Report Overview

Mechanical Recycling Market Size, Highlights

Mechanical Recycling Market Size:

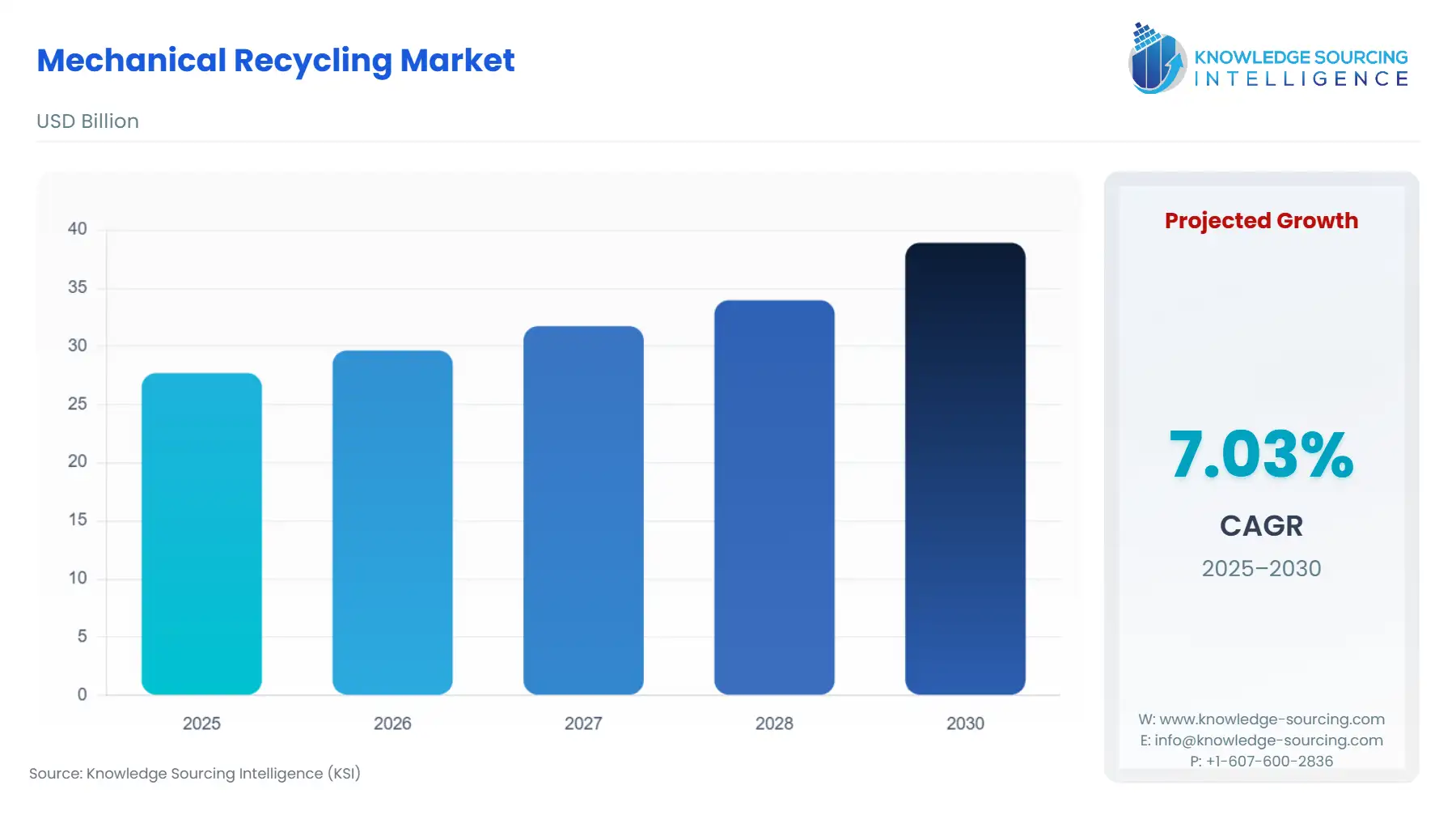

The mechanical recycling market is estimated to grow from US$27.705 billion in 2025 to US$38.920 billion in 2030 at a 7.27% CAGR.

The mechanical recycling market reprocesses waste materials, especially plastics, into new products by physical means. It helps in sustainability since it reduces waste and helps in resource conservation to alleviate environmental problems related to waste disposal and resource depletion.

According to OECD reports, global policy changes will decrease 96% of plastic leakage in 2040. While the manufacture of plastics has risen by 70%, if effective regulations are not more extensive, the mismanaged waste rescission can increase by 50%, impacting the environment negatively. Effective policy imparts significant competitive and ecological advantages.

Mechanical Recycling Market Growth Drivers:

- Recycled plastics demand by end industries is driving the mechanical recycling market growth

Recycled plastics are raising the demand from packaging, automotive, and construction industries. It offers price stability and a more predictable supply chain, making it an appealing option for companies looking to substitute virgin materials.

The EU's plastic recycling capacity is 99% mechanical recycling-based, which is important for circularity. Launched in 2018, the Circular Plastics Alliance of the Commission will achieve 10 million tonnes of plastic recyclates in products by 2025, supported by 290 members from the plastics value chain and academia.

- Governmental policies and environmental regulations are fueling the mechanical recycling market expansion

Governments are enforcing stricter waste management laws, promoting recycling through Extended Producer Responsibility (EPR) policies, and implementing plastic bans. These regulations aim to reduce plastic waste, hold manufacturers accountable, and encourage the use of recycled materials for sustainability.

In 2024, the Indian government amended the rule aiming at addressing plastic pollution, the Plastic Waste Management Rules, 2016, and it came up with new standards for these decrees. These guidelines describe new regulations about extended producer responsibility, the labeling of biodegradable plastics, and reporting requirements. In doing so, the EPR targets will be achieved effectively, with increased recycling performances ranging from 50-80% for individual categories.

Mechanical Recycling Market Segment Analysis:

- By product, recycled fibers are anticipated to grow fastest during the forecast period

Recycled fiber is an eco-friendly alternative to virgin material used in many industries, such as textiles and packaging. Its production supports circular economies, reduces waste, and has a lesser environmental impact, meeting international sustainability and recycling targets.

Global production of recycled polyester fiber grew from 8.6 million tonnes in 2022 to 8.9 million tonnes in 2023. However, increased virgin polyester production reduced the market share of recycled polyester from 13.6 percent in 2022 to 12.5 percent in 2023, stating challenges in scaling sustainable alternatives.

Mechanical Recycling Market Geographical Outlook:

By geography, North America will be the fastest-growing region during the forecasted period. It has been the most developed area for mechanical recycling, owing to very rigid environmental laws and increased consumer awareness. Industries in the United States have been compelled by law to look towards mechanical recycling to reduce plastic waste and pollution. Major recycling companies and waste management firms are increasing investment in advanced recycling technologies to keep pace with the growing demand for sustainable packaging and automotive components. Likewise, Canada has focused on sustainable waste management practices where government initiatives encourage a circular economy and waste reduction.

A study by Stina and the Association for Plastic Recyclers for the U.S. Plastic Recycling Study found over 5 billion pounds of post-consumer plastic were recycled in 2022. However, according to The Recycling Partnership's 2024 report, 83% of recyclable plastic packaging—like bottles and containers—aren't making it into recycling bins.

List of Top Mechanical Recycling Companies:

- Veolia

- KW Plastics

- Indorama Ventures

- Biffa

- Alpek

These companies are at the forefront of developing and supplying the mechanical recycling market, contributing to the growth and innovation in recycled polymers and fibers.

Mechanical Recycling Market Key Developments:

- In December 2024, BASF partnered with Endress+Hauser, TechnoCompound, and the Universities of Bayreuth and Jena on the SpecReK project, funded by the German Federal Ministry of Education and Research (BMBF). The project aims to enhance plastic recycling using AI and advanced measurement techniques to identify waste composition and improve recycled plastic quality.

- In May 2023, TotalEnergies bought out Iber Resinas, Spain's largest mechanical recycling channel for plastics for sustainable applications. It will bolster the production of TotalEnergies in Europe regarding circular polymers. This will further diversify and increase access to feedstock thanks to Iber Resinas' network of suppliers.

Mechanical Recycling Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Mechanical Recycling Market Size in 2025 | US$27.705 billion |

| Mechanical Recycling Market Size in 2030 | US$38.920 billion |

| Growth Rate | CAGR of 7.27% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Mechanical Recycling Market |

|

| Customization Scope | Free report customization with purchase |

The Mechanical Recycling market is analyzed into the following segments:

- By Waste Type

- Industrial

- Post Consumer

- By Product

- Recycled Polymers

- Recycled Fibers

- Others

- By End-User

- Packaging Industry

- Automotive Industry

- Construction Industry

- Electronics Industry

- Textile Industry

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Others

- North America