Report Overview

Pet Dental Health Market Highlights

Pet Dental Health Market Size:

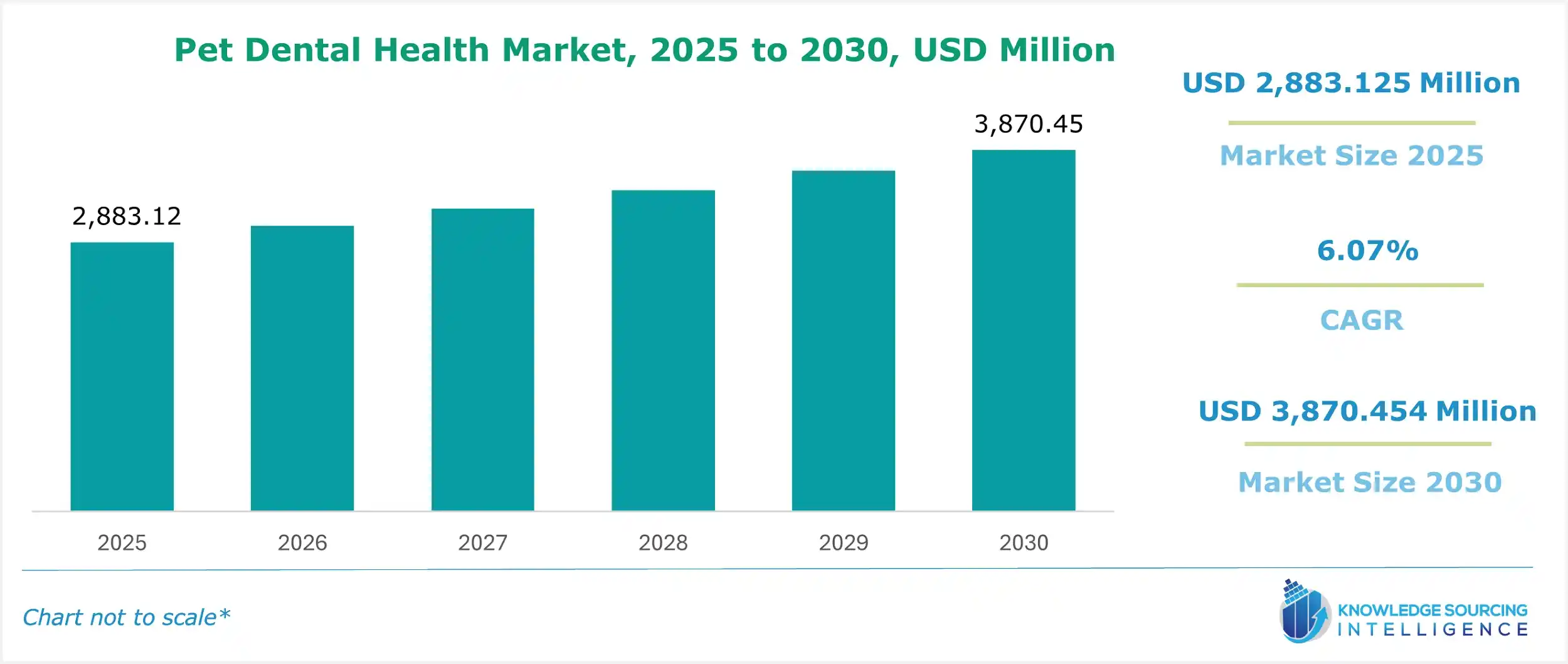

The Pet Dental Health Market, valued at US$2,883.125 million in 2025, is projected to grow at a CAGR of 6.07%, reaching a market size of US$3,870.454 million by 2030.

The increasing trend towards pet adoption and rising disposable income are driving the market of pet dental health. The growing awareness of maintaining pet health and hygiene is promoting the demand for pet dental health products and services. Additionally, a growing shift in people’s perception of pets as family members is increasing the spending of pet owners on dental health care products. Further, growth in new products and emerging market players are driving the pet dental health market.

Pet Dental Health Market Overview & Scope:

The Pet Dental Health Market is segmented by:

- Animal Type: The Pet Dental Health market, by animal type, is segmented into dogs, cats, and others.

- Indication: The Pet Dental Health market, by indication, is segmented into gum disease, endodontic disease, oral tumour, and others.

- Distribution Channel: The Pet Dental Health market, by distribution channel, is segmented into veterinary hospitals & clinics, retail pharmacies, e-commerce, and others.

- Region: The Pet Dental Health Market is segmented into North America, South America, Europe, the Middle East & Africa and Asia-Pacific.

Top Trends Shaping the Pet Dental Health Market:

1. The dog’s segment will witness significant growth in the pet dental health market.

- The dog segment is primarily driven by the rising ownership of dogs among people. The increased humanization of dogs and viewing them as family members is a growing trend worldwide, leading to a rise in focus on their preventive care and health, including their dental hygiene.

- For instance, in July 2024, Pet Honesty® launched the Fresh Breath Dental Powder, a new supplement topper developed to enhance dogs' gums and teeth health as well as maintain fresh breath.

2. Periodontal disease accounts for a significant portion of dental issues in pets

- Periodontal disease is expected to be the primary focus of treatment in the pet dental care market, driven by its high prevalence among pets and increasing awareness of oral health's impact on overall well-being.

- According to data from the Royal Veterinary College, periodontal disease is the most common cat disease in the UK, affecting 15.2% of cats annually, with an estimated 1.8 million cats affected annually, with many more likely undiagnosed. As cats age, the risk of periodontal disease increases significantly, with cats aged 9-12 years being 6.7 times more likely to suffer from the condition compared to those under 3 years old, emphasizing the need for extra dental care.

Pet Dental Health Market Growth Drivers vs. Challenges:

Opportunities:

- Increasing ownership of pets worldwide: The market growth is driven by increasing ownership of pets worldwide, especially of dogs and cats, raising the number of pet owners demanding better pet dental health care. According to the data by the American Veterinary Medical Association, there has been an increase in the number of pet owners. From 1996 to 2024, the U.S. dog population increased from 52.9 million to 89.7 million. The number of cats increased from 31.3 million in 1996 to 59.8 million. This highlights the growth in the ownership of dogs and cats. In emerging economies such as Brazil, there were 54.2 million dogs and 23.9 million cats in 2023.

- Growing awareness for maintaining pet health and hygiene: The growing awareness for maintaining pet health and hygiene is promoting the demand for pet dental health products and services.

Challenges:

- High cost of dental procedures: The high cost of dental procedures remains a key challenge in the pet dental care market, limiting access to advanced treatments for many pet owners. Many pet owners may delay or forgo necessary dental care due to financial constraints, leading to worsening oral health conditions.

Pet Dental Health Market Regional Analysis:

- Asia-Pacific: The Asia Pacific region is anticipated to have a faster growth rate in the Pet Dental Health market due to the increasing disposable income of the people and rising demand for the adoption of cats and dogs as pets. In growing regions like India, there is a significant increase in pet ownership. As per the report on Connect Journal, there were 11.672 million dogs in India in 2006, is increasing by 26% every year. India Today states that there were 33 million dogs in India in 2023.

- North America: North America will continue to have a considerable market share due to high disposable income, increased awareness of pet dental health, and the availability of related products and services. The American Veterinary Medical Association, or AVMA, in its press release of November 2024, stated that in the USA, the pet dog population reached 89.7 million in 2024, whereas the pet cat population reached 73.8 million. The agency further stated that in the USA, the total number of households owning cats was recorded at 37.0 million in 2022, which surged to 38.7 million in 2023 and 42.1 million in 2024. Similarly, the number of households owning pet dogs was recorded at 59.8 million in 2024, 62.0 million in 2022 and 53.4 million in 2023. Furthermore, the pet industry expenditure in the USA has also witnessed major growth over the past few years. The American Pet Products Association, in its report, stated that in 2022, the pet industry expenditure was recorded at US$ 136.8 billion, surging to US$147 billion in 2023 and US$150.6 in 2024.

Pet Dental Health Market Competitive Landscape:

The market is fragmented, with the presence of some of the key notable players such as Virbac Corporation, iM3, Pet Dental Services, and others.

- Leading Player: Virbac Corporation is one of the leading companies offering pet dental health products and services. It offers dental chews, water additives, toothbrushes, toothpaste, and dental care starter kits. It has products for both cats and dogs.

- Product Innovation: In January 2025, GingiGuard, a unique product for periodontal disease treatment in dogs, was launched by Saint Roch Veterinary LLC as a subsidiary company of Topikos Scientific, Inc. This novel patented compound rectifies periodontal biofilm disease without much harm to the given systemic effects while impeding harmful bacteria and restoring a healthy oral microbiome, thus creating one of the firsts in the field.

Pet Dental Health Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Pet Dental Health Market Size in 2025 | US$2,883.125 million |

| Pet Dental Health Market Size in 2030 | US$3,870.454 million |

| Growth Rate | CAGR of 6.07% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Pet Dental Health Market | |

| Customization Scope | Free report customization with purchase |

The Pet Dental Health Market is analyzed into the following segments:

By Animal Type

By Indication

- Gum Disease

- Endodontic Disease

- Oral Tumor

- Others

By Distribution Channel

- Veterinary Hospitals & Clinics

- Retail Pharmacies

- E-Commerce

- Others

By Region

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others