Report Overview

Malaysia Probiotics Market - Highlights

Malaysia Probiotics Market Size:

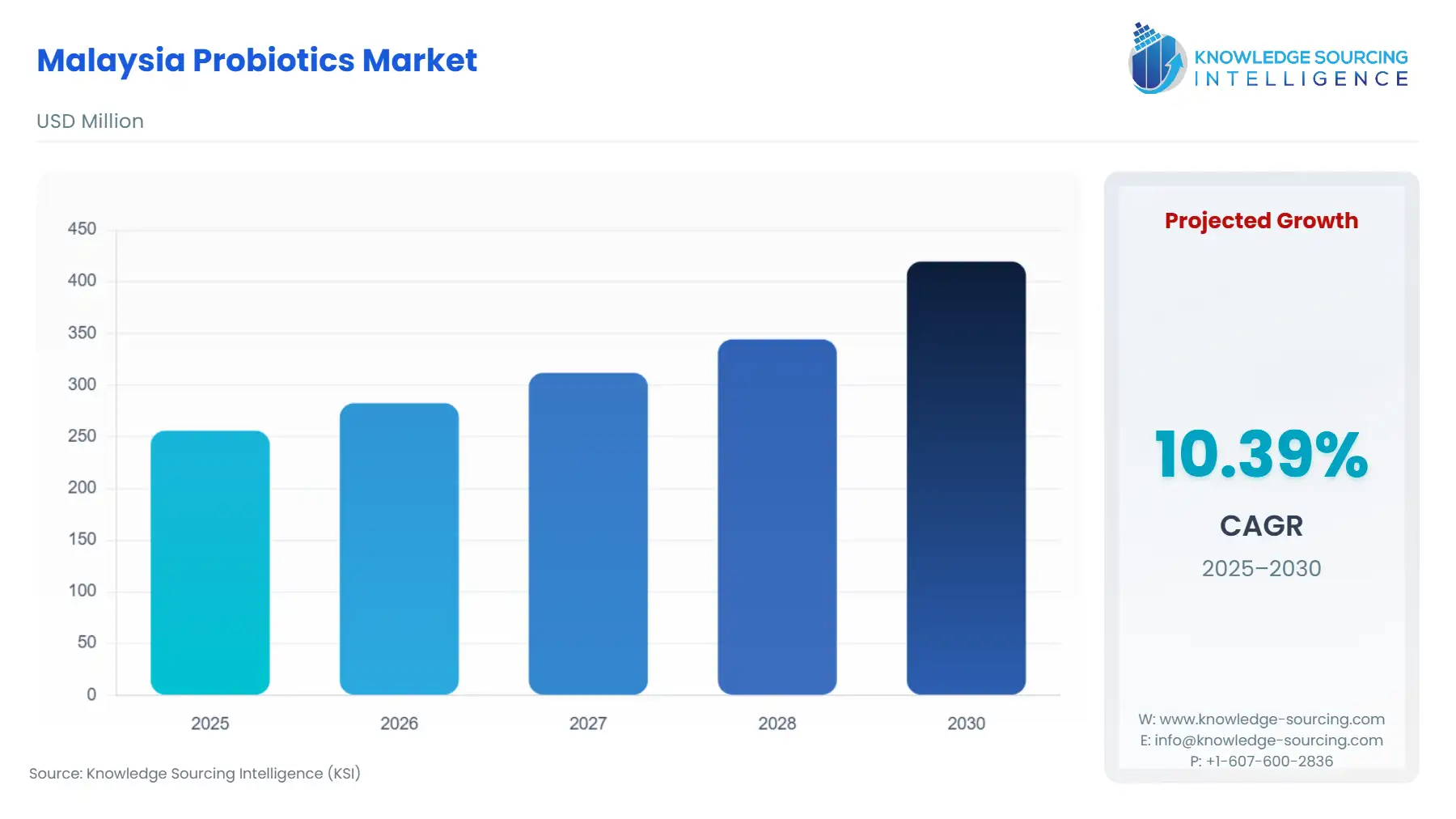

The Malaysian Probiotics Market is estimated to attain a market size of USD 419.674 million by 2030, growing at a 10.39% CAGR from a valuation of USD 255.982 million in 2025.

This probiotic market will rise owing to the growing emphasis on healthier lifestyle adoption among citizens, along with the rising investments in functional drinks and dietary supplements in the coming years. Furthermore, the increased prevalence of chronic diseases such as cardiovascular diseases, coupled with an ageing population, has driven the overall demand for probiotics in the country. Additionally, diverse probiotic types, including bacteria and yeast, support digestive health and may reduce health conditions like irritable bowel syndrome and traveller's diarrhoea.

The probiotics market will also witness rising demand from the country’s animal feed industry during the projected period, particularly for poultry, ruminants, and aquaculture. Since probiotics are known for digestive health, enhancing immunity, and fueling the expansion of the livestock population, while also decreasing the requirement for antibiotics, this aligns with the rising trend toward sustainable farming in the country. Moreover, new product launches and strategic collaborations with market players have provided new growth prospects for the market.

Malaysia Probiotics Market Overview:

The Malaysian probiotics market is flourishing owing to the rising digestive problems and health consciousness. The shift toward functional foods and creative product development stimulates this growth. The expansion of e-commerce has made it easier to obtain a variety of probiotic products. Market expansion is further aided by integration with pharmaceuticals and regulatory frameworks that are helpful. In Malaysia, consumer education programs are essential for highlighting the health advantages of probiotics in promoting gut health, digestion, boosting immunity, as well as helping in health conditions like irritable bowel syndrome.

According to the Department of Statistics reports, from January to April of 2022, Malaysia's food and beverage sales accounted for 11.8% ($1.7 billion) of the $14 billion total wholesale sales value, an increase of 11.5% over the same time in 2021. Premium grocery stores and convenience stores are becoming increasingly popular, and the nation's food retailers are growing quickly. Prominent potential American goods for the Malaysian food retail market are dairy, seafood, wine, pig, and beef, as well as fresh and processed fruits and vegetables.

In addition, retail food sales further grew to 6% in 2023, accounting for approximately $16.3 billion, which is promoted due to a rise in consumer preference for grocery format and e-commerce channels.

Furthermore, businesses are employing various tactics in the ever-changing Malaysian probiotics industry to take advantage of the rising demand for wellness and health products. To stand out in the market, industry participants are putting a premium on product innovation, creating formulations with targeted strains to address a range of health issues.

Besides the growing shift towards healthier lifestyles, which has bolstered the need for probiotic products in Malaysia, this aligns with the increasing geriatric population. This rise in the ageing population is anticipated to give rise to health concerns, which will promote the necessity for probiotics used practically for the prevention and treatment of health conditions. According to the Department of Statistics Malaysia (DOSM), an increase in the percentage of individuals aged 65 and above was 8.1% in 2024, to grow to 14.5% of total citizens by 2040.

Furthermore, product launches and innovations are also contributing as additional factors fuelling the probiotics market expansion in the country. For instance, in February 2025, Lang Bragman Probiotics announced the expansion of its range of probiotic products in Malaysia, offering four multi-strain products that provide benefits in respiratory health, children's gut health, and postnatal mothers/ childbearing specific health benefits.

Malaysia Probiotics Market Drivers:

Rising Health Concerns

The use of probiotics in Malaysia has been shown to have positive impacts on various health problems. Probiotics balance the gut and assist in ailments such as irritable bowel syndrome, which all enhance digestive health. These beneficial bacteria reduce the occurrence and intensity of diseases as they have been associated with the enhancement of immunity. Therefore, the integration of probiotics into Malaysian foods further supports the overall health and well-being, as there is an increase in awareness.

According to the Government of Malaysia, the number of hospitalizations due to diseases of the digestive system in Malaysia in 2023 was 4.69%. Aligning with this, Malaysians are becoming more cognizant of the connections between digestive disorders and overall health. The increasing frequency of these conditions has raised the demand for such solutions of preventive and functional nutrition, with probiotics becoming popular as a natural method to maintain gut health, decrease stomach discomfort, and enhance immunity. Therefore, the growing health concerns related to the trends of hospitalization are compelling consumers to incorporate functional foods and beverages containing probiotics into their everyday meals.

Additionally, the Malaysian government has budgeted 7.6 billion as part of Budget 2023 to boost health and wellness programs, enhance and refurbish the healthcare facilities, increase the effectiveness of health treatments, upgrade and replace critical and outdated medical assets, and digitalize healthcare services.

Moreover, probiotic drinks and other functional drinks are gaining more popularity in the Malaysian market as an effective means of enhancing the health and wellness of people worldwide. This is due to the busy lifestyles that customers are engaging in, who are seeking convenient, nutritionally easy-to-consume beverages to help in satisfying their nutritional needs, promoting digestion, sharpening the mind, and losing weight.

Malaysia Probiotics Market Segmentation Analysis

By Application: Functional Food and Beverages

By application, the Malaysian probiotics market is segmented into functional food and beverages, dietary supplements, and animal feed. The functional food and beverage category in the Malaysian probiotics market is being propelled largely by increasing consumer awareness of the connection between digestive health and general well-being. The growing awareness of the importance of probiotics in maintaining gut health, immunity, and preventive health has placed more pressure on probiotic-enhanced yoghurts, fermented beverages, and functional drinks. This trend has been further enhanced by post-pandemic health consciousness, with consumers taking on products that promote immunity and long-term health.

As observed in the chart above, the sales value of beverage manufacturing in Malaysia rose by USD 2,901 thousand in 2023 to USD 3,161 thousand in 2024, indicating that the food and beverage industry has grown steadily. This tendency directly contributes to the probiotics market’s growth with the increasing production of beverages providing more opportunities to develop functional innovations like probiotic-enriched beverages, yoghurts, and fermented drinks. As consumer tastes and preferences move towards health-conscious products, companies are more likely to add probiotics to the mainstream beverage lines, which is not only attractive due to this industry’s expansion but also the increase in demand for functional wellness products.

Demographic shifts, including an ageing population and rising disposable incomes, are also creating favourable conditions for probiotic demand. According to the Economic Outlook 2023 report released by the Ministry of Finance Malaysia, the Department of Statistics Malaysia observed that Malaysia’s ageing population is growing at a faster-than-expected rate, whereby more than 15% of its population will be above the age of 65 by 2050. Older consumers are increasingly seeking digestive and immune health solutions, while younger demographics are attracted to preventive and functional wellness options. This dual demand profile has encouraged manufacturers to diversify product portfolios, catering to different age groups and price segments.

Furthermore, expansion will be supported by the rising contribution of e-commerce and direct-to-consumer channels in the Malaysian F&B industry. The accessibility of probiotic products through online platforms and contemporary distribution networks makes it easier and allows target marketing, sampling, and subscription schemes.

The combination of health awareness, expansion of functional beverages, positive demographics, and digital distribution is the essence of probiotics growing in the Malaysian functional food and beverage industry.

By End-user: Human

By end user, the Malaysian probiotics market is segmented into human and animal. The human segment is witnessing growth in the Malaysian probiotics market primarily due to the rise in consumer awareness and interest in gut microbiome and immunity. This is promoting the shift towards probiotics functional foods like yoghurt, symbiotic, and drinks, along with probiotic supplements.

Similarly, there is a rise in Malaysian citizens' adoption of natural solutions and a preference for non-invasive remedies such as probiotics for curing digestive problems and lifestyle-related issues like cardiovascular disease and obesity. This shift indicates a growing preference for these alternatives over pharmaceutical interventions.

According to the data from the World Obesity Federation, the obesity prevalence in adults above 18 years of age was 36.3%, while overweight was 33.8% in 2023. Further, the prevalence of obesity in women was highest, with 39.8%, and overweight was 30.7% in the same year. Meanwhile, the obesity rate in men was 33.2%, and the overweight rate was 36.7%. This increase in the prevalence of obesity and overweight in the country will contribute to the demand for probiotics, as it assists in preventing and treating overweight and obesity conditions.

Moreover, the new product launches in the country targeting human health, along with expanding availability throughout pharmacies and online stores, will also promote the market in the human end-user segment during the forecasted period. For instance, in July 2025, BP Nutriscience launched the Enescene Probio 3+ product in the country. It is a synbiotic gut health supplement created by a mix of probiotics, which are NutriLeads’ Benicaros precision prebiotic, along with heat-treated postbiotics. The product is offered in the form of a mixed berry powder drink and is available across pharmacies and online stores in Malaysia. The probiotic benicaros is derived from carrot pomace and works effectively to improve gut microbiota action, enhancing innate immunity, with minimal digestive discomfort compared to traditional probiotics.

Malaysia Probiotics Market Key Products:

LACTOGROW PROBIO - A growing-up milk formula for children aged 1-3 years and 4-6 years, featuring probiotic L. reuteri to enhance digestive function, support immunity, and aid nutrient absorption, combined with DHA for cognitive development.

NUTREN OPTIMUM - A complete nutritional supplement for adults, containing Lactobacillus paracasei probiotics to promote beneficial gut bacteria and digestive wellness, suitable for daily nutrient needs.

Malaysia Probiotics Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 255.982 million |

| Total Market Size in 2030 | USD 419.674 million |

| Forecast Unit | Million |

| Growth Rate | 10.39% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Application, End-User, Function, Form |

| Companies |

|

Malaysia Probiotics Market Segmentation:

By Application

Functional Food and Beverages

Dietary Supplements

Animal Feed

By End-User

Human

Animal

By Function

Regular

Preventative Healthcare

Therapeutic

By Type

Lactobacillus

Streptococcus

Bifidobacterium

Spore Formers

Others

By Form

Liquid

Dry