Report Overview

Mexico Shampoo Market Size, Highlights

Mexico Shampoo Market Size:

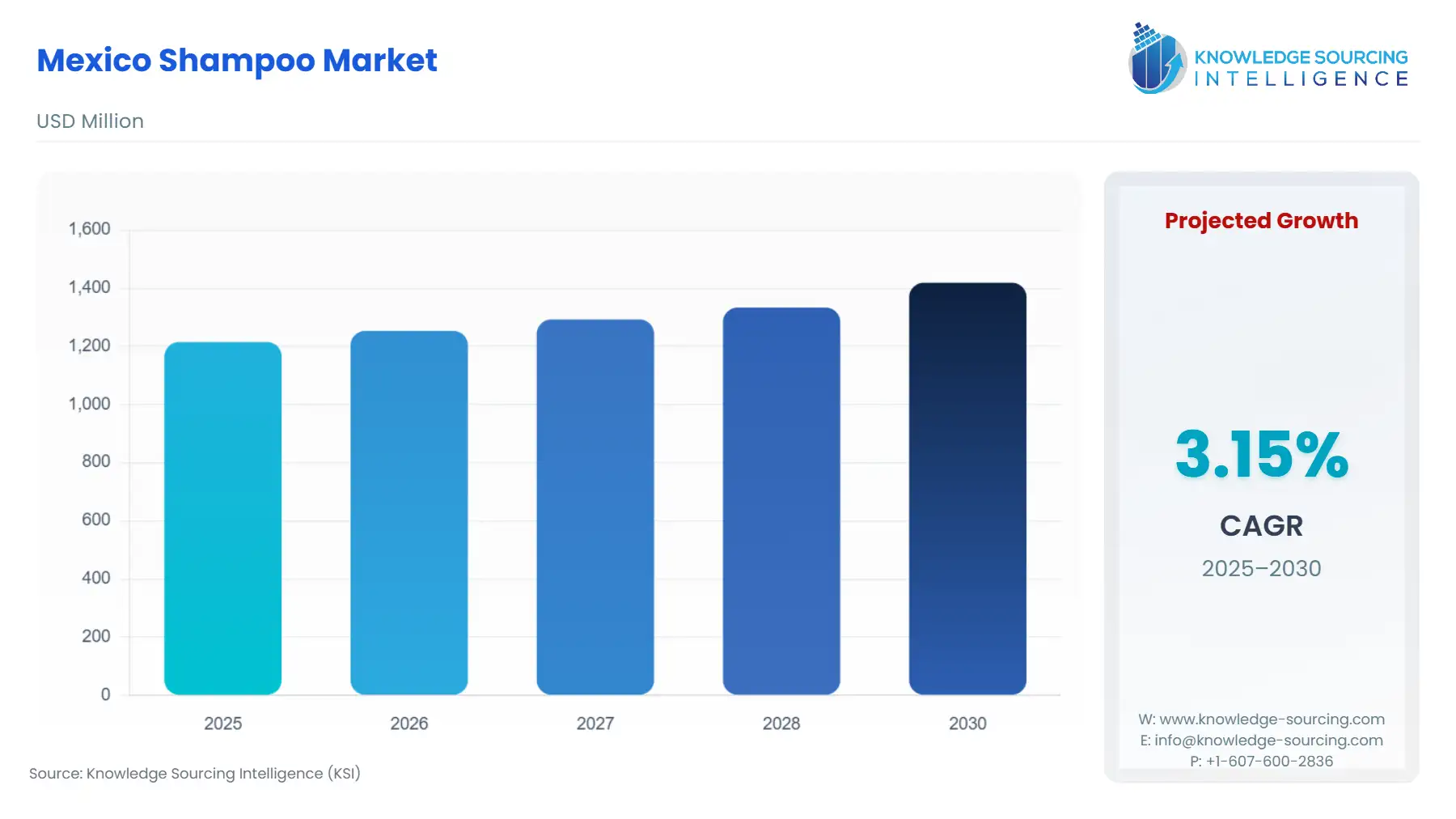

The Mexico Shampoo Market is projected to grow at a CAGR of 3.15 % from 2025 to 2030, reaching USD 1.419 billion in 2030 from USD 1.215 billion in 2025.

The growing shift towards urban lifestyle and rising consumer demand driven by increasing disposable income are the key factors driving Mexico’s shampoo market. Also, the increasing consumer awareness of hygiene products and the increasing demand for natural, sulfate-free, and medicated formulations are leading the market to grow. Additionally, urbanization and higher internet penetration are boosting online sales, enabling wider access to both mainstream and niche products.

Mexico Shampoo Market Overview & Scope:

The Mexico Shampoo Market is segmented by:

- Product: By product, the market is categorized into medicated/special purpose shampoos and non-medicated or regular shampoos. Medicated shampoos include shampoos targeted at dandruff, hair loss, scalp infections and other issues. While non-medicated shampoos are for general use for daily care.

- Application: By application, the market is divided into household and commercial segments. The household segment accounts for the majority share, driven by daily personal care routines. The commercial segment also has a considerable share, driven by increasing demand from salons, hotels and wellness centers. This is a dominant share of households as they use shampoos for daily use, while the commercial segment also holds a considerable share for the use of shampoos at salons and barbershops.

- Distribution Channel: In terms of distribution channel, the market includes hypermarkets/supermarkets, convenience stores, online stores, and others. Hypermarkets/Supermarkets hold key dominance, particularly in urban centers. While the overall distribution channel is led by the convenience stores. The online segment is growing at a rapid rate and gaining a significant share of the market.

- Region: By region, the market is segmented into northern Mexico, Central Mexico and Southern Mexico. Northern and Central Mexico have a significant share due to the high-disposable income group, while Southern Mexico is also growing.

Top Trends Shaping Mexico’s Shampoo Market

- Growing popularity of dry shampoo

- Mexico’s shampoo market is experiencing increasing demand for dry shampoo, a niche yet rapidly emerging product category. It is a powder or aerosol spray used to clean hair without water, and it works by absorbing oil or sebum from the scalp. Consumer reviews on platforms like Amazon Mexico, such as for Batiste’s Self Love Dry Shampoo, praise its functionality, pleasant fragrance, and ability to address oily scalps or unwashed hair, reflecting a clear consumer shift toward time-saving, waterless hair care solutions in urban areas.

- It has high popularity among middle and high-income segments, appealing to their beauty enhancement. Brands such as Batiste, Dove and Not Your Mother's are gaining traction in dry shampoo.

- Growing online distribution channel

Mexico Shampoo Market Growth Drivers vs. Challenges:

Opportunities:

- Evolving Consumer Preferences: Mexican consumers are increasingly seeking shampoo with multiple benefits, and there is growing demand for natural and organic products. Also, consumers are prioritising hygiene, and this leads to a shift in consumer demand for shampoos. Consumers are looking for e-commerce for better prices. Cheaper products and ease of comparing prices, along with convenience and quick delivery, are driving the consumer demand for shampoo towards online.

- Growing Population: The population growth is one of the major factors driving the demand for shampoos. As per Worldometers, the current population of Mexico is 131,859,473 as of June 2025, based on its elaboration of the latest United Nations data. The population have grown from 115.24 million in 2011 to 131.94 million in 2025, reflecting steady demographic growth over the past decade. As the population expands, the demand for personal care products such as shampoos increases, especially as urbanization and awareness of hygiene standards continue to rise.

- Increasing Disposable Income: Increasing disposable income is playing a significant role in driving the Mexican shampoo market. As per OECD, Mexico has exhibited a remarkable wage recovery. As of Q1 2024, real wages increased by 5.4% compared with Q4 2019. As per Inicio Mexico Embajada de Mexico en Filipinas, Mexico has 50% of its population as middle class and 30 per cent are in the upper class. The growth in income to spend drives the consumers’ spending capacity on goods such as shampoos. Also, Urban households have higher incomes to spend, significantly boosting the sales of premium shampoo products.

Challenges:

- Price Sensitivity: A significant portion of Mexico’s population is price-conscious, especially in lower and middle-income groups. This significantly impacts the demand for premium and speciality products, limiting the penetration and growth of higher-margin and natural or organic shampoo variants. This price sensitivity, thus, slows down the market growth by restricting consumer spending on differentiated shampoo products.

Mexico Shampoo Market Regional Analysis:

- Northern Mexico: Northern Mexico will dominate the market in terms of value. This region of Mexico is more industrailized and urbanized, with higher disposable income, driving strong growth in the shampoo market. The premium and organic segment has high growth in this region.

Southern Mexico: Southern Mexico is dominated by the economy of budget-friendly shampoos. There is a strong presence of mass market products with a high presence of local brands and small-format packaging.

Mexico Shampoo Market Competitive Landscape:

The market is moderately fragmented, with some notable key players such as Procter & Gamble, Unilever, L’Oréal Group, and Johnson and Johnson.

- Product Launch: In 2024, TRESemmé launched Lamellar Shine in the UK, Argentina, Mexico and Brazil. It uses exclusive Lamellar molecule technology to smooth the hair’s surface to boost shine on all hair textures.

Mexico Shampoo Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Mexico Shampoo Market Size in 2025 | US$1.215 billion |

| Mexico Shampoo Market Size in 2030 | US$1.419 billion |

| Growth Rate | CAGR of 3.15% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Northern Mexico, Central Mexico, Southern Mexico |

| List of Major Companies in the Mexico Shampoo Market |

|

| Customization Scope | Free report customization with purchase |

Mexico Shampoo Market Segmentation:

By Product

- Medicated/Special Purpose

- Non-Medicated/Regular

By Application

- Household

- Commercial

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Stores

- Others

By Region

- Northern Mexico

- Central Mexico

- Southern Mexico