Report Overview

Japan Electric Vehicle Components Highlights

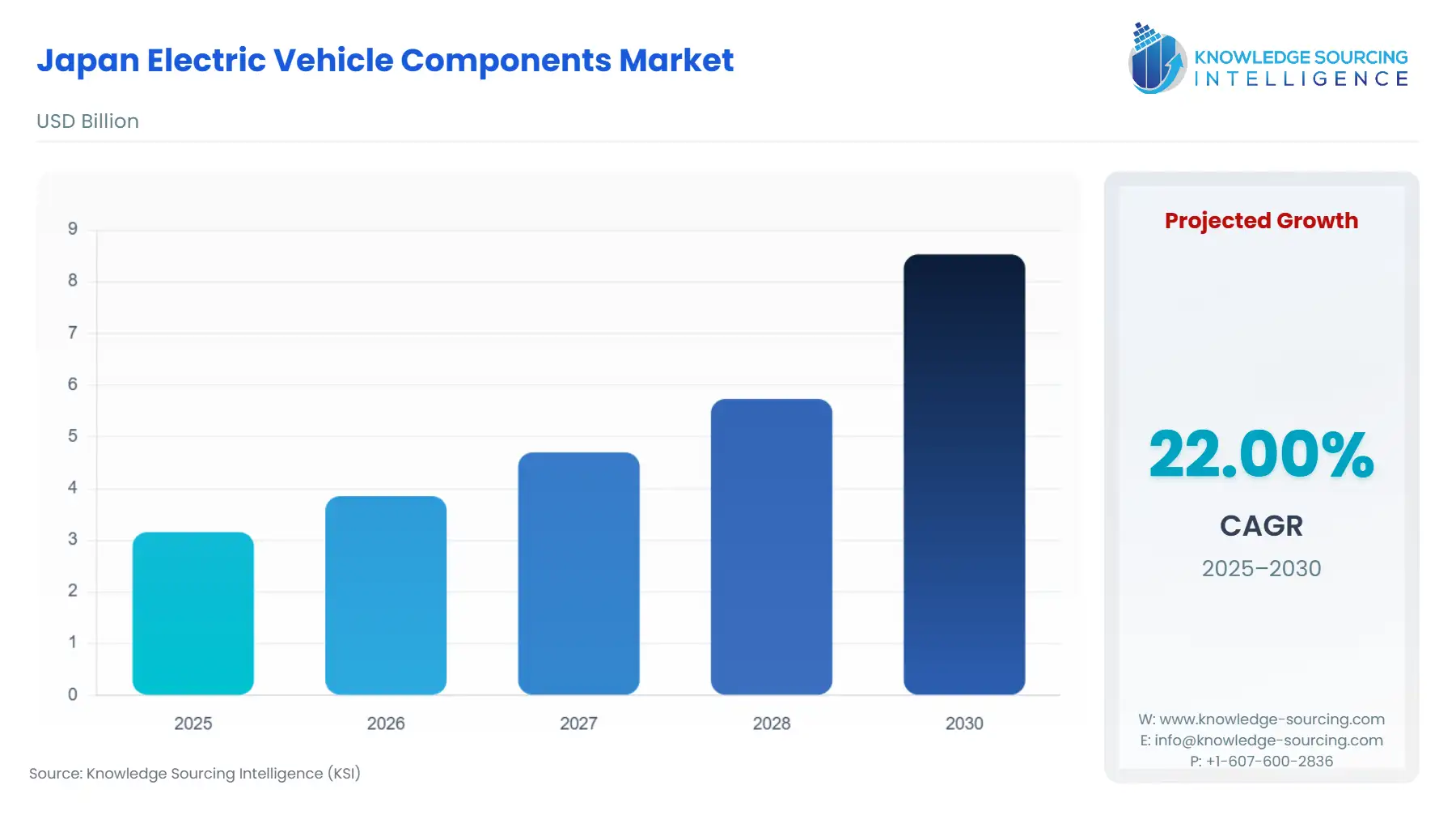

Japan Electric Vehicle Components Market Size:

The Japan Electric Vehicle Components Market is projected to rise at a CAGR of 22.00%, attaining USD 8.532 billion in 2030 from USD 3.157 billion in 2025.

The Japanese Electric Vehicle (EV) Components Market is navigating a complex transition defined by a globally aggressive push toward battery electric vehicles and a powerful domestic legacy of hybrid electric vehicle technological mastery. This unique market dynamic forces component suppliers to manage two parallel, often competing, product strategies: optimizing the electric drivetrain for high-volume, cost-sensitive HEV platforms and simultaneously developing next-generation, high-performance components (like solid-state batteries and Silicon Carbide (SiC) power modules) required for purely electric architectures. The market’s structure is, therefore, inherently dual-focused, with significant governmental and industrial capital being deployed to secure the entire EV supply chain, from raw material sourcing to advanced manufacturing capability, thereby underwriting demand for high-value components.

Japan Electric Vehicle Components Market Analysis:

- Growth Drivers

Japan's regulatory environment and established industrial capabilities serve as direct catalysts for component demand. The government’s mid-2030 target, aiming for all new passenger car sales to be Zero-Emission Vehicles (ZEV) or electrified, explicitly increases the mandated production volume of vehicles containing electric motors, battery packs, and power electronics, thus propelling the primary demand for these core components. Furthermore, the substantial and sustained consumer preference for HEVs—which account for over 80% of the electrified vehicle market—creates a stable, high-volume procurement requirement from OEMs for mature, cost-optimized components like Nickel-Metal Hydride (NiMH) and standard Lithium-ion battery systems, ensuring continuous demand for well-established component supply chains.

- Challenges and Opportunities

The primary challenge is the structural disparity between the domestic component supply and the rapid technological evolution of global BEVs. Japanese automakers have prioritized HEV development, resulting in a lag in scaling up domestic production capacity for high-energy-density BEV-specific components, such as large-format battery cells, which creates a domestic supply constraint and necessitates high import dependency. This dynamic presents an opportunity for domestic suppliers to rapidly transition their core competencies, such as Denso's focus on SiC inverters, which offer lower power losses and greater efficiency. Investing in these advanced materials and integrated power electronics directly addresses the BEV efficiency imperative, creating a new, high-margin demand segment for local manufacturers.

- Raw Material and Pricing Analysis

The Japan EV Components Market, particularly the battery pack segment, is a physical product directly exposed to global mineral pricing. Japan is heavily reliant on imports for essential battery raw materials, including lithium, cobalt, and natural graphite. This import dependency directly translates global commodity price volatility into a significant cost headwind for domestic battery manufacturers like Panasonic and Prime Planet Energy & Solutions (PPES). The price fluctuations increase the bill of materials (BOM) for battery packs, placing substantial pressure on OEMs to either absorb the cost or pass it on to consumers, which constrains growth by raising the average selling price of electrified vehicles. The Ministry of Economy, Trade and Industry (METI) has designated these as critical materials, driving government-backed efforts to secure supply from stable partner countries, which in turn secures long-term demand for alternative, de-risked materials.

- Supply Chain Analysis

The Japanese EV component supply chain is highly complex, marked by deep vertical integration with traditional domestic OEMs and a critical dependence on external hubs for raw material processing. Key production hubs for high-value components (power electronics, motor stators, battery management systems) remain concentrated in Japan, with major domestic players controlling the technological IP. However, the logistical complexity is defined by Japan's near-total reliance on foreign sources for essential battery raw materials and their primary processing. This dependency creates a vulnerability, as geopolitical shifts or export controls can disrupt the supply of key inputs, leading to production slowdowns and increasing the lead time for all physical components.

Japan Electric Vehicle Components Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

Japan (National) |

2050 Carbon Neutral Policy / METI |

Sets the foundational target for vehicle electrification (ZEV/electrified sales by mid-2030s), directly creating the long-term, structural demand imperative for all EV components. |

|

Japan (National) |

Economic Security Promotion Act (2022) |

Designates EV batteries and critical minerals as "National Strategic Materials," directly stimulating domestic production and supply chain diversification, thus increasing localized R&D and manufacturing capacity demand for components. |

|

Tokyo Metropolitan Area |

ZEV-only Sales Target (by 2030) |

Local regulation that accelerates the transition beyond the national goal, disproportionately boosting demand for BEV and PHEV components within the high-density Kanto region, forcing quicker product portfolio shifts for suppliers. |

Japan Electric Vehicle Components Market Segment Analysis:

- By Component Type: Battery Pack

The battery pack segment is undergoing a fundamental shift, moving from a unit dominated by high-volume, reliable HEV packs to a higher-capacity, energy-dense BEV architecture. The strong market position of HEVs, such as those produced by Toyota, primarily drives demand for smaller-capacity, durable Lithium-ion and NiMH packs, emphasizing longevity and cost-effectiveness. The emerging growth catalyst, however, is the commitment by major domestic players to solid-state battery technology. Toyota's progress in securing key patents and its declared intent to commercialize solid-state cells creates substantial future demand for new materials and complex manufacturing equipment capable of handling the solid electrolyte structure. This technological migration will redefine the battery pack market by prioritizing energy density and safety, establishing a new, high-value demand curve for advanced cell designs.

- By End-User: OEMs

The Original Equipment Manufacturers (OEMs) segment is the decisive growth driver, operating as the immediate buyer for virtually all high-value EV components. This segment's expansion is uniquely shaped by a dual-platform strategy: mass production HEV platforms and low-volume, high-tech BEV platforms. Toyota’s sheer scale of HEV production creates an immense, stable demand floor for electric motors and power electronics optimized for hybrid operation. Concurrently, the OEMs' global expansion plans for full BEVs, such as Nissan's global push with its latest models, ensures a surge in demand for modular battery platforms and advanced thermal management systems to meet international range and fast-charging standards. The need from OEMs is therefore a function of both domestic HEV volume stability and strategic, compliance-driven investment in new BEV component architecture for export markets.

Japan Electric Vehicle Components Market Competitive Analysis:

The Japan EV Component Market features a highly concentrated competitive structure, dominated by vertically integrated domestic giants that maintain global leadership in specific component categories, primarily power electronics and magnet materials. This oligopoly is characterized by decades-long, close-knit relationships between Tier 1 suppliers and major Japanese OEMs.

- Panasonic Holdings Corporation: Panasonic's strategic positioning revolves around its global leadership in high-energy-density cylindrical Lithium-ion batteries. The company leverages its deep technical partnership with major global automakers to focus on scaling up the next generation of cells, particularly the 4680 format, for BEV platforms. This direct focus on high-capacity cells secures its competitive position as the key supplier for the most valuable component in a full EV, making its long-term strategy one of maximizing energy density and production volume.

- DENSO Corporation: DENSO is a powerhouse in electric motors, inverters, and thermal management systems. The company's strategy focuses on developing and commercializing high-efficiency components using Silicon Carbide (SiC) semiconductors, which are vital for reducing energy loss and increasing range in all types of electrified vehicles. By vertically integrating SiC wafer production with power module assembly, DENSO secures a competitive advantage in cost control and technological leadership in a component category critical for both HEVs and high-performance BEVs.

Japan Electric Vehicle Components Market Developments:

- November 2024: DENSO Corporation and Fuji Electric Co., Ltd. announced a semiconductor supply plan that received approval from the Ministry of Economy, Trade and Industry (METI). The plan involves joint investment and production to develop and strengthen the supply frameworks for Silicon Carbide (SiC) power semiconductors within Japan. This capacity addition aims to expand the efficient and stable supply of SiC components for electrified vehicles domestically.

- October 2024: DENSO announced the expansion of its manufacturing operations in Athens, Tennessee, including 54,560 square feet of new production space. This capacity addition is purposed to manufacture a wider range of the company's product portfolio, beginning with its latest heating, ventilation, and air conditioning (HVAC) product, which is a critical sub-system for electric vehicle thermal management.

Japan Electric Vehicle Components Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 3.157 billion |

| Total Market Size in 2031 | USD 8.532 billion |

| Growth Rate | 22% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component Type, Vehicle Type, Technology, End User |

| Companies |

|

Japan Electric Vehicle Components Market Segmentation:

- BY COMPONENT TYPE

- Battery Pack

- Electric Motor

- Power Electronics

- Inverter

- Converter (DC-DC)

- On-Board Charger

- Thermal Management System

- Body & Chassis

- Other Components

- BY VEHICLE TYPE

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers & Three-Wheelers

- BY TECHNOLOGY

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

- Fuel Cell Electric Vehicle (FCEV)

- BY END-USER

- OEMS

- Aftermarket