopulating areas, maintaining essential connections while minimizing the need for fixed, low-occupancy routes requiring human drivers. In urban logistics, the technology is essential for managing e-commerce parcel booms and ensuring delivery within mandated time windows, which directly increases the demand for software licenses and cloud compute resources capable of executing rapid, complex combinatorial optimization.

Japan AI in Transportation Market Competitive Environment and Analysis:

The Japanese AI in Transportation market is highly concentrated, with a core group of domestic conglomerates leveraging their extensive cross-industry expertise in automotive, heavy machinery, and IT infrastructure. Competition revolves around securing the central control point for the Software-Defined Vehicle (SDV) architecture and offering integrated solutions that span from in-car components to city-wide data platforms.

Denso Corporation: Denso’s strategic positioning is transitioning from a leading Tier 1 automotive hardware supplier to a deep-technology mobility systems integrator. The company’s core strategy focuses on securing the foundational electronic architecture for the next generation of intelligent vehicles. This is exemplified by the 2024 development license agreement with Quadric.inc for a Neural Processing Unit (NPU), which is critical IP for advanced, low-power, in-vehicle AI computation. Furthermore, the 2024 strategic partnership with NTT DATA to establish a global software development system for SDVs underscores their shift to cloud-based, outside-car technologies, aiming to quickly create and jointly deploy new mobility services and AI-based platforms. Denso’s move into silicon and software IP is a direct competitive play to capture higher-margin AI solution revenue.

NEC Corporation: NEC capitalizes on its expertise in public sector IT and communications infrastructure to position itself as a key supplier for government-led smart city and smart logistics projects. The company’s focus is on utilizing AI for large-scale data aggregation and complex societal problem-solving, such as workforce automation. NEC's competitive advantage lies in its ability to integrate AI into existing public infrastructure. This is indicated in their 2024 deployment of AI technology for robotics in logistics, designed to handle unorganized items precisely. This technology directly targets the labor shortage challenge in distribution centers by increasing the utility and flexibility of robotic systems, thus creating demand for their highly specific, vision-based AI algorithms.

Japan AI in Transportation Market Recent Developments:

- May 2025: Denso Corporation and ROHM Co., Ltd. finalized a basic agreement for a strategic partnership, primarily focusing on enhancing the development and stable supply of high-quality analog ICs and power semiconductors vital for vehicle electrification and intelligent systems. This collaboration solidifies Denso's commitment to controlling the core electronic components necessary for advanced AI functions in vehicles, securing a reliable supply chain for next-generation mobility platforms.

- May 2024: Hitachi Rail completed the acquisition of Thales' Ground Transportation Systems Business, significantly expanding its signaling, rail control, and mobility solution portfolio globally. This M&A activity directly impacts the Japan AI in Transportation market by integrating a vast global network and advanced digital technology into Hitachi's existing railway and urban mobility framework, increasing its capability to deploy AI for network optimization, predictive maintenance, and autonomous train operation within Japan and internationally.

- March 2024: Hitachi announced the launch of a new mobility control infrastructure utilizing AI to manage the real-time risk assessment and movement of drones and future air mobility systems. This product launch positions Hitachi to capture the emerging "sky logistics" and "last-mile air delivery" market segments, showcasing the application of highly sophisticated, real-time AI to control complex, multi-agent transportation systems in an unmapped public space.

Japan AI in Transportation Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 3.452 billion |

| Total Market Size in 2031 | USD 6.386 billion |

| Growth Rate | 13.09% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Deployment, Application |

| Companies |

|

Japan AI in Transportation Market Segmentation:

- BY TECHNOLOGY

- Deep Learning

- Natural learning process

- Machine Learning

- Others

- BY DEPLOYMENT

- On-Premise

- Cloud

- BY APPLICATION

- Route optimization

- Shipping volume prediction

- Predictive Fleet Maintenance

- Real-time Vehicle tracking

- Others