Report Overview

Philippines Sugar Market - Highlights

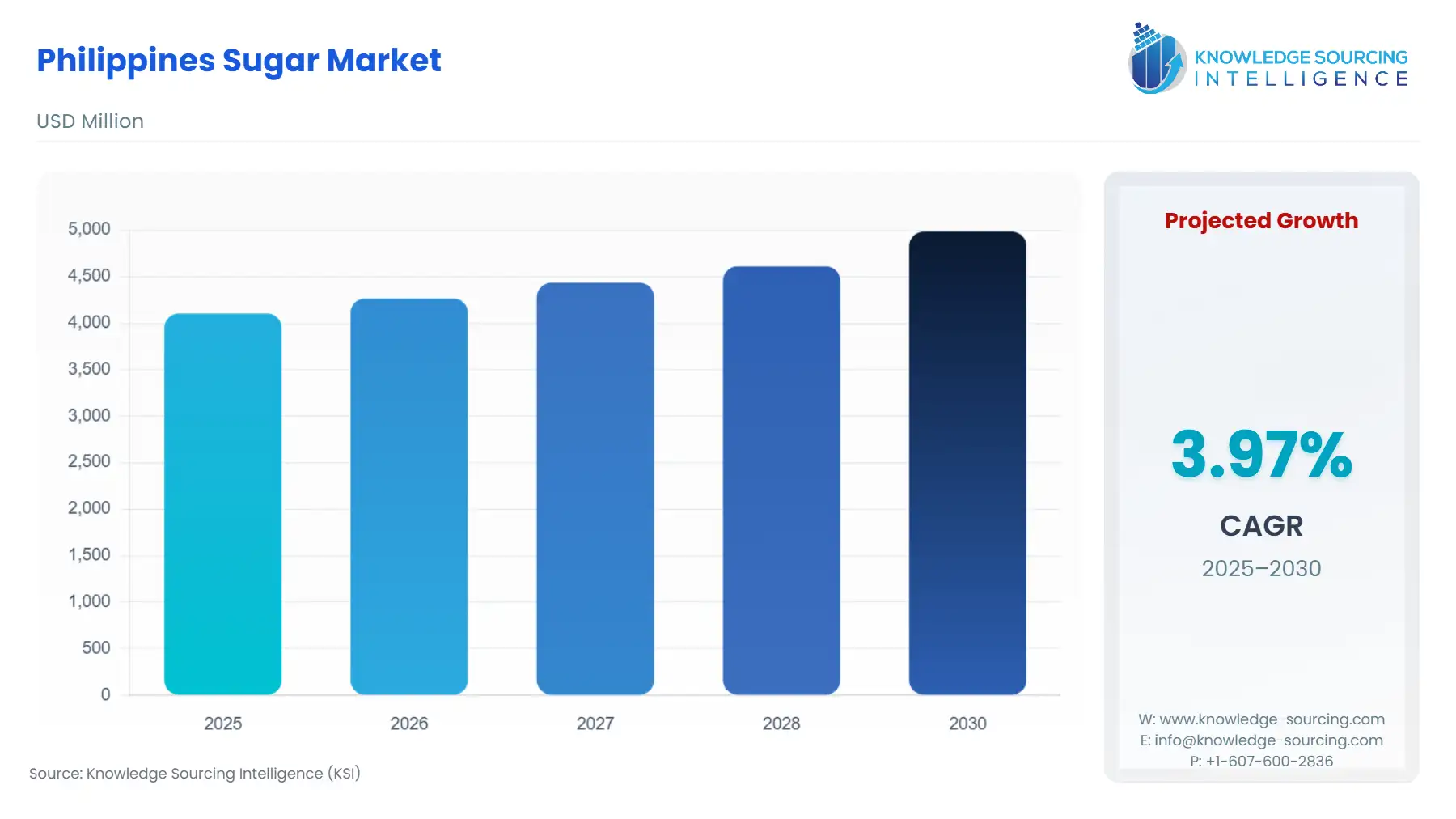

Philippines Sugar Market Size:

The Philippines sugar market is expected to grow at a compound annual growth rate (CAGR) of 3.97% from US$4,103.309 million in 2025 to US$4,984.140 million in 2030.

Philippines Sugar Market Trends:

The Philippines' sugar industry of today is considerably dissimilar from that of the past. The nation's economy continues to depend heavily on the sugar sector. The majority of the sugar industry's output is currently used to meet the local demands of Filipino producers and consumers. It primarily exports to the American market and seldom engages in exporting to the international sugar market. Western Visayas is the region that produces the most, followed by Northern Mindanao and Central Visayas. The major landowners, millers, distillers, and refineries are the key actors in the sugar sector. The largest sugar producer in the nation and one of the biggest sugar mills and refineries in Asia is Victoria’s Milling in Negros Occidental. According to Victoria Milling (2019), it meets around 30% of the county's daily demand for refined sugar.

Sugarcane as a crop is currently grown in 17 provinces, which are widely distributed in 8 regions from the northernmost island of Luzon to the southernmost island of Mindanao. Sugar trading and marketing have been too fragmented. The producers and cooperatives do not market and sell sugar collectively. Although traders have played an important role as market distributors in reaching the retail markets.

The raw sugar production was 380,816 hectares in 2022-2023, 394,637 hectares in 2021-2022, and 399,166 hectares in 2020-2021, according to the Sugar Regulation Administration, Philippines. Low productivity is due to the El Niño and the lack of irrigation facilities in some regions.

In recent years, the Philippine sugar sector has been severely tested by natural disasters such as typhoons and droughts, both of which are exacerbated by climate change. The production declined, with raw sugar output of only 1.8 million metric tons in the fiscal year 2022/23. Consequently, raw and refined sugar prices have skyrocketed, causing inflationary pressure on consumer goods.

To stabilize supply and prices, the government has decided to import refined sugar while re-exporting raw sugar to fulfill its quota with the United States36. This twin strategy seems to balance domestic needs with international commitments, but is likely to hurt the already-battered local farmers who suffer from a combination of high cost of production and adverse weather conditions.

Stakeholders are looking forward to better infrastructural and irrigation facilities, which will enhance productivity. There is also a clamor for more integrated marketing strategies among producers to gain bargaining power over traders. The future of the industry depends on the solution of these systemic problems while adapting to changing environmental conditions.

Philippines Sugar Market Growth Drivers:

The growing food and beverage sector is projected to propel the Philippines' sugar market expansion.

The Philippines has a rapidly growing food & beverage (F&B) industry and is one of the biggest contributors to the nation’s economy, making up about half of its manufacturing sector. In 2022, revenue in the food market amounted to €113,009m 2022. The overall food and beverage market expansion will increase the demand for sugar in the sector. The country has significant sugarcane-producing regions. Western Visayas is the top sugarcane-producing region with 1.34 million metric tons or a 47.2 percent share of the total production. This is followed by Northern Mindanao and Central Visayas, with corresponding production shares of 18.3% and 12.6%, respectively. These regions contributed 78.1 percent of the country’s total sugarcane production.

The rapid proliferation of chain restaurants and meal delivery services adds to this need, as consumers seek different culinary experiences that frequently include sweetened beverages and sweets. Furthermore, the move toward health-conscious eating has resulted in a growing market for organic and natural sugar alternatives, compelling traditional sugar producers to improve their product offerings. This trend not only appeals to health-conscious customers but also creates new opportunities for growth in the sugar business.

This, therefore, motivates local producers to increase their production capacity and embrace sustainable practices to answer the domestic as well as international demand. The Philippine government is expected to support this change through policies promoting agricultural productivity and sustainability in the sugar industry. Overall, the interplay between a booming F&B sector and a solid sugar production framework positions the Philippines for tremendous growth in its sugar market over the coming years.

Philippines Sugar Market Segment Analysis:

By distribution channel, online is anticipated to hold a substantial market share

The online segment of the Philippines sugar market is expected to grow significantly, owing to several factors, such as the evolving consumer behaviors coupled with its technological advancements and the evolving landscape of e-commerce.

First and foremost, online shopping is pretty convenient. Consumers can access a large array of sugar products from different companies without visiting physical stores. All such platforms offer in-depth product descriptions, customer reviews, and competitive pricing, enabling consumers to make well-informed decisions. E-commerce platforms are particularly helpful for specialty sugars like muscovado, as most supermarkets will not carry them. They are essential to consumers who want something unique and producers who seek to reach more people. In this regard, according to the International Trade Administration, in 2021, the e-commerce market sales of the Philippines were US$17 billion, which, by 2025, will witness an increase of 17%, reaching US$24 billion.

Moreover, the rise of health consciousness among Filipino consumers has also brought about a change in the way they purchase. Natural and unrefined sugars are the new favorites as consumers opt for healthier alternative sources of sugar to avoid processed sugars. Online retailers are filling this niche market by carrying specialty products where taste, quality, and health benefits take over, where price alone used to determine. The trend is of fresh worldwide impulses towards healthier eating and causes a growth of premium sugar online sales. The other end comprises local artisans and small-scale producers who now use e-commerce. In most cases, they used social media websites and online marketplaces to sell their products directly to consumers.

In the next phase of e-commerce evolution in the Philippines, there will be a continued surge of more sugar producers going digital to increase their market visibility and reach. Such a change not only helps small-scale farmers and local brands compete with big corporations but also fosters a more diversified marketplace for unique sugar products from consumers.

In addition, innovations in logistics and delivery services will lead to increased efficiency in online sugar distribution. The turnaround times for orders are likely to be shorter while customer satisfaction increases. Incorporation of technology into the supply chain management will also ensure efficiency in producers' operations, reducing costs while increasing profitability.

Growing popularity in the subscription services of food items may also be in sugar, where consumers may regularly receive their favorite sugar items at discounted rates. Such a model can establish loyalty among customers while at the same time providing continuous sales to producers.

In summary, with the growing digital landscape in the Philippines, there are significant growth opportunities in the sugar market. The synergy of a growing health awareness among consumers and online shopping convenience makes this segment ready for significant expansion in the coming years.

Philippines Sugar Market Key Developments:

Oct 2025: The Department of Agriculture (DA) and Sugar Regulatory Administration (SRA) committed to no sugar importation until mid-2026, stating any future imports will be classified as reserve (“C”) sugar.

Oct 2025: The DA and SRA agreed to maintain a two-month buffer stock of refined sugar to stabilize the market amid price concerns.

Jul 2025: Under Sugar Order No. 08, the SRA authorized the importation of 424,000 metric tons of refined “reserve (C) sugar”, to ensure sufficient supply and buffer stocks.

November 2024- The Philippine government has opted to delay further sugar importation plans until mid-2025, as agreed upon in a meeting between Agriculture Secretary Francisco Tiu Laurel Jr. and Sugar Regulatory Administration (SRA) Administrator Pablo Luis Azcona. This is a move that aims to shield domestic producers since both raw and refined sugar stocks are said to be sufficient to cover projected demand. The delay will allow for a clearer view of the domestic supply after this harvest season, which has been affected by El Niño, lowering sugar yields and delaying the harvest.

August 2024- The Philippines has unveiled its first sugar import program for the marketing year 2024-2025, allowing the importation of 240,000 metric tons (MT) of refined sugar. The program, formalized through Sugar Order No. 5 issued on August 8, aims to stabilize domestic supply and prices amid expected challenges from El Niño. Importers must have previously supported local farmers to qualify for the program. Imported sugar is expected to arrive by 15th September, which would leave a buffer stock before the milling season begins in October.

Philippines Sugar Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 4,103.309 million |

| Total Market Size in 2030 | USD 4,984.140 million |

| Forecast Unit | Million |

| Growth Rate | 3.97% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Form , Source, Use, Distribution Channel |

| Companies |

|

Philippines Sugar Market Segmentation:

By Form

Granulated

Powdered

Syrup

By Source

Cane Sugar

Beet Sugar

By Use

Food And Beverage

Pharmaceuticals

By Distribution Channel

Online

Offline